Highlights

- Major planned outage on CfD(1) unit completed on schedule

- Incremental power sales on biomass ROC(2) units since July 2021 capturing higher prices

- Commissioning of 550Kt of new biomass pellet production capacity in US Southeast

- 2021 Adjusted EBITDA(3) – around the top end of current range of analyst expectations, subject to continued baseload generation on biomass units throughout December

- Positive policy developments for biomass and framework for UK BECCS(4)

Pellet Production

In North America, the Group has made good progress integrating Pinnacle Renewable Energy Inc. (“Pinnacle”) since acquisition in April 2021 and is currently in the final stages of commissioning over 360Kt of new production capacity at Demopolis, Alabama. In October 2021, the Group commissioned a 150Kt expansion at its LaSalle plant in Louisiana and at Leola, Arkansas, a new 40Kt satellite plant is due to be commissioned in December.

These developments, along-side incremental new capacity in 2022, support the Group’s continued focus on production capacity expansion and cost reduction. Once fully commissioned, Drax will operate around 5Mt of production capacity across three major North American fibre baskets – British Columbia, Alberta and the US Southeast, of which around 2Mt are contracted to high-quality third-party counterparties under long-term contracts, with the balance available for Drax’s own-use requirements.

There has been no disruption to own-use or third-party volumes from the global supply chain delays currently being experienced in some other sectors. However, as outlined at the Group’s 2021 Half Year Results, summer wildfires led to pellet export restrictions in Canada. More recently, heavy rainfall and flooding in British Columbia have led to some further disruption to rail movements and regional supply chains. Through its enlarged and diversified supply chain Drax has been able to manage and limit the impact on biomass supply for own-use and to customers.

In addition, due to the Group’s active and long-term hedging of freight costs, there has been no material impact associated with higher market prices for ocean freight. The Group uses long-term contracts to hedge its freight exposure on biomass for its Generation business, and following the acquisition of Pinnacle, is taking steps to optimise freight requirements between production centres in the US Southeast and Western Canada, and end markets in Asia and Europe.

Generation

In the UK, the Group’s biomass and pumped storage generation assets have continued to play an important role providing stability to the UK power system at a time when higher gas prices, European interconnector issues, and periods of low wind have placed the system under increased pressure. The Group’s strong forward sold position means that it has not been a significant beneficiary of higher power prices from these activities in 2021 but has been able to increase forward hedged prices in 2022 and 2023.

In March, the Group’s two legacy coal units ended commercial generation activities and will formally close in September 2022 following the fulfilment of their Capacity Market obligations. Reflecting the system challenges described above, these units were called upon in the Balancing Mechanism by the system operator for limited operations in September and November. These short-term measures helped to stabilise the power system during periods of system stress and have not resulted in any material increase in the Group’s total carbon emissions.

In September, the Generation business experienced a two-week unplanned outage on one biomass unit operating under the ROC scheme. The unit’s contracted position in this period was bought back and the generation reprofiled across the two unaffected biomass ROC units and deferred until the fourth quarter. During this period, the Group’s pumped storage power station (Cruachan) provided risk mitigation from the operational or financial impact of any additional forced outages.

In November, the Generation business successfully completed a major 98 day planned outage on its biomass CfD unit, which included the third in a series of high-pressure turbine upgrades. Drax now expects the unit to benefit from thermal efficiency improvements and lower maintenance costs, incrementally reducing the cost of biomass generation at Drax Power Station.

Customers

The Group continues to expect the Customers business will return to profitability at the Adjusted EBITDA level for 2021, inclusive of an expected increase in mutualisation costs associated with the failure of a number of energy supply businesses in the second half of 2021. Separately, the Group is continuing to assess operational and strategic solutions to support the development of the SME(5) supply business.

Full year expectations

Reflecting these factors, the Group now expects that full year Adjusted EBITDA for 2021 will be around the top of the range of current analyst expectations(6), subject to good operational performance during December, including baseload running of all four biomass units. The Group’s financial expectations do not include any Balancing Mechanism activity in December for the coal units.

Drax continues to expect net debt to Adjusted EBITDA to return to around 2x by the end of 2022.

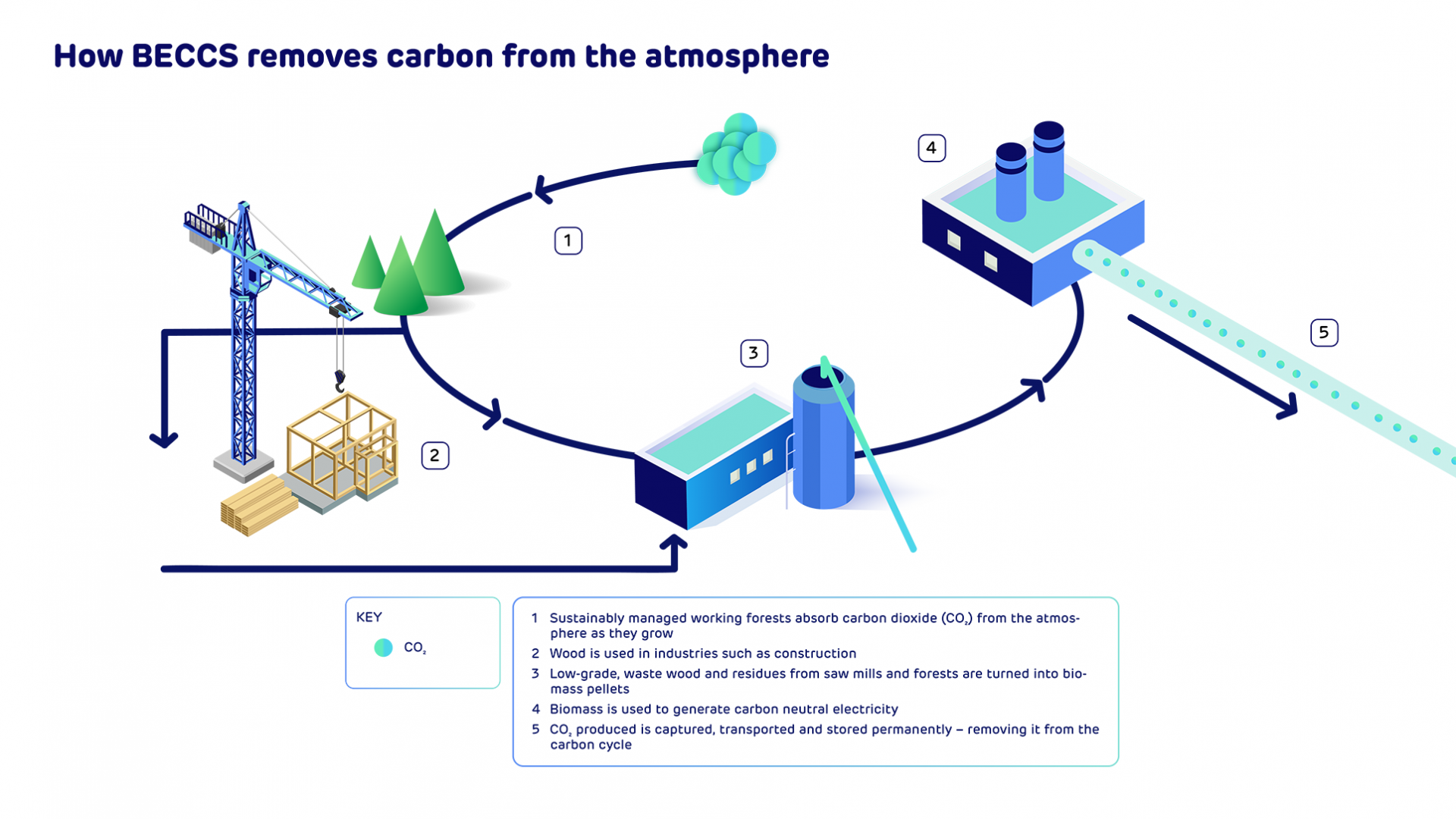

Negative emissions

In October, the UK Government selected the East Coast Cluster and Hynet as the first two regional clusters in the UK to take forward the development of the infrastructure required for carbon capture and storage. In addition, the UK Government published its Net Zero Strategy and Biomass Policy Statement, reaffirming the established international scientific consensus that sustainable biomass is renewable and indicating that it will play a critical role in helping the UK achieve its climate targets. It also signposted an ambition for at least 5Mt pa of negative emissions from BECCS and Direct Air Capture by 2030, 23Mt pa by 2035 and up to 81Mt pa by 2050. The reports commit the Government to the development during 2022 of a financial model to support the development of BECCS to meet these requirements.

The Group is continuing to progress its work on BECCS with the aim to develop 8Mt of negative CO2 emissions pa at Drax Power Station by 2030 and expects to make a decision on the commencement of a full design study in the coming weeks.

Generation contracted power sales

As at 25 November 2021, Drax had 34.3TWh of power hedged between 2021 and 2023 at £61.3/MWh as follows:

| 2021 | 2022 | 2023 | |

|---|---|---|---|

| Fixed price power sales (TWh) | 16.0 | 12.4 | 5.8 |

| Of which ROC (TWh) | 10.8 | 10.1 | 5.8 |

| Of which CfD (TWh)(7)(8) | 3.8 | 2.1 | - |

| Other (TWh) | 1.4 | 0.2 | - |

| Average achieved price (£ per MWh) | 54.0 | 70.7 | 61.2 |

| Of which ROC (£ per MWh) | 56.9 | 61.1 | 61.2 |

| Of which CfD (£ per MWh)(7) | 47.3 | 118.3 | - |

| Of which Other (£ per MWh) | 50.0 | 58.2 | - |

Since the Group’s last update on 29 July 2021, incremental power sales from the ROC units were 3.3TWh between 2022 and 2023, at an average price of £98.7/MWh.

Notes:

(1) Earnings before interest, tax, depreciation, amortisation, excluding the impact of exceptional items and certain remeasurements.

(2) BioEnergy Carbon Capture and Storage.

(3) Renewable Obligation Certificate.

(4) Contract for Difference.

(5) Small and Medium-size Enterprise.

(6) As at 26 November 2021 analyst consensus for 2021 Adjusted EBITDA was £380 million, with a range of £374-£391 million. The details of this company collected consensus are displayed on the Group’s website.

(7) The CfD biomass unit typically operates as a baseload unit, with power sold forward against a season ahead reference price. The CfD counterparty pays the difference between the season ahead reference price and the strike price. The contracted position therefore only includes CfD volumes and prices for the front six months.

(8) Expected annual CfD volumes of around 5TWh. Lower level of generation in 2021 unit due to major planned outage.

Enquiries:

Drax Investor Relations: Mark Strafford

+44 (0) 7730 763 949

Media:

Drax External Communications: Ali Lewis

+44 (0) 7712 670 888

Website: www.drax.com/uk

Forward Looking Statements

This announcement may contain certain statements, expectations, statistics, projections and other information that are or may be forward-looking. The accuracy and completeness of all such statements, including, without limitation, statements regarding the future financial position, strategy, projected costs, plans, investments, beliefs and objectives for the management of future operations of Drax Group plc (“Drax”) and its subsidiaries (the “Group”), including in respect of Pinnacle Renewable Energy Inc. (“Pinnacle”), together forming the enlarged business, are not warranted or guaranteed. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that may occur in the future. Although Drax believes that the statements, expectations, statistics and projections and other information reflected in such statements are reasonable, they reflect the Company’s current view and beliefs and no assurance can be given that they will prove to be correct. Such events and statements involve significant risks and uncertainties. Actual results and outcomes may differ materially from those expressed or implied by those forward-looking statements. There are a number of factors, many of which are beyond the control of the Group, which could cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements. These include, but are not limited to, factors such as: future revenues being lower than expected; increasing competitive pressures in the industry; and/or general economic conditions or conditions affecting the relevant industry, both domestically and internationally, being less favourable than expected; change in the policy of key stakeholders, including governments or partners or failure or delay in securing the required financial, regulatory and political support to progress the development of Drax and its operations. We do not intend to publicly update or revise these projections or other forward-looking statements to reflect events or circumstances after the date hereof, and we do not assume any responsibility for doing so.

END

Pumped storage / hydro – good operational and system support performance

Pumped storage / hydro – good operational and system support performance