RNS Number : 6410C

Drax Group PLC

24 February 2022

| Twelve months ended 31 December | 2021 | 2020 |

|---|---|---|

| Key financial performance measures | ||

| Adjusted EBITDA (£ million) (1)(2) | 398 | 412 |

| Continuing operations | 378 | 366 |

| Discontinued operations – gas generation | 20 | 46 |

| Net debt (£ million) (3) | 1,044 | 776 |

| Adjusted basic EPS (pence) (1) | 26.5 | 29.6 |

| Total dividend (pence per share) | 18.8 | 17.1 |

| Total financial performance measures from continuing operations | ||

| Operating profit / (loss) (£ million) | 197 | (156) |

| Profit / (loss) before tax (£ million) | 122 | (235) |

Will Gardiner, CEO of Drax Group, said:

Drax Group CEO Will Gardiner

“2021 was a transformational year for Drax as we became the world’s leading sustainable biomass generation and supply company, whilst continuing to invest in delivering positive outcomes for the climate, nature and people.

“Over the past ten years Drax has invested over £2 billion in renewable energy and has plans to invest a further £3 billion this decade, supporting the global transition to a low-carbon economy. Our investment has reduced our emissions from power generation by over 95% and we are the UK’s largest producer of renewable power by output. We are proud to be one of the lowest carbon intensity power generators in Europe – a significant transformation from being the largest coal power station in Western Europe.

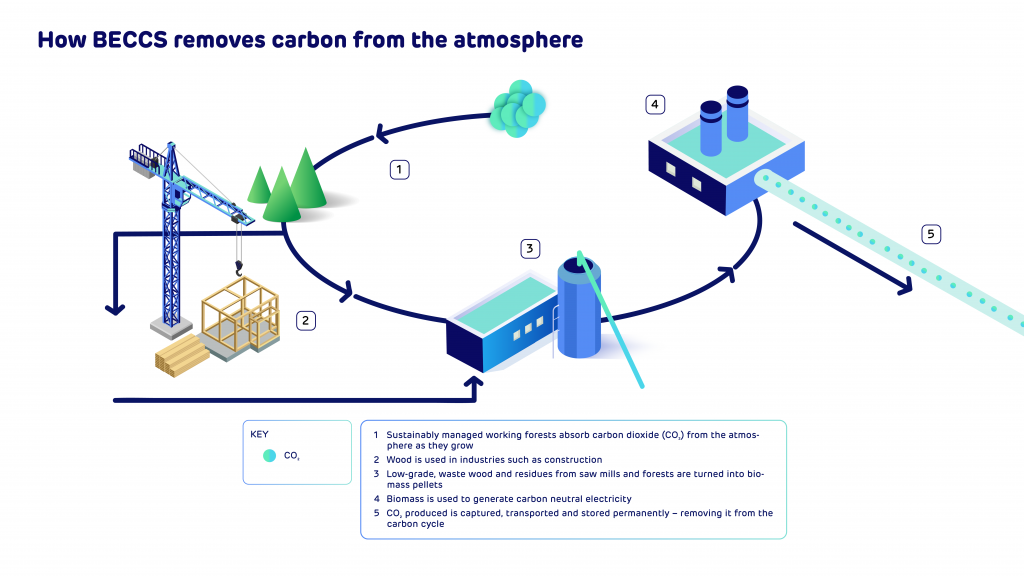

“We have significantly advanced our plans for bioenergy with carbon capture and storage (BECCS) in the UK and globally. By 2030 we aim to deliver 12 million tonnes of negative emissions and lead the world in providing a critical technology which scientists agree is key to delivering the global transition to net zero.”

Financial highlights

- Adjusted EBITDA £398 million (2020: £412 million)

- Strong liquidity and balance sheet – £549 million of cash and committed facilities at 31 December 2021

- Expect to be below 2x net debt to Adjusted EBITDA by the end of 2022

- Total dividend – 10% increase to 18.8 pence per share (2020: 17.1 pence per share)

- Proposed final dividend of 11.3 pence per share (2020: 10.3 pence per share)

Strategic highlights

- Acquisition of Pinnacle Renewable Energy Inc. for C$385 million (£222 million) (enterprise value of C$796 million)

- Sale of Combined Cycle Gas Turbine (CCGT) generation assets for £186 million

- Development of the world’s leading sustainable biomass generation and supply company

- Supply – 17 pellet plants and developments across three major fibre baskets, production capacity of c.5Mt pa

- 22Mt (c.$4.5 billion) of long-term contracted sales to high-quality customers in Asia and Europe

- 14Mt of own-use sales through 2026

- Generation – 2.6GW of biomass generation – UK’s largest source of renewable power by output

- Development of BECCS in UK

- East Coast Cluster – selected as one of two priority carbon capture and storage clusters

- Government – BECCS included in Net Zero Strategy and Interim Bioenergy Strategy

- Drax Power Station – planning application started, technology partner selected and FEED study commenced

Strategic outlook – growth plans aligned with global low-carbon growth

- To be a global leader in sustainable biomass

- Targeting 8Mt pa of production capacity and 4Mt pa of biomass sales to third parties by 2030

- To be a global leader in negative emissions

- Targeting 12Mt pa of negative CO2 – UK and international BECCS

- To be a UK leader in dispatchable, renewable generation

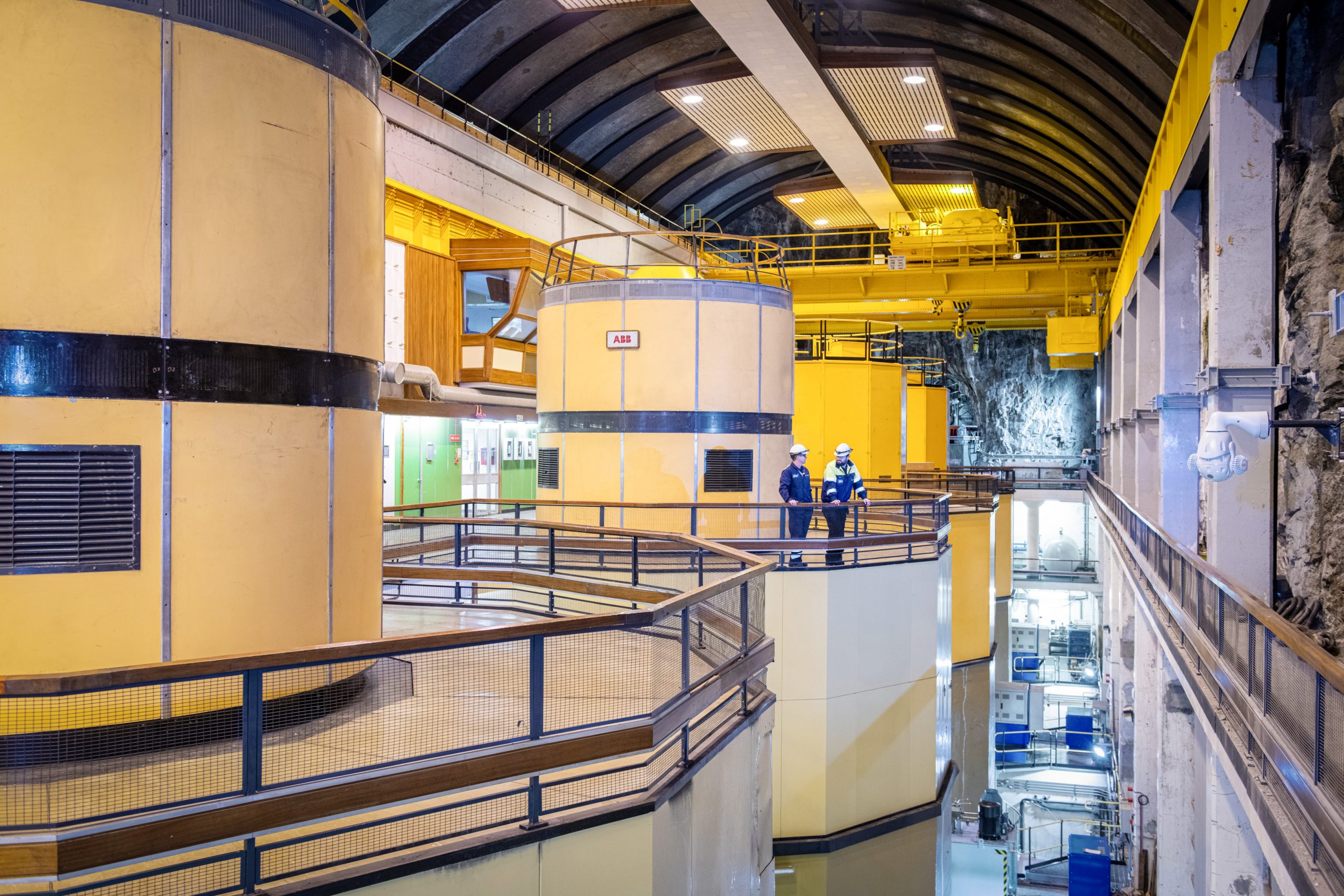

- Key system support role for biomass and expansion of Cruachan Pumped Storage Power Station

- All underpinned by continued focus on safety, sustainability and biomass cost reduction

- Investments totalling £3bn in period to 2030, fully funded through cash generation

- Pellet production, UK BECCS and Cruachan expansion

Future positive – people, nature, climate

- CO2 – >95% reduction in generation emissions since 2012 – sale of CCGT generation assets and end of commercial coal in March 2021 and closure in September 2022 following fulfilment of Capacity Market agreements

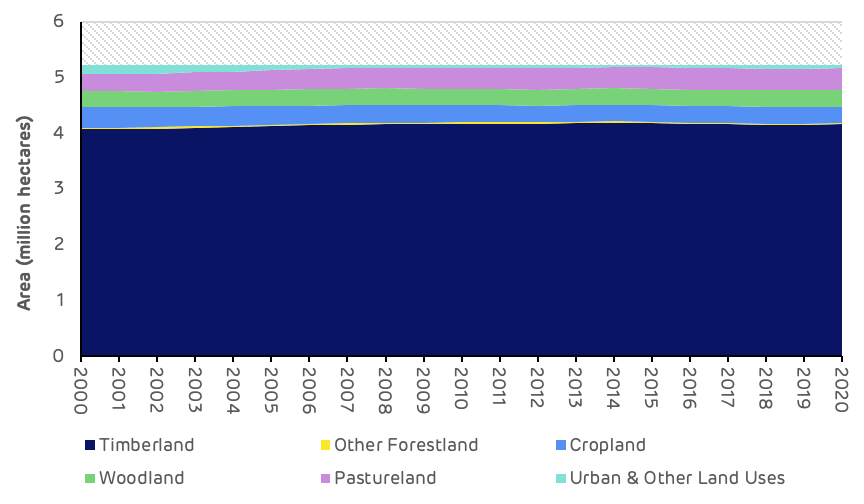

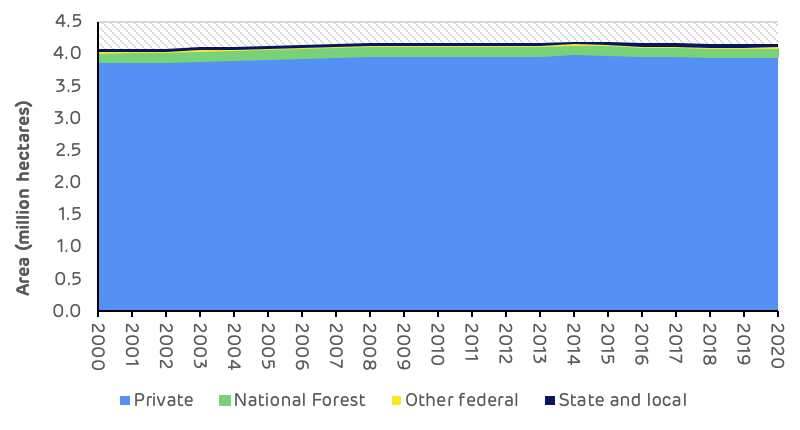

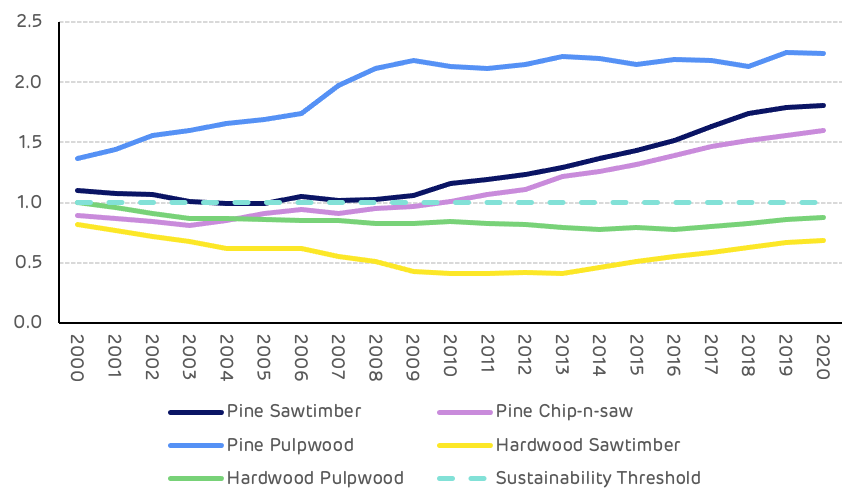

- Sustainable biomass sourcing

- Science-based sustainability policy compliant with current UK and EU law on sustainable biomass

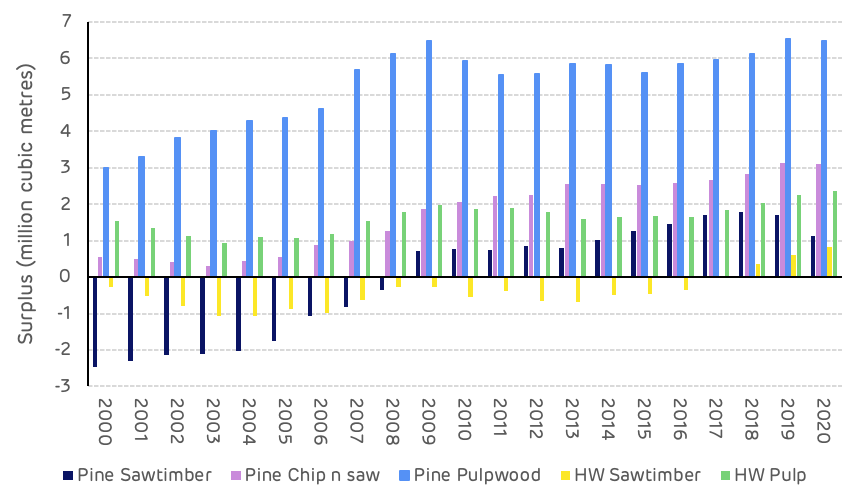

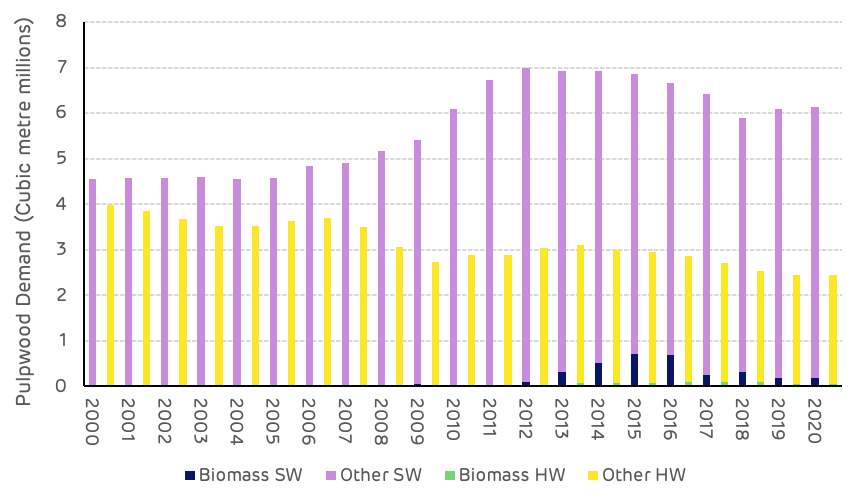

- Biomass produced using sawmill and forest residuals, and low-grade roundwood, which often have few alternative markets and would otherwise be landfilled, burned or left to rot, releasing CO2 and other GHGs

- Significant increase in sawmill residues used by Drax to produce pellets – 57% of total fibre (2020: 21%)

- 100% of woody biomass produced by Drax verified against SBP, SFI, FSC®(4) or PEFC Chain of Custody certification with third-party supplier compliance primarily via SBP certification

- Glasgow Declaration launched at COP26 to establish a world-wide industry standard on biomass sustainability

- People – Diversity, Equity and Inclusion – female representation in the UK business increased to 36% (2020:34%)

- Governance – two new North America based Non-Executive Directors – Kim Keating and Erika Peterman

Operational review

Pellet Production – acquisition of Pinnacle, capacity expansion and biomass cost reduction

- Adjusted EBITDA (including Pinnacle since 13 April 2021) up 65% to £86 million (2020: £52 million)

- Pellet production up 107% to 3.1Mt (2020: 1.5Mt), with 1.2Mt sales to third parties and increased own-use

- Total $/t cost of production down 7% to $143/t(5) (2020: $153/t(5))

- Developments in US southeast (2021-22) – addition of c.0.6Mt of new production capacity

- Completion of LaSalle and Morehouse plant expansions

- Commissioning of Demopolis and first satellite plant (Leola)

- Commencement of construction of second satellite plant (Russellville)

- Further opportunities for growth and cost reduction – increased production capacity, sales to third parties, continued operational efficiencies and improvement, wider range of sustainable biomass and technical innovation

Generation – dispatchable renewable generation and system support services

- UK’s largest generator of renewable power by output – 12% of total

- Adjusted EBITDA from discontinued CCGT generation assets £20 million (2020: £46 million)

- Adjusted EBITDA from continuing operations £352 million (2020: £400 million)

- Biomass – 5% increase in generation less major planned outage on CfD unit (successfully completed November 2021), higher cost from historic foreign exchange hedging and system charges

- Pumped storage / hydro – good operational performance

- Strong portfolio system support role (balancing mechanism, ancillary services and optimisation)

- Limited role for coal in H2 at request of system operator

- Ongoing cost reductions to support operating model for biomass generation at Drax Power Station from 2027

- Reduction in fixed cost base – end of commercial coal operations March 2021, closure September 2022

- Third biomass turbine upgrade, delivering improved thermal efficiency and lower maintenance cost

- Trials to expand range of lower cost sustainable biomass – up to 35% blend achieved in test runs on one unit

- As at 21 February 2022, Drax had 20.4TWh of power hedged between 2022 and 2024 on its ROC and hydro generation assets at £70.2/MWh, with a further 0.9TWh equivalent of gas sales (transacted for the purpose of accessing additional liquidity for forward sales from ROC units and highly correlated to forward power prices) plus additional sales under the CfD mechanism

| Contracted power sales 21 February 2022 | 2022 | 2023 | 2024 |

|---|---|---|---|

| ROC (TWh(6)) | 10.9 | 6.9 | 2.4 |

| ROC (£ per MWh) | 70.0 | 70.0 | 70.6 |

| Hydro (TWh) | 0.2 | - | - |

| Hydro (£ per MWh) | 90.9 | - | - |

| Gas hedges (TWh equivalent)(7) | 0.5 | 0.4 | |

| Pence per therm | 105 | 101 | |

| CfD(6/8) typical annual output c.5TWh and current strike price £118.5/MWh |

Customers – renewable power under long-term contracts to high-quality I&C customers and decarbonisation products

- Adjusted EBITDA of £6 million inclusive of impact of mutualisation changes and Covid-19 (2020: £39 million loss)

- Continued development of Industrial & Commercial (I&C) portfolio

- Focusing on key sectors to increase sales to high-quality counterparties supporting generation route to market

- Energy services to expand the Group’s system support capability and customer sustainability objectives

- Rebranding of the Haven Power I&C business to Drax Energy Solutions

- Closure of Oxford and Cardiff offices as part of Small & Medium-Size (SME) strategic review and continuing to evaluate options for SME portfolio to maximise value and align with strategy

Other financial information

- Total operating profit from continuing operations of £197 million (2020: £156 million loss, including exceptional costs totalling £275 million principally in respect of the announced closure of coal operations)

- Total profit after tax from continuing operations of £55 million including a £49 million non-cash charge from revaluing deferred tax balances following confirmation of UK corporation tax rate increases from 2023 (2020: loss of £195 million)

- 2021 capital investment of £230 million (2020: £183 million) – continued investment in biomass strategy

- 2022 expected capital investment of £230–250 million – £70-80 million maintenance, £20 million enhancements, £110-120 million strategic, (primarily biomass and BECCS), and £30 million other (primarily safety and systems)

- Excludes any material investment in non-core Open Cycle Gas Turbine developments – continuing to evaluate options, including sale, but continue to invest as appropriate to fulfil obligations under the Capacity Market agreements and to maximise value from any sale. In the event of a sale Drax expects to recover any capital expenditure incurred during 2022, which could total up to £100 million

- Group cost of debt below 3.5%

- Refinancing of Canadian facilities (July 2021) with lower cost ESG facility following Pinnacle acquisition

- Net debt of £1,044 million (31 December 2020: £776 million), including cash and cash equivalents of £317 million (31 December 2020: £290 million)

- Expect net debt to Adjusted EBITDA below 2x by the end of 2022

Forward Looking Statements

This announcement may contain certain statements, expectations, statistics, projections and other information that are, or may be, forward-looking. The accuracy and completeness of all such statements, including, without limitation, statements regarding the future financial position, strategy, projected costs, plans, beliefs and objectives for the management of future operations of Drax Group plc (“Drax”) and its subsidiaries (the “Group”), are not warranted or guaranteed. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that may occur in the future. Although Drax believes that the statements, expectations, statistics and projections and other information reflected in such statements are reasonable, they reflect the Company’s current view and no assurance can be given that they will prove to be correct. Such events and statements involve risks and uncertainties. Actual results and outcomes may differ materially from those expressed or implied by those forward-looking statements. There are a number of factors, many of which are beyond the control of the Group, which could cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements. These include, but are not limited to, factors such as: future revenues being lower than expected; increasing competitive pressures in the industry; and/or general economic conditions or conditions affecting the relevant industry, both domestically and internationally, being less favourable than expected. We do not intend to publicly update or revise these projections or other forward-looking statements to reflect events or circumstances after the date hereof, and we do not assume any responsibility for doing so.

Results presentation and webcast arrangements

Management will host a webcast presentation for analysts and investors at 11:00am (UK Time) on Thursday 24 February 2022.

The presentation can be accessed remotely via a live webcast link, as detailed below. After the meeting, the webcast recording will be made available and access details of this recording are also set out below.

A copy of the presentation will be made available from 7:00am (UK time) on Thursday 24 February 2022 for download at: https://www.drax.com/investors/announcements-events-reports/presentations/

| Event Title: | Drax Group plc: Full Year Results |

| Event Date: | Thursday 24 February 2022 |

| Event Time: | 11:00am (UK time) |

| Webcast Live Event Link: | https://secure.emincote.com/client/drax/drax019 |

| Conference call and pre-register Link: | https://secure.emincote.com/client/drax/drax019/vip_connect |

| Start Date: | Thursday 24 February 2022 |

| Delete Date: | Friday 24 February 2023 |

| Archive Link: | https://secure.emincote.com/client/drax/drax019 |

For further information, please contact: [email protected]