Full year results presentation [PDF]

Drax Group plc (“Drax”) confirms that it will be announcing its Full Year Results for the twelve months ended 31 December 2020 on Thursday 25 February 2021.

Information regarding the results presentation meeting and webcast is detailed below.

Management will host a webcast presentation for analysts and investors at 9:00am (UK Time), Thursday 25 February 2021.

The presentation can be accessed remotely via a live webcast link, as detailed below. After the meeting, the webcast recording will be made available and access details of this recording are also set out below.

In order to ask a question following the presentation please either dial-in using the conference call details below or submit a written question using the Q&A functionality on the webcast platform.

A copy of the presentation will be made available from 7:00am (UK time) on Thursday 25 February 2021 for download at: www.drax.com>>investors>>results-reports-agm>> #investor-relations-presentations or use the link https://www.drax.com/investors/results-reports-agm/#investor-relations-presentations

Drax biomass wagons entering rail unloading building

Drax Group plc: Full Year Results

Thursday 25 February 2021

9:00am (UK time)

https://secure.emincote.com/client/drax/drax009

https://secure.emincote.com/client/drax/drax009/vip_connect

Thursday 25 February 2021

Friday 31 December 2021

https://secure.emincote.com/client/drax/drax009

www.drax.com

Drax is pleased to announce that it has signed an agreement (the “Acquisition Agreement”) with Pinnacle Renewable Energy Inc. (PL.TO) (“Pinnacle”), providing for the acquisition by Drax Canadian Holdings Inc., an indirect, wholly-owned subsidiary of Drax, of the entire issued share capital of Pinnacle (the “Acquisition”). The Acquisition will be implemented by way of a statutory plan of arrangement in accordance with the laws of the Province of British Columbia, Canada, at a price of C$11.30 per share (representing a premium of 13% based on the closing market price as at 5 February of C$10.04 per share and valuing the fully diluted equity of Pinnacle at C$385 million (£226 million(1)), with an implied enterprise value of C$741 million, including C$356 million of net debt(2)). The Acquisition, which remains subject to Drax and Pinnacle shareholder approval, court approval, regulatory approvals and the satisfaction of certain other customary conditions, has been unanimously recommended by the board of Pinnacle and has the full support of Pinnacle’s major shareholder, affiliates of ONCAP (which, together hold shares representing approximately 31% of Pinnacle’s shares as at 5 February 2021). Completion is expected to occur in the second or third quarter of 2021.

The Board believes that the Acquisition advances Drax’s biomass strategy by more than doubling its biomass production capacity, significantly reducing its cost of biomass production and adding a major biomass supply business underpinned by long-term contracts with high-quality Asian and European counterparties. The Acquisition positions Drax as the world’s leading sustainable biomass generation and supply business alongside the continued development of Drax’s ambition to be a carbon negative company by 2030, using Bioenergy Carbon Capture and Storage (BECCS).

“I am excited about this deal which positions Drax as the world’s leading sustainable biomass generation and supply business, progressing our strategy to increase our self-supply, reduce our biomass production cost and create a long-term future for sustainable biomass.

“We expect to benefit greatly from Pinnacle’s operational and commercial expertise, and I am looking forward to what we can achieve together.

“It will pave the way for our plans to use Bioenergy with Carbon Capture and Storage (BECCS), and become a carbon negative company by 2030 – permanently removing millions of tonnes of carbon dioxide from the atmosphere each year. Negative emissions from BECCS are vital if we are to address the global climate emergency whilst also providing renewable electricity needed in a net zero economy, supporting jobs and clean growth in a post-COVID recovery.”

“Pinnacle’s Board of Directors has unanimously determined that the transaction represents the best course of action for the company and its shareholders. On closing, the transaction will deliver immediate, significant and certain cash value to our shareholders. At the same time, the combination of Pinnacle and Drax will create a global leader in sustainable biomass with the vision, technical expertise and financial strength to help meet the growing demand for renewable energy products, which is exciting for our employees, customers and others around the world.”

Sustainable biomass has an important role to play in global energy markets as a flexible and sustainable source of renewable energy, as well as having the potential to deliver negative emissions. Drax believes that the Acquisition accelerates the Group’s strategic objectives to increase its available self-supply of sustainable biomass to five million tonnes per annum (Drax currently operates 1.6 million tonnes of capacity with 0.4 million tonnes in development) and reduce the cost of biomass to £50/MWh(4) by 2027. Through the delivery of these strategic objectives Drax aims to create a long-term future for sustainable biomass, including third-party supply, BECCS and merchant biomass generation.

Employee at Morehouse BioEnergy in Louisiana

The Group’s enlarged supply chain will have access to 4.9 million tonnes of operational capacity from 2022. Of this total, 2.9 million tonnes are available for Drax’s self-supply requirements in 2022 (increasing to 3.4 million tonnes in 2027). Drax aims to increase the level of third-party sales and further expand its capacity to meet its target of five million tonnes of self-supply by 2027.

Drax believes that the Acquisition is highly complementary to the Group’s other long-term strategic options for biomass. Once optimised, the enlarged group’s biomass supply chain will support Drax’s own generation requirements, including the potential development of BECCS, whilst also serving the growing biomass markets in Europe and Asia via long-term off-take agreements.

Pinnacle, which is listed on the Toronto Stock Exchange, operates 2.5 million tonnes of biomass capacity at sites in Western Canada and the Southeastern US, with a further 0.4 million tonnes of capacity in development (commissioning in 2021). Investment in this new capacity is expected to be substantially complete in the first half of 2021. Once the new capacity is commissioned, Pinnacle’s nameplate production capacity is expected to increase to 2.9 million tonnes per annum.

Pinnacle has ownership of c.80% of this nameplate capacity, with the remaining c.20% co-owned with its forestry industry joint venture partners, ensuring strong commercial relationships and shared interests in security of supply. Pinnacle has sales and marketing rights to 100% of the output from all sites.

Pinnacle is a key supplier of wood pellets for Drax and other third parties in Asia and Europe, with C$6.7 billion of contracted third-party sales (including sales to Drax).

Wood pellets loaded onto vessel at Westview Terminal, British Columbia

Through scale, operational efficiency and low-cost fibre sourcing, Pinnacle is currently produces biomass at a lower cost than Drax, with a like-for-like 2019 production cost of US$124/tonne(3), compared to Drax’s 2019 production cost of US$161/tonne(3). The pro forma 2019 production cost for the combined business is US$141/tonne.

Pinnacle’s lower cost partially reflects the use of high levels of low-cost sawmill residues. British Columbia has a large and well-established commercial forestry industry, which has in recent years seen increased harvest levels, in part associated with management of a pine beetle infestation, producing good levels of residue material availability for the production of biomass. This infestation has now run its course and alongside other influences on the forest landscape, including wild-fire, is resulting in a reduction in the annual harvest and sawmill closures. The industry is adjusting to this with some production curtailment as well as developing approaches to fibre recovery and use which is expected to result in some increase in fibre costs.

Since 2017, the Sustainable Biomass Program has conducted annual audits of each of Pinnacle’s operational sites, allowing Drax to ensure, through its diligence, that the material that it purchases from Pinnacle is in line with its sustainability standards.

Drax is committed to ensuring best practice in health and safety, operational efficiency and sustainability across the enlarged group and intends to invest accordingly to deliver this outcome.

Drax is committed to ensuring that its biomass sources are compliant with Drax’s well-established responsible sourcing policy and Drax expects to invest in, adapt and develop sourcing practices to ensure compliance with Drax’s policies to deliver both Drax’s biomass strategy and positive forest outcomes.

Pinnacle has ownership interests in ten operational plants and one in development (commissioning 2021), six of which are operated through joint venture arrangements, providing access to nameplate production capacity of 2.9 million tonnes per annum.

Seven of Pinnacle’s sites are in British Columbia (1.6 million tonne nameplate capacity) and two are in Alberta (0.6 million tonne nameplate capacity). All of these sites have rail lines to ports at either Prince Rupert or Vancouver, both accessing the Pacific Ocean, providing routes to Asian and European markets.

Pinnacle also operates a US hub at Aliceville, Alabama (0.3 million tonne nameplate capacity) and is developing a second site in Demopolis, Alabama (0.4 million tonne nameplate capacity), which Pinnacle expects to commission in 2021. Pinnacle’s total operational and development nameplate capacity in the US is 0.7 million tonnes.

Pinnacle’s US sites are close to Drax’s existing operations in the Southeastern US and will utilise river barges to access the Port of Mobile and barge-to-ship loading, reducing fixed port storage costs.

Working forest in LaSalle BioEnergy catchment area, Louisiana

All production sites are located in areas with access to fibre and are able to operate with a range of biomass material from existing commercial forestry activities, including sawmill residues, pre-commercial thinnings and low-grade wood. Combined with a geographic spread of production capacity and access to three separate export facilities, Pinnacle benefits from operational and sourcing flexibility, further enhancing Drax’s security of supply.

Further information is set out in Appendix 1 to this announcement.

Pinnacle has contracted sales of C$6.7 billion, with high-quality Asian and European counterparties (including Drax). This equates to 99% of its current production capacity contracted to third parties through 2026 and a significant volume contracted in 2027 and beyond, providing long-term high-quality revenues.

Vessel carrying biomass pellets at Westview Terminal, British Columbia

Pinnacle has been supplying biomass to Europe since 2004. The location of the majority of Pinnacle’s production capacity in Western Canada, with access to the Pacific Ocean, provides a strong position from which to serve the growing demand for biomass in Asian markets. In 2018 and 2019, Pinnacle entered into 12 new long-term contracts in Japan and South Korea, totalling over 1.3 million tonnes per annum, valued at C$4.6 billion, with most contracts commencing between 2021 and 2023. The average contract duration is nine years, with certain contracts extending significantly beyond this point. Contracts typically operate on a take-or-pay basis.

The global biomass wood pellet market has a broad range of providers that are expected to expand their production capacity, including operators such as Enviva, Graanul Invest, Pinnacle, An Viet Phat, Fram and SY Energy.

The market for biomass wood pellets for renewable generation in Europe and Asia is expected to grow in the current decade, principally driven by Asian demand(5). Drax believes that increasingly ambitious global decarbonisation targets, the need for negative emissions and an improved understanding of the role that sustainably sourced biomass can play will result in continued robust demand.

Train pulling biomass wagons, storage domes and wood pellet conveyor system Drax Power Station, North Yorkshire

As a vertically integrated producer and consumer of sustainable biomass Drax is differentiated from its peers and well positioned to deliver supply chain efficiencies and an expanded range of sustainable biomass materials for own-use and third-party sales.

Through its expanding lower cost supply chain, expertise in biomass generation and enhanced global footprint, Drax believes that there will be opportunities to work with other companies and countries in developing their own biomass-enabled decarbonisation strategies.

The Acquisition is expected to be cash generative and represent an attractive opportunity to create significant value for shareholders, with expected returns significantly in excess of the Group’s weighted average cost of capital.

The addition of long-term contracts with high-quality counterparties in growing international biomass markets will reduce the Group’s relative exposure to commodity prices, in line with the Group’s objective to improve earnings quality and visibility.

In total, the Acquisition increases access to lower cost biomass by a further 2.9 million tonnes after the commissioning of the Demopolis plant in 2021. The price paid for this capacity is consistent with the previously outlined strategy to invest in the region of c.£600 million to deliver Drax’s plans for five million tonnes of self-supply capacity and a biomass cost of £50/MWh by 2027.

For the year ended 27 December 2019, Pinnacle generated Adjusted EBITDA(6) of C$47 million from pellet sales of 1.7 million tonnes.

Pinnacle’s 2019 performance was impacted by fire at its Entwistle plant, reduced rail access due to rail industrial action and weather disrupted forestry activity. At the same time Pinnacle experienced regional Canadian sawmill closures, resulting in some reduction in sawmill residues and an increase in provincial fibre prices.

Fibre diversification and the development of a second hub in the Southeastern US is expected to partially mitigate the risk of fibre price rises.

Taking these factors into account, alongside the commissioning of new capacity and the commencement of Asian supply contracts, Pinnacle’s 2022 consensus EBITDA is C$99 million, increasing to C$126 million in 2023 (Bloomberg).

The Acquisition strengthens the Group’s ability to pay a sustainable and growing dividend. Drax does not expect the Acquisition to have any impact on its expectations for the final dividend payment for 2020.

The Acquisition is expected to be funded from cash and existing agreements. On 15 December 2020 the Group issued a trading update which noted cash and total committed liquidity of £643 million at 30 November 2020. Following the completion, on 31 January 2021, of the sale of four gas power stations, previously announced on 15 December 2020, the Group received cash of £188 million, being the agreed purchase price consideration of £164 million and £24 million of customary working capital adjustments.

Net debt to Adjusted EBITDA(7) in 2021 is expected to be above Drax’s long-term target of around 2 times immediately after completion of the Acquisition but is expected to return to around this level by the end of 2022.

The Acquisition price will be paid in Canadian dollars. Pinnacle’s existing contracts with Drax and third parties are denominated in Canadian and US dollars and Drax expects to manage any exposure within its foreign exchange processes.

Drax’s policy is to hedge its foreign currency exposure on contracted biomass volumes over a rolling five-year period. This has given rise to an average foreign exchange rate hedge around 1.40 (US$/GBP£).

Sustainably sourced biomass is an important part of UK and European renewable energy policy. The renewable status of sustainably sourced biomass is based on well-established scientific principles set out by the Intergovernmental Panel on Climate Change and reflected in the European Union’s (EU) second Renewable Energy Directive and the UK Renewables Obligation.

Drax maintains a rigorous approach to biomass sustainability, ensuring the wood fibre it uses is fully compliant with the UK’s mandatory standards as well as those of the EU.

Dead pine trees in background, infected with mountain pine beetle, British Columbia

Drax recognises that the forest landscape in British Columbia and Alberta is different to commercially managed forests in the Southeastern US. Working in partnership with eNGO Earthworm, Drax has a good understanding of the considerations associated with sourcing residues from harvesting of primary forest and the particular characteristics of the forests in British Columbia and Alberta. In line with its responsible sourcing policy, Drax will work closely with eNGO partners, Indigenous First Nation communities and other stakeholders, and invest to deliver good environmental, social and climate outcomes in Pinnacle’s sourcing areas.

The strong financial returns associated with the Acquisition are not dependent on synergy benefits, but the Group has identified areas for potential operational improvements and efficiencies, and opportunities to invest across the supply chain to achieve consistent standards and improve outputs across the enlarged group.

Drax aims to leverage Pinnacle’s trading capability across its expanded portfolio. Drax believes that the enlarged supply chain will provide greater opportunities to optimise the supply of biomass from its own assets and third-party suppliers.

With existing plans to widen of the Group’s sustainable biomass fuel mix to include a wider range of lower cost sustainable biomass materials, Drax expects to create further opportunities to optimise fuel cargos for own use and third-party supply.

Drax believes that the transport and shipping requirements of the enlarged group will provide greater opportunities to optimise logistics, with delivery of cargos to a counterparty’s closest port, reducing distance, time, carbon footprint and cost.

Control of Drax’s biomass supply chain, with geographically diverse production and export facilities, is expected to enhance security of supply, further mitigating the risk of supply interruptions thereby resulting in improved reliability and a reduced risk of supply interruption.

Drax believes that there will be opportunities to share best practice and drive improved production performance across the enlarged group by leveraging combined expertise in the production of good-quality, low-cost pellets across the enlarged supply chain.

Drax also expects to leverage Pinnacle’s experience in developing and managing third-party off-take agreements alongside its existing commercial and trading capabilities to develop new agreements for supply to third-parties.

Drax has a stronger credit rating, which could enable Pinnacle to develop its supply capability and contracts in Asian and European markets beyond its current position.

Drax’s average cost of debt is lower than Pinnacle’s giving rise to potential future savings.

Drax expects to derive typical corporate cost savings associated with the Acquisition and delisting from the Toronto Stock Exchange.

The Acquisition constitutes a Class 1 transaction under the Listing Rules. As a consequence, completion of the Acquisition is conditional on the Acquisition receiving the approval of Drax shareholders. A combined shareholder circular and notice of general meeting will be posted to shareholders as soon as practicable.

Among other things, the Acquisition is also conditional upon the approval of the Acquisition by Pinnacle’s shareholders, the approval of the Supreme Court of British Columbia, certain antitrust and other regulatory approvals other customary conditions.

A summary of the terms of the Acquisition Agreement is set out in Appendix 2 to this announcement.

Drax’s board has unanimously recommended that Drax’s shareholders vote in favour of the Acquisition, as each of the Drax directors that hold shares in Drax shall do in respect of their own beneficial holdings of Drax’s shares, representing approximately 0.17 per cent. of the existing share capital of Drax as at 5 February 2021, being the last business day prior to the date of this announcement.

Pinnacle’s board has unanimously recommended that Pinnacle’s shareholders vote in favour of the Acquisition at the Pinnacle General Meeting, as the Pinnacle directors (and certain current and former members of Pinnacle management that hold shares in Pinnacle) shall do in respect of their own beneficial holdings of Pinnacle’s shares, representing approximately 4.75 per cent. of the existing share capital of Pinnacle as at 5 February 2021, being the last business day prior to the date of this announcement.

In addition to the irrevocable undertakings from Pinnacle directors described above, Drax has also received an irrevocable undertaking from affiliates of ONCAP (which, together, hold shares representing approximately 31% of Pinnacle’s shares as at 5 February 2021 (being the last business day prior to the date of this announcement)) to vote in favour of the Acquisition at Pinnacle’s General Meeting.

Drax issued a trading update on 15 December 2020 outlining its expectations for 2020 and expects to announce its full year results for the year ended 31 December 2020 on 25 February 2021.

Drax Investor Relations: Mark Strafford

+44 (0) 7730 763 949

Drax External Communications: Ali Lewis

+44 (0) 7712 670 888

+44 (0) 20 7653 4000

Peter Buzzi

Mark Rushton

Evgeni Jordanov

Jonathan Hardy

Jack Wood

Management will host a webcast for analysts and investors at 9:30am (UK Time), Monday 8 February 2021.

The webcast can be accessed remotely via a live webcast link, as detailed below. After the meeting, the webcast recording will be made available and access details of this recording are also set out below.

A copy of the presentation will be made available from 7am (UK time) on 8 February 2021 for download at: https://www.drax.com/investors/results-reports-agm/#investor-relations-presentations

Event Title:

Drax Group plc: Proposed Acquisition of Pinnacle Renewable Energy Inc

Event Date:

9:30am (UK time), Monday 08 February 2021

Webcast Live Event Link:

https://secure.emincote.com/client/drax/drax010

Start Date:

9:30am (UK time), Monday 08 February 2021

Delete Date:

Monday 27 December 2021

Archive Link:

https://secure.emincote.com/client/drax/drax010

The contents of this announcement have been prepared by and are the sole responsibility of Drax Group plc (the “Company”).

RBC Europe Limited (“RBC”), which is authorised by the Prudential Regulation Authority (the “PRA”) and regulated in the United Kingdom by the Financial Conduct Authority (“FCA”) and the PRA, is acting exclusively for the Company and for no one else in connection with the Acquisition, the content of this announcement and other matters described in this announcement and will not regard any other person as its clients in relation to the Acquisition, the content of this announcement and other matters described in this announcement and will not be responsible to anyone other than the Company for providing the protections afforded to its clients nor for providing advice to any other person in relation to the Acquisition, the content of this announcement or any other matters referred to in this announcement.

This announcement does not constitute or form part of any offer or invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for, any shares in the Company or in any entity discussed herein, in any jurisdiction nor shall it or any part of it nor the fact of its distribution form the basis of, or be relied on in connection with, any contract commitment or investment decision in relation thereto nor does it constitute a recommendation regarding the securities of the Company or of any entity discussed herein.

RBC and its affiliates do not accept any responsibility or liability whatsoever and make no representations or warranties, express or implied, in relation to the contents of this announcement, including its accuracy, fairness, sufficient, completeness or verification or for any other statement made or purported to be made by it, or on its behalf, in connection with the Acquisition and nothing in this announcement is, or shall be relied upon as, a promise or representation in this respect, whether as to the past or the future. RBC and its respective affiliates accordingly disclaim to the fullest extent permitted by law all and any responsibility and liability whether arising in tort, contract or otherwise which it might otherwise be found to have in respect of this announcement or any such statement.

Certain statements in this announcement may be forward-looking. Any forward-looking statements reflect the Company’s current view with respect to future events and are subject to risks relating to future events and other risks, uncertainties and assumptions relating to the Company and its group’s and/or, following completion, the enlarged group’s business, results of operations, financial position, liquidity, prospects, growth, strategies, integration of the business organisations and achievement of anticipated combination benefits in a timely manner. Forward-looking statements speak only as of the date they are made. Although the Company believes that the expectations reflected in these forward looking statements are reasonable, it can give no assurance or guarantee that these expectations will prove to have been correct. Because these statements involve risks and uncertainties, actual results may differ materially from those expressed or implied by these forward looking statements.

Each of the Company, RBC and their respective affiliates expressly disclaim any obligation or undertaking to supplement, amend, update, review or revise any of the forward looking statements made herein, except as required by law.

You are advised to read this announcement and any circular (if and when published) in their entirety for a further discussion of the factors that could affect the Company and its group and/or, following completion, the enlarged group’s future performance. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements in this announcement may not occur.

Neither the content of the Company’s website (or any other website) nor any website accessible by hyperlinks on the Company’s website (or any other website) is incorporated in, or forms part of, this announcement.

| Plant | Location | Status | Commissioning | Nameplate Capacity (Mt) | Pinnacle Ownership (%) |

|---|---|---|---|---|---|

| Williams Lake | BC, Canada | Operational | 2004 | 0.2 | 100% |

| Houston | BC, Canada | Operational | 2006 | 0.2 | 30% |

| Armstrong | BC, Canada | Operational | 2007 | 0.1 | 100% |

| Meadowbank | BC, Canada | Operational | 2008 | 0.2 | 100% |

| Burns Lake | BC, Canada | Operational | 2011 | 0.4 | 100% |

| Lavington | BC, Canada | Operational | 2015 | 0.3 | 75% |

| Smithers | BC, Canada | Operational | 2018 | 0.1 | 70% |

| Entwistle | Alberta, Canada | Operational | 2018 | 0.4 | 100% |

| Aliceville | Alabama, USA | Operational | 2018 | 0.3 | 70% |

| High Level | Alberta, Canada | Operational | 2020 | 0.2 | 50% |

| Demopolis | Alabama, USA | Development | Est. 2021 | 0.4 | 70% |

| Total | 2.9 | 80% |

| Location | Nameplate Capacity (Mt) | Pinnacle Ownership (%) |

|---|---|---|

| BC, Canada | 1.6 | 84% |

| Alberta, Canada | 0.6 | 83% |

| Alabama, USA | 0.3 | 70% |

| Total | 2.5 | 82% |

| Location | Nameplate Capacity (Mt) | Pinnacle Ownership (%) |

|---|---|---|

| BC, Canada | 1.6 | 84% |

| Alberta, Canada | 0.6 | 83% |

| Alabama, USA | 0.7 | 63% |

| Total | 2.9 | 81% |

Across its business Pinnacle employs 485 employees, principally in the operation of its assets.

The following is a summary of the principal terms of the Acquisition Agreement.

The Acquisition Agreement was entered into on 7 February 2021 between Drax, Drax Canadian Holdings Inc., (an indirect wholly-owned subsidiary of Drax) (“Bidco”) and Pinnacle. Pursuant to the Acquisition Agreement, Bidco has agreed to acquire all of the issued and outstanding shares in Pinnacle and, immediately following completion, Pinnacle will be an indirect wholly-owned subsidiary of Drax. The Acquisition will be implemented by way of a statutory plan of arrangement in accordance with the laws of the Province of British Columbia, Canada.

Completion under the Acquisition Agreement is subject to, and can only occur upon satisfaction or waiver of, a number of conditions, including:

(a) the approval of the Acquisition by Drax shareholders who together represent a simple majority of votes cast at a meeting of Drax shareholders;

(b) the approval of the Acquisition by Pinnacle shareholders who together represent not less than two-thirds of votes cast at a meeting of Pinnacle shareholders;

(c) an interim order providing for, among other things, the calling and holding of a meeting of Pinnacle shareholders and a final order to approve the Arrangement, each having been granted by the Supreme Court of British Columbia;

(d) no material adverse effect having occurred in respect of Pinnacle;

(e) in the event that the Competition and Markets Authority (the “CMA”) has requested submission of a merger notice or opened a merger investigation, the CMA having issued a decision that the Acquisition will not be subject to a Phase 2 reference or the period for the CMA considering a merger notice has expired without a Phase 2 reference having been made;

(f) either the receipt of an advance ruling certificate or both the expiry, termination or waiver of the applicable waiting period under the Competition Act (Canada) and, unless waived by Drax, receipt of a no-action letter in respect of the Acquisition from the Commissioner of Competition;

(g) the expiry or early termination of any applicable waiting period (and any extension of such period) applicable to the Acquisition under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (US); and

(h) the receipt a third party consent

In addition, Drax has the unilateral right not to complete the Acquisition where registered Pinnacle shareholders representing more than five per cent. of the outstanding share capital of Pinnacle duly exercise their dissent rights.

If any of the conditions are not satisfied (or waived) by 7 September 2021, either party can terminate the Acquisition Agreement.

Prior to obtaining approval from their respective shareholders in relation to the Acquisition, each of Drax and Pinnacle are prohibited from soliciting from any third party any acquisition proposal (relating to 20 per cent. or more of their shares or their group’s assets). However, if prior to obtaining Drax shareholder approval, Drax receives an unsolicited bona fide proposal in respect of 50 per cent. or more of its shares or all or substantially all of the assets of the Drax group and which the Drax board considers would result in a transaction that is more favourable to Drax shareholders from a financial perspective than the Acquisition (a “Drax Superior Proposal”), it may engage in discussions in relation to such Drax Superior Proposal in accordance with the terms of the Acquisition Agreement. Similarly, if prior to obtaining Pinnacle shareholder approval, Pinnacle receives an unsolicited bona fide proposal in respect of 100 per cent. of its shares or all or substantially all of the assets of the Pinnacle group and which the Pinnacle board considers would result in a transaction that is more favourable to Pinnacle shareholders from a financial perspective than the Acquisition (a “Pinnacle Superior Proposal”), it may engage in discussions in relation to such proposal in accordance with the terms of the Acquisition Agreement.

Drax has agreed to pay a break fee of C$25 million to Pinnacle if the Acquisition Agreement is terminated as a result of:

(a) the Drax board withholding, withdrawing or adversely modifying its recommendation that Drax shareholders approve the Acquisition;

(b) the Drax board authorising Drax to enter into any definitive agreement (other than a confidentiality agreement) in respect of a Drax Superior Proposal;

(c) the Drax board terminating the Acquisition Agreement in response to any intervening event that was not known to the Drax board as of the date of the Acquisition Agreement;

(d) Drax breaching its non-solicitation obligations set out in the Acquisition Agreement; or

(e) completion not occurring by 7 September 2021 or a failure to obtain Drax shareholder approval and, in each case, an acquisition of 50 per cent. of Drax’s shares or assets (subject to certain exceptions) is is made or announced prior to the Drax shareholder approval having been obtained and any such acquisition is consummated (or a definitive agreement is entered into in respect of the same) within 12 months of termination.

In addition, Drax has agreed to pay Pinnacle an expense fee of C$5 million in the event that the Acquisition Agreement is terminated as a result of a failure to obtain Drax shareholder approval. The expense fee shall not be payable in the event that the break fee is also payable.

Pinnacle has agreed to pay a break fee of C$12.5 million to Drax if the Acquisition Agreement is terminated as a result of:

(a) the Pinnacle board withholding, withdrawing or adversely modifying its recommendation that Drax shareholders approve the Acquisition;

(b) the Pinnacle board authorising Pinnacle to enter into any definitive agreement (other than a confidentiality agreement) in respect of a Pinnacle Superior Proposal;

(c) the Pinnacle board terminating the Acquisition Agreement in response to any intervening event that was not known to the Pinnacle board as of the date of the Acquisition Agreement;

(d) Pinnacle breaching its non-solicitation obligations set out in the Acquisition Agreement; or

(e) completion not occurring by 7 September 2021 or a failure to obtain Pinnacle shareholder approval and, in each case, an acquisition of 50 per cent. of Pinnacle’s shares or assets (subject to certain exceptions) is made or announced prior to the Drax shareholder approval having been obtained and any such acquisition is consummated (or a definitive agreement is entered into in respect of the same) within 12 months of termination.

https://www.drax.com/investors/disclaimer-proposed-acquisition-of-pinnacle-renewable-energy-inc-by-drax/

Drax Group plc is pleased to announce that it has completed the sale of Drax Generation Enterprise Limited, which holds four Combined Cycle Gas Turbine (“CCGT”) power stations, to VPI Generation Limited.

Following the sale Drax no longer operates any CCGTs and on 31 March 2021 will end commercial coal generation, with formal closure of its remaining coal assets in September 2022.

Drax Investor Relations: Mark Strafford

+44 (0) 7730 763 949

Drax External Communications: Ali Lewis

+44 (0) 7712 670 888

Website: www.Drax.com

END

Tackling climate change requires global collaboration. As a UK-US sustainable energy company, with communities on both sides of the Atlantic, we at Drax are keenly aware of the need for thinking that transcends countries and borders.

Joe Biden has become the 46th President of my native country at a crucial time to ensure there is global leadership and collaboration on climate change. Starting with re-joining the Paris Agreement, I am confident that the new administration can make a significant difference to this once-in-a-lifetime challenge.

This is why Drax and our partners are mobilising a transatlantic coalition of negative emissions producers. This can foster collaboration and shared learning between the different technologies and techniques for carbon removal that are essential to decarbonise the global economy.

Biomass storage domes at Drax Power Station in North Yorkshire

Whilst political and technical challenges lie ahead, clear long-term policies that spur collaboration, drive innovation and enable technologies at scale are essential in achieving the UK and US’ aligned targets of reaching net zero carbon emissions by 2050.

What makes climate change so difficult to tackle is that it requires collaboration from many different parties on a scale like few other projects. This is why the Paris Agreement and this year’s COP26 conference in Glasgow are so vital.

Sustainable biomass wood pellets being safely loaded at the Port of Greater Baton Rouge onto a vessel destined for Drax Power Station

Our effort towards delivering negative emissions using bioenergy with carbon capture and storage (BECCS) is another example of ambitious decarbonisation that is most impactful as part of an integrated, collaborative energy system. The technology depends upon sustainable forest management in regions, such as the US South where our American communities operate. Carbon capture using sustainable bioenergy will help Drax to be carbon negative by 2030 – an ambition I announced at COP25, just over a year ago in Madrid.

Will Gardiner announcing Drax’s carbon negative ambition at COP25 in Madrid (December 2019).

Experts on both sides of the Atlantic consider BECCS essential for net zero. The UK’s Climate Change Committee says it will play a major role in tackling carbon dioxide (CO2) emissions that will remain in the UK economy after 2050, from industries such as aviation and agriculture that will be difficult to fully decarbonise. Meanwhile, a report published last year by New York’s Columbia University revealed that rapid development of BECCS is needed within the next 10 years in order to curb climate change.

A variety of negative emissions technologies are required to capture between 10% and 20% of the 35 billion metric tonnes of carbon produced annually that the International Energy Agency says is needed to prevent the worst effects of climate change.

We believe that sharing our experience and expertise in areas such as forestry, bioenergy, and carbon capture will be crucial in helping more countries, industries and businesses deploy a range of technologies.

A formal coalition of negative emissions producers that brings together approaches including land management, afforestation and reforestation, as well as technical solutions like direct air capture (DAC), as well as BECCS, would offer an avenue to ensure knowledge is shared globally.

It would also offer flexibility in countries’ paths to net zero emissions. If one approach under-delivers, other technologies can work together to compensate and meet CO2 removal targets.

As with renewable energy, working in partnership with governments is essential to develop these innovations into the cost-effective, large scale solutions needed to meet climate targets in the mid-century.

I agree whole heartedly that a nation’s economy and environment are intrinsically linked – something many leaders are now saying, including President Biden. The recently approved US economic stimulus bill, supported by both Republicans and Democrats in Congress and which allocates $35 billion for new clean energy initiatives, is a positive step for climate technology and job creation.

Globally as many as 65 million well-paid jobs could be created through investment in clean energy systems. In the UK, BECCS and negative emissions are not just essential in preventing the impact of climate change, but are also a vital economic force as the world begins to recover from the effects of COVID-19.

Engineer inside the turbine hall of Drax Power Station

Government and private investments in clean energy technologies can create thousands of well-paid jobs, new careers, education opportunities and upskill workforces. Developing BECCS at Drax Power Station, for example, would support around 17,000 jobs during the peak of construction in 2028, including roles in construction, local supply chains and the wider economy.

Additional jobs would be supported and created throughout our international supply chain. This includes the rail, shipping and forestry industries that are integral to rural communities in the US South.

We are also partnered with 11 other organisations in the UK’s Humber region to develop a carbon capture, usage and storage (CCUS) and hydrogen industrial cluster with the potential to spearhead creating and supporting more than 200,000 jobs around the UK in 2039.

The expertise and equipment needed for such a project can be shared, traded and exported to other industrial clusters around the world, allowing us to help reach global climate goals and drive global standards for CCUS and biomass sustainability.

Clear, long-term policies are essential here, not just to help develop technology but to mitigate risk and encourage investment. These are the next crucial steps needed to deploy negative emissions at the scale required to impact CO2 emissions and lives of people.

Engineer at BECCS pilot project within Drax Power Station

At Drax we directly employ almost 3,000 people in the US and UK, and indirectly support thousands of families through our supply chains on both sides of the Atlantic. Drax Power Station is the most advanced BECCS project in the world and we stand ready to invest in this cutting-edge carbon capture and removal technology. We can then share our expertise with the United States and the rest of the world – a world where major economies are committing to a net zero future and benefiting from a green economic recovery.

(“Drax”, “the Group”, “Drax Group”, “the Company”; Symbol: DRX)

Drax is pleased to announce that it has reached agreement for the sale of Drax Generation Enterprise Limited (“DGEL”), which holds four Combined Cycle Gas Turbine (“CCGT”) power stations, to VPI Holding Limited (“VPI”) for consideration of £193.3 million, subject to customary adjustments. This includes £29.0 million of contingent consideration associated with the option to develop a new CCGT at Damhead Creek.

The transaction is subject to certain customary closing conditions, including anti-trust approval, with completion to take place by 31 January 2021.

The CCGTs have performed well since acquisition by Drax in December 2018, but do not form part of the Group’s core flexible and renewable generation strategy. Drax expects to realise a premium on sale, use the proceeds to develop its biomass supply chain and accelerate its ambition to become a carbon negative business by 2030.

DGEL also holds the Group’s pumped storage and hydro assets and is the shareholder of SMW Limited (the owner of the Daldowie fuel plant). These assets, shares and employees are to be transferred out of DGEL prior to completion and will be retained by Drax.

“By focusing on our flexible and renewable generation activities in the UK we expect to deliver a further reduction in the Group’s CO2 emissions, which should accelerate our ambition to become not just carbon neutral but carbon negative by 2030.

“By using carbon capture and storage with biomass (BECCS) at the power station in North Yorkshire to underpin the decarbonisation of the wider Humber region, we believe we would be creating and supporting around 50,000 new jobs and delivering a green economic recovery in the North.

“We greatly value the contribution that our colleagues in gas generation have made to the Group over the last two years. As we focus on a renewable and flexible portfolio, it is right that we divest these gas generation assets and in doing so create value for our shareholders.”

Between 2012 and 2019, through investment in sustainable biomass and hydro, Drax has reduced its carbon emissions by over 85% and become the largest source of renewable electricity in the UK(1).

In December 2019 Drax announced an ambition to become a carbon negative company by 2030. The negative emissions provided by BECCS will offset carbon emissions within the Group’s supply chain and help to offset emissions in harder to abate sectors of the economy, such as aviation and agriculture.

In February 2020 Drax announced an end to commercial coal generation in 2021 and now, by divesting its existing gas generation assets, Drax will further reduce its carbon emissions.

Drax will continue to provide system support services alongside its decarbonisation strategy through its renewable generation portfolio, other development opportunities and demand-side response within its Customers business. These activities provide renewable electricity and a fully flexible generation and supply portfolio, which can support the UK power system as it becomes increasingly reliant on intermittent and inflexible generation sources.

Drax acquired the CCGTs from Iberdrola in December 2018 as part of a portfolio of pumped storage, hydro and gas generation. The majority of the value in the acquisition was ascribed to the pumped storage and hydro assets, which in the first six months of 2020 provided £35 million of Adjusted EBITDA(3). In the same period the CCGTs provided £18 million of Adjusted EBITDA. Group Adjusted EBITDA for the first six months of 2020 was £179 million.

As at 30 June 2020 the gross fixed assets for the CCGTs were £182 million.

The CCGTs also have £89 million of Capacity Market income between 2021 and 2024(4) which will remain with DGEL on completion.

The CCGT business currently employs 121 people in operational roles who will transfer with DGEL on completion.

Drax has agreed a series of transitional services to support the transition through 2021.

Drax continues to evaluate options for the development of four Open Cycle Gas Turbines and Drax Power Station following the end of coal operations.

Total consideration is £193.3 million, subject to customary completion accounts adjustments, comprising £164.3 million for the four CCGT power stations and a further £29.0 million of contingent consideration payable on satisfaction of certain triggers in respect of the option to develop a new CCGT at Damhead Creek.

The payment of £164.3 million in respect of the four CCGTs is payable in cash on completion, with an option to defer the payment of £50.0 million until April 2022. The deferred component would carry an interest rate of four percent and be backed by a letter of credit. In the event that the deferral option is exercised Drax intends to convert the payment obligation to cash upon completion for the face value.

Subject to fulfilment of pre-closing conditions, completion is to take place by 31 January 2021.

The sale price represents an expected premium compared to the book value of the assets, subject to customary adjustments and a return over the period of ownership significantly ahead of the Group’s WACC.

Sustainable biomass wood pellet storage domes at Baton Rouge Transit, a renewable fuel storage and logistics site operated by Drax at the Port of Greater Baton Rouge, Louisiana [Click to view/download]

These savings will be delivered through the optimisation of existing biomass operations, greater utilisation of low-cost wood residues and an expansion of the fuel envelope to incorporate other low-cost renewable biomass across the Group’s expanded supply chain.

Drax believes that the additional capital and operating cost investment required to deliver this supply chain expansion is in the region of £600 million, which the Group expects to invest ahead of 2027. Drax remains alert to sector opportunities for both organic and inorganic growth.

The Group has identified three models through which it believes it can deliver a long-term future for sustainable biomass, all of which are underpinned by the delivery of its supply chain expansion and cost reduction plans. These options, which are not mutually exclusive, are summarised below. The delivery of one or more of these models by 2027 would enable Drax to continue its biomass activities when the current UK renewable schemes for biomass generation end in March 2027.

Drax believe that biomass has an important role to play in the UK as a flexible and reliable source of renewable energy, supporting increased utilisation of intermittent and inflexible generation across the UK power grid. In March 2027, when the current CfD(6) and ROC(7) renewable schemes end, Drax believes that through a combination of peak power generation, system support services, Capacity Market income and a low-cost operating model for Drax Power Station (including low-cost biomass), this site can continue to operate as a merchant renewable power station.

The four biomass units located in the turbine hall at Drax Power Station have a total capacity of 2.6 GW [Click to view/download]

The UK’s Climate Change Committee (CCC) has set out what is required for the country to achieve its legally binding objective of being net zero by 2050. This includes an important role for BECCS to remove CO2 from the atmosphere, creating negative emissions. BECCS is the only large-scale solution for negative emissions with renewable electricity and system support capabilities. Through combining BECCS with its existing four biomass generation units at Drax Power Station, Drax believes it could remove up to 16 million tonnes of CO2 per year – over two thirds of the CCC’s 2035 target for BECCS. In doing so Drax aims to become a carbon negative company by 2030.

The technology to deliver post-combustion BECCS exists and is proven at scale. In September 2020, Drax commenced a trial of one such technology provided by Mitsubishi Heavy Industries (MHI). In addition, Drax is developing innovative technology options, including C-Capture, a partnership between Leeds University, Drax, IP Group and BP, which has developed an organic solvent which could be used for BECCS.

Innovation engineer inspects pilot carbon capture facility at Drax Power Station [Click to view/download]

Drax expects global demand for wood pellets to increase in the current decade, as other countries develop decarbonisation programmes which recognise the benefits of sustainable biomass for generation. Whilst there is an abundance of unprocessed sustainable biomass material globally, there remains limited capacity to convert these materials into energy dense pellets, which have a low-carbon footprint and lower cost associated with transportation. As a result, Drax expects the global market for biomass to remain under supplied. Drax is therefore exploring options to service biomass demand in Europe, North America and Asia alongside the UK. Establishing a presence in these markets could offer the potential for long-term offtake agreements, providing diversified revenues from other biomass markets.

Since publishing its half year results on 29 July 2020 the trading and operational performance of the Group has remained robust.

In the USA, the Group’s Pellet Production business is commissioning 100,000 tonnes of new production capacity at its Morehouse facility in Louisiana as part of its previously announced plans to add 350,000 tonnes across its three existing production sites by 2022. The project is part of the Group’s plan to expand its sustainable biomass supply chain and reduce costs.

The Generation business has continued to perform well in the provision of system support services, responding to both the low and high demand needs of the UK electricity system.

In addition to the successful completion of a major planned outage and upgrade of a biomass unit at Drax Power Station, the Group has progressed its earlier stage development work on BECCS. Alongside the commencement of a solvent trial with MHI, Drax has awarded pre-FEED (Front End Engineering Design) contracts and expects to incur incremental operating costs associated with the development of a full FEED study during 2021.

At its half year results in July 2020 Drax noted that further lockdown measures in the UK in the second half of 2020 could create a small downside risk on the performance of the Customers business, principally in the SME(8) market. Drax is continuing to assess operational and strategic options for this part of the Group.

The Group’s expectations for 2020 Adjusted EBITDA remain in line with market expectations(9), inclusive of the impact of Covid-19, principally in relation to its Customers business. Full year expectations for the Group remain underpinned by good operational availability for the remainder of 2020.

Electricity pylons take flexible power generated from water stored in a reservoir at Cruachan Power Station in the Highlands into the national grid [Click to view/download]

| 2020 | 2021 | 2022 | |

|---|---|---|---|

| Fixed price power sales (TWh) | 18.2 | 15.2 | 6.5 |

| Contracted % versus 2019 full year output | 1.06 | 0.86 | 0.38 |

| Of which CfD (TWh) (10) | 4.8 | 1.7 | - |

| Of which CCGT (TWh) | 2.5 | 3.1 | 0.2 |

| At an average achieved price (£ per MWh) | 54.8 | 48.2 | 48 |

| Average price for CCGT (£ per MWh) | 53.2 | 46.5 | 54.7 |

As announced on 19 November 2020 the Group agreed a new £300 million ESG(11) Revolving Credit Facility (RCF). This replaces an RCF which was due to mature in 2021 and provides increased liquidity, enabling the full facility to be drawn as cash (the previous facility restricted cash drawn to support liquidity to £165 million). The ESG RCF is currently undrawn for cash.

In addition to the ESG RCF, the Group has agreed new infrastructure facilities (£213 million) and a Euro denominated bond issue (€250 million), which replace an existing RCF, Sterling bond and ESG term-loan, reducing the Group’s overall cost of debt and extending its maturity profile to 2030.

As at 30 November 2020 Drax had adjusted cash and total committed facilities of £643 million.

The Group remains committed to its capital allocation policy, through which it aims to maintain a strong balance sheet; invest in the core business; pay a sustainable and growing dividend and return surplus capital beyond investment requirements.

Subject to the continued good operational performance and overall impact from Covid-19 remaining in line with the position Drax set out in April 2020, the Group continues to expect to pay a dividend for the 2020 financial year of 17.1 pence per share (approximately £68 million), a 7.5% increase on 2019. This is consistent with the policy to pay a dividend which is sustainable and expected to grow as the strategy delivers an increasing proportion of stable earnings and cash flows.

Drax Investor Relations:

Mark Strafford

Drax External Communications:

Ali Lewis

Website: www.drax.com

ENDS

December 2020 marks the fifth anniversary of the Paris Agreement. It represented a landmark moment in the global effort to combat climate change and build a better future. However, global progress is not moving at the speed it needs to in order to meet the treaty’s target of keeping global warming below 1.5-2 degrees Celsius.

Explore Carbon Capture by Drax

Countries have set their own decarbonisation targets and many companies have laid out plans to become carbon neutral or even carbon negative – as we at Drax intend to achieve by 2030. While these leading ambitions are important for the UK and the world to meet the goals of the Paris Agreement, real action, polices and investment are needed at scale.

We have a clearer view of the path ahead than five years ago. We know from the recent 6th Carbon Budget that renewable energy, as well as carbon capture, usage and storage (CCUS) are essential for the UK to reach its target of net zero carbon emissions by 2050.

In that detailed, 1,000-page report, the Climate Change Committee (CCC) was clear that progress must be made immediately – the country as a whole must be 78% of the way there by 2035. By investing where it’s needed, the UK can lead the world in a whole new industry. One that may come to define the next century.

It was a combination of resource and ingenuity that enabled the UK to launch the Industrial Revolution some 250 years ago. Today the country is in a similar position of being able to inspire and help transform the world.

As a country – one that I moved to over 20 years ago now – we have decarbonised at a greater pace than any other over the past decade. Investing in renewable generation such as wind, solar and biomass has allowed the UK to transform its energy systems and set ambitious targets for net zero emissions.

To remain resilient and meet the increased electricity demand of the future, power grids will require vastly increased support from energy storage systems such as pumped hydro – as well as flexible, reliable forms of low and zero carbon power generation.

However, the urgency of climate change means the UK must go beyond decarbonisation to implementing negative emissions technologies (which remove more carbon dioxide (CO2) from the atmosphere than they emit). The CCC, as well as National Grid’s Future Energy Scenarios report have emphasised the necessity of negative emissions for the UK to reach net zero, by removing CO2 not just from energy but other industries too.

The UK can build on its global leadership in decarbonisation to invest in the cutting-edge green technology that can take the country to net zero, establishing it as a world leader for others to follow.

When the Paris agreement was signed, I was just joining Drax. I had been impressed by the power station’s transformation from coal to biomass – Europe’s largest decarbonisation project – supporting thousands of jobs in the process.

Five years on and I’m excited for the next stage: delivering negative emissions. By deploying bioenergy with carbon capture and storage (BECCS) we can permanently remove CO2 from the atmosphere while producing renewable electricity.

Drax has successfully piloted BECCS and is ready to deploy it at scale as part of our Zero Carbon Humber partnership.

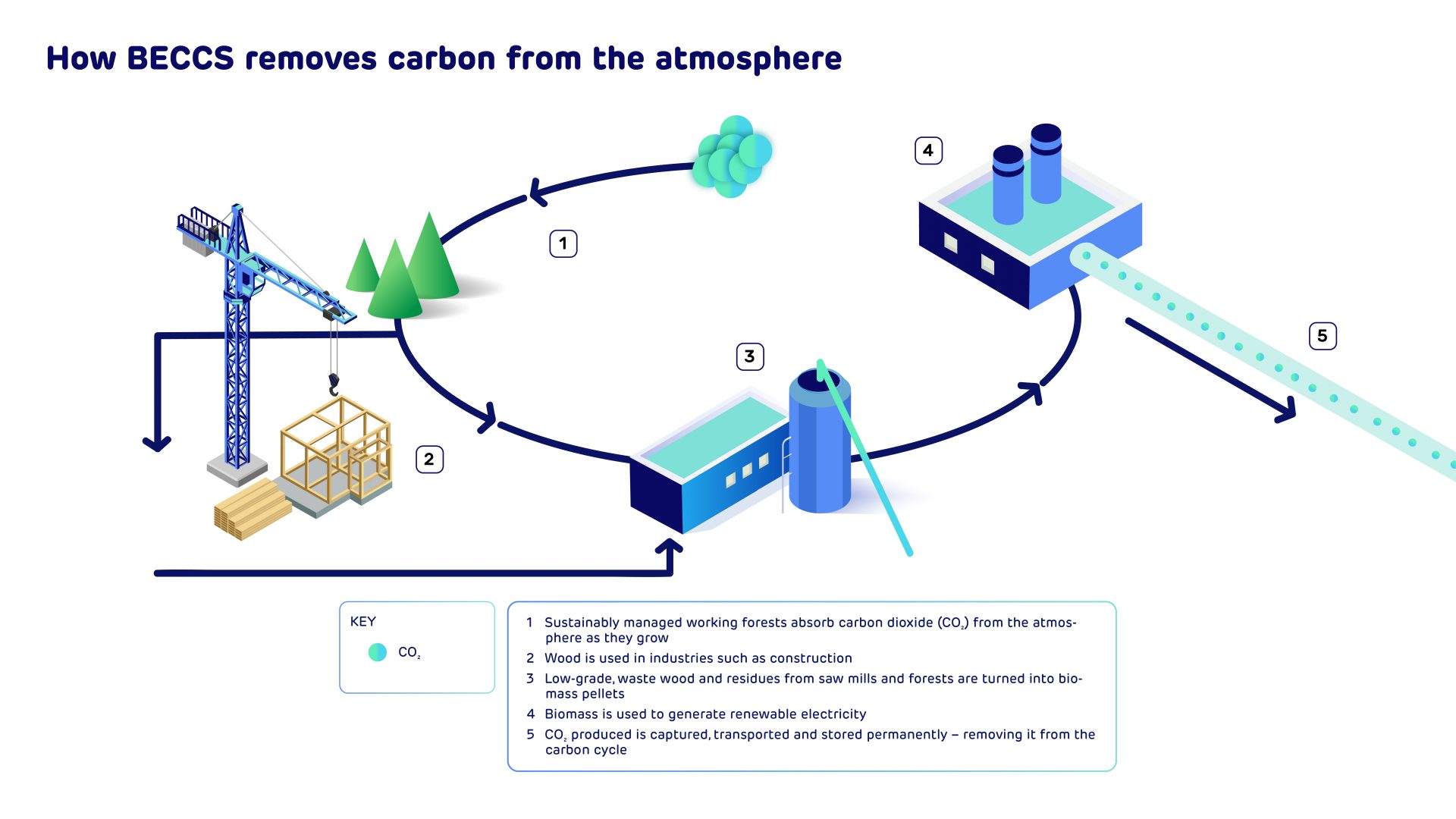

Click graphic to view. Find out more about Bioenergy with carbon capture and storage (BECCS) and negative emissions.

I’m confident the partnership with other leading energy, industrial and academic organisations can act as a revitalising force in a region that has historically been under-invested in, protect 55,000 jobs and create 50,000 new opportunities.

Developing the supply chain surrounding a world-leading zero-carbon cluster in the Humber could deliver a £3.2 billion economic boost to the wider economy as we emerge from the COVID-19 pandemic.

I believe we can establish a new industry to export globally. The Humber’s ports have a long history of trade and we can build on this legacy. The machinery, equipment and services needed to develop BECCS and Zero Carbon Humber will be an essential export as the rest of the world races to decarbonise.

Unloading sustainable biomass wood pellets destined for Drax Power Station from a vessel at the port of Immingham

By providing training and partnering with educational institutions we can increase scientific and technical skills. Net zero industrial clusters can enable more in society the opportunity to have rewarding and fulfilling engineering, energy and environmental careers.

This model can reach around the world – positioning people and businesses to help countries to reach the collective goals of Paris Agreements.

The economic benefits for such achievements far outweigh the costs of failing to stem global warming and we are ready to invest in the technologies needed to do so. With robust government policies in place, a net zero future could cost as little as 1% of GDP over the next 30 years.

Countering climate change is a once-in-a-lifetime challenge for the world, but also a once-in-a-lifetime opportunity to build a sustainable future with sustainable jobs, improved standards of living, health and wellbeing. The UK has a responsibility to use its expertise and resources, setting in place the structures that can allow companies like mine – Drax – to lead the world to reaching the Paris Agreement’s targets and beyond.