The economic impact of Drax in the U.K., U.S. and Canada

When the iconic Humber Bridge opened in June 1981, it did more than just set records for its size. It connected the region, uniting both communities and industries, and allowing the Humber to become what it is today: a thriving industrial hub that contributes more than £18 billion to the UK economy and supports some 360,000 jobs.

As the UK works towards a low-carbon future, the shift to a green economy will require new regional infrastructure, that once again unites the Humber’s people and businesses around a shared goal.

While the Humber Bridge connected the region across the estuary waters, a new subterranean pipeline that can transport the carbon captured from industries, will unify the region’s decarbonisation efforts.

It’s infrastructure that will be crucial in helping the UK reach its net zero goals, but also cement the Humber’s position as a global decarbonisation leader.

The Humber Bridge

Capturing carbon, preventing emissions from entering the atmosphere and storing them safely and permanently, is a fundamental part of decarbonising the economy and tackling climate change. Aside from the chemical engineering required to extract carbon dioxide (CO2) from industrial emissions, one of the key challenges of carbon capture is how you transport it at scale to secure storage locations, such as below the North Sea bed where the carbon can be permanently trapped and sequestered.

Engineers at Drax Power Station

At Drax, we’re pioneering bioenergy with carbon capture and storage (BECCS) technology. But carbon capture will play an important role in decarbonising a wide range of industries. The Humber region not only produces about 20% of the UK’s electricity, it’s also a major hub for chemicals, refining, steel making and other carbon-intensive industries.

The consequence of this industrial mix is that the Humber’s carbon footprint per head of population is bigger than anywhere else in the country. At an international level it’s the second largest industrial cluster by CO2 emissions in the whole of Western Europe. If the UK is to reach net zero, the Humber must decarbonise. And carbon capture and storage will be instrumental in achieving that.

The scale of the challenge in the Humber also makes it an opportunity to significantly reduce the country’s overall emissions and break new ground, implementing carbon capture innovations across a wide range of industries. These diverse businesses can be united in their collective efforts and connected through shared decarbonisation infrastructure – equipment to capture emissions, pipelines to transport them, and a shared site to store them safely and permanently.

The idea of a CO2 transport pipeline traversing the Humber might sound unusual, but large-scale natural gas pipelines have criss-crossed the region since the late 1960s when gas was dispatched from the Easington Terminal on the east Yorkshire coast under the Humber to Killingholme in North Lincolnshire. Further, the UK’s existing legislation creates an environment to ensure they can be operated safely and effectively. CO2 is a very stable molecule, compared to natural gas, and there are already thousands of miles of CO2 pipelines operating around the US, where it’s historically been used in oil recovery.

A shared pipeline also offers economies of scale for companies to implement carbon capture, allowing the Humber’s cluster of carbon-intensive industries to invest in vital infrastructure in a cost-effective way. The diversity of different industries in the region, from renewable baseload power generation at Drax to cutting-edge hydrogen production, also offers a chance to experiment and showcase what’s possible at scale.

The Humber’s position as an estuary onto the North Sea is also advantageous. Its expansive layers of porous sandstone offer an estimated 70 billion tonnes of potential CO2 storage space.

The Humber Estuary

But this isn’t just an opportunity to decarbonise the UK’s most emissions-intensive region, it’s a stage to present a new green industrial hub to the world. A hub that could create as many as 47,800 jobs, including high quality technical and construction roles, as well as other jobs throughout supply chains and the wider UK economy.

As industries of all kinds across the world race to decarbonise, there’s an increasing demand for products with green credentials. If we can decarbonise products from the region, such as steel, it will give UK businesses a global edge. Failure to follow through on environmental ambitions, however, will not just damage the cluster’s status, it will put hundreds of thousands of jobs at risk.

Breaking new ground is difficult but there are first-mover advantages. The products and processes trialled and run at scale within the Humber offer intellectual property that industrial hubs around the world are searching for, creating a new export for the UK.

But this vision of a decarbonised Humber, that exports both its products and knowledge to the world, is only possible if we take the right action now. We have a genuine global leadership position. If we don’t act now, that will be lost.

Through projects like Zero Carbon Humber and the East Coast Cluster, alongside Net Zero Teesside, the region’s businesses have shown our collective commitment to implementing decarbonisation at scale through collaboration.

As a Track 1 cluster, the Humber presents one of the UK’s greatest opportunities to level up – attracting global businesses and investors, as well as protecting and creating skilled jobs. We need to seize this moment and put in place the infrastructure that will put the Humber at the forefront of a low-carbon future.

View translated versions [PDFs]:

Introducing restrictions to reduce the use of primary woody biomass and clear-cuts will not stop harvesting from taking place because harvesting is primarily driven by long-lived, solid wood product sectors. Instead, such restrictions may result in a reduction in markets for the low-grade by-products of the timber industry that will in turn lead to forest degradation and loss.

Biomass is the EU’s largest source of renewable energy by some distance. In 2020, solid biomass – woodchips, pellets, and renewable waste materials – accounted for ~40% of the final consumption of renewable energy.

Solid biomass, like wood pellets, comes from low-grade or low-value wood from actively managed working forests. The sale of this wood provides a vital revenue stream for landowners practising sustainable forest management. But proposed changes to the EU’s Renewable Energy Directive (RED III) will lead to unintended consequences for sustainable forestry and the energy sector.

The low-quality or low-value wood used by the biomass sector includes sourcing from practices like thinning – periodic felling of a proportion of the trees in a forest to promote healthy, vigorous growth of the remaining trees. Thinning is an important element of active forest management. Fewer trees mean less competition for light, water and nutrients so the remaining trees can reach sawtimber-size sooner, increasing the landowner’s return on investment and contributing to long-term carbon storage in solid wood products.

Thinning also improves forest health and biodiversity. Removing weaker and diseased trees, which are more susceptible to disease and pest infestation, contributes to a more resilient forest. Greater levels of sunlight hitting the forest floor stimulate a more diverse herbaceous layer, which in turn supports a number of endemic wildlife species.

Clear-cuts are another common and important sustainable forest management practice: it is a myth that the act of clearcutting is unsustainable. Clear-cuts are an accepted regeneration technique used in Europe and North America. The practice is guided by science and mimics natural disturbance events such as wildfire and storm damage. It is crucial for forest types which require full sunlight to regenerate and grow and helps prevent forest degradation that would otherwise occur if only weaker trees were left in the forest to regenerate. In addition, clear-cuts regeneration plays a vital role in habitat diversity, supporting a suite of species which thrive in this early successional habitat. In many situations clear-cuts set the stage for stronger forest regrowth and are essential for maintaining landscape-level diversity.

Clear-cuts generate low-value fibre that can’t be used for solid wood products but that must be removed to ensure forests remain healthy and productive.

The European Parliament proposals under RED III would confusingly put both valuable sawlogs and low-grade wood under the EU classification of ‘primary woody biomass’

The proposal would also place extreme restrictions around how energy produced using primary woody biomass is accounted for in progress towards renewable energy targets. This will negatively impact the market for low-value wood and in turn, reduce economic incentives to sustainably manage forests. Proposals to introduce a cap and “phase down” of this type of material will stunt the entire growth of the sector, which is at odds to widely held views globally that demand for sustainable biomass will increase towards 2050.

Without a market for lower quality or lower value wood, there is less incentive to manage forests sustainably. This increases the risk of pests, disease and wildfire, and compromises the long-term health of the forest. Wood that would be removed through thinning or final harvest, for example, may be left to rot on site or be burned.

In British Columbia, forest owners must, by law, dispose of waste wood, meaning millions of tonnes are burned, releasing an estimated 3 million tonnes of CO2 a year into the atmosphere.

The biomass sector has long operated in Europe and North America; regions where deforestation is currently not a threat to working forests even with the sustained use of biomass which might become categorised as ‘primary woody biomass’.

Through sustainable management the US South, where Drax sources around a third of our biomass, saw annual forest growth increase by 112% between 1953 and 2015, while forest coverage increased by 108%.

View translated versions [PDFs]:

Reaching climate goals depends on decarbonisation across every sector of the global economy, all the way through the supply chain. For carbon-intensive industries, such as steel, cement, chemicals and the aviation sector, this is a huge challenge.

Bioenergy, produced from sustainably sourced biomass wood pellets, can play a crucial role in replacing fossil fuels, strengthening Europe’s energy security, and reducing emissions from these industries which are finding it hard to decarbonise. The addition of bioenergy with carbon capture and storage (BECCS) can even allow such industries to take the crucial step of becoming carbon negative.

Achieving ambitious BECCS plans in Europe requires action now to ensure that supportive policy frameworks are in place to support the advancement of biomass technologies throughout the 2020s and then enable BECCS to be delivered at scale in the 2030s.

Proposed changes to biomass support in the 2020s in the EU’s Renewable Energy Directive (RED III) could help reach this goal, but policy decisions must be realistic and not set unachievable expectations, or hamper investment in these critical solutions. Specifically, BECCS is unlikely to be scaled up until later in the second half of 2020s. REDIII must acknowledge this and enable support for carbon capture technologies to be in place on similar timelines to overall EU emissions reductions targets, for example 2030.

One of the key ways to tackle industrial emissions is through the decarbonisation of Europe’s industrial clusters. Zero Carbon Humber aims to be the world’s first net zero cluster by 2040 through shared carbon capture and storage (CCS) and hydrogen infrastructure.

Drax Power Station serves as an anchor for the project, with BECCS technology already at a more advanced stage than any other project around the world. Through the emissions removals BECCS makes possible, we aim to be a carbon negative business by 2030 and play a key part in decarbonising the Humber – the UK’s single most emissions intensive region.

BECCS technology, at Drax Power Station and globally, depends on sustained collaboration between governments and industries. Importantly, Drax is on track to deliver the first scaled up BECCS project from 2027 and we are working with government and industry to ensure both infrastructure availability and appropriate monitoring, reporting and verification is in place at the same time.

Carbon removal technologies, such as BECCS, have a key role to play in decarbonising other hard-to-abate industries.

Steel, cement, and chemical production processes require high amounts of energy. Today the vast majority of this comes from fossil fuels. However, biomass, and carbon removal through BECCS, can rapidly decarbonise these carbon-intensive sectors.

Sustainable aviation fuels (SAF) offer another way to decarbonise a vital, but emissions-heavy industry. Research into SAF is ongoing, with a range of feedstocks currently in the mix, including animal fats, vegetable oils, and algae. But the production of these fuels has its own carbon footprint, and BECCS has the potential to mitigate this.

The Sustainable Aviation Fuels Innovation Centre at the University of Sheffield, the first research and testing centre of its kind in Europe, is set to open in 2023. The facility will lead R&D into how BECCS can be used in the manufacture of zero-carbon fuels.

Sustained research and investment into biomass and BECCS innovation are crucial throughout this decade, to prepare essential technology for the next. According to the Intergovernmental Panel on Climate Change (IPCC), 10bn tonnes of CO2 may need to be captured by carbon removal technologies annually between now and 2050 to prevent catastrophic climate change.

BECCS is the most scalable of these and has the potential to be integrated into a wide range of industries. But the right action and policies are needed now to create net zero industries by 2050.

Jane Breach, Community, and Education lead for Drax Power Station

At Drax, we have a long-lasting commitment to promoting Science, Technology, Engineering, and Maths (STEM) education in the Yorkshire and Humber region and beyond.

Delivering the Zero Carbon Humber and the East Coast Cluster initiatives means that we will need a highly skilled labour force to help us reach the region’s goal of building the world’s first net zero industrial region. In practice, this will create roughly 50,000 new jobs in the region – requiring a workforce who are proficient in new and emerging low carbon technologies.

We have a responsibility to be a good neighbour, support education in our local area, to help secure our talent pipeline, and provide inspiration.

Bruce Heppenstall Drax Plant Director, Lewis Marron, Drax 4th Year Apprentice, and Liz Ridley Deputy Principal at Selby College.

One way we’re helping to develop the next generation of green economy colleagues is through our partnership with nearby Selby College. In 2020, we announced a £180,000 five-year partnership with the college, aimed at supporting education and skills. Last year, we expanded our partnership even further and developed the UK’s first educational programmes dedicated to carbon capture.

Working together, we secured more than £270,000 in funding from the government for the programme, enabling the college to create a new training course in carbon capture, usage, and storage (CCUS) technologies. Our engineers work closely with the college, developing a syllabus that will equip both current and future Drax employees with the vital skills needed to operate negative emissions technology.

This even includes a rig that mirrors the CCUS equipment used in our bioenergy with carbon capture and storage (BECCS) pilot, giving students the chance to work with real equipment rather than just the theory. We believe that by showing students the kind of work we do on-site we can give them a deeper understanding of how we operate.

The Department of Education highlighted the success of our partnership as an example of how business and education can work together – something I believe is crucial to bridging the emerging low carbon skills gap.

Our work with Selby College has highlighted the significant need to educate and upskill the UK’s workforce in low carbon technologies as quickly as possible. Although most organisations recognise the need to decarbonise, they are uncertain about what they and their employees need to do to achieve this.

There are a lot of conversations about the need for green skills and re-skilling employees in carbon-intensive sectors but to put a real definition on what’s needed is a lot harder. Every company must examine its business plan and try to unpick what skills they will need in 10, 20, or even 50 years down the line – and in such a fast moving world this can prove to be a real challenge.

At Drax, we’re committed to building on our values, as an innovative and best in class place where we care about what matters. We aim to do this by identifying training needs that are linked with new technologies beyond just BECCS, and working together with educators to make sure the relevant courses can either be distributed to other SMEs and large companies or adapted to help retrain people in other sectors.

Our commitment to STEM and education starts with young people and a hands-on curriculum delivered by our engineers to help support teachers. We want to develop deeper, more impactful education programmes that offer them multiple interactions with Drax, our engineers and operations throughout a person’s education.

In my role, you don’t always see the immediate impact. However, when you start talking to people, you realise that you’ve impacted them at some stage on their career journey. That impact is what’s really important to us and to building a net zero Humber.

RNS Number: 8081U

Drax Group plc

(“Drax” or the “Group”; Symbol:DRX)

The plant, which has been operating since 1995, has the capacity to produce 90,000 tonnes of wood pellets a year, primarily from sawmill residues. Around half of the output from the plant is currently contracted to Drax.

The plant is located close to the Group’s Armstrong and Lavington plants and the port of Vancouver, and has 32 employees, who are expected to join Drax.

Following completion of the acquisition the plant is expected to contribute to the Group’s strategy to increase pellet production to 8 million tonnes a year by 2030.

The acquisition is expected to complete in Q3 2022.

Drax CEO, Will Gardiner

“We look forward to welcoming the Princeton pellet plant team to Drax Group as we continue to build our global pellet production and sales business, supporting UK security of supply and increasing pellet sales to third parties in Asia and Europe as they displace fossil fuels from energy systems. Drax’s strategy to become a world leader in sustainable biomass, supports international decarbonisation goals and puts Drax at the heart of the global, green energy transition.”

Drax Investor Relations: Mark Strafford

+44 (0) 7730 763 949

Drax External Communications: Ali Lewis

+44 (0) 7712 670 888

Website: www.Drax.com

END

View RNS here.

RNS Number: 6883T

Drax Group plc

(“Drax” or the “Group”; Symbol:DRX)

| Six months ended 30 June | H1 2022 | H1 2021 |

|---|---|---|

| Key financial performance measures | ||

| Adjusted EBITDA (£ million)(1)(2) | 225 | 186 |

| Continuing operations | 225 | 165 |

| Discontinued operations – gas generation | - | 21 |

| Net debt (£ million)(3) | 1,101 | 1,029 |

| Adjusted basic EPS (pence)(1) | 20.0 | 14.6 |

| Interim dividend (pence per share) | 8.4 | 7.5 |

| Total financial performance measures from continuing operations | ||

| Operating profit (£ million) | 207 | 84 |

| Profit before tax (£ million) | 200 | 52 |

“As the UK’s largest generator of renewable power by output, Drax plays a critical role in supporting the country’s security of supply. We are accelerating our investment in renewable generation, having recently submitted planning applications for the development of BECCS at Drax Power Station and for the expansion of Cruachan Pumped Storage Power Station.

“As a leading producer of sustainable wood pellets we continue to invest in expanding our pellet production in order to supply the rising global demand for renewable power generated from biomass. We have commissioned new biomass pellet production plants in the US South and expect to take a final investment decision on up to 500,000 tonnes of additional capacity before the end of the year.

“As carbon removals become an increasingly urgent part of the global route to Net Zero, we are also making very encouraging progress towards delivering BECCS in North America and progressing with site selection, government engagement and technology development.

“In the UK and US we have plans to invest £3 billion in renewables that would create thousands of green jobs in communities that need them, underlining our position as a growing, international business at the heart of the green energy transition.”

Engineers at Cruachan Power Station

An apprentice working in the turbine hall at Drax Power Station, North Yorkshire

Nature and climate

Nature and climate

| Contracted power sales 21 July 2022 | 2022 | 2023 | 2024 |

|---|---|---|---|

| ROC (TWh(6)) | 11.7 | 8.8 | 4.5 |

| Average achieved £ per MWh | 87.2 | 98.3 | 109.5 |

| Hydro (TWh) | 0.3 | 0.1 | - |

| -Average achieved £ per MWh | 133.1 | 242.0 | - |

| Gas hedges (TWh equivalent) | (0.1) | 0.5 | 1.9 |

| -Pence per therm | 361.0 | 145.8 | 135.0 |

| Lower expected level of ROC generation in 2023 due to major planned outages on two units |

Meeting big ambitions takes big actions. And there’re few ambitions as big, or as urgent, as achieving a net zero power sector by 2035.

This energy transition must mean more low carbon power sources and fewer fossil fuels. But delivering that future requires new ways of managing power, balancing the grid and a new generation of technologies, innovation, and thinking to make big projects a reality.

As the system evolves and more renewables, particularly wind, come online, the UK is forecast to need 10 times more energy storage to deliver power when wind-levels drop, as well as absorb excess electricity when supply outstrips demand, and to maintain grid stability. Pumped hydro storage offers a tried and tested solution, but with no new long-duration storage projects built for almost 40 years in the UK, the challenges of bringing long-term projects to fruition are less engineering than they are financial.

Drax’s plan to expand Cruachan Power Station to add as much as 600 megawatts (MW) of additional capacity will help support a renewable, more affordable, net zero electricity system. But government action is needed to unlock a new generation of projects that deliver electricity storage at scale.

Wind is the keystone power source in the UK’s renewable ambitions. Wind capacity increased from 5.4 GW in 2010 to 25.7 GW in 2021 – enough to provide renewable power for almost 20 million homes – and the government aims to increase this to 50 GW by 2030.

However, wind comes with challenges: the volume of electricity being generated must always match the level of demand. If there is a spike in electricity demand when there are low wind-levels, other technologies, such as electricity storage or carbon-emitting gas power, are required to make up the shortfall.

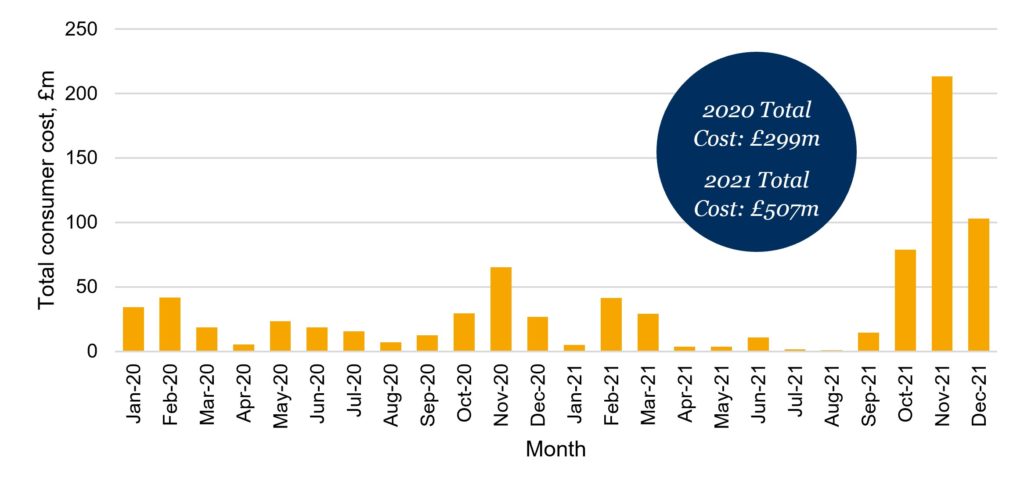

Conversely, if there is too much wind power being generated and not enough demand for electricity the grid often has to pay windfarms to stop generating. This is known as wind curtailment and it’s becoming more expensive, growing from £300 million during 2020 to more than £500 million in 2021.

An independent report by Lane Clark & Peacock (LCP), by Drax, found that over the last two years curtailing wind power added £806 million to energy bills in Britain.

There can also be a carbon cost to curtailing wind power. As more intermittent renewables come onto the system the grid can become more unstable and difficult to balance. In such an event the National Grid is required to turn to fossil fuel plants, like gas generation, that can deliver balancing and ancillary services like inertia, voltage control and reserve power that wind and solar can’t provide.

“It’s lose-lose for everyone,” says Richard Gow, Senior Government Policy Manager at Drax. “Consumers are paying money to turn off wind and to turn up gas generation because there’re not enough sources of ancillary services on the system or renewable power can’t be delivered to where it’s needed.”

“Curtailment costs have spiked this year because of gas prices, and while they might dip in the next two or three years, curtailment costs are only ever going to increase. If there’s wind power on the system without an increase in storage, the cost of managing the system is only going to go up and up.”

Source: the LCP’s ‘Renewable curtailment and the role of long duration storage’ report, click to view/download here.

The proposed Cruachan 2 expansion would help the grid avoid paying to turn off wind farms by increasing the amount it would be able to absorb from 400 MW to over 1,000 MW, and rapidly deliver the same amount of zero carbon power back to the grid should wind levels suddenly drop or the grid need urgent balancing.

Adding this kind of capability is a huge engineering project, involving huge new underground caverns, tunnels and waterways carved out of the rock below Ben Cruachan. However, the challenge in such a project lies less with the scale of the engineering than with its financeability.

The original Cruachan Power Station’s six-year construction period began in 1959. The work of digging into the mountainside was carried out by a team of 1,300 men, known affectionately as the Tunnel Tigers, armed with hand drills and gelignite explosives in an era before modern health and safety practices.

Engineer working at Cruachan Power Station

Expanding Cruachan in the 21st century will be quite a different, and safer process, and one that’s practically, straightforward.

“There is no reason why we physically couldn’t build Cruachan 2,” says Gow. “Detailed engineering work has indicated that this is a very feasible project. There’s no technological reason or physical constraint that would prevent us. It has a large upfront cost, and requires drilling into a mountain, but the challenge is much more on the financial, particularly securing the investment, side of the project.”

Pumped storage hydro facilities today generate their revenues from three different markets: the capacity market, where they receive a flat rate per kilowatt they deliver to the grid; the wholesale and balancing market, where they buy power to store when it’s abundant and cheap and sell it back to the grid when it’s needed, more valuable and used to support the Electricity System Operator in matching supply and demand on a second-by-second basis; and through ancillary services contracts, dedicated to specific stability services.

These available markets present challenges for ambitious, capital-intensive projects designed to operate at scale. With the exception of the capacity market, revenues from these markets are often volatile and difficult to forecast, with no long-term contracts available.

Sourcing the investment needed to build projects on the scale of Cruachan 2 requires mechanisms to attract investors comfortable with long project development lead times that offer stable, low risk, rates of return in the long-term.

An approach that can provide sufficient certainty to investors that income will cover the cost of debt and unlock finance for new projects is known as a ‘cap and floor’ regime.

With cap and floor, a facility’s revenues are subject to minimum and maximum levels. If revenues are below the ‘floor’ consumers would top-up revenues, while earnings above the ‘cap’ would be returned to consumers. This means investors can secure upfront funding safe in the knowledge of revenue certainty in the long term, whilst also offering protection to consumers.

Such an approach won’t attract investors looking to make a fast buck, but the vital role that it could play in the ongoing future of the UK energy system offers a long-term, stable return. At the same time, the system would save both the grid and energy consumers hundreds of millions of pounds.

The cap and floor system is also not unique, with a similar approach currently used for interconnectors, the sub-marine cables that physically connect the UK’s energy system to nearby countries allowing the UK to trade electricity with them. This means investors are already familiar with cap and floor structures, how they operate and what kind of returns they can expect.

“It’s not just pumped storage hydro that this could apply to,” explains Gow. “There are other, different large-scale, long-duration storage technologies that this could also apply to.”

“It would give us revenue certainty so that we can invest to support the system and reduce the cost of curtailment while ensuring consumers get value for their money.”

The Turbine Hall inside Cruachan Power Station

Cruachan was originally only made possible through the advocacy and actions of MP and wartime Secretary of State for Scotland Tom Johnston. Then it was needed to help absorb excess generation from the country’s new fleet of nuclear power stations and release this to meet short term spikes in demand. Today it’s renewable wind the system must adapt to.

For the UK to continue to meet an ever-changing energy system the government must be prepared to act and enable projects at scale, that bring long-term transformation for a net zero future.

RNS Number : 5930R

Drax Group plc

(“Drax” or the “Group”; Symbol:DRX)

In response to increased pressure on European gas markets and associated concerns about electricity security of supply in the UK this winter, Drax continues to optimise its biomass generation and logistics. To accomplish this Drax is reprofiling biomass generation and supply from the summer to the winter, enabling it to provide high levels of reliable renewable electricity generation in the UK throughout the winter when demand is likely to be higher.

The Group also expects to provide additional support from pumped storage hydro at Cruachan Power Station, building on a strong year to date performance, which reflects a high level of system support activities.

Separately, at the request of the UK Government, Drax has now entered into an agreement with National Grid – in its capacity as the electricity systems operator – pursuant to which its two coal-fired units at Drax Power Station will remain available to provide a “winter contingency” service to the UK power system from October 2022 until the end of March 2023. The units will not generate commercially for the duration of the agreement and only operate if and when instructed to do so by National Grid.

Under the terms of the agreement, Drax will be paid a fee for the service and compensated for costs incurred, including coal costs, in connection with the operation of the coal units in accordance with the agreement.

Reflecting these factors, Drax now expects that full year Adjusted EBITDA(1) for 2022 will be slightly above the top of the range of analyst expectations(2), subject to continued good operational performance.

(1) Earnings before interest, tax, depreciation, amortisation, excluding the impact of exceptional items and certain remeasurements.

(2) As of 5 July 2022, analyst consensus for 2022 Adjusted EBITDA was £613 million, with a range of £584-£635 million. The details of this company collected consensus are displayed on the Group’s website.

https://www.drax.com/investors/announcements-events-reports/presentations/

Drax Investor Relations: Mark Strafford

+44 (0) 7730 763 949

Drax External Communications: Ali Lewis

+44 (0) 7712 670 888

Website: www.Drax.com

END