RNS Number: 6825I

Drax Group PLC (Symbol: DRX)

(“Drax”, “the Group”, “Drax Group”, “the Company”; Symbol: DRX)

Drax is pleased to announce that it has reached agreement for the sale of Drax Generation Enterprise Limited (“DGEL”), which holds four Combined Cycle Gas Turbine (“CCGT”) power stations, to VPI Holding Limited (“VPI”) for consideration of £193.3 million, subject to customary adjustments. This includes £29.0 million of contingent consideration associated with the option to develop a new CCGT at Damhead Creek.

The transaction is subject to certain customary closing conditions, including anti-trust approval, with completion to take place by 31 January 2021.

The CCGTs have performed well since acquisition by Drax in December 2018, but do not form part of the Group’s core flexible and renewable generation strategy. Drax expects to realise a premium on sale, use the proceeds to develop its biomass supply chain and accelerate its ambition to become a carbon negative business by 2030.

DGEL also holds the Group’s pumped storage and hydro assets and is the shareholder of SMW Limited (the owner of the Daldowie fuel plant). These assets, shares and employees are to be transferred out of DGEL prior to completion and will be retained by Drax.

Highlights

- Sale of non-core gas generation and development assets for consideration of £193.3 million

- Expected premium on sale to book value, subject to customary adjustments

- Returns significantly ahead of the Group’s Weighted Average Cost of Capital (WACC)

- Accelerates decarbonisation – ambition to become a carbon negative business by 2030

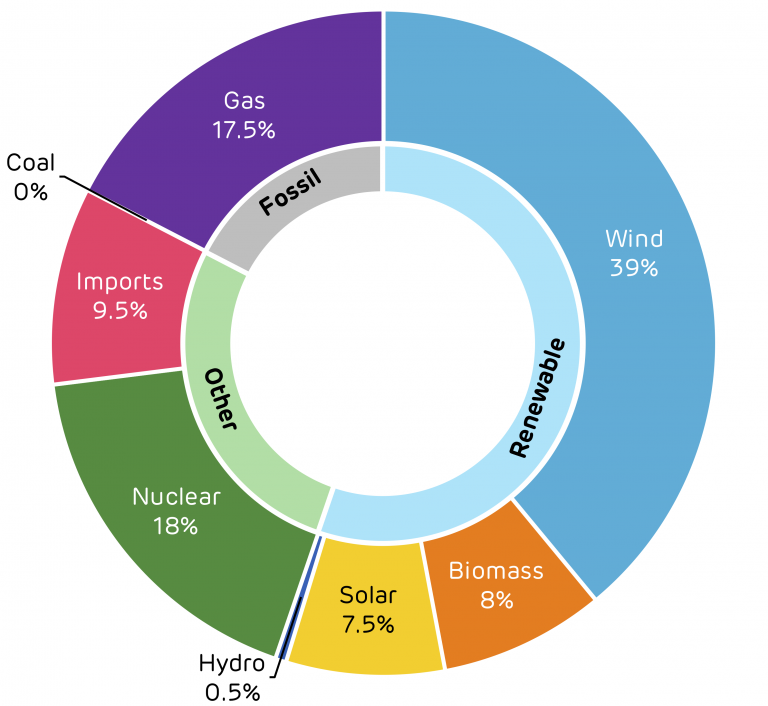

- UK’s largest flexible and renewable portfolio – largest source of renewable electricity(1)

- 2.6GW of sustainable biomass

- 0.6GW of hydro – pumped storage and hydro

- Continued focus on biomass strategy and system support services

- Development of a long-term future for sustainable biomass – underpinned by biomass supply chain expansion and cost reduction

- Development of options for negative emissions technology – BECCS(2)

- Provision of system support services from biomass, pumped storage and hydro

- Robust trading and operational performance – outlook remains in line with expectations

Will Gardiner, Drax Group CEO, said:

Drax Group CEO Will Gardiner in the control room at Drax Power Station [Click to view/download]

“By focusing on our flexible and renewable generation activities in the UK we expect to deliver a further reduction in the Group’s CO2 emissions, which should accelerate our ambition to become not just carbon neutral but carbon negative by 2030.

“By using carbon capture and storage with biomass (BECCS) at the power station in North Yorkshire to underpin the decarbonisation of the wider Humber region, we believe we would be creating and supporting around 50,000 new jobs and delivering a green economic recovery in the North.

“We greatly value the contribution that our colleagues in gas generation have made to the Group over the last two years. As we focus on a renewable and flexible portfolio, it is right that we divest these gas generation assets and in doing so create value for our shareholders.”

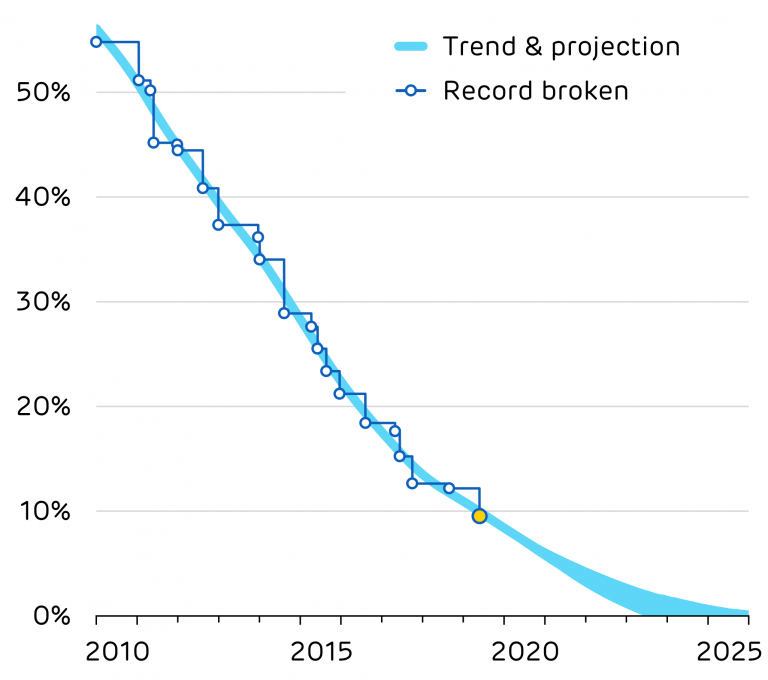

Between 2012 and 2019, through investment in sustainable biomass and hydro, Drax has reduced its carbon emissions by over 85% and become the largest source of renewable electricity in the UK(1).

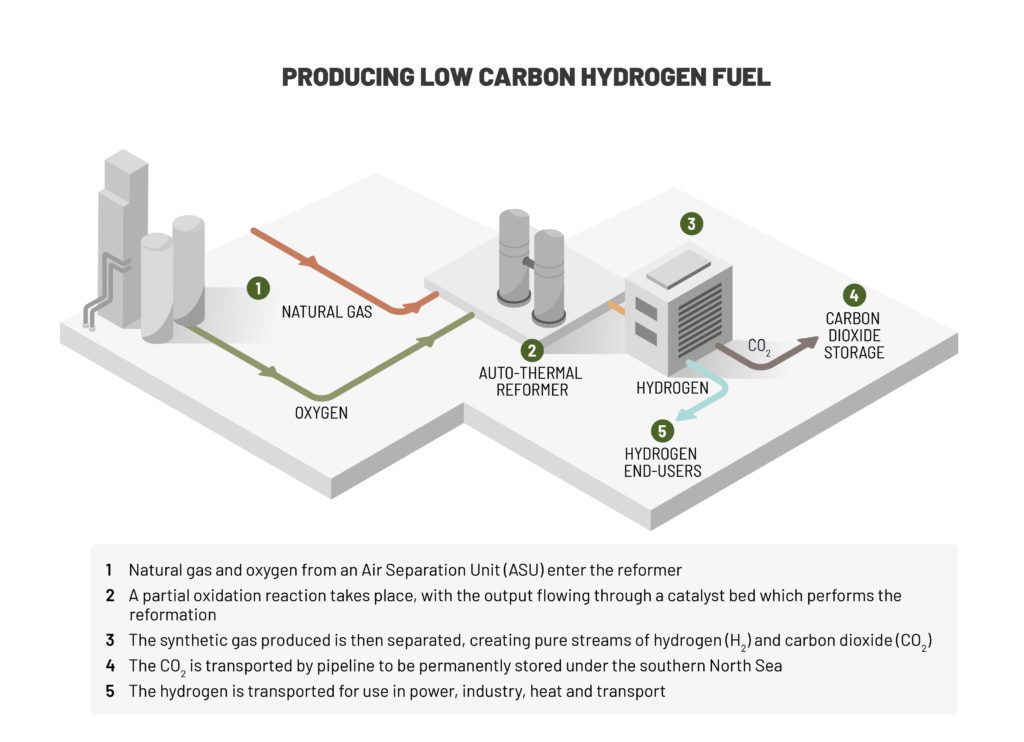

In December 2019 Drax announced an ambition to become a carbon negative company by 2030. The negative emissions provided by BECCS will offset carbon emissions within the Group’s supply chain and help to offset emissions in harder to abate sectors of the economy, such as aviation and agriculture.

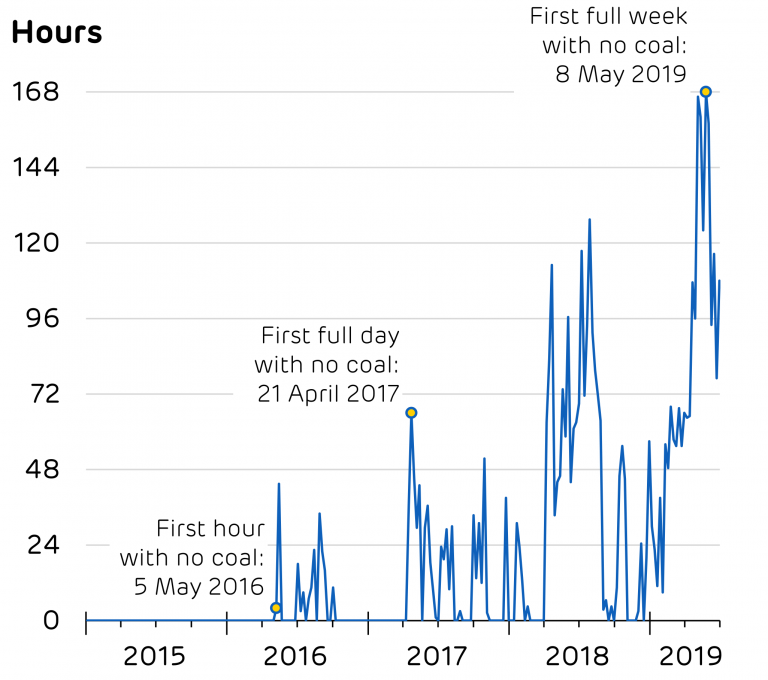

In February 2020 Drax announced an end to commercial coal generation in 2021 and now, by divesting its existing gas generation assets, Drax will further reduce its carbon emissions.

Drax will continue to provide system support services alongside its decarbonisation strategy through its renewable generation portfolio, other development opportunities and demand-side response within its Customers business. These activities provide renewable electricity and a fully flexible generation and supply portfolio, which can support the UK power system as it becomes increasingly reliant on intermittent and inflexible generation sources.

About the assets and transitional arrangements

Rye House Power Station, Hertfordshire [Click to view/download]

Drax acquired the CCGTs from Iberdrola in December 2018 as part of a portfolio of pumped storage, hydro and gas generation. The majority of the value in the acquisition was ascribed to the pumped storage and hydro assets, which in the first six months of 2020 provided £35 million of Adjusted EBITDA(3). In the same period the CCGTs provided £18 million of Adjusted EBITDA. Group Adjusted EBITDA for the first six months of 2020 was £179 million.

As at 30 June 2020 the gross fixed assets for the CCGTs were £182 million.

The CCGTs also have £89 million of Capacity Market income between 2021 and 2024(4) which will remain with DGEL on completion.

The CCGT business currently employs 121 people in operational roles who will transfer with DGEL on completion.

Drax has agreed a series of transitional services to support the transition through 2021.

Other gas projects

Drax continues to evaluate options for the development of four Open Cycle Gas Turbines and Drax Power Station following the end of coal operations.

Financial

Total consideration is £193.3 million, subject to customary completion accounts adjustments, comprising £164.3 million for the four CCGT power stations and a further £29.0 million of contingent consideration payable on satisfaction of certain triggers in respect of the option to develop a new CCGT at Damhead Creek.

The payment of £164.3 million in respect of the four CCGTs is payable in cash on completion, with an option to defer the payment of £50.0 million until April 2022. The deferred component would carry an interest rate of four percent and be backed by a letter of credit. In the event that the deferral option is exercised Drax intends to convert the payment obligation to cash upon completion for the face value.

Subject to fulfilment of pre-closing conditions, completion is to take place by 31 January 2021.

The sale price represents an expected premium compared to the book value of the assets, subject to customary adjustments and a return over the period of ownership significantly ahead of the Group’s WACC.

Biomass strategy – investment in capacity expansion and cost reduction

Sustainable biomass wood pellet storage domes at Baton Rouge Transit, a renewable fuel storage and logistics site operated by Drax at the Port of Greater Baton Rouge, Louisiana [Click to view/download]

These savings will be delivered through the optimisation of existing biomass operations, greater utilisation of low-cost wood residues and an expansion of the fuel envelope to incorporate other low-cost renewable biomass across the Group’s expanded supply chain.

Drax believes that the additional capital and operating cost investment required to deliver this supply chain expansion is in the region of £600 million, which the Group expects to invest ahead of 2027. Drax remains alert to sector opportunities for both organic and inorganic growth.

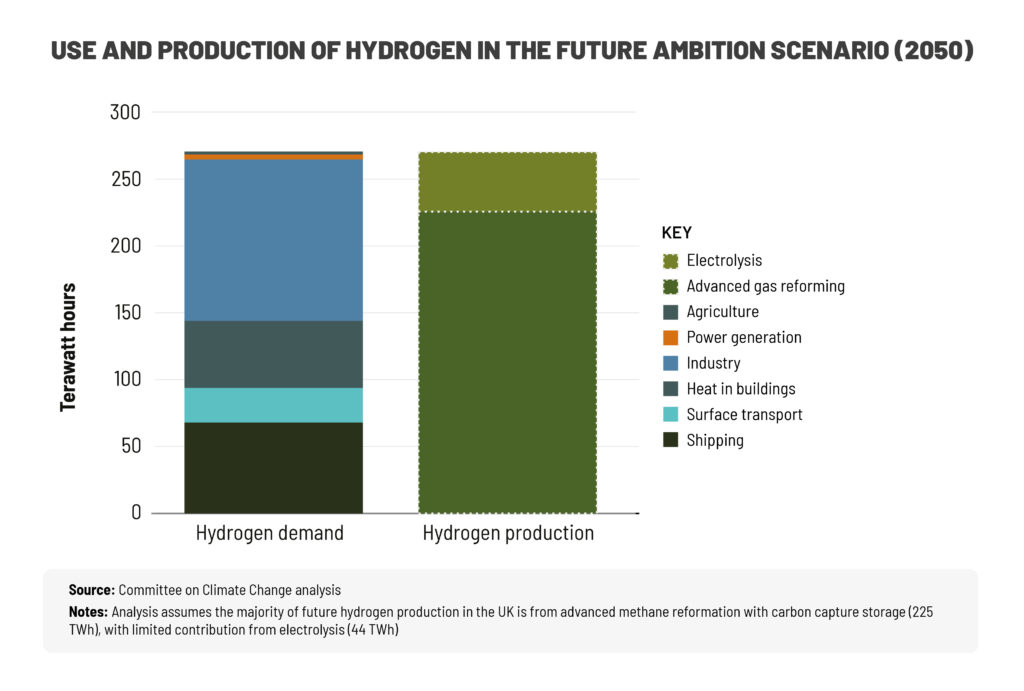

The Group has identified three models through which it believes it can deliver a long-term future for sustainable biomass, all of which are underpinned by the delivery of its supply chain expansion and cost reduction plans. These options, which are not mutually exclusive, are summarised below. The delivery of one or more of these models by 2027 would enable Drax to continue its biomass activities when the current UK renewable schemes for biomass generation end in March 2027.

1) Merchant biomass generation at Drax Power Station

Drax believe that biomass has an important role to play in the UK as a flexible and reliable source of renewable energy, supporting increased utilisation of intermittent and inflexible generation across the UK power grid. In March 2027, when the current CfD(6) and ROC(7) renewable schemes end, Drax believes that through a combination of peak power generation, system support services, Capacity Market income and a low-cost operating model for Drax Power Station (including low-cost biomass), this site can continue to operate as a merchant renewable power station.

The four biomass units located in the turbine hall at Drax Power Station have a total capacity of 2.6 GW [Click to view/download]

2) BECCS

The UK’s Climate Change Committee (CCC) has set out what is required for the country to achieve its legally binding objective of being net zero by 2050. This includes an important role for BECCS to remove CO2 from the atmosphere, creating negative emissions. BECCS is the only large-scale solution for negative emissions with renewable electricity and system support capabilities. Through combining BECCS with its existing four biomass generation units at Drax Power Station, Drax believes it could remove up to 16 million tonnes of CO2 per year – over two thirds of the CCC’s 2035 target for BECCS. In doing so Drax aims to become a carbon negative company by 2030.

The technology to deliver post-combustion BECCS exists and is proven at scale. In September 2020, Drax commenced a trial of one such technology provided by Mitsubishi Heavy Industries (MHI). In addition, Drax is developing innovative technology options, including C-Capture, a partnership between Leeds University, Drax, IP Group and BP, which has developed an organic solvent which could be used for BECCS.

Innovation engineer inspects pilot carbon capture facility at Drax Power Station [Click to view/download]

3) Third party biomass supply

Drax expects global demand for wood pellets to increase in the current decade, as other countries develop decarbonisation programmes which recognise the benefits of sustainable biomass for generation. Whilst there is an abundance of unprocessed sustainable biomass material globally, there remains limited capacity to convert these materials into energy dense pellets, which have a low-carbon footprint and lower cost associated with transportation. As a result, Drax expects the global market for biomass to remain under supplied. Drax is therefore exploring options to service biomass demand in Europe, North America and Asia alongside the UK. Establishing a presence in these markets could offer the potential for long-term offtake agreements, providing diversified revenues from other biomass markets.

Trading update

Since publishing its half year results on 29 July 2020 the trading and operational performance of the Group has remained robust.

In the USA, the Group’s Pellet Production business is commissioning 100,000 tonnes of new production capacity at its Morehouse facility in Louisiana as part of its previously announced plans to add 350,000 tonnes across its three existing production sites by 2022. The project is part of the Group’s plan to expand its sustainable biomass supply chain and reduce costs.

The Generation business has continued to perform well in the provision of system support services, responding to both the low and high demand needs of the UK electricity system.

In addition to the successful completion of a major planned outage and upgrade of a biomass unit at Drax Power Station, the Group has progressed its earlier stage development work on BECCS. Alongside the commencement of a solvent trial with MHI, Drax has awarded pre-FEED (Front End Engineering Design) contracts and expects to incur incremental operating costs associated with the development of a full FEED study during 2021.

At its half year results in July 2020 Drax noted that further lockdown measures in the UK in the second half of 2020 could create a small downside risk on the performance of the Customers business, principally in the SME(8) market. Drax is continuing to assess operational and strategic options for this part of the Group.

The Group’s expectations for 2020 Adjusted EBITDA remain in line with market expectations(9), inclusive of the impact of Covid-19, principally in relation to its Customers business. Full year expectations for the Group remain underpinned by good operational availability for the remainder of 2020.

Contracted power sales

Electricity pylons take flexible power generated from water stored in a reservoir at Cruachan Power Station in the Highlands into the national grid [Click to view/download]

| 2020 | 2021 | 2022 |

| Fixed price power sales (TWh) | 18.2 | 15.2 | 6.5 |

| Contracted % versus 2019 full year output | 1.06 | 0.86 | 0.38 |

| Of which CfD (TWh) (10) | 4.8 | 1.7 | - |

| Of which CCGT (TWh) | 2.5 | 3.1 | 0.2 |

| At an average achieved price (£ per MWh) | 54.8 | 48.2 | 48 |

| Average price for CCGT (£ per MWh) | 53.2 | 46.5 | 54.7 |

Balance sheet

As announced on 19 November 2020 the Group agreed a new £300 million ESG(11) Revolving Credit Facility (RCF). This replaces an RCF which was due to mature in 2021 and provides increased liquidity, enabling the full facility to be drawn as cash (the previous facility restricted cash drawn to support liquidity to £165 million). The ESG RCF is currently undrawn for cash.

In addition to the ESG RCF, the Group has agreed new infrastructure facilities (£213 million) and a Euro denominated bond issue (€250 million), which replace an existing RCF, Sterling bond and ESG term-loan, reducing the Group’s overall cost of debt and extending its maturity profile to 2030.

As at 30 November 2020 Drax had adjusted cash and total committed facilities of £643 million.

Capital allocation and dividend

The Group remains committed to its capital allocation policy, through which it aims to maintain a strong balance sheet; invest in the core business; pay a sustainable and growing dividend and return surplus capital beyond investment requirements.

Subject to the continued good operational performance and overall impact from Covid-19 remaining in line with the position Drax set out in April 2020, the Group continues to expect to pay a dividend for the 2020 financial year of 17.1 pence per share (approximately £68 million), a 7.5% increase on 2019. This is consistent with the policy to pay a dividend which is sustainable and expected to grow as the strategy delivers an increasing proportion of stable earnings and cash flows.

Enquiries

Drax Investor Relations:

Mark Strafford

+44 (0) 7730 763 949

Media

Drax External Communications:

Ali Lewis

+44 (0) 7712 670 888

Website: www.drax.com

ENDS

Notes