Hello everyone. My name is Will Gardiner and I am the CEO of the Drax Group. It is great to have the opportunity to speak to you today at the Utility Week Investor Summit and to discuss attracting investment in emerging low carbon technologies.

Drax at the heart of the energy transition

My company Drax has been at the heart of Britain’s energy system for decades. And we have played a key role in the decarbonisation of the power sector: Drax Power Station in Selby, North Yorkshire, is the UK’s largest power station and Europe’s largest decarbonisation project. Cruachan, our Scottish Pumped Storage facility, is a key complement to Britain’s ever-increasing supply of offshore wind.

Our transition from coal to biomass has allowed us to reduce our greenhouse gas emissions by over 80% while providing clean and flexible energy to millions of homes and businesses across the UK. This month saw the end of commercial coal generation at Drax power station – a milestone in the history of our company and of the UK economy, too.

But the drive to create a more sustainable, net zero economy means that we cannot stop here.

Which is why at Drax we have committed to a world-leading ambition to be carbon negative by 2030.

Engineer in the workshop at Drax Power Station

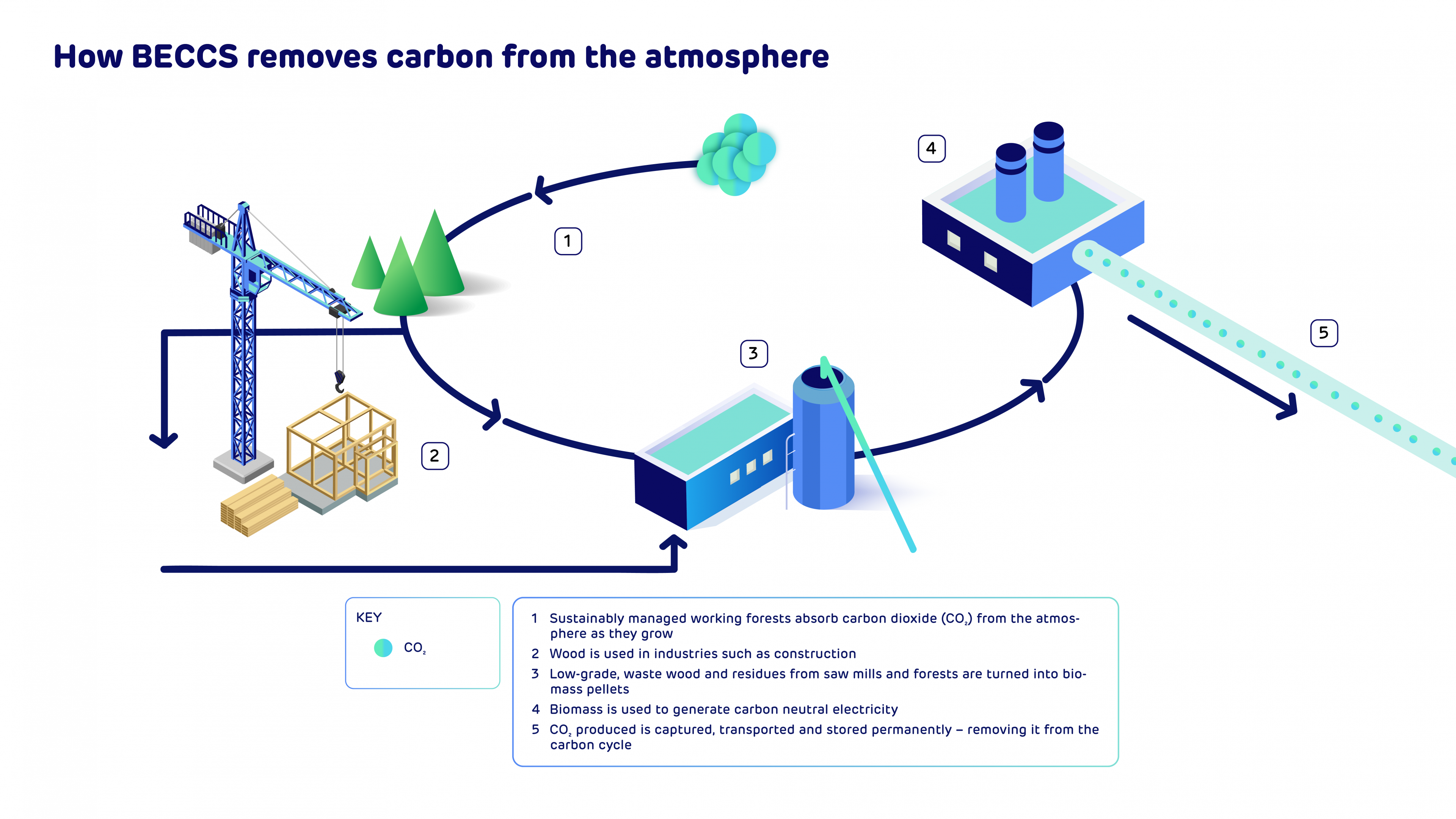

We will achieve this by increasing our capacity to generate renewable electricity, and by making a transformational investment in bioenergy with CCS, or BECCS, which will enable us to permanently remove carbon emissions from the atmosphere.

We are pioneering BECCS at Drax Power Station as part of the Zero Carbon Humber cluster, a coalition of diverse businesses with the same ambition: to create the world’s first net zero emissions industrial cluster.

I am delighted to confirm today that the Zero Carbon Humber Cluster project has received more than £21m in funding from the Government’s Industrial Strategy Challenge Fund to help accelerate our plans and to help transform our vision of a zero carbon industrial cluster into a reality.

The benefits are enormous

BECCS is a vital technology in the fight against climate change. Expert bodies such as the Climate Change Committee here in the UK and the IPCC at a global level are clear that we need negative emissions technologies including BECCS to reach net zero. And BECCS is central to the UK government and Europe’s decarbonisation plans.

As the world’s largest, and most experienced, generator and supplier of sustainable bioenergy there is no better place to pioneer BECCS than at Drax. The economic, social and environmental benefits are enormous.

BECCS at Drax will permanently remove millions of tonnes of carbon from the atmosphere and help heavy industry in the UK’s largest emitting area decarbonise quickly and cost effectively;

It will enable the creation of tens of thousands of green jobs in the North of England, levelling up the economy and delivering a green recovery from the Covid crisis;

And it will put the UK at the forefront of global efforts to develop carbon removal technology in this, the year that we host COP26 in Glasgow.

A proven technology

We know that BECCS works and that the technology is available now. Looking at cost projections from the CCC, we also know that it is the best value negative emissions technology.

We have already successfully run two BECCS pilots at the power station. In 2019 we demonstrated that we can capture CO2 from a 100% biomass feedstock. And in 2020, we began a second pilot working with Mitsubishi Heavy Industries to further enhance the potential for delivering negative emissions.

We aim to deploy BECCS at scale by 2027. To that end, earlier this month, we kickstarted the planning process for our proposals to build our first BECCS unit, marking a major milestone in the project and putting us in a position to commence building BECCS as soon as 2024.

A partnership between industry and government

Successful decarbonisation has always been a partnership between industry and government.

This is evident looking at the incredible rise of Britain’s offshore wind sector. As a direct response to government’s political commitment, a strong price signal, and an investable Contract for Difference mechanism, offshore wind capacity has grown from 1GW to over 10GW in a decade. And build costs are now two thirds lower than what they were 10 years ago.

Pylon that takes excess wind power to be stored at Cruachan pumped hydro storage power station in Scotland

At Drax, our conversion from coal to biomass was benefited from much the same framework:

- The UK Government was – and continues to be – very strong in its support for biomass as a renewable technology to replace coal;

- Our CfD mechanism has given investors the certainty they need to invest;

- And successive government’s commitment to a carbon price that matches or exceeds that of our European neighbours has told the market that Britain is serious about decarbonising the power sector rapidly.

That combination of factors – a clear, transparent, investable framework for renewables, combined with a strong price signal from the UK government discouraging fossil fuel power generation – has been the key to driving private sector investment in renewable power technology in the UK. As a result, the UK leads the world in decarbonising its electricity sector, while also enabling a global technology revolution in offshore wind power. Importantly, the whole effort has been underpinned by transparency, competition and confidence in the regulatory and legal framework, all of which are critical.

Building a partnership for the future

By continuing this partnership between industry and government, the UK could become the world leader in emerging green technologies such as BECCS.

Right now, markets and regulatory frameworks for BECCS or negative emissions more broadly either don’t exist – or aren’t flexible enough – to support the scaling of the technologies we need to get to net zero. But the first-generation framework, as I have just described, provides a great model.

Fundamentally, we believe that we can do BECCS at a cost of less than £100/t of CO2, which is less than any other negative emissions technology available.

We know this investment will help the UK reach net zero at a lower cost than it otherwise could do.

Maintenance inside a water cooling tower at Drax Power Station

But although we’re ready to make the investment – the UK’s regulatory system isn’t yet ready to support it.

Despite being world leaders in these areas, our carbon pricing system and financial markets don’t yet recognise the value of negative emissions, even though our political institutions and scientists say they are vital to tackling climate change.

There is no government defined business model for BECCS, which will be essential to signalling long term political support as well as operational support.

And despite being the best placed country in the world to develop BECCS, we risk losing out as other countries race to deploy this technology first. Just last week we saw Aker, Microsoft and Orsted sign a memorandum of understanding to develop BECCS in Denmark.

However, in its ten-point plan, the UK government has committed to outline what role biomass and BECCS will play in the UK’s transition to net zero by the end of this year. Soon it will be consulting on a new bioenergy strategy. And it has already taken evidence on Greenhouse Gas Removal technologies and consulted on CCS clusters.

This, we believe, demonstrates that a set of policies could emerge in the coming months that will support investment in BECCS.

At their core, we think these policies should capture the stability and investability of a CfD for the renewable power that we will produce, as well as deliver payment for the negative emissions. By compensating negative emissions with a credit for every ton of CO2 they remove from the environment, the government can properly reward those technologies, and add a critical new set of tools to the fight against climate change – ultimately lower the cost of winning that battle.

This would enable Drax to invest in BECCS, begin delivering negative emissions and helping to decarbonise the North of England as soon as 2027.

With COP26 later this year, making this policy commitment will allow us to accelerate our own decarbonisation journey and support the industries of the future develop here in the UK.

BECCS in context

We know that there is no silver bullet solution to tackling climate change.

Negative emissions technologies such as BECCS will be needed alongside others, for example more renewables, electric vehicles, energy storage, energy efficiency and hydrogen.

Drax employee charging an electric car at Haven Power in Ipswich

BECCS complements – and does not – and should not – substitute for ambitious decarbonisation plans. Technologies such as BECCS have a clear and unique role to play by helping harder to abate sectors such as heavy industry, aviation and agriculture – decarbonise.

This is critically important if we are to meet our legally binding 2050 net zero target. The CCC estimates that 51m tonnes of CO2 will need to be captured via BECCS to meet net zero.

Sustainability at our core

We know that BECCS can only make a meaningful contribution to tackling climate change if the bioenergy is sustainably sourced. This has been fundamental to Drax’s transition from coal to biomass, and it remains fundamental as we progress our plans for BECCS.

Sustainably sourced wood residues at Morehouse Bioenergy pellet plant in Louisiana

Biomass, as the UK Government has stated, is one of our most valuable tools for reaching net zero emissions. So we need the right framework to ensure it is sourced sustainably.

As the world’s largest bioenergy producer and generator, we recognise our responsibility to be the world leaders in sustainability, too.

At Drax, we have invested in world leading policies, tools and expertise to ensure that our biomass is sustainably sourced. We go beyond regulatory compliance and have set up an Independent Advisory Board, Chaired by the UK Government’s former Chief Scientific Advisor, to help us and challenge us on sustainable biomass and its role in Drax’s transition to net zero.

Thanks to our independent catchment area analyses, we know more about the forests we source from than ever before. We know and can demonstrate how demand for biomass can support healthy forests. For example, in the South East US where Drax sources most of its biomass, there is more than double the carbon stored in forests than there was 50 years ago.

Ready to deliver

BECCS will be a critical green technology. And with the right support and policy framework we could be pioneers in making it a reality.

There is no better place to deliver BECCS than at Drax, and no better time to deliver it than now.

At Drax, we stand ready to invest hundreds of millions of pounds to scale up BECCS technology;

To put the UK at the forefront of global efforts to reach net zero emissions;

And to help create tens of thousands of green jobs in the North of England.

Thank you very much for listening.

Adjusted EBITDA loss of £39 million (2019: £17 million profit) inclusive of estimated £60 million impact of Covid-19

Adjusted EBITDA loss of £39 million (2019: £17 million profit) inclusive of estimated £60 million impact of Covid-19