RNS Number: 6883T

Drax Group plc

(“Drax” or the “Group”; Symbol:DRX)

| Six months ended 30 June | H1 2022 | H1 2021 |

|---|---|---|

| Key financial performance measures | ||

| Adjusted EBITDA (£ million)(1)(2) | 225 | 186 |

| Continuing operations | 225 | 165 |

| Discontinued operations – gas generation | - | 21 |

| Net debt (£ million)(3) | 1,101 | 1,029 |

| Adjusted basic EPS (pence)(1) | 20.0 | 14.6 |

| Interim dividend (pence per share) | 8.4 | 7.5 |

| Total financial performance measures from continuing operations | ||

| Operating profit (£ million) | 207 | 84 |

| Profit before tax (£ million) | 200 | 52 |

Will Gardiner, CEO of Drax Group, said:

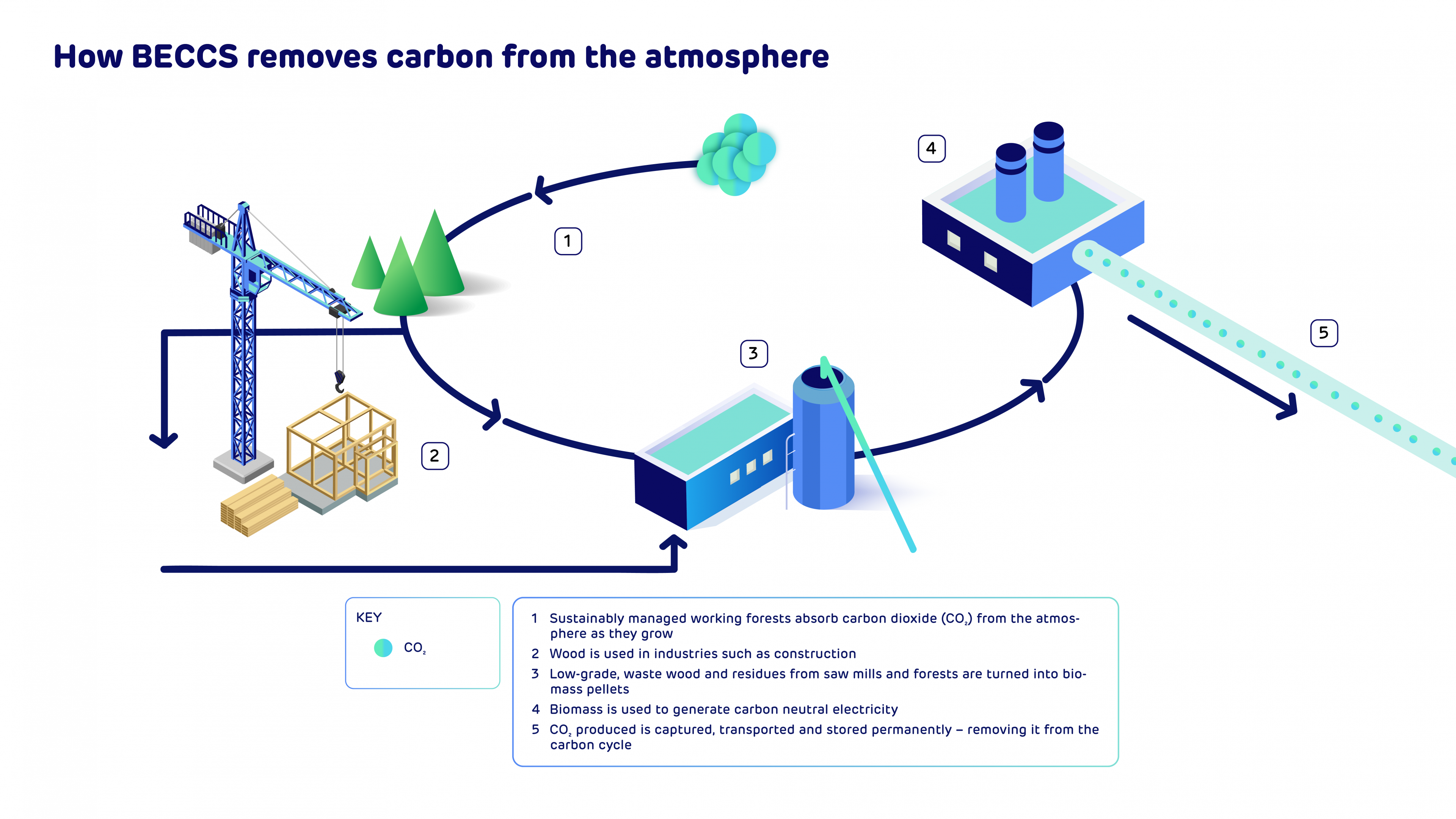

“As the UK’s largest generator of renewable power by output, Drax plays a critical role in supporting the country’s security of supply. We are accelerating our investment in renewable generation, having recently submitted planning applications for the development of BECCS at Drax Power Station and for the expansion of Cruachan Pumped Storage Power Station.

“As a leading producer of sustainable wood pellets we continue to invest in expanding our pellet production in order to supply the rising global demand for renewable power generated from biomass. We have commissioned new biomass pellet production plants in the US South and expect to take a final investment decision on up to 500,000 tonnes of additional capacity before the end of the year.

“As carbon removals become an increasingly urgent part of the global route to Net Zero, we are also making very encouraging progress towards delivering BECCS in North America and progressing with site selection, government engagement and technology development.

“In the UK and US we have plans to invest £3 billion in renewables that would create thousands of green jobs in communities that need them, underlining our position as a growing, international business at the heart of the green energy transition.”

Financial highlights

- Adjusted EBITDA £225 million up 21% (H1 2021: £186 million)

- Strong liquidity and balance sheet – £539 million of cash and committed facilities at 30 June 2022

- Expect to be significantly below 2 times Net Debt to Adjusted EBITDA by the end of 2022

- Sustainable and growing dividend – expected full year dividend up 11.7% to 21.0 p/share (2021: 18.8 p/share)

- Interim dividend of 8.4 p/share (H1 2021: 7.5 p/share) – 40% of full year expectation

Engineers at Cruachan Power Station

Progress with strategy in H1 2022

- To be a global leader in sustainable biomass – targeting 8Mt of capacity and 4Mt of sales to 3rd parties by 2030

- Addition of 0.4Mt of operational pellet production capacity

- New Tokyo sales office opened July 2022

- To be a global leader in negative emissions

- BECCS – UK – targeting 8Mt of negative emissions by 2030

- Planning application submitted and government consultation on GGR business models published with power BECCS business model consultation expected “during the summer”

- BECCS – North America – targeting 4Mt of negative emissions by 2030

- Ongoing engagement with policy makers, screening of regions and locations for BECCS

- To be a leader in UK dispatchable, renewable power

- >99% reduction in scope 1 and 2 emissions from generation since 2012

- UK’s largest generator of renewable power by output – 11% of total

- Optimisation of biomass generation and logistics to support security of supply at times of higher demand

- Planning application submitted for 600MW expansion of Cruachan and connection agreement secured

Outlook for 2022

- Expectations for full year Adjusted EBITDA unchanged from 6 July 2022 update which reflected optimisation of biomass generation and logistics to support UK security of supply this winter when demand is high, a strong pumped storage performance and agreement of a winter contingency contract for coal

Future positive – people, nature, climate

- People

- Diversity and inclusion programme – inclusive management, promoting social mobility via graduates, apprenticeships and work experience programmes

- Continued commitment to STEM outreach programme

An apprentice working in the turbine hall at Drax Power Station, North Yorkshire

Nature and climate

Nature and climate

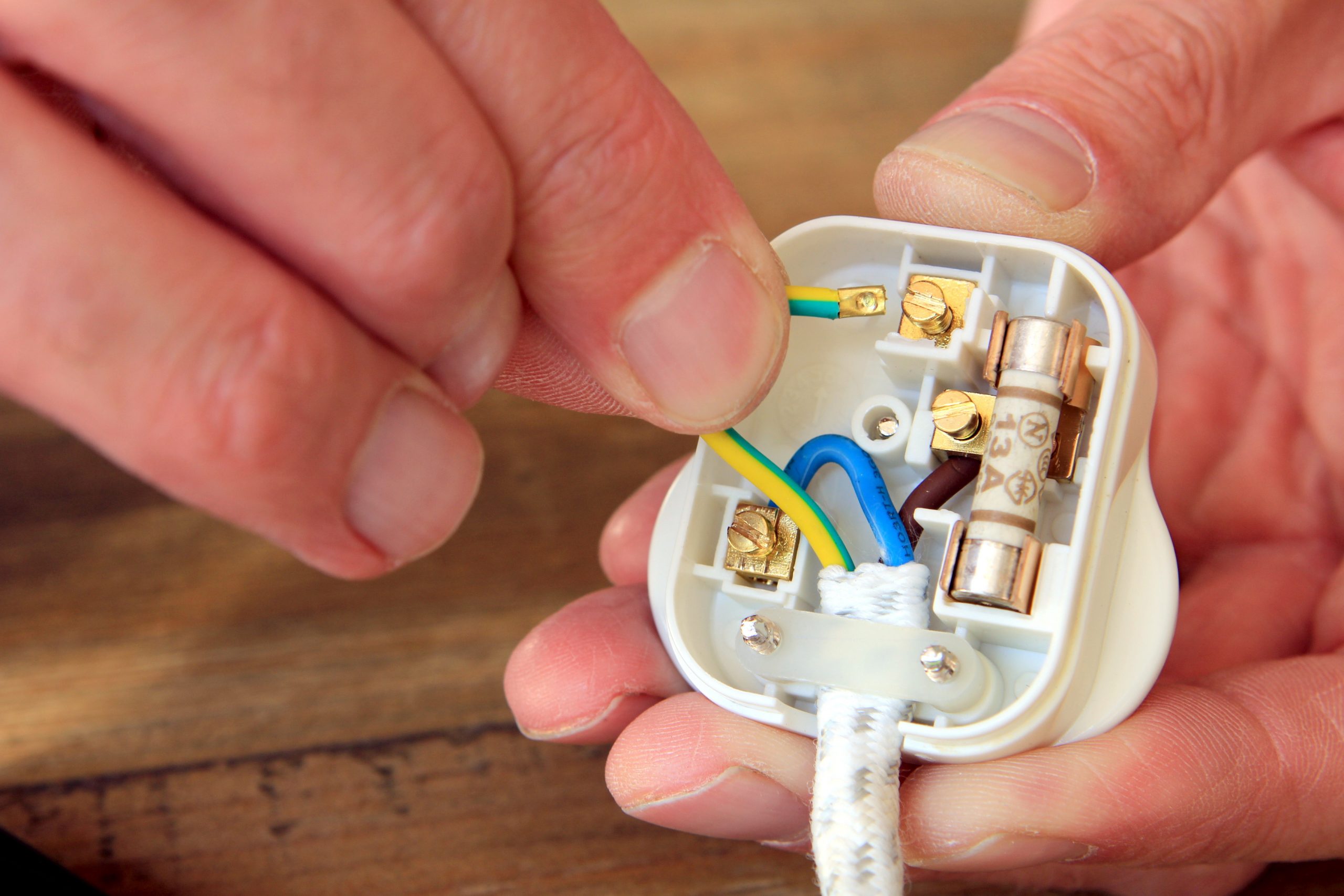

- Science-based sustainability policy fully compliant with current UK and EU law on sustainable sourcing and aligned with UN guidelines for carbon accounting

- Biomass produced using sawmill and forest residuals, and low-grade roundwood, which often have few alternative markets and would otherwise be landfilled, burned or left to rot, releasing CO2 and other GHGs

- Increase in sawmill residues used by Drax to produce pellets – 67% of total fibre (FY 2021: 62%)

- 100% of woody biomass produced by Drax verified against SBP, SFI, FSC®(4) or PEFC Chain of Custody certification with third-party supplier compliance primarily via SBP certification

Operational review

Pellet Production – increased production, flexible operations to support UK generation, addition of 0.4Mt of capacity

- Adjusted EBITDA up 13% to £45 million (H1 2021: £40 million)

- Pellet production up 54% to 2.0Mt (H1 2021: 1.3Mt) (including Pinnacle since 13 April 2021)

- Addition of c.0.4Mt of new production capacity

- Commissioning of Demopolis and Leola, expect to reach full production capacity in H2 2022

- Total $/t cost of $146/t(5) – 2% increase on 2021 ($143/t(5))

- Increase in utility costs in Q2-22 (>20% increase)

- Fuel surcharge – barge and rail to port (> 10% increase)

- Commissioning costs at Demopolis and Leola plants

- Net reduction in other costs, inclusive of optimisation of supply chain to meet reprofiling of Generation

- No material change in fibre costs

- Areas of focus for further savings – wider range of sustainable biomass fibre, continued focus on operational efficiency and improvement, capacity expansion, innovation and technology

- Continue to target final investment decision on up to 0.5Mt of new capacity in H2 2022

Generation – increased recognition of value of long-term security of supply from biomass and pumped storage

- Adjusted EBITDA from continuing operations £205 million up 24% (H1 2021: £165 million)

- Optimisation of biomass generation and logistics to support security of supply at times of higher demand

- Summer – lower power demand, lower power generation and sale of reprofiled biomass

- Winter – maximise biomass deliveries to support increased generation at times of higher demand

- Four small, planned biomass outages completed in H1, supporting higher planned generation in H2-22

- Strong portfolio system support performance (balancing mechanism, ancillary services and optimisation)

- Higher cost of sales – logistics optimisation, biomass and system costs

- Six-month extension of coal at request of UK government – winter contingency contract for security of supply

- Closure of coal units in March 2023 following expiration of agreement with ESO at end of March 2023

- Fixed fee and compensation for associated costs, including coal

- Remain committed to coal closure and development of BECCS, with no change to expected timetable

- As at 21 July 2022, Drax had 25.4TWh of power hedged between 2022 and 2024 on its ROC and hydro generation assets at an average price of £95.9/MWh, with a further 2.3TWh equivalent of gas sales (transacted for the purpose of accessing additional liquidity for forward sales from ROC units and highly correlated to forward power prices) plus additional sales under the CfD mechanism

| Contracted power sales 21 July 2022 | 2022 | 2023 | 2024 |

|---|---|---|---|

| ROC (TWh(6)) | 11.7 | 8.8 | 4.5 |

| Average achieved £ per MWh | 87.2 | 98.3 | 109.5 |

| Hydro (TWh) | 0.3 | 0.1 | - |

| -Average achieved £ per MWh | 133.1 | 242.0 | - |

| Gas hedges (TWh equivalent) | (0.1) | 0.5 | 1.9 |

| -Pence per therm | 361.0 | 145.8 | 135.0 |

| Lower expected level of ROC generation in 2023 due to major planned outages on two units |

Customers – renewable power under long-term contracts to high-quality I&C customers and decarbonisation products

- Adjusted EBITDA of £24 million (H1 2021: £5 million loss) – continued improvement following impact of Covid-19

- principally in the SME business

- Includes benefit of excess contracted power sold back into merchant market

- Continued development of Industrial & Commercial (I&C) portfolio

- 9TWh of power sales – 21% increase compared to H1 2021 (5.7TWh)

- Focusing on key sectors to increase sales to high-quality counterparties supporting generation route to market

- Energy services to expand the Group’s system support capability and customer sustainability objectives

- SME – increasingly stringent credit control in SME business to reflect higher power price environment

Other financial information

- Total operating profit from continuing operations of £207 million (H1 2021: £84 million), including £130 million mark-to-market gain on derivative contracts and £27 million of exceptional costs

- Total profit after tax from continuing operations of £148 million includes an £8 million non-cash charge from revaluing deferred tax balances following confirmation of UK corporation tax rate increases from 2023 (H1 2021: £6 million loss including a £48 million non-cash charge from revaluing deferred tax balances)

- Capital investment of £60 million (H1 2021: £71 million) – primarily maintenance

- Full year expectation of £290–£310 million, includes £120 million for Open Cycle Gas Turbine projects, £20 million BECCS FEED and site preparation, and £10 million associated with new pellet capacity, subject to final investment decision (FID)

- Depreciation and amortisation of £121 million (H1: £89 million) reflects inclusion of Pinnacle for a full six months, plant upgrades and accelerated depreciation of certain pellet plant equipment in line with planned capital upgrades

- Group cost of debt below 3.6%

- Cash Generated from Operations £185 million (H1 2021: £138 million)

- Net Debt of £1,101 million (31 December 2021: £1,044 million), including cash and cash equivalents of £288 million (31 December H1 2021: £317 million)

- Continue to expect Net Debt to Adjusted EBITDA significantly below 2 times by end of 2022, reflecting optimisation of generation and logistics to deliver higher levels of power generation and cash flows in H2 2022

Adjusted EBITDA loss of £39 million (2019: £17 million profit) inclusive of estimated £60 million impact of Covid-19

Adjusted EBITDA loss of £39 million (2019: £17 million profit) inclusive of estimated £60 million impact of Covid-19

It’s clear that care homes require extra support at this time. We are offering energy bill relief for more than 170 small care homes situated near our UK operations for the next two months, allowing them to divert funds to their other priorities such as PPE, food or carer accommodation.

It’s clear that care homes require extra support at this time. We are offering energy bill relief for more than 170 small care homes situated near our UK operations for the next two months, allowing them to divert funds to their other priorities such as PPE, food or carer accommodation.