RNS Number: 0978L

Drax Group plc

(“Drax” or the “Group”; Symbol:DRX)

Highlights

- Strong performance – FlexGen(1), Pellet Production and Biomass Generation

- Full year 2025 expectations for Adj. EBITDA(2) around the top end of consensus estimates(3)

Adj. EBITDA and free cash flow targets from existing business

- Continuing to target post 2027 Adj. EBITDA of £600-700 million pa(4)

- Targeting £3 billion of free cash flow(5) from the existing business (2025 to 2031), supporting:

- >£1 billion returns to shareholders

- Up to c.£2 billion for options to invest in growth

Options to invest in growth – energy security, data centres and flexible, renewable energy

- FlexGen – flexible, renewable energy, including GW scale pipeline of BESS(6) opportunities

- Drax Power Station site – development of options to utilise 4GW of capacity and grid access

- Planning application in development for potential option for c.100MW data centre

- Ambition to grow to >1GW data centre post 2031

- Potential to further develop system support capabilities and FlexGen

Drax Group CEO, Will Gardiner said:

“It is vital that the UK maintains its energy security and delivers affordable routes to decarbonisation into the 2030s and beyond. Drax stands ready to invest in and grow our portfolio to deliver the renewable and flexible power the country needs while also supporting economic growth in the communities where we operate.

“By 2050, demand for power is expected to double, while secure gas generation reduces and intermittent renewable generation increases, meaning more dispatchable and reliable generation will be required to help keep the lights on when the wind isn’t blowing and the sun isn’t shining.

“Aligned to the UK’s future energy needs and underpinned by a strong balance sheet, good cash generation, and a disciplined approach to capital allocation, we are working to maximise the value of our existing portfolio, while driving growth over the short, medium and long term.

“Our year to date operational and financial performance has been strong, and we are focused on delivering c.£3 billion of free cash flow between 2025 and 2031, which can support investment in energy security, data centres and flexible, renewable energy underpinning long-term value creation and returns to shareholders.”

Full year expectations

Reflecting a strong performance across the Group in the second half of 2025, Drax now expects 2025 full year Adj. EBITDA to be around the top end of consensus estimates(3). Full year expectations remain subject to continued good operational performance.

Generation contracted power sales

As at 9 December 2025, Drax had c.£2.3 billion of contracted forward power sales between 2025 and Q1 2027 on its Renewables Obligation (RO) biomass, pumped storage and hydro generation assets. RO generation is fully hedged for 2025 and 2026, with over £1 billion of associated ROCs.

| Contracted power sales as at 9 December 2025 | 2025 | 2026 | 2027 | Total |

|---|---|---|---|---|

| Net RO, hydro and gas (TWh)(7) | 10.7 | 10.9 | 2.2 | 23.7 |

| Average achieved £ per MWh(8) | 117.1 | 76.7 | 79.4 | 95.1 |

| Contract for Difference (CfD) (TWh) | 4.8 | 1.8 | - | 6.5 |

Capital returns

In October 2025, the Group completed a £300 million share buyback programme which had commenced in August 2024. The Group subsequently began a £450 million share buyback programme (first announced in July 2025), with an initial £75 million tranche. In aggregate, during 2025, up to 9 December 2025, the share buyback programmes have purchased c.33 million shares for c.£216 million. The total number of voting rights in Drax Group, excluding treasury shares, as at 9 December 2025 was c.341 million. In October 2025 an interim dividend of 11.6 pence per share was paid, totalling c.£40 million.

Outlook

Adj. EBITDA and free cash flow targets from existing business

The Group is continuing to target post 2027 Adj. EBITDA of £600-700 million pa before development expenditure. Delivery of this target is underpinned by disciplined cost management and an operating model adapted to reflect the structure of the recently signed low-carbon, dispatchable CfD agreement with the Low Carbon Contracts Company (a UK Government body) for Drax Power Station, combined with a high-performance culture.

Reflecting growing UK power demand, combined with an increased system reliance on intermittent and inflexible generation, Drax expects to grow its FlexGen business to comprise a greater proportion of total Adj. EBITDA over time.

Open Cycle Gas Turbines (OCGTs) will be a key component of the FlexGen portfolio. The flexibility of these grid balancing assets can enable the increased use of intermittent renewables across the UK system, supporting energy security and a reduction in net carbon emissions. Reflecting these factors, Drax now expects to retain these assets as a part of its FlexGen portfolio.

Taking strong cash flows from the current business (2025-2026) together with targeted Adj. EBITDA (2027-2031), plus working capital, less maintenance capex, interest and tax, Drax is targeting free cash flow of c.£3 billion (2025-2031)(5).

The Group’s capital allocation policy remains unchanged. Drax expects to initially allocate >£1 billion of free cash flow to shareholder returns (2025-2031). This is inclusive of the ongoing £450 million three-year share buyback programme and the continuation of its long-standing policy to pay a sustainable and growing dividend, through which the dividend per share has grown on average by 11% pa since 2017.

Drax expects to allocate up to c.£2 billion to incremental investment, primarily in the flexible and renewable energy the UK needs, as well as opportunities to maximise value from the Drax Power Station site.

Returns to shareholders and investment for growth follow a capital ranking process which aims to maximise risk adjusted returns to shareholders.

Options to invest in growth – FlexGen – flexible, renewable energy

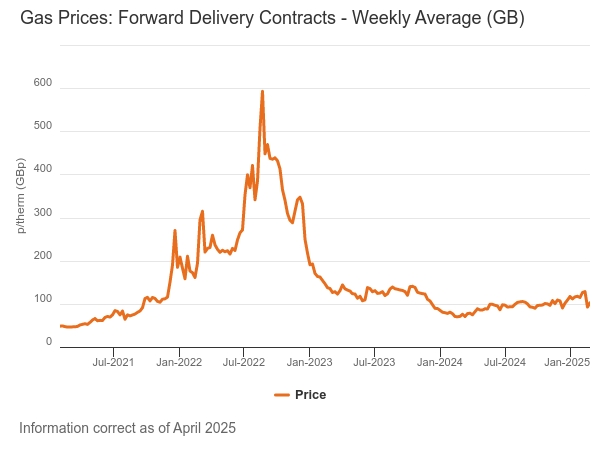

The UK National Energy System Operator’s Future Energy Scenarios indicate a doubling of power demand by 2050, via electrification and new sources of demand, including data centres. At the same time, the continued decarbonisation of the system is leading to a greater reliance on intermittent renewables. The system is becoming cleaner but more volatile, driving a growing need for dispatchable power and system support services, creating long-term earnings opportunities for, and value from, the Group’s FlexGen assets. While the trend is clear, it is hard to forecast from year to year, being dependent on weather and associated renewable activity as much as underlying commodity prices.

This position informs the Group’s view on the value of its FlexGen portfolio and opportunities for growth which can support energy security and the continued deployment of renewables. Since acquisition of the pumped storage and hydro assets in 2018, utilisation of these assets has increased significantly, delivering a five-year payback.

Pumped Storage and Hydro

An £80 million investment to refurbish and upgrade two units at Cruachan Power Station is progressing, with an initial planned outage programme through 2025. The project, which is underpinned by 15-year Capacity Market agreements worth over £220 million (c.£15 million Adj. EBITDA pa), will add 40MW of additional capacity by 2027 and improve unit operations. An additional planned outage programme associated with a transformer upgrade is expected to complete shortly.

OCGTs

Drax expects to take commercial control of the first of the three OCGTs (Hirwaun Power) in Q1 2026. The unit is now commissioning and receiving capacity market payments. The second and third sites are expected to commence commissioning in 2026.This is later than originally planned, primarily due to delays in grid connection by the relevant authorities.

Inclusive of the OCGTs Drax remains committed to its validated SBTi(9) targets and continues to assess options to realise this commitment.

BESS

The Group sees BESS as an important new technology for its FlexGen portfolio, adding fast response capabilities to long duration pumped storage and OCGT assets, which could allow the portfolio to provide a wider range of system support services to the grid.

Drax is developing a GW scale pipeline of BESS opportunities comprised of (1) physical assets and (2) the capabilities to optimise third-party assets with the provision of route to market, floor and tolling structures. In this regard, Drax already provides a route to market for c.2,000 embedded third-party renewable assets with capacity of c.800MW via its Energy Solutions business.

In October 2025, Drax signed an agreement with Apatura Limited (“Apatura”) to acquire three BESS projects, which when fully commissioned will provide capacity totalling 260MW. Drax will pay a fixed amount of £157.2 million in staged payments between 2025 and 2028, reflecting construction milestones and including payments to Apatura linked to their delivery of the projects. The acquisition of the Marfleet (England) and Neilston (Scotland) projects is now complete, with the acquisition of the East Kilbride (Scotland) project expected to be finalised in 2026.

The Group is also assessing options for other renewables, which can complement its FlexGen model.

Options to invest in growth – Drax Power Station Site

The Drax Power Station site comprises over 1,000 acres and 4GW of capacity and grid access, with 2.6GW of active dispatchable generation, cooling systems, and proximity to the UK fibre network.

The Group is focused on options to maximise value from the site, which could utilise multiple generation technologies including its existing biomass generation as well as flexible, renewable energy, to continue to support energy security, while potentially meeting the power demands of a large-scale data centre and in the long-term the potential for carbon removals from BECCS(10).

Data centre

Drax is considering a range of options for the site which could utilise its existing land, grid access, active generation, cooling solutions, site security, location and skilled workforce to meet the needs of data centre developers.

Drax is preparing a planning application to support the potential option for a first phase data centre of c.100MW on land identified at Drax Power Station, using existing infrastructure and transformers previously used to support coal generation to import power directly from the grid (front-of-the-meter). This could support the operation of a data centre at Drax Power Station as soon as 2027.

In November 2025, Drax signed a CfD agreement with the UK Government to provide c.6TWh of biomass generation pa between April 2027 and March 2031 – equivalent to c.30% of baseload output – with a strike price of £109.90/MWh (2012 real). In addition to the option to produce additional merchant generation above the cap and for system support and ancillary services, the agreement includes a mechanism for Drax to request up to 500MW to power a data centre during this period. This is subject to agreement with the UK Government, taking into account a number of factors, including value for money for consumers, energy security, and sustainability.

In the long term Drax is assessing options for over 1GW of data centre capacity, which is expected to utilise existing generation capabilities at Drax Power Station to provide a distributed (behind-the-meter) energy solution with around-the-clock renewable power directly to a data centre under a long-term Power Purchase Agreement, subject to necessary consents.

Any decision to develop data centres at Drax Power Station will require a full assessment of the capital cost and investment case as well as establishment of the commercial and development structures, including joint ventures.

Pellet Production

In the medium term, the Group’s US business is well underpinned by sales into the UK. The Group’s Canadian business, which primarily sells pellets into Asia, is expected to be more challenged, which has contributed to the decision to close Drax’s pellet plant in Williams Lake. Against this backdrop the Group does not currently expect to invest in additional capacity in the short to medium term, including the paused Longview project.

In the long term, Drax remains positive on biomass’ role in industrial decarbonisation and carbon removals via its Elimini business. Drax is continuing to assess options for own-use and third-party sales, from existing and new markets, including Sustainable Aviation Fuel, which could represent a major market opportunity from 2030 onwards.

Other matters

Drax will report its full year results on Thursday 26 February 2026.

Notes:

- Flexible Generation (FlexGen) is currently comprised of the Group’s pumped storage and hydro assets, three OCGT plants which are expected to enter commercial service in 2026 and an Energy Solutions business which provides renewable energy and services to I&C customers as well as a route to market for small renewable assets.

- Earnings before interest, tax, depreciation, amortisation, excluding the impact of exceptional items and certain remeasurements. Adj. EBITDA includes the Electricity Generator Levy (EGL).

- As of 4 December 2025, analyst consensus for 2025 Adj. EBITDA was £902 million, with a range of £892 – £909 million. The details of this consensus are displayed on the Group’s website.

Consensus – Drax Global - Excludes investment opportunities including development expenditure in Elimini, Innovation, Capital Projects and Other.

- Free cash flow pre-dividend, including targets for post 2027 Adj. EBITDA, c.£0.5 billion working capital inflow from end of RO scheme, maintenance capex, interest, taxes and EGL.

- Battery Energy Storage System.

- Includes <0.1TWh of structured power sales in 2026 and 2027 (forward gas sales as a proxy for forward power), transacted for the purpose of accessing additional liquidity for forward sales from RO units and highly correlated to forward power prices.

- Presented net of cost of closing out gas positions at maturity and replacing with forward power sales.

- Science Based Targets Initiative.

- Bioenergy with Carbon Capture and Storage.

Enquiries:

Drax Investor Relations:

Mark Strafford

[email protected]

+44 (0) 7730 763 949

Chris Simpson

[email protected]

+44 (0) 7923 257 815

Media:

Drax External Communications:

Chris Mostyn

[email protected]

+44 (0) 7743 963 483

Andy Low

[email protected]

+44 (0) 7841 068 415

Website: www.Drax.com

Forward Looking Statements

This announcement may contain certain statements, expectations, statistics, projections, and other information that are, or may be, forward looking. The accuracy and completeness of all such statements, including, without limitation, statements regarding the future financial position, strategy, projected costs, plans, beliefs, and objectives for the management of future operations of Drax Group plc (“Drax”) and its subsidiaries (the “Group”), are not warranted or guaranteed. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that may occur in the future. Although Drax believes that the statements, expectations, statistics and projections and other information reflected in such statements are reasonable, they reflect Drax’s current view and no assurance can be given that they will prove to be correct. Such events and statements involve risks and uncertainties. Actual results and outcomes may differ materially from those expressed or implied by those forward-looking statements. There are a number of factors, many of which are beyond the control of the Group, which could cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements. These include, but are not limited to, factors such as: future revenues being lower than expected; increasing competitive pressures in the industry; uncertainty as to future investment and support achieved in enabling the realisation of strategic aims and objectives; and/or general economic conditions or conditions affecting the relevant industry, both domestically and internationally, being less favourable than expected, including the impact of prevailing economic and political uncertainty, the impact of conflict including those in the Middle East and Ukraine, the impact of cyber-attacks on IT and systems infrastructure (whether operated directly by Drax or through third parties), the impact of strikes, the impact of adverse weather conditions or events such as wildfires, changes to the regulatory and compliance environment within which the Group operates. Drax do not intend to publicly update or revise these projections or other forward-looking statements to reflect events or circumstances after the date hereof, and we do not assume any responsibility for doing so.

END

Both Government and industry will have to work closely together to ensure that billions of pounds of investment is made into the UK in order to enable the delivery of the renewable energy infrastructure required to power this increase in demand.

Both Government and industry will have to work closely together to ensure that billions of pounds of investment is made into the UK in order to enable the delivery of the renewable energy infrastructure required to power this increase in demand.