In brief

- £75m backing for Zero Carbon Humber to develop net zero technologies

- Accenture and World Economic Forum report says Humber could decarbonise quicker than any other UK industrial region

- Mitsubishi Heavy Industries partners with Drax, supplying its advanced carbon capture technology, making millions of tonnes of negative emissions possible at Drax Power Station this decade

- Deploying bioenergy with carbon capture and storage (BECCS) in the 2020s will have ‘positive spillover’ for a net zero economy, says Frontier Economics

- Delaying BECCS until the 2030s, argues Baringa research, could increase energy system costs by £4.5bn

- Planning consent process for BECCS at Drax from 2027 is underway, with public consulted

- Drax and Bechtel studying global BECCS deployments

Around the world governments, industries and societies have begun to set themselves targets for reaching net zero but it is at home in the UK where real progress is starting to be made in answering some of the tougher challenges posed by the global environmental crisis.

Eyebrows were raised when the UK set itself one of the most stretching timeframes in which to decarbonise but like many business leaders, I am firmly of the belief that this ambitious target will be the catalyst to deliver the innovative thinking needed to get the planet to where it needs to be.

I was delighted to learn recently that Government has awarded the Zero Carbon Humber partnership £75 million in funding to develop world-leading net zero technologies.

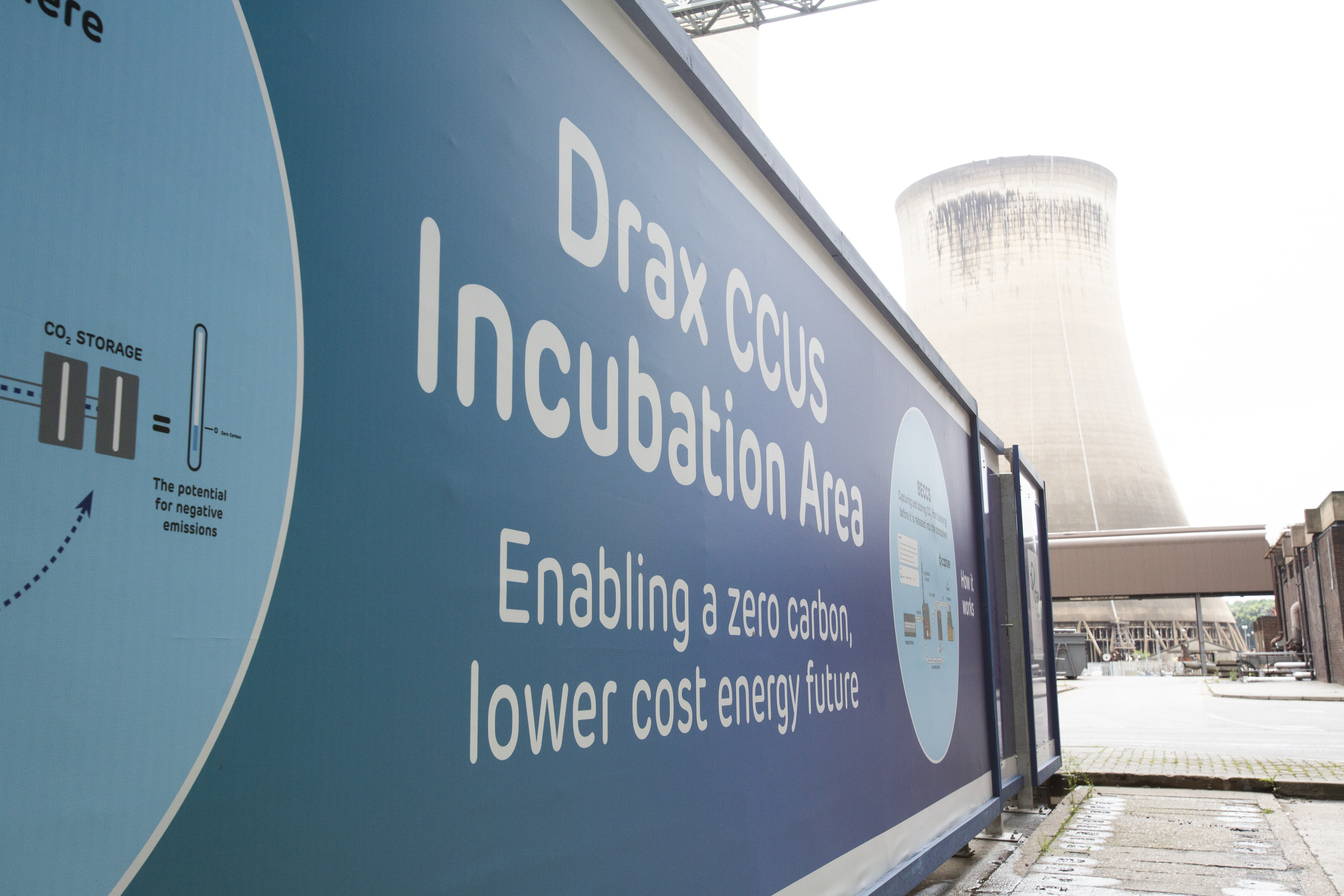

MHI BECCS pilot plant within CCUS Incubation Area, Drax Power Station, North Yorkshire

Drax was one of the founder members of the Partnership and its goal is to build the world’s first net zero industrial cluster and decarbonise the North of England. Along with the other members, we worked hard to secure this Government support and it consists of money from the Department for Business, Energy & Industrial Strategy’s Industrial Decarbonisation Challenge fund, with two thirds coming from private backing. This financing is a vote of confidence from investors and highlights the Government’s commitment to developing the world’s first zero-carbon industrial cluster in the region.

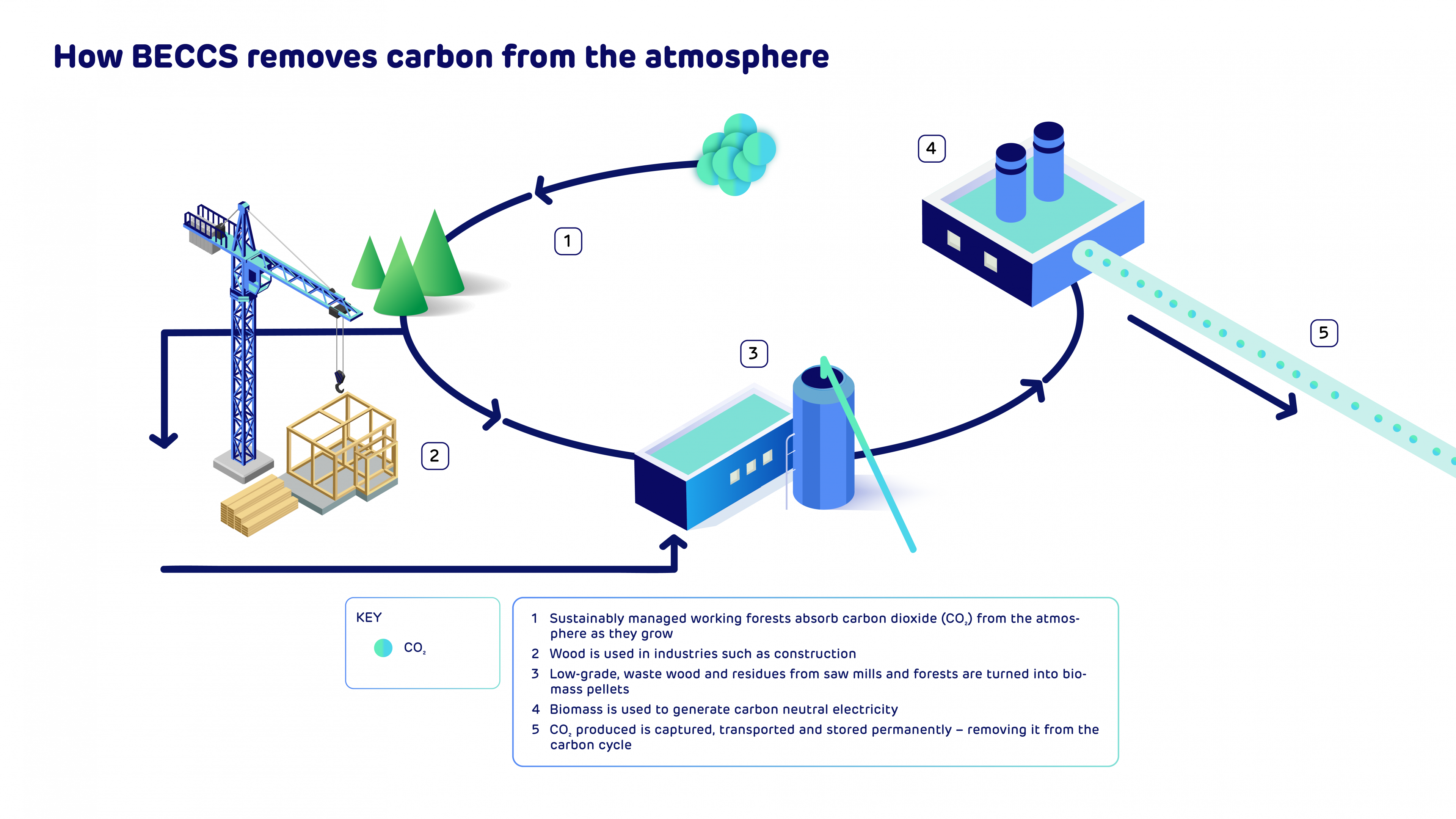

Projects of this scale, backed with meaningful funding, are key to accelerating a range of technologies that will be essential to advancing decarbonisation. These include hydrogen production, carbon capture usage and storage (CCUS) and negative emissions through bioenergy with carbon capture and storage (BECCS). But more than just having a positive effect on reducing emissions, delivering this in the Humber will also support clean economic growth and future-proof vital industries.

Biomass storage domes and water cooling towers at Drax Power Station in North Yorkshire

I believe that in a similar way to how renewables have made huge strides in helping decarbonise power, a range of new technologies are now needed to decarbonise industry and industrial regions. Our work as a partnership in the Humber is establishing a landmark project for the UK and the world’s journey to net zero and clean growth.

Reaching net zero depends on a diverse range of technologies

There are many factors that will be essential for the world to reach net zero, but perhaps none more important than open collaboration and integration. Government, industry and individual businesses will need to work together and share learnings and infrastructure to be able to make true progress. This collaboration will of course take many forms, but one that is crucially important is industrial clusters, such as Zero Carbon Humber and neighbouring Net Zero Teesside.

A recent report by Accenture highlighted how vital decarbonising industrial regions will be to reaching climate goals. Industrial carbon dioxide (CO2) emissions account for as much as 11 gigatonnes, or 30% of global greenhouse gas emissions (GHG). However, the report also highlights the opportunities, both environmental and economic, in decarbonising clusters. The market for global industrial efficiency alone is expected to receive investments worth as much as $40bn, while the global hydrogen market was estimated at around $175bn in 2019.

The Humber is the UK’s largest cluster by industrial emissions, emitting 10 million tonnes of CO2 per year – more than 2% of the UK’s total GHG emissions. Pioneering projects around hydrogen production, CCUS and negative emissions through BECCS are all ready to scale in the region, beginning the task of reducing and removing emissions. The potential benefit to the regional economy could also be significant – it’s estimated these technologies could create 48,000 direct, indirect and induced jobs in the Humber region by 2027. This new £75 million in funding will allow work to gather pace on these transformational projects.

The funding will be used to obtain land rights and begin front-end engineering design (FEED) for the hydrogen facility at H2H Saltend, as well as onshore pipeline infrastructure for CO2 and hydrogen. It marks the beginning of the vital work of putting transportation systems in place that will take captured CO2 from Drax Power Station’s BECCS generating units and permanently store it under the southern North Sea’s bed.

Drax’s BECCS power generation is one of Zero Carbon Humber’s anchor projects. Our recently confirmed partnership with Mitsubishi Heavy Industries (MHI) will see its Advanced KM CDR™️ carbon capture technology deployed at Drax Power Station. The negative emissions that this long-term agreement will make possible, will enable the region to reduce its emissions faster than any other UK cluster, according to Accenture. Developing negative emissions through BECCS will help us achieve our ambition of becoming a carbon negative company by 2030. By that time, Drax Power Station could remove 8 million tonnes of CO2 from the atmosphere each year, playing a major part in helping the UK meet its climate goals.

From BECCS to a net zero UK

In March 2021, Drax kickstarted the process to gain the necessary planning permissions called a Development Consent Order (DCO) from the Government. It’s a crucial administrative step towards delivering a BECCS unit as early as 2027, and a landmark moment in developing negative emissions in the UK.

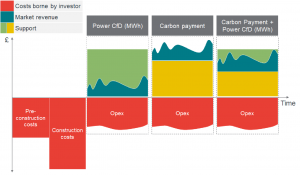

A report by Frontier Economics for Drax highlights BECCS as a necessary step on the UK’s path to decarbonisation. Developing a first-of-a-kind BECCS power plant would also have ‘positive spillover’ effects that can contribute to wider decarbonisation and a net zero economy. These include learnings and efficiencies that come from developing and operating the country’s first BECCS power station, as well as transport and storage infrastructure, which will reduce the cost of subsequent BECCS, negative emissions and other CCS projects.

However, the benefits of acting quickly and pioneering BECCS deployment at scale can only be achieved if policy is put in place to enable the right business models for BECCS and negative emissions. According to the Frontier report, intervention is needed to instil confidence in investors while also protecting consumer energy prices from spikes.

Inside MHI pilot carbon capture plant, Drax Power Station

Failure to implement negative emissions through BECCS could also be costly. Time is of the essence for the UK to reach net zero by 2050 and research by energy consultancy Baringa, commissioned by Drax, highlights the economic cost of hesitation. Findings showed that delaying BECCS from 2027 to 2030 could increase energy system costs by more than £4.5bn over the coming decade and over £5bn by the time the UK has to reach net zero.

I believe what we are developing at Drax can become a world-leading and exportable solution for large-scale carbon negative power generation. The potential in negative emissions is economic as well as environmental, protecting thousands of jobs in the UK’s carbon-intensive industries, as well as overseas.

BECCS offers great potential for the UK to export skills, knowledge and equipment to an international market. To help establish this market we are working with engineering and construction project management firm Bechtel to explore locations globally where there is the opportunity to deploy BECCS, and identify how new-build BECCS plants can be optimised to deliver negative emissions for those regions.

Pictured L-R: Kentaro Hosomi, Chief Regional Officer EMEA, Mitsubishi Heavy Industries (MHI); Jenny Blyth, Project Analyst, Drax Group at Drax Power Station, North Yorkshire; Carl Clayton, Head of BECCS, Drax Group;

Multiple government and independent organisations have highlighted how essential negative emissions are to reaching net zero in the UK, as well as global climate goals. The recently formed Coalition for Negative Emissions aims to advance this vital industry at a global scale. By uniting a range of negative emissions providers and users from across industries, we can make it a more powerful force for decarbonisation and sustainable growth.

It will still be a long journey towards the UK’s goals, but the Government’s funding for Zero Carbon Humber, the beginning of our BECCS DCO and partnerships with MHI and Bechtel are key steps on the path to reaching net zero by 2050. I, for one, am excited to be on this journey.

Adjusted EBITDA loss of £39 million (2019: £17 million profit) inclusive of estimated £60 million impact of Covid-19

Adjusted EBITDA loss of £39 million (2019: £17 million profit) inclusive of estimated £60 million impact of Covid-19