-

Drax has been using effective post-harvest evaluations, which includes remote sensing technology and satellite imagery

-

Alongside sustainable forest management, monitoring can help support rapid regrowth after harvesting

-

Evidence shows healthy managed forests with no signs of deforestation or degradation

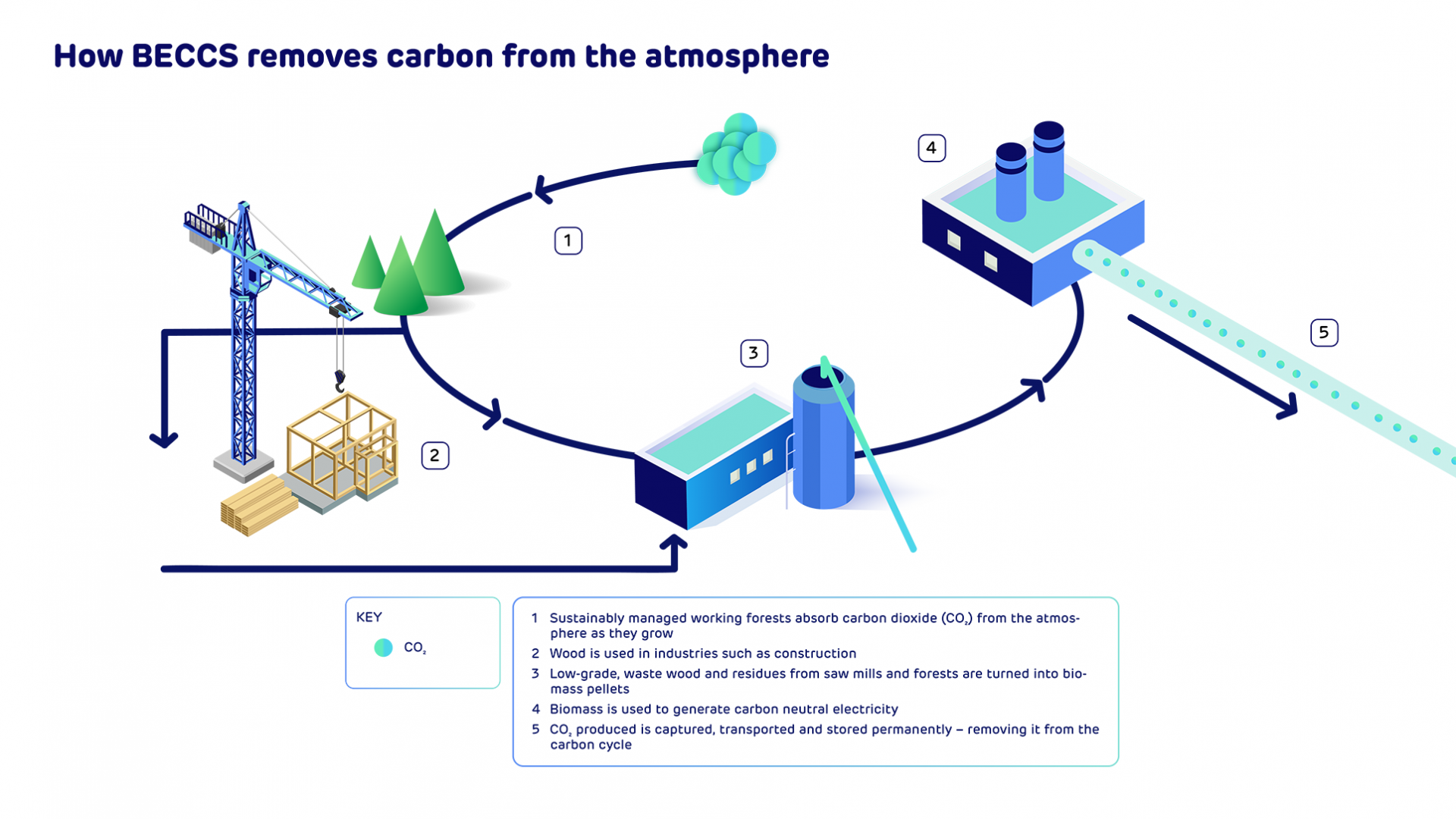

As part of Drax’s world-leading programme of demonstrating biomass sustainability, including ongoing work on catchment area analysis (CAA), responsible sourcing policy and healthy forest landscapes (HFL). We have also been trialling the use of high-resolution satellite imagery to monitor forest conditions on specific harvesting sites in the years after harvesting has taken place, in addition to the catchment area level monitoring of trends and data. Post-harvest evaluations (PHE) are an essential part of an ongoing sustainability monitoring process, ensuring that the future forest resource is protected and maintained and that landowners restore forests after harvesting to prevent deforestation or degradation.

The most effective form of PHE is for an experienced local forester to walk and survey the harvesting site to check that new trees are growing and that the health and quality of the young replacement forest is maintained.

Rapid regrowth

The images below show some of the sites surrounding Drax’s Amite Bioenergy pellet plant in Mississippi, with trees at various stages of regrowth in the years after harvesting.

- Newly planted pine

- Pine, 2-3 years

- Pine, 6-12 months

- Pine, 4-5 years

A full site inspection can therefore enable a forester to determine whether the quantity and distribution of healthy trees is sufficient to make a productive forest, equivalent to the area that was harvested. It can also identify if there are any health problems, pest damage or management issues such as weed growth or water-logging that should be resolved.

Typically, this will be the responsibility of the forest owner or their forest manager and is a regular part of ongoing forest management activity. This degree of survey and assessment is not practical or cost-effective where a third-party consumer of wood fibre purchases a small proportion (typically 20-25 tonnes per acre) of the low-grade fibre produced at a harvest as a one-off transaction for its wood pellet plant.. It is time consuming to walk every acre of restocked forest and it is not always possible to get an owner’s permission to access their land.

Forests from space

Therefore, an alternative methodology is required to make an assessment about the condition of forest lands that have been harvested to supply biomass, without the need to physically inspect each site. One option is to use remote sensing and satellite imagery to view each harvested site in the years after biomass sourcing, this helps to monitor restocking and new tree growth.

Drax has been testing the remote sensing approach using Maxar’s commercial satellite imagery. Maxar has four satellites on orbit that collect more than three million square kilometres of high-resolution imagery every day. Drax accesses this imagery through Maxar’s subscription service SecureWatch.

To test the viability of this methodology, Drax has been looking at harvesting sites in Mississippi that supplied biomass to the Amite Bioenergy pellet plant in 2015 and in 2017. As part of the sustainability checks that are carried out prior to purchasing wood fibre, Drax collects information on each harvesting tract. This includes the location of the site, the type of harvest, the owner’s long-term management intentions and species and volume details.

This data can then be used at a later date to revisit the site and monitor the condition of the area. Third-party auditors, for instance Through Sustainable Biomass Program (SBP) certification, do visit harvesting sites, however this is typically during the year of harvest rather than after restocking. Maxar has historical imagery of this region from 2010, which is prior to any harvesting for wood pellets. The image below shows a harvesting site near the pellet plant at Gloster, Mississippi, before any harvesting has taken place.

March 2010 (100m)

Satellite image © 2021 Maxar Technologies.

The image below shows the same site in 2017 immediately following harvesting.

December 2017 (100m)

Satellite image © 2021 Maxar Technologies.

If we look again at this same site three years after harvesting, we can see the rows of trees that have been planted and the quality of the regrowth. This series of images demonstrates that this harvested area has remained a forest, has not been subject to deforestation and that the regrowth appears to be healthy at this stage.

August 2020 (50m)

Satellite image © 2021 Maxar Technologies.

Another site in the Amite catchment area is shown below. The image shows a mature forest prior to harvesting, the site has been previously thinned as can be seen from the thinned rows that are evident in the imagery.

May 2010 (200m)

Satellite image © 2021 Maxar Technologies.

Looking at the same site in the year after harvesting, the clear cut area can be seen clearly. Some green vegetation cover can also be seen on the harvested area, but this is weed growth rather than replanted trees. Some areas of mature trees have been left at the time of harvesting, and are visible as a grey colour in the 2010 image. These are likely to be streamside management zones that have been left to maintain biodiversity and to protect water quality, with the grey winter colouring suggesting that they are hardwoods.

September 2018 (200m)

Satellite image © 2021 Maxar Technologies.

Three years after the harvest, in a zoomed in view from the previous image, clear rows of replanted trees can be seen in the imagery. This demonstrates that the owner has successfully restocked the forest area and that the newly planted forest appears healthy and well established.

August 2020 (50m)

Satellite image © 2021 Maxar Technologies.

While examining different harvesting sites in satellite imagery, Drax noted that not every site had evidence of tree growth, particularly within the first three years after harvesting. Deliberate conversion of land to non-forest use, such as for conversion to pasture, agricultural crops or urban development, is likely to be evident fairly soon after harvesting.

Preparing for planting

Some forest owners like to leave a harvested site unplanted for a couple of years to allow ground vegetation and weed growth to establish, this can then be treated to ensure that trees can be planted and that the weed growth does not impede the establishment of the new forest, this process can mean that trees are not visible in satellite imagery for three to four years after harvesting.

The image below shows a site three years after harvesting with no evidence of tree growth. Given that no conversion of land use is evident and that the site appears to be clear of weed growth, this is likely to be an example of where the owners have waited to clear the site of weeds prior to replanting. This site can be monitored in future imagery from the Maxar satellites to ensure that forest regrowth does take place.

November 2020 (100m)

Satellite image © 2021 Maxar Technologies.

Drax will continue to use Maxar’s SecureWatch platform to monitor the regrowth of harvesting sites and will publish more detailed results and analysis when this process has been developed further. The platform allows ongoing comparison of a site over time and could prove a more efficient method of analysis than ground survey. In conjunction with the CAA and HFL work, PHE can add remote sensing as a valuable monitoring and evidence-gathering tool to demonstrate robust biomass sustainability standards and a positive environmental impact.