RNS Number: 8333G

Drax Group plc

(“Drax” or the “Group”; Symbol:DRX)

| Six months ended 30 June | H1 2021 | H1 2020 |

|---|---|---|

| Key financial performance measures | ||

| Adjusted EBITDA (£ million)(1)(2) | 186 | 179 |

| Continuing operations | 165 | 160 |

| Discontinued operations – gas generation | 21 | 19 |

| Net debt (£ million)(3) | 1,029 | 792 |

| Adjusted basic EPS (pence)(1) | 14.6 | 10.8 |

| Interim dividend (pence per share) | 7.5 | 6.8 |

| Total financial performance measures from continuing operations | ||

| Operating profit / (loss) (£ million) | 84 | (57) |

| Profit / (loss) before tax (£ million) | 52 | (85) |

Will Gardiner, CEO of Drax Group, said:

“We have had a great first half of the year, transforming Drax into the world’s leading sustainable biomass generation and supply company as well as the UK’s largest generator of renewable power.

“The business has performed well, and we have exciting growth opportunities to support the global transition to a low-carbon economy.

“Drax has reduced its generation emissions by over 90%, and we are very proud to be one of the lowest carbon intensity power generators in Europe – a huge transformation for a business which less than a decade ago operated the largest coal power station in Western Europe.

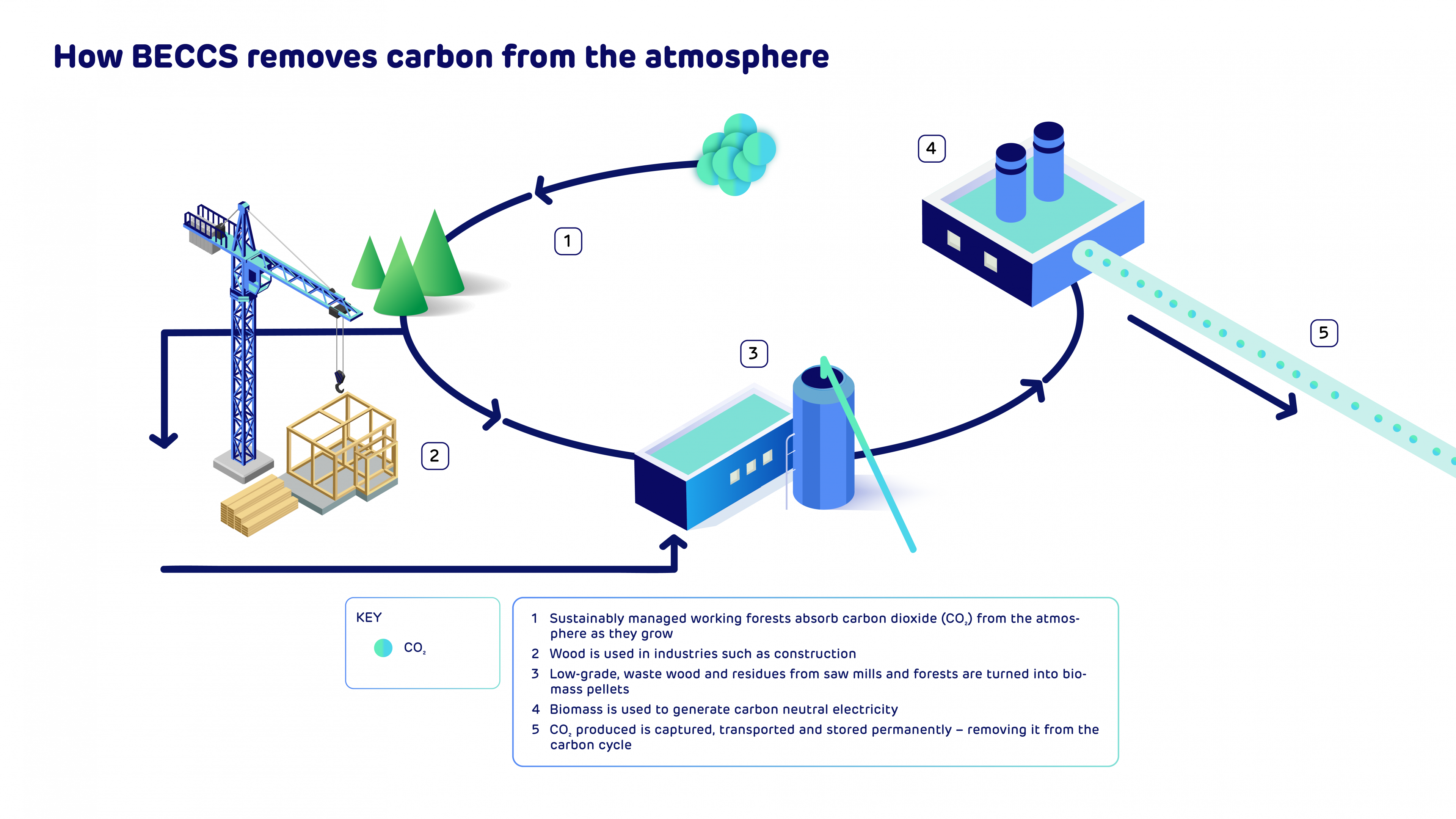

“In the past six months we have significantly advanced our plans for Bioenergy with Carbon Capture and Storage (BECCS) in the UK and globally. By 2030 Drax could be delivering millions of tonnes of negative emissions and leading the world in providing a critical technology needed to tackle the climate crisis.

“We are pleased to be announcing a 10% increase in our dividend, and we remain committed to creating long-term value for all our stakeholders.”

Financial highlights

- Adjusted EBITDA from continuing and discontinued operations up £7 million to £186 million (H1 2020: £179 million)

- Acquisition of Pinnacle Renewable Energy Inc. (Pinnacle) for cash consideration of C$385 million (£222 million) (enterprise value of C$796 million) and sale of gas generation assets for £186 million

- Strong liquidity and balance sheet

- £666 million of cash and committed facilities at 30 June 2021

- Refinancing of Canadian facilities (July 2021) with lower cost ESG facility following Pinnacle acquisition

- Sustainable and growing dividend – expected full year dividend up 10% to 18.8 pence per share (2020: 17.1p/share)

- Interim dividend of 7.5 pence per share (H1 2020: 6.8p/share) – 40% of full year expectation

Strategic highlights

Kentaro Hosomi, Chief Regional Officer EMEA, Mitsubishi Heavy Industries (MHI) at Drax Power Station, North Yorkshire

- Developing complementary biomass strategies for supply, negative emissions and renewable power

- Creation of the world’s leading sustainable biomass generation and supply company

- Supply – 17 operational plants and developments across three major fibre baskets with production capacity of 4.9Mt pa and $4.3 billion of long-term contracted sales to high-quality customers in Asia and Europe

- Generation – 2.6GW of biomass generation – UK’s largest source of renewable power by output

- >90% reduction in generation emissions since 2012

- Sale of gas generation assets January 2021 and end of commercial coal March 2021

- Development of BECCS

- Planning application submitted for Drax Power Station and technology partner (MHI) selected

- Participation in East Coast Cluster – phase 1 regional clusters and projects to be selected from late 2021

- Partnerships with Bechtel and Phoenix BioPower evaluating international BECCS and biomass technologies

- System support – option to develop Cruachan from 400MW to over 1GW – commenced planning approval process

Outlook

- Adjusted EBITDA, inclusive of Pinnacle from 13 April 2021, full year expectations unchanged

Operational review

Pellet Production – acquisition of Pinnacle, capacity expansion and biomass cost reduction

- Sustainable sourcing

- Biomass produced using forestry residuals and material otherwise uneconomic to commercial forestry

- Science-based sustainability policy fully compliant with current UK, EU law on sustainable sourcing aligned with UN guidelines for carbon accounting

- All woody biomass verified and audited against FSC®(4), PEFC or SBP requirements

- Adjusted EBITDA (including Pinnacle since 13 April 2021) up 60% to £40 million (H1 2020: £25 million)

- Pellet production up 70% to 1.3Mt (H1 2020: 0.8Mt)

- Cost of production down 8% to $141/t(5) (H1 2020: $154/t(5))

- Near-term developments in US Southeast (2021-22)

- Commissioning of LaSalle expansion, Demopolis and first satellite plant in H2

- Other opportunities for growth and cost reduction

- Increased production capacity, supply of biomass to third parties and expansion of fuel envelope to include lower cost biomass

Generation – flexible and renewable generation

- 12% of UK’s renewable electricity, strong operational performance and system support services

- Adjusted EBITDA down 14% to £185 million (H1 2020: £214 million)

- Biomass – Lower achieved power prices and higher GBP cost of biomass reflecting historical power and FX hedging

- Strong system support (balancing mechanism, Ancillary Services and optimisation) of £70 million (H1 2020: £66 million) – additional coal operations and continued good hydro and pumped storage performance, in addition to coal operations

- Coal – utilisation of residual coal stock in Q1 2021 and capture of higher power prices

Pumped storage / hydro – good operational and system support performance

Pumped storage / hydro – good operational and system support performance

- £34 million of Adjusted EBITDA (Cruachan, Lanark, Galloway schemes and Daldowie) (H1 2020: £35 million)

- Ongoing cost reductions to support operating model for biomass at Drax Power Station from 2027

- End of commercial coal operations in March, formal closure September 2022 – reduction in fixed cost base

- Major planned outage for biomass CfD unit – August to November 2021 – including third turbine upgrade delivering improved thermal efficiency and lower maintenance cost, supporting lower cost biomass operations

- Trials to expand range of lower cost biomass fuels – up to 35% load achieved in test runs on one unit

- Strong contracted power position – 29.3TWh sold forward at £52.1/MWh 2021-2023. Opportunities to capture higher power prices in future periods, subject to liquidity

| As at 25 July 2021 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Fixed price power sales (TWh) | 15.9 | 9.1 | 4.3 | |

| - CfD(6) | 3.8 | 0.6 | - | |

| - ROC | 10.8 | 8.4 | 4.0 | |

| - Other | 1.3 | 0.1 | 0.3 | |

| At an average achieved price (£ per MWh) | 51.7 | 52.4 | 52.7 |

Customers – renewable electricity and services under long-term contracts to high-quality I&C customer base

- Adjusted EBITDA loss of £5 million inclusive of £10-15 million impact of Covid-19 (H1 2020 £37 million loss inclusive of £44 million impact of Covid-19)

- Continuing development of Industrial & Commercial (I&C) portfolio

- Focusing on key sectors to increase sales to high-quality counterparties supporting generation route to market

- Energy services expand the Group’s system support capability and customer sustainability objectives

- Closure of Oxford and Cardiff offices as part of SME strategic review and the rebranding of the Haven Power I&C business to Drax

- Continue to evaluate options for SME portfolio to maximise value and alignment with strategy

Other financial information

- Total operating profit from continuing operations of £84 million including £20 million mark-to-market gain on derivative contracts and acquisition related costs of £10 million and restructuring costs of £2 million

- Total loss after tax from continuing operations of £6 million including a £48 million charge from revaluing deferred tax balances following announcement of future UK tax rate changes

- Total loss after tax from continuing operations of £6 million including a £48 million charge from revaluing deferred tax balances following confirmation of UK corporation tax rate increases from 2023

- Capital investment of £71 million (H1 2020: £78 million) – continued investment in biomass strategy

- Full year expectation of £210–230 million, includes pellet plant developments – LaSalle expansion, satellite plants and commissioning of Demopolis

- Group cost of debt now below 3.5% reflecting refinancing of Canadian facilities in July 2021

- Net debt of £1,029 million (31 December 2020: £776 million), including cash and cash equivalents of £406 million (31 December 2020: £290 million)

- 5x net debt to Adjusted EBITDA, with £666 million of total cash and committed facilities (31 December 2020: £682 million)

- Continue to expect around 2.0x net debt to Adjusted EBITDA by end of 2022

| View complete half year report | View investor presentation | Listen to webcast |

Adjusted EBITDA loss of £39 million (2019: £17 million profit) inclusive of estimated £60 million impact of Covid-19

Adjusted EBITDA loss of £39 million (2019: £17 million profit) inclusive of estimated £60 million impact of Covid-19

It’s clear that care homes require extra support at this time. We are offering energy bill relief for more than 170 small care homes situated near our UK operations for the next two months, allowing them to divert funds to their other priorities such as PPE, food or carer accommodation.

It’s clear that care homes require extra support at this time. We are offering energy bill relief for more than 170 small care homes situated near our UK operations for the next two months, allowing them to divert funds to their other priorities such as PPE, food or carer accommodation.