RNS Number : 3978U

Drax Group PLC (Symbol: DRX)

| Six months ended 30 June | H1 2020 | H1 2019 |

|---|---|---|

| Key financial performance measures | ||

| Adjusted EBITDA (£ million) (1)(2) | 179 | 138 |

| Cash generated from operations (£ million) | 226 | 229 |

| Net debt (£ million) (3) | 792 | 924 |

| Interim dividend (pence per share) | 6.8 | 6.4 |

| Adjusted basic earnings per share (pence) (1) | 10.8 | 2 |

| Total financial performance measures | ||

| Coal obsolescence charges | -224 | - |

| Operating (loss) / profit (£ million) | -32 | 34 |

| (Loss) / profit before tax (£ million) | -61 | 4 |

| Basic (loss) / earnings per share (pence) | -14 | 1 |

Financial highlights

- Group Adjusted EBITDA up 30% to £179 million (H1 2019: £138 million)

- Includes estimated £44 million impact of Covid-19, principally in Customers SME business

- £34 million of capacity payments (H1 2019: nil) following re-establishment of the Capacity Market

- Strong biomass performance in both Pellet Production and Generation

- Strong cash generation and balance sheet

- £694 million of cash and total committed facilities

- Extended £125 million ESG CO2 emission-linked facility to 2025

- DBRS investment grade rating

- Sustainable and growing dividend

- Expected full year dividend up 7.5% to 17.1 pence per share (2019: 15.9 pence per share), subject to good operational performance and impact of Covid-19 being in line with current expectations

- Interim dividend of 6.8 pence per share (H1 2019: 6.4 pence per share) – 40% of full year

Biomass storage dome with conveyor in the foreground, Drax Power Station, North Yorkshire [Click to view/download]

Operational highlights

- Biomass self-supply – 9% reduction in cost, 15% increase in production and improved quality vs. H1 2019

- Generation – 11% of UK’s renewable electricity, strong operational performance and system support services

- Customers – lower demand and an increase in bad debt provisions, principally in SME business

Progressing plans to create a long-term future for sustainable biomass

- Targeting five million tonnes of self-supply at £50/MWh(4) by 2027 from expanded sources of sustainable biomass

- Plan for $64 million ($35/t, £13/MWh(4)) annual savings on 1.85Mt by 2022 vs. 2018 base

- Investment in new satellite plants in US Gulf – targeting 20% reduction in pellet cost versus current cost

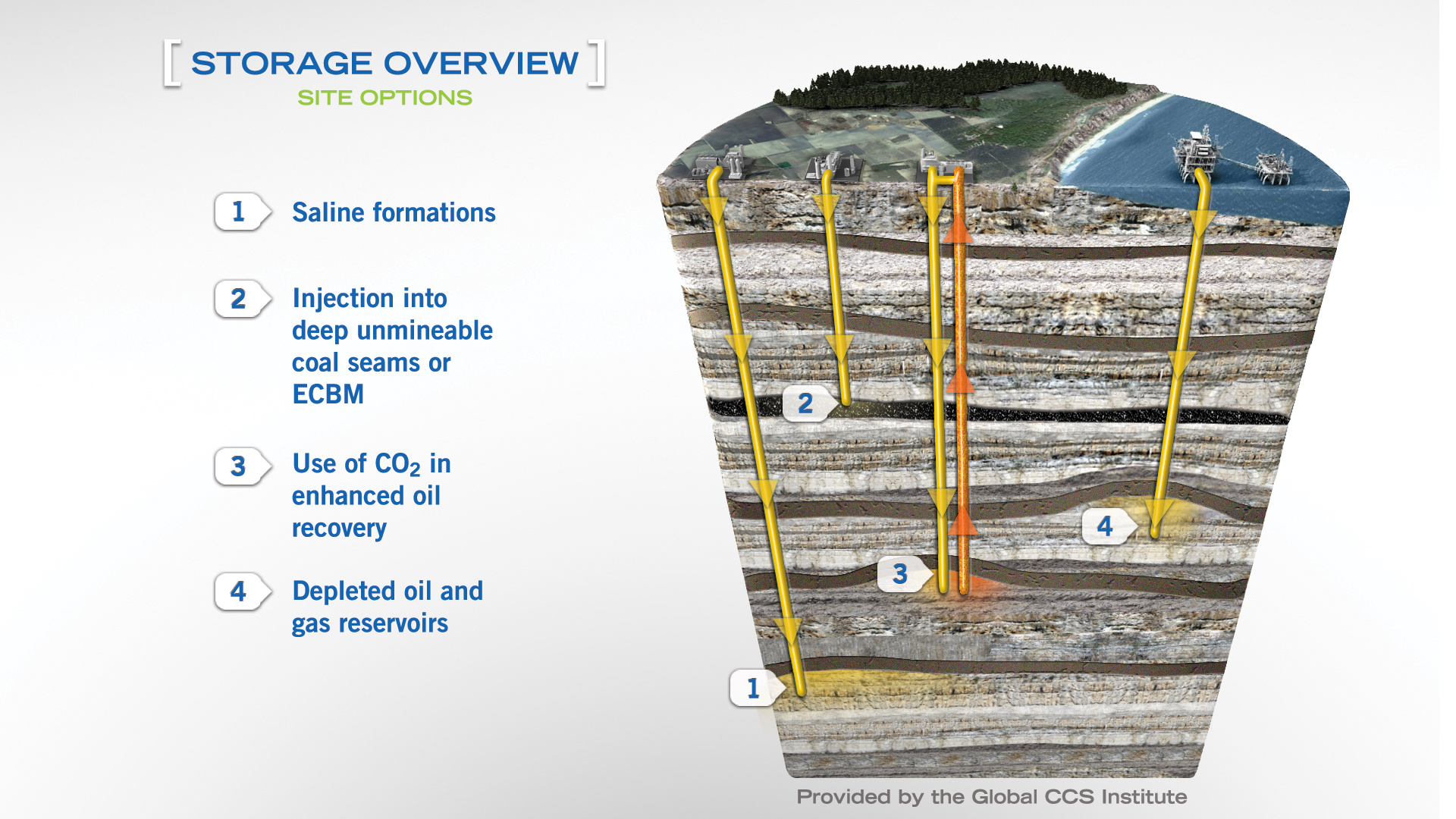

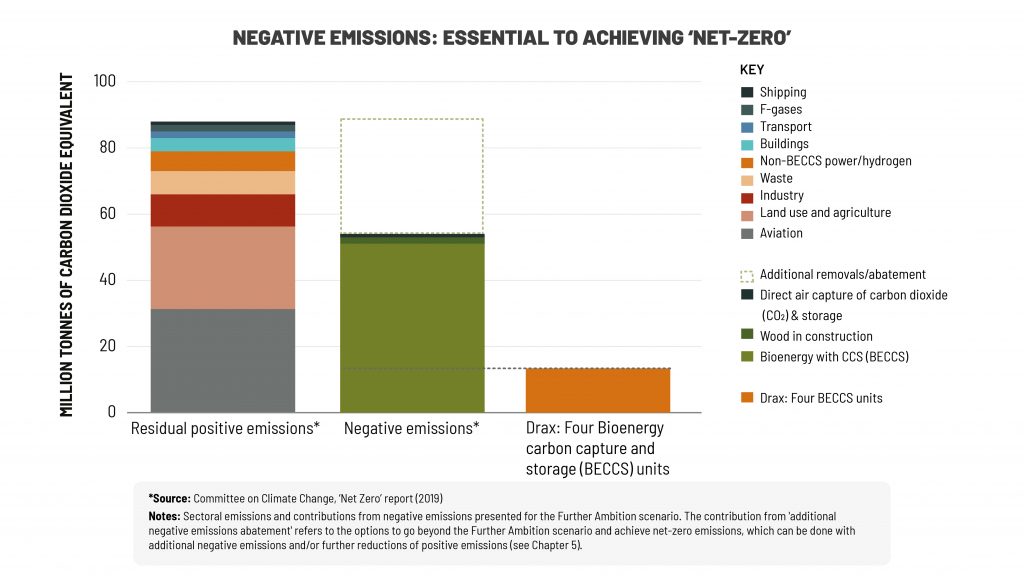

- BECCS(5) – developing proven and emerging technology options for large-scale negative emissions

- End of coal operations – further reduction in CO2 emissions and lower cost operating model for biomass

Outlook

- Full year Adjusted EBITDA, inclusive of c.£60 million estimated impact of Covid-19, in line with market consensus

- Evaluating attractive investment options for biomass growth: cost reduction and capacity expansion

- Strong contracted power sales (2020–2022) 34TWh at £51.4/MWh and high proportion of non-commodity revenues

Will Gardiner, CEO of Drax Group said:

“As well as generating the flexible, reliable and renewable electricity the UK economy needs, we’re delivering against our strategy to reduce the costs of our sustainable biomass and we’re continuing to make progress pioneering world-leading bioenergy with carbon capture technologies, known as BECCS, to deliver negative emissions and help the UK meet its 2050 net zero carbon target.“With these robust half-year results, Drax is delivering for shareholders with an increased dividend while continuing to support our employees, communities and customers during the Covid-19 crisis.

“National Grid stated this week that the UK can’t reach net zero by 2050 without negative emissions from bioenergy with carbon capture and storage. BECCS delivers for the environment and also provides an opportunity to create jobs and clean economic growth in the North and around the country.”

Operational review

Pellet Production – capacity expansion, improved quality and reduced cost

- Adjusted EBITDA up 213% to £25 million (H1 2019: £8 million)

- Pellet production up 15% to 0.75Mt (H1 2019: 0.65Mt) – impact of adverse weather in H1 2019

- Cost of production down nine per cent to $154/t(6) (H1 2019: $170/t(6))

- Reduction in fines (larger particle-sized dust) in each cargo

- Cost reduction plan – targeting $64 million ($35/t, £13/MWh(4)) annual savings on 1.85Mt by 2022 vs. 2018 base

- Expect to deliver $27 million of annual savings by end of 2020 – a saving of $18/t vs. 2018

- Greater use of low-cost fibre, LaSalle (improved rail infrastructure, woodyard and sawmill co-location) and relocation of HQ from Atlanta to Monroe

- Savings from projects to be delivered in 2020-2022

- 35Mt capacity expansion (LaSalle, Morehouse and Amite), increased use of low-cost fibre, improved logistics and other operational enhancements

- $40 million investment in three 40kt satellite plants in US Gulf – commissioning from 2021, potential for up to 0.5Mt

- Use of Drax infrastructure and sawmill residues – targeting 20% reduction in pellet cost versus current cost

Power lines and pylon above Cruachan Power Station, viewed from Ben Cruachan above [Click to view/download]

Power Generation – flexible, low-carbon and renewable generation

- Adjusted EBITDA up 45% to £214 million (H1 2019: £148 million)

- Limited impact from Covid-19 – strong contracted position provided protection from lower demand, reduction in ROC(7) prices offset by increased system support services

- £34 million of Capacity Market income (H1 2019: nil; £36 million in relation to H1 2019 subsequently recognised in H2 2019 following re-establishment of the Capacity Market)

- £54 million of Adjusted EBITDA from hydro and gas generation assets (H1 2019: £36 million)

- System support (Balancing Market, ancillary services and portfolio optimisation) up 8% to £66 million (H1 2019: £61 million)

- Good commercial availability across the portfolio – 91% (H1 2019: 87%)

- Covid-19 – business continuity plan in place to ensure safe and uninterrupted operations

- Biomass generation up 16% to 7.4TWh (H1 2019: 6.4TWh)

- Strong supply chain (impact of adverse weather in H1 2019) and record CfD availability (Q2 2020 – 99.5%)

- Pumped storage / hydro – excellent operational and system support performance

- Gas – excellent operational and system support performance, Damhead Creek planned outage underway

- Coal – 10% of output in H1 2020 – utilisation of coal stock before end of commercial generation (March 2021)

Customers – managing the impact of Covid-19 on SME business

- Adjusted EBITDA loss of £37 million (H1 2019: £9 million profit) inclusive of estimated £44 million impact of Covid-19 – reduced demand, MtM loss on pre-purchased power and increase in bad debt, principally in SME business

- Covid-19 – implemented work from home procedures to allow safe and continuous operations and customer support

- Good performance in Industrial and Commercial market – new contracts with large water companies providing five-year revenue visibility, while supporting the Group’s flexible, renewable and low-carbon proposition

- Monitoring and optimisation of portfolio to ensure alignment with strategy

Other financial information

- Total financial performance measures reflects £108 million MtM gain on derivative contracts, £224 million coal obsolescence charges and £10 million impact (£6 million adjusted impact) from UK Government’s reversal of previously announced corporation tax rate reduction resulting in revaluation of deferred tax asset and increased current tax charge

- Additional c.£25–£35 million for coal closure costs expected to be reported as exceptional item in H2 2020 when coal consultation process is further advanced

- Capital investment – continuing to invest in biomass strategy, some delay in investment due to Covid-19

- H1 2020: £78 million (H1 2019: £60 million)

- Full year expected investment £190–£210 million (was £230–£250 million), includes 0.35Mt expansion of existing pellet plants and $20 million initial investment in satellite plants ($40 million in total)

- Net debt of £792 million, including cash and cash equivalents of £482 million (31 December 2019: £404 million)

- Remain on track for around 2.0x net debt to Adjusted EBITDA by end of 2020

View complete half year report

View analyst presentation

Listen to webcast

View/download main image. Caption: LaSalle BioEnergy (centre) and co-located sawmill (right), Louisiana