RNS Number : 7670J

Drax Group plc

(“Drax” or the “Group”; Symbol:DRX)

Operational Highlights

- Critical role supporting UK energy system with biomass, pumped storage and hydro

- System support – strong pumped storage and hydro performance in H2-22

- Strong contracted power sales 2022-24

- >99% of generation from renewables – biomass, pumped storage and hydro

- Jan to Nov Drax generated 20% of UK renewables at peak demand and 11% in total

Financial Highlights

- 2022 Adjusted EBITDA(1) now slightly above the top of the range of analyst expectations(2)

- Remain on track to be significantly below 2x net debt to Adjusted EBITDA by the end of 2022

Strategic Highlights

- Growing global demand for negative emissions and increasing opportunities for BECCS

- Development of North American options including two new-build BECCS power stations, a pellet plant with BECCS and coal-to-biomass-to-BECCS

- £30 million development expenditure in 2023 to support options in North America

- MoU signed for sale of 2Mt of Carbon Dioxide Removal (CDR) certificates

- UK BECCS

- “Track 1” Power-BECCS application submitted, shortlisted projects selected in Q1-23

- UK Government – publication of Power-BECCS business model consultation

- Pellet Production

- $300m investment in new US pellet plant, port and capacity expansion – c.0.6Mt

- 90kt pellet plant acquired – Princeton, British Columbia

Drax Group CEO, Will Gardiner said:

Will Gardiner, Drax Group CEO

“Drax plays a critical role in supporting the UK energy system, generating more renewable power by output than any other company. During the difficult winter ahead, we will continue to optimise our biomass operations to ensure that more renewable power is available, when the country needs it most.

“As governments around the world increasingly look to introduce supportive policies for carbon removals, Drax is considering more exciting global opportunities for deployment of BECCS, advancing our ambition to be a leader in this critical technology.

“Drax is a growing, international business at the heart of the green energy transition and we are accelerating our plans to invest billions of pounds in critical renewable energy and carbon removal technologies which could create thousands of jobs and generate the secure, renewable power that this planet urgently needs.”

Pellets Production

The Group’s sustainable biomass pellet business has continued to support efforts to optimise biomass power generation and security of supply in the UK at times of higher demand this winter.

As outlined at the Group’s half year results, in July 2022, there has been an incremental increase in costs in North America, primarily in transportation and utility costs. These cost increases have continued in the second half of 2022 and taken together with costs incurred in providing supply-side flexibility, production costs for the business are expected to be higher in 2022 and 2023. These increased costs have been considered in an adjusted transfer price, which was implemented in the second half of the 2022.

Drax remains focused on opportunities to reduce the cost of biomass but will balance this against the need to optimise its supply chain to deliver value for the Group.

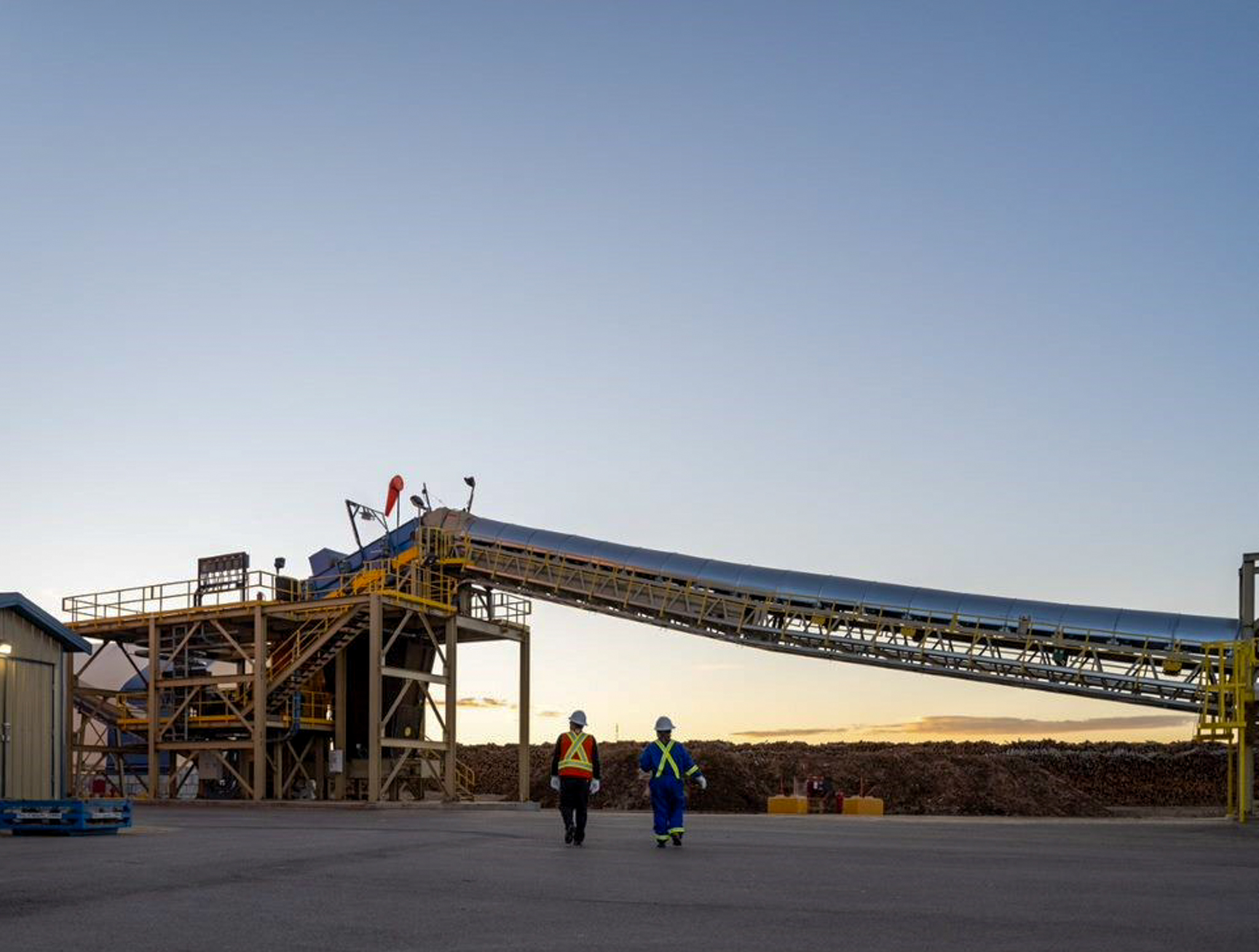

In the second half of 2022, Drax commissioned a second 40kt satellite plant at Russellville (Arkansas) and in August 2022, Drax acquired a 90kt pellet plant in Princeton (British Columbia) from Princeton Standard Pellet Corporation. In addition, following commissioning in the first half of 2022 both the Demopolis (Alabama) and Leola (Arkansas) pellet plants have continued to work towards full production and these four plants combined will add over 500kt of full production capacity.

Investment in new production capacity

Drax has taken a Final Investment Decision (FID) to invest in two new pellet production projects – a 450kt new-build pellet plant at Longview (Washington State), including the development of a new port facility at this location, and a 130kt expansion of its Aliceville site (Alabama). The combined investment in these three projects is expected to be in the region of $300 million, inclusive of the effect of inflation on construction costs.

The development of the new plant at Longview will provide the Group with access to a new fibre basket and Drax will also develop port infrastructure at the Port of Longview, adding a fifth port to the Group’s North American supply chain, with the opportunity to consolidate additional capacity in the future. The US Pacific North-West will be the Group’s fourth major fibre basket alongside; the US South; British Columbia; and Alberta. The new facility is expected to support further diversification of the Group’s fibre sourcing production and export capacity, supporting sales into Asian and European markets, as well as own-use.

The Longview plant will be located next to the Port of Longview, removing the need for rail or road transport of pellets, significantly reducing transport time, cost and carbon emissions.

The plant and port are expected to begin commissioning in 2025.

The Aliceville expansion includes upgrades to existing systems as well as new truck dumps and pelletiser units which will allow for an increase in the amount of sawmill residuals processed. The additional capacity is expected to begin commissioning in 2024.

Generation

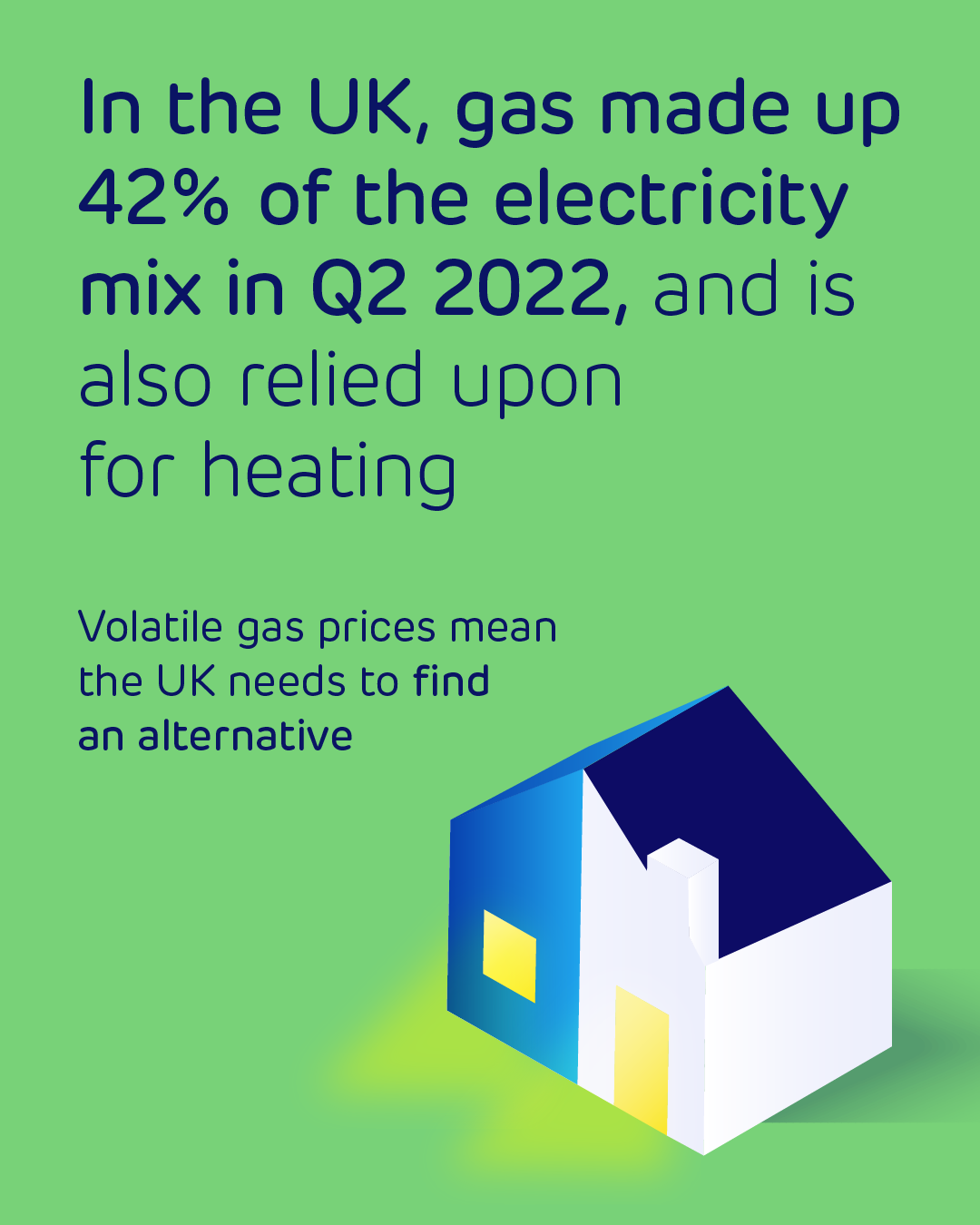

The Group’s biomass, pumped storage and hydro assets have continued to support UK security of supply, providing power system stability at a time of higher gas prices and volatility on the power system.

Drax has continued to optimise biomass generation across all four biomass units (ROC and CfD), maximising generation in the winter, based on system need and sustainable biomass supply.

In October 2022, due to a fall in gas prices and a consequential fall in short-term power prices, Drax bought back certain existing forward sold power sales for 2022 on its ROC units. As a result, Drax has taken steps to reprofile and optimise biomass supplies between own-use and third-party supply.

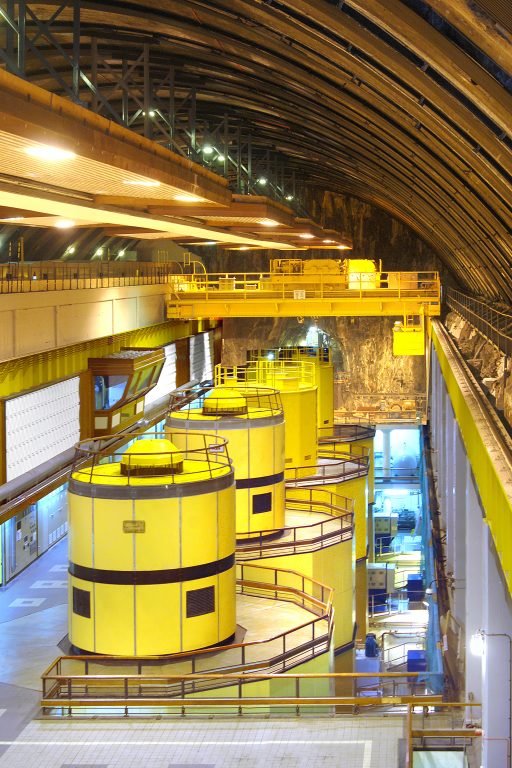

The Group’s pumped storage and hydro assets have performed strongly in the second half of 2022, providing a wide range of services to the system operator in support of system stability and renewable electricity.

Generation contracted power sales

As at 8 December 2022, Drax had 28.3TWh of contracted power sales between 2022 and 2024 on its ROC and hydro generation assets at an average price of £135.8/MWh, with a further 1.4TWh equivalent of gas sales (transacted for the purpose of accessing additional liquidity for forward sales from ROC units and highly correlated to forward power prices) plus additional sales under the CfD mechanism.

| Contracted power sales 8 December 2022 | 2022 | 2023 | 2024 |

| | | |

| ROC (TWh) | 10.7 | 11.1 | 6.1 |

| - Average achieved £ per MWh | 90.2 | 154.5 | 159.0 |

| | | |

| Hydro (TWh) | 0.3 | <0.1 | - |

| - Average achieved £ per MWh | 255.6 | - | - |

| | | |

| Gas hedges (TWh equivalent) | - | 0.1 | 1.3 |

| Pence per therm | - | 153.2 | 133.9 |

| | | |

| Lower expected level of ROC generation in 2023 due to major planned outages on two units | | | |

Generation biomass costs

Over the past 12 months the cost of biomass in the European spot market has increased significantly, with cargoes trading at over three times their historic average.

Reflecting higher production costs in its own supply chain, those of third parties and higher spot market prices, Drax has incurred additional costs in the second half of 2022, securing biomass to support its reliable and dispatchable generation. Accordingly, the Group currently expects its all-in contracted cost of biomass for the UK generation business to be over £100/MWh in 2023. This is above the historic average, in part reflecting increased transportation and fuel costs associated with higher energy costs, inflation and the lower value of Sterling captured in the Group’s foreign exchange hedges.

These factors, alongside the Electricity Generators Levy (EGL) (see note below), could make generation at certain times less economic and is expected to restrict the Group’s purchase of additional biomass cargoes at spot prices.

Coal

In July 2022, at the request of the UK Government, Drax entered into an agreement with National Grid, to provide a “winter contingency” service to support the UK power system via its legacy coal units.

The units will not generate commercially for the duration of the agreement and will only operate if, and when, instructed to do so by National Grid. To date National Grid has not instructed the units to run, other than for testing. The contract, which covers the period October 2022 to March 2023, provides Drax with a fixed fee for the provision of the units with National Grid remunerating Drax for costs, including the coal and carbon associated with any generation.

Drax’s decision, in 2020, to end coal generation supports the Group’s purpose of enabling a zero-carbon, lower-cost energy future and the transition to a flexible, renewable generation model. This has led to a c.99% reduction in the Group’s Scope 1 and Scope 2 carbon emissions since 2012 and enabled Drax to become the UK’s largest source of renewable electricity by output.

Full year expectations

Reflecting these factors, and the strong pumped storage and hydro performance in the second half of 2022, Drax now expects that full year Adjusted EBITDA(1) for 2022 will be slightly above the top of the range of analyst expectations(2), subject to continued good operational performance and logistics for the remainder of the year.

The power sales reflected in the Generation business’s contracted power sales book includes some exchange traded contracts, with higher power prices resulting in an increase in collateral payments on these contracts in 2022. Inclusive of these temporary cash outflows the Group continues to expect net debt to Adjusted EBITDA(1) to be significantly below 2x at the end of 2022.

Electricity Generators Levy

In November 2022, the UK Government announced a windfall tax on renewable and low-carbon generators, the EGL.

The EGL, which is expected to be implemented from 1 January 2023, represents a levy on power sales above a threshold and would apply to Drax’s three biomass units operating under the Renewable Obligation scheme and its run of river hydro operations, but does not include the sale of ROCs. Drax’s CfD biomass unit is exempt, along with Cruachan pumped storage hydro power station and coal generation.

Through November and December Drax has engaged with the UK Government regarding the precise details of the EGL, including UK investment allowances and the treatment of costs for dispatchable generators. Drax notes the UK Government’s reference to the potential for cost adjustments in its EGL technical note published in November 2022. Drax anticipates an update from Government on these issues shortly.

Bioenergy Carbon Capture and Storage (BECCS) – UK

Drax has continued to commit development expenditure into its Drax Power Station BECCS project, including continuing a Front-End Engineering Design study.

The project would see the addition of post combustion Carbon Capture and Storage (CCS) to two of the existing biomass units, using sustainable biomass and adapting a proven technical solution from Drax technology partner, Mitsubishi Heavy Industries. By 2030 the project aims to permanently remove 8Mt of CO2 per annum from the atmosphere. In doing so Drax Power Station aims to become one of the largest sources of Carbon Dioxide Removals (negative CO2) in the world.

The UK Government recognises the important role which BECCS has to play in delivering net zero, requiring at least 5Mt of CO2 removals per annum from BECCS and other engineered Greenhouse Gas Removal technologies by 2030.

In August 2022, the UK Government published a Power-BECCS business model consultation which set a viable investment framework based on a CfD mechanism for both power generation and negative emission production. In addition, the UK Government also set out the timeframe for the selection of “Track 1” Power-BECCS projects, stating that shortlisted projects could be confirmed from December 2022 with draft heads of terms for the contracts in the first half of 2023. “Track 1” projects are expected to commission in the mid-2020s and along with expected clarity on the financial model, this supports Drax’s aim to take a FID in 2024 and commission a first unit in 2027, with a second by 2030.

The six-month extension of coal unit availability to March 2023 is not expected to impact the timing of a FID or intended commissioning date for the project. Site preparation works for BECCS are ongoing and will continue following formal closure of the coal units in March 2023 on conclusion of the contract with National Grid (see above).

BECCS – North America

Drax aims to realise its ambition to become a carbon negative company by 2030 primarily through the development of BECCS, including the development of BECCS globally.

To realise these opportunities, the Group is progressing a number of work streams including regulation and policy, technology, fibre sourcing, logistics and commercial.

Over the course of the year, the Group has made good progress towards its ambition to deliver 4Mt per annum of CDRs from new-build BECCS outside of the UK by 2030, with a primary focus on North America.

Opportunities under consideration include two new-build 300MW BECCS power units each capable of producing 2TWh of renewable electricity from sustainable biomass and each capturing over 2Mt of CO2 per annum. Drax is also developing options for a pellet plant with BECCS and the addition of BECCS to existing generation assets, including coal-to-biomass-to-BECCS.

Key considerations for these opportunities include proximity to sustainable biomass fibre, CCS infrastructure, regulatory support, commercial potential and technology.

Drax is evaluating a range of potential financial models for these projects, which could include long-term Power Purchase Agreements (PPAs), long-term CDR offtake agreements and government investment frameworks. As part of the development of these models, in September 2022, Drax announced a Memorandum of Understanding (MoU) for the world’s biggest carbon removals deal with Respira, a carbon broker. Under the terms of the MoU, Respira will be able to purchase up to 2Mt of CDRs over a five-year period from Drax’s North American BECCS projects.

Regulation and policy development

The regulatory environment for BECCS in the US has continued to develop in 2022, with the inclusion of BECCS as an eligible technology under the Department of Energy climate goals funding scheme and the increase in 45Q support to $85 per tonne of CO2 captured, under the Inflation Reduction Act. A recent National Renewable Energy Lab report highlights that by 2035, the US could need c.100Mt of negative emissions from BECCS to offset remaining carbon emissions in the power sector.

In addition, recent State level developments in Louisiana and California have both been supportive of the development of BECCS. The Louisiana Congress approved a bill that classifies biomass as carbon neutral and BECCS as carbon negative. Similarly, California’s net zero strategy identifies BECCS as a critical tool in the delivery of their climate targets. The California Air Resources Board, which is responsible for climate policy, has stated its intention to deploy 75Mt of carbon removals, including BECCS, by 2045.

Potential for significant growth in CDRs

Research by the Intergovernmental Panel on Climate Change (IPCC), the world’s leading authority on climate science, states that CDR methods, including BECCS, are needed to mitigate residual emissions and keep the world on a pathway to limit warming to 1.5oc.

All the illustrative mitigation pathways assessed in the IPCC’s latest report use significant volumes of CDRs, and specifically BECCS as a key tool for mitigating climate change. The IPCC believes that globally between 0.5 and 9.5 billion tonnes of CDRs via BECCS will be required and the UN-backed Principles for Responsible Investment estimate that the CDR market could be worth over a trillion dollars by 2050.

Drax sees significant growth opportunities linked to BECCS in North America and in order to progress these opportunities in 2023, expects to invest in development expenditure in the region of £30 million with a view to progressing these opportunities to a FID. Drax expects to update on progress with these opportunities in the first half of 2023.

Biomass Sustainability

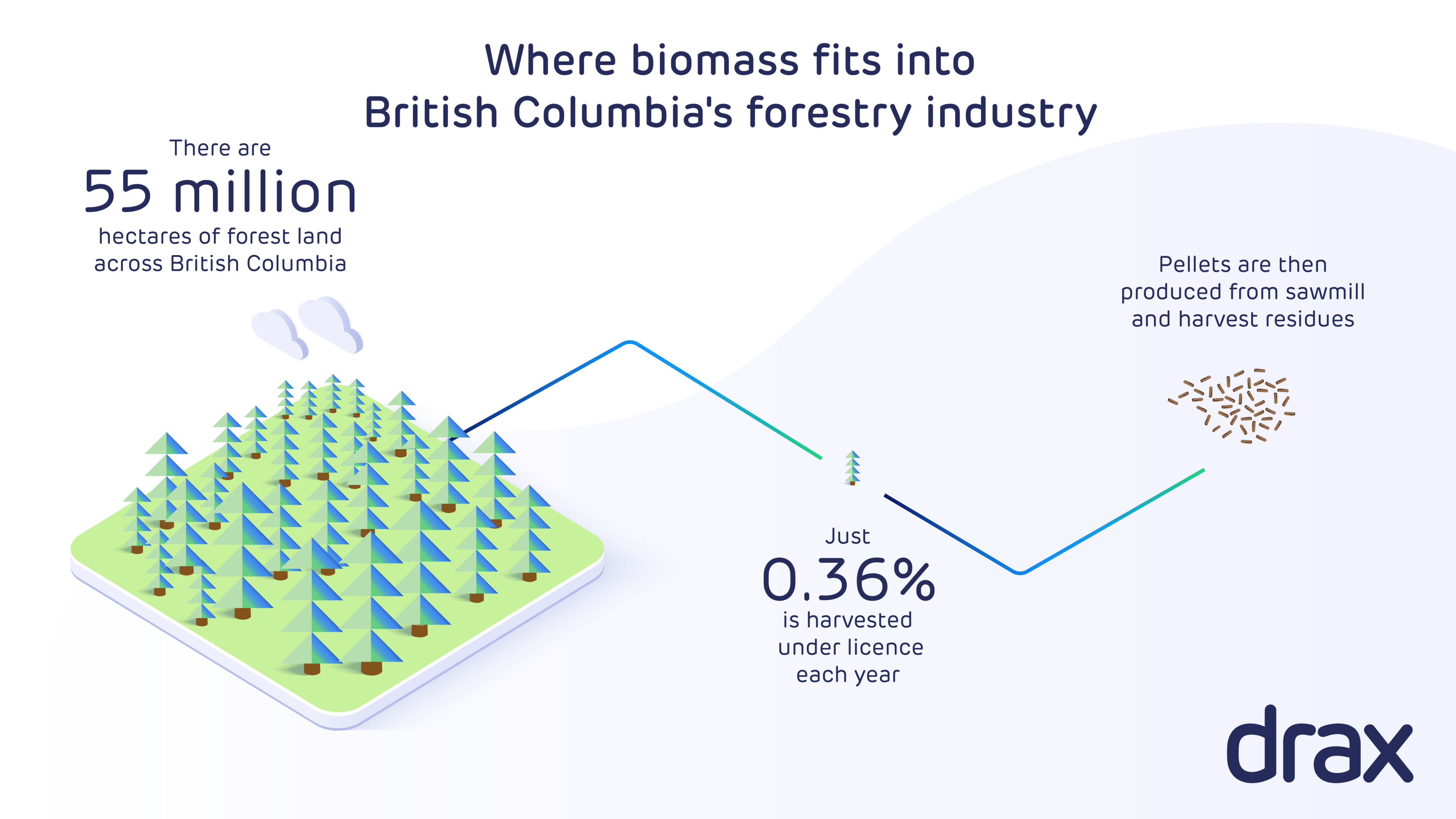

Delivering positive outcomes for people, climate and nature are at the core of Drax’s business model and ensuring that Drax only uses biomass which is sourced sustainably is central to this ambition.

Biomass – when sustainably sourced – supports good forestry, is a renewable source of energy, and an important part of both UK and international renewable energy policy.

Drax sources its biomass from well-established forestry markets in the US and Canada as well as Europe. The main output from these markets is sawlogs, which are processed for use in construction and manufacturing, such as house building. When used in this way, these materials represent a source of long-term carbon storage and when the forest regenerates or is replanted these growing trees absorb carbon from the atmosphere.

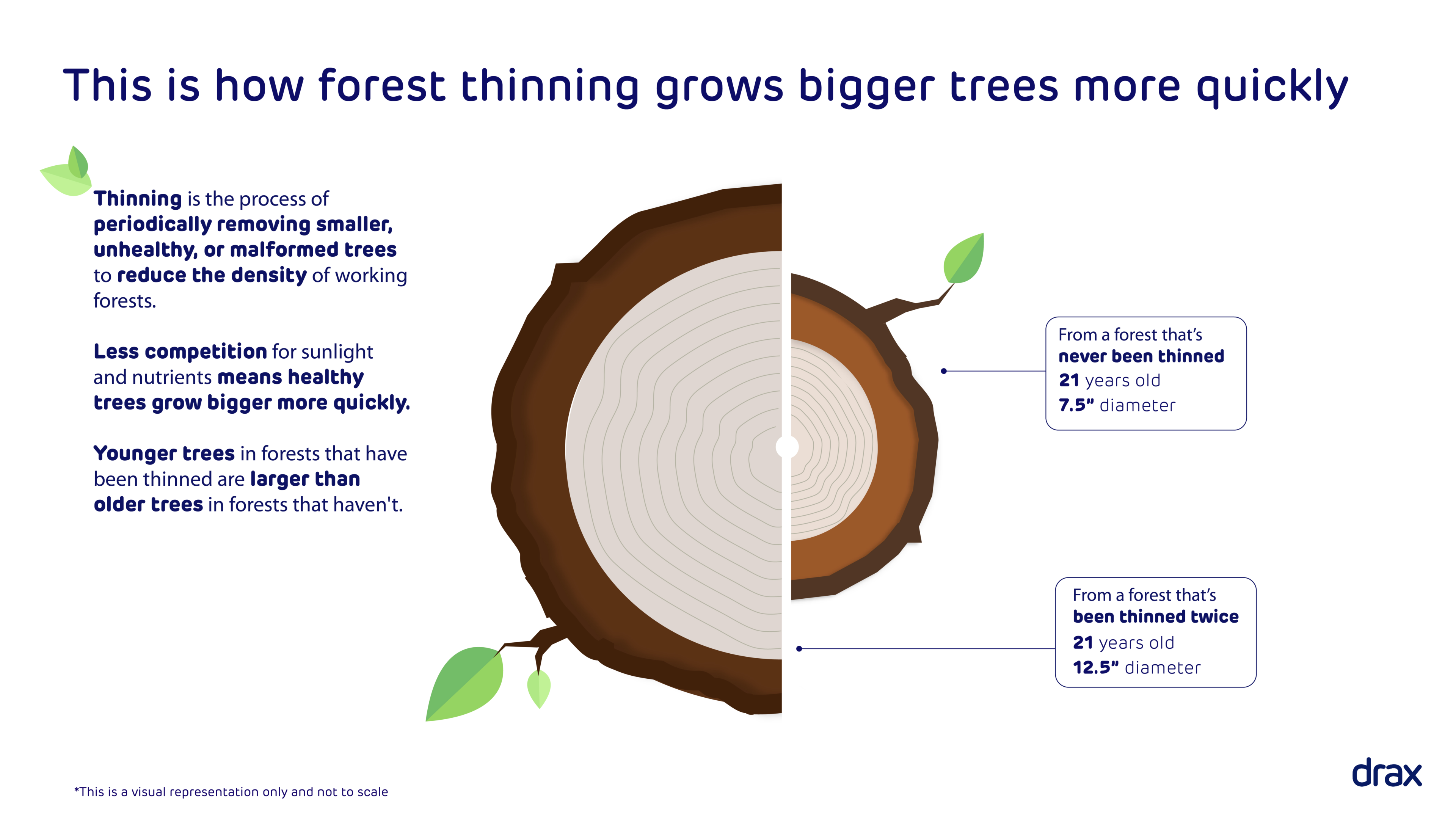

Drax supports these forest economies by providing incremental secondary revenues to forest landowners through the purchase of material which is not merchantable to a sawmill, such as bark, branches, low-grade wood and woody material from forest management activities (thinning), in addition to purchasing sawmill residues from sawmills. These materials often have limited alternative uses. In some instances, where there would otherwise be no demand for these materials, they are burned to reduce the risk of wildfire, the spread of disease and to allow the forest to be replanted – this is especially prevalent in Canada.

In the US South, the periodic thinning of a forest helps improve the size and quality of sawlogs when the trees reach maturity, the economic value of the timber produced and the carbon absorbed and stored, as well as forest health and biodiversity. If forests were not thinned, the revenue from sawlogs would be reduced and landowners may consider other uses for their land, such as agricultural crops and livestock farming. The management of forestland to produce sawlogs ensures forests are growing vigorously, absorbing carbon, and forests remain a carbon sink.

Forests in the areas where Drax sources material are subject to national and regional regulation and typically supported by, and independently monitored for compliance by, forest certification schemes such as: the Forestry Stewardship Council® (FSC)(3), Sustainable Forestry Initiative (SFI) and Programme for the Endorsement of Forest Certification (PEFC).

Drax supplements this regulation through its own biomass sourcing policy and checks of its supply chain, with third party verification under the Sustainable Biomass Program (SBP).

Other

In December 2022 Drax agreed a new £200 million credit facility with banks within its lending group. The facility provides an additional source of liquidity to the Group’s undrawn £300 million revolving credit facility, over the next 12 months.

Drax will report its full year results on 23 February 2023.

Notes:

- Earnings before interest, tax, depreciation, amortisation, excluding the impact of exceptional items and certain remeasurements.

- As of 12 December 2022, analyst consensus for 2022 Adjusted EBITDA was £668 million, with a range of £651-£681 million. The details of this company collected consensus are displayed on the Group’s website. https://www.drax.com/investors/announcements-events-reports/presentations/

- FSC C119787.

Enquiries:

Drax Investor Relations: Mark Strafford

Media:

Drax External Communications: Ali Lewis

Forward Looking Statements

This announcement may contain certain statements, expectations, statistics, projections and other information that are, or may be, forward-looking. The accuracy and completeness of all such statements, including, without limitation, statements regarding the future financial position, strategy, projected costs, plans, beliefs and objectives for the management of future operations of Drax Group plc (“Drax”) and its subsidiaries (the “Group”), are not warranted or guaranteed. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that may occur in the future. Although Drax believes that the statements, expectations, statistics and projections and other information reflected in such statements are reasonable, they reflect the Company’s current view and no assurance can be given that they will prove to be correct. Such events and statements involve risks and uncertainties. Actual results and outcomes may differ materially from those expressed or implied by those forward-looking statements. There are a number of factors, many of which are beyond the control of the Group, which could cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements. These include, but are not limited to, factors such as: future revenues being lower than expected; increasing competitive pressures in the industry; and/or general economic conditions or conditions affecting the relevant industry, both domestically and internationally, being less favourable than expected. We do not intend to publicly update or revise these projections or other forward-looking statements to reflect events or circumstances after the date hereof, and we do not assume any responsibility for doing so.

END

Total investment would be in the region of $2 billion per plant with a target FID in 2026 and commercial operation by 2030. The capital cost reflects the construction of new-build power generation as well as carbon capture and storage (CCS) systems.

Total investment would be in the region of $2 billion per plant with a target FID in 2026 and commercial operation by 2030. The capital cost reflects the construction of new-build power generation as well as carbon capture and storage (CCS) systems.

Adjusted EBITDA up 56% to £134 million (2021: £86 million)

Adjusted EBITDA up 56% to £134 million (2021: £86 million)