Enabling a zero carbon, lower cost energy future

Chapter 1:

Welcome, highlights & at a glance

WELCOME TO DRAX GROUP

Our purpose:

Enabling a zero carbon, lower cost energy future

Drax’s goals are to enable:

-

A zero carbon economy: Meeting climate change commitments and leaving our environment better than we found it

-

A lower cost energy system: Ensuring the energy system is delivered at a lower cost

-

Greater security and control: Providing and supporting a reliable supply of renewable energy and giving customers greater control of their energy

This web page presents the Strategic Report section. View the full Drax Group plc Annual report and accounts PDF.

Main photo: Cruachan dam and reservoir above Cruachan Power Station, acquired by Drax on 31 December 2018 (view case study).

2018 HIGHLIGHTS

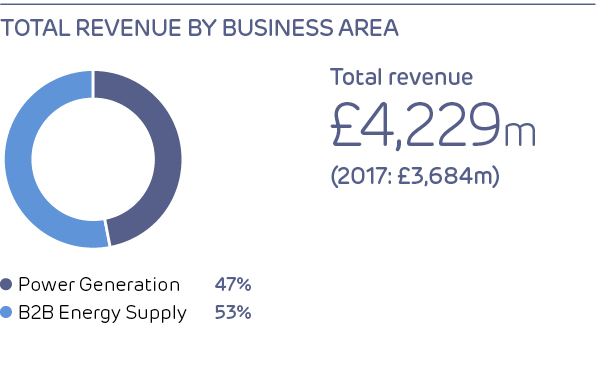

(1) Adjusted EBITDA is defined as earnings before interest, tax, depreciation, amortisation, excluding the impact of exceptional items and certain remeasurements.

(2) Net debt is defined as borrowings less cash and cash equivalents. Net debt does not include the £687 million which was paid on 2nd January 2019 for the acquisition of the generation business from ScottishPower.

(3) Drax estimates that it produced around 12% of the UK’s renewable electricity between Q4 2017 and Q3 2018 (Q4 2016 to Q3 2017). This is based upon the latest BEIS Energy Trends 6.1 data.

WHAT'S INSIDE: Chapter 2 -- Our Group CEO, Will Gardiner, reviews the year and progress made against our strategy; Chapter 3 -- Our business model describes our activities and how we generate value from our resources; Chapter 6 -- Sustainability is at the heart of our business

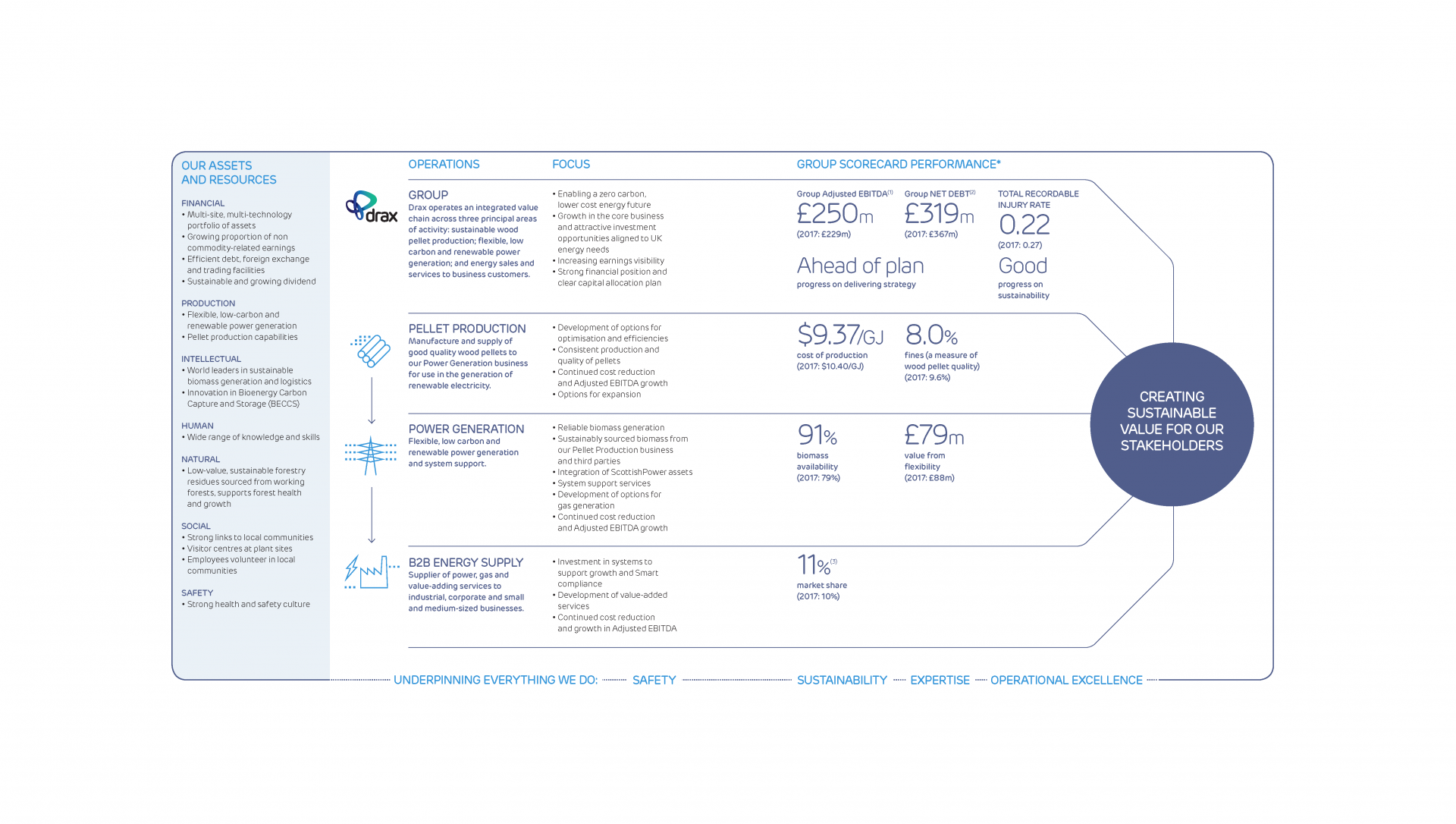

OUR CORE ACTIVITIES AT A GLANCE

Drax Group operates an integrated value chain across three principal areas of activity: sustainable wood pellet production; flexible, low carbon and renewable energy generation; and energy sales and services to business customers. Our activities are underpinned by safety, sustainability, operational excellence and expertise in our markets.

PELLET PRODUCTION

A leading producer of wood pellets from sustainable low-value commercial forestry residues.

Manufacture and supply of good quality wood pellets at the lowest cost to our Power Generation business for use in the generation of renewable electricity.

Our assets:

- 2 x 525 ktonne pellet plants

- 1 x 450 ktonne pellet plant

- 1 Mtonne export facility at Baton Rouge port

1,351kt

pellets produced

POWER GENERATION

A portfolio of flexible, low carbon and renewable UK power generation.

A multi-site, multi-technology generation portfolio providing power and system support services to the electricity grid.

Our assets:

- 6GW biomass generation and system support

- 3GW coal generation and system support

- On 31 December 2018 we acquired a 2.6GW portfolio of assets from ScottishPower (further details)

- Option for 4 x 299MW Open Cycle Gas Turbines (OCGT)

Generation

18.3TWh

Capacity

3.9GW

(6.5GW from 31 December 2018)

Renewables

75%

B2B ENERGY SUPPLY

A leading supplier of renewable energy solutions to industrial and business customers.

Supplier of power, gas and value-adding services to industrial, corporate and small and medium-sized businesses, representing an 11% share of the B2B power market.

Our assets:

- Opus Energy

- Haven Power

Customer meters

396k

Power sales

20.9TWh

Chapter 2:

Chair's statement & CEO's review

CHAIR’S STATEMENT

“Our flexible, low carbon and renewable approach is delivering high quality earnings and further opportunities for growth.”

Philip Cox CBE, Chair, Drax Group

INVESTMENT CASE

-

Critical to decarbonisation of the UK’s energy system and a major source of flexible, low carbon and renewable power from a nationwide portfolio of generation technologies

-

Underlying growth in the core business and attractive investment opportunities

-

Increasing earnings visibility, reducing commodity exposure

-

Strong financial position and clear capital allocation plan

Introduction

In 2018 we made good progress with the strategy we first announced in December 2016.

The strategy is to focus on our flexible, low carbon and renewable generation, combined with a customer-focused approach to energy supply. The Group aims to deliver higher quality earnings, a reduction in commodity exposure and opportunities for growth aligned with the country’s ambitious low carbon energy needs. I expect the Group to be at the centre of this change and to work in partnership with Government to help the UK meet its energy objectives.

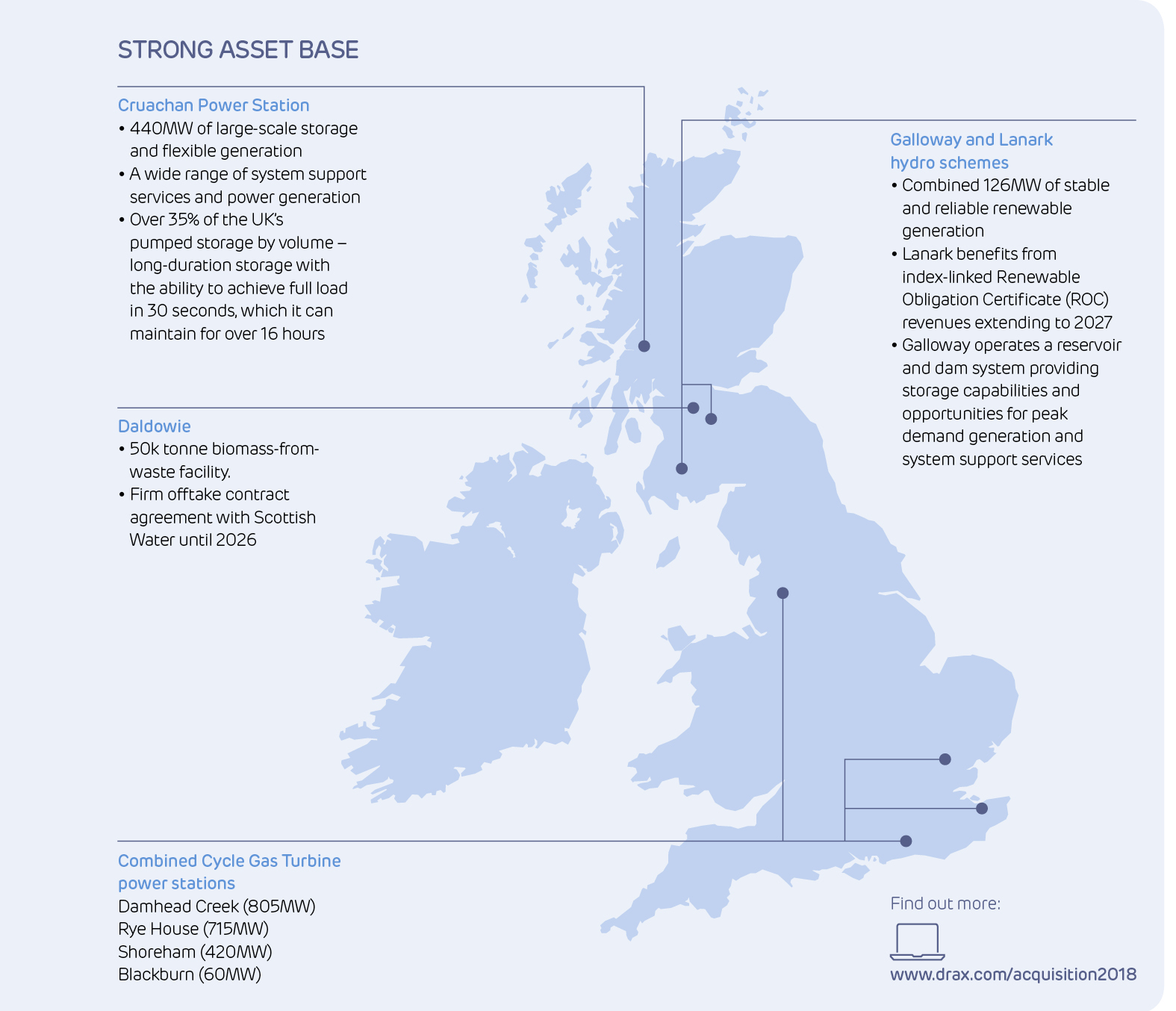

In December 2018 we completed the acquisition of a portfolio of pumped storage, hydro and gas generation assets from ScottishPower, following shareholder approval at the General Meeting held on 21 December 2018. These assets are highly complementary to our strategy, and will form a very important part of our portfolio.

Operationally, the Power Generation business managed a major unplanned generator outage in early 2018, as well as an unrelated outage in December 2017 due to a fire at our rail unloading facility. Both outages restricted biomass generation in early 2018. We have learned important lessons from these events as we continuously strive for improved safety and operational performance.

Notwithstanding these events we continued to provide a significant amount of the UK’s renewable power and completed the conversion of a fourth unit from coal to biomass – on schedule and budget.

We have continued to develop options for gas generation at four sites around the UK as well as the option for coal-to-gas repowering at Drax Power Station. These options could provide new sources of flexible generation and support the UK’s decarbonisation targets while delivering attractive returns to our shareholders, subject to the right long-term support mechanism being in place.

Millbrook Power, one of four rapid-response gas power station development projects

Good quality, sustainable, low cost biomass is central to our business and, in Pellet Production, we successfully commissioned our third pellet plant – LaSalle Bioenergy – ahead of schedule and on budget. We also relocated our US administration to Monroe, Louisiana to bring increased focus and efficiency to our business. Although pellet quality improved in 2018 it was below the level we targeted and we are focused on delivering further improvements during 2019.

LaSalle BioEnergy in Louisiana, one of three Drax Biomass pellet plants

In B2B Energy Supply we have increased customer meters and margin, although the market for many of our customers remains challenging. This has contributed to an increase in bad debt provisioning.

Results and dividend

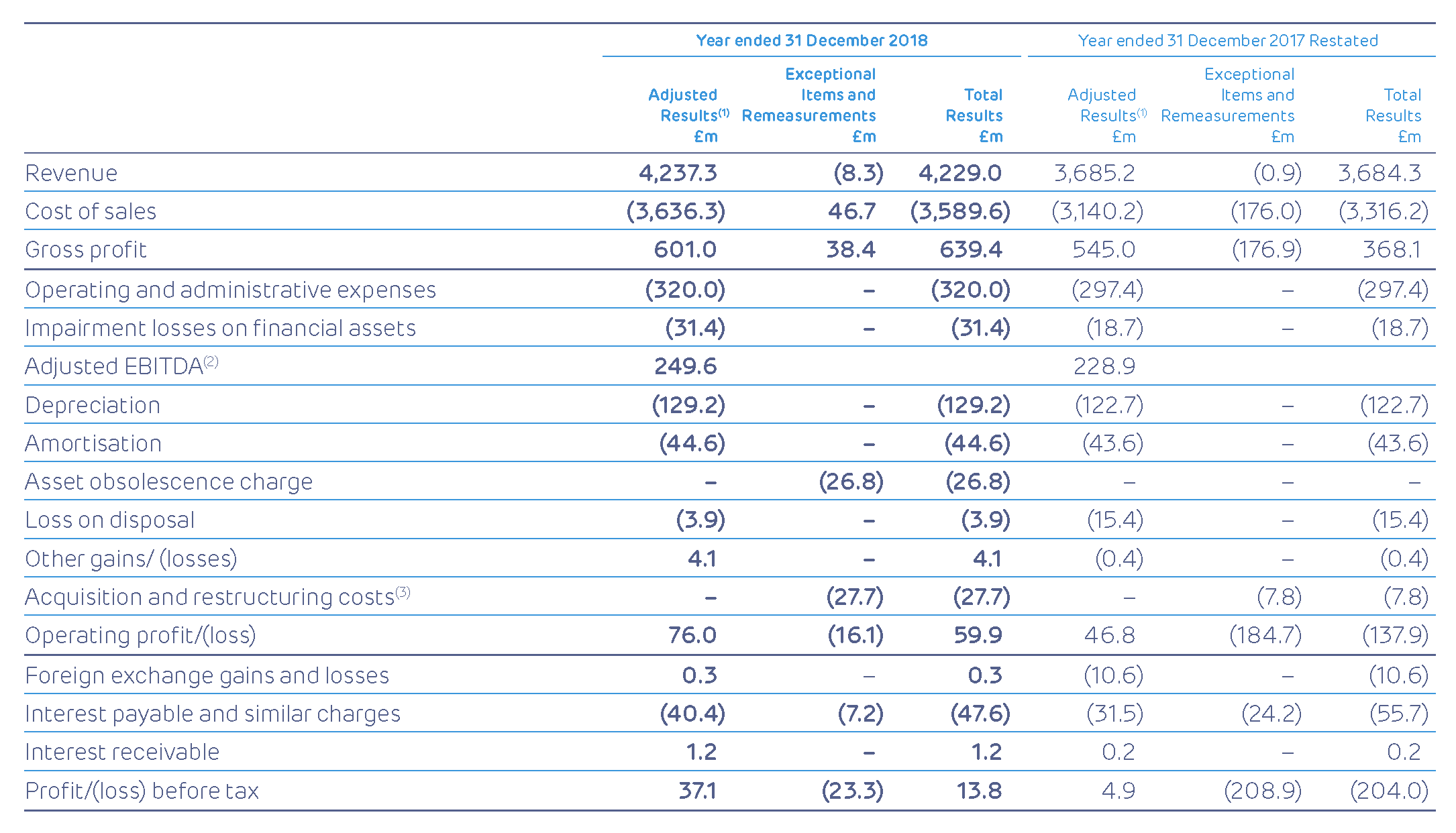

Adjusted EBITDA in 2018 of £250 million grew by 9% compared to 2017 (£229 million). This reflects high levels of renewable power generation from sustainable biomass as well as Adjusted EBITDA growth in our Pellet Production business.

At the 2018 half year results we confirmed an interim dividend of £22 million (5.6 pence per share) representing 40% of the full year expected dividend of £56 million (14.1 pence per share) (2017: £50 million, 12.3 pence per share). Accordingly, the Board proposes to pay a final dividend in respect of 2018 of £34 million, equivalent to 8.5 pence per share. This represents a 12% increase on 2017 and is consistent with our policy to pay a dividend which is sustainable and expected to grow as the strategy delivers an increasing proportion of stable earnings and cash flows.

The Group has a clear capital allocation policy which it has applied throughout 2018. In determining the rate of growth in dividends from one year to the next the Board will take account of contracted cash flows, the less predictable cash flows from the Group’s commodity based business and future investment opportunities. If there is a build-up of capital, the Board will consider the most appropriate mechanism to return this to shareholders.

Reflecting this approach to capital allocation, in February 2018 the Group announced a £50 million share buy-back programme, which was successfully completed in January 2019.

Corporate governance

In January 2018 Will Gardiner, who was previously Group Chief Financial Officer (CFO), became Group Chief Executive Officer, succeeding Dorothy Thompson CBE. His appointment followed a thorough review of internal and external candidates and was a natural progression after two years working alongside Dorothy developing a strategy which I am confident will continue to create significant benefits for all stakeholders.

We are also delighted to welcome Andy Skelton to the Board as CFO from January 2019. Andy is a highly experienced CFO having previously served as CFO at Fidessa. I extend my thanks to Den Jones who did an excellent job as Interim CFO, supporting the delivery of the strategy and the acquisition of the ScottishPower assets. Den will remain with the Group until May 2019 to support the integration process.

Drax remains committed to the highest standards of corporate governance. The Board and its committees play an active role in guiding the Company and leading its strategy. We greatly value the contribution made by our Non-Executive Directors and during a time of transition their role remains especially important.

During 2018, as part of our structured succession planning, we welcomed two new Non-Executive Directors to the Board. Nicola Hodson has valuable experience in technology, business transformation and energy. Vanessa Simms has over 20 years’ experience in senior finance roles, with a particular focus on implementing strategic change.

David Lindsell will step down at the Annual General Meeting (AGM) in April 2019. David has served for ten years and remained on the Board during 2018 to assist with the onboarding of the new CFO and Chair of the Audit Committee. Tony Thorne will step down in June 2019 and Tim Cobbold will step down in September 2019, each having served nine years. Nicola will succeed Tony as Chair of the Remuneration Committee and Vanessa will succeed David as Chair of the Audit Committee. David Nussbaum will take over as our Senior Independent Director.

I would like to thank each of David Lindsell, Tony and Tim for their very significant contributions to the Board and, for David and Tony, their invaluable leadership of the Audit and Remuneration Committees respectively.

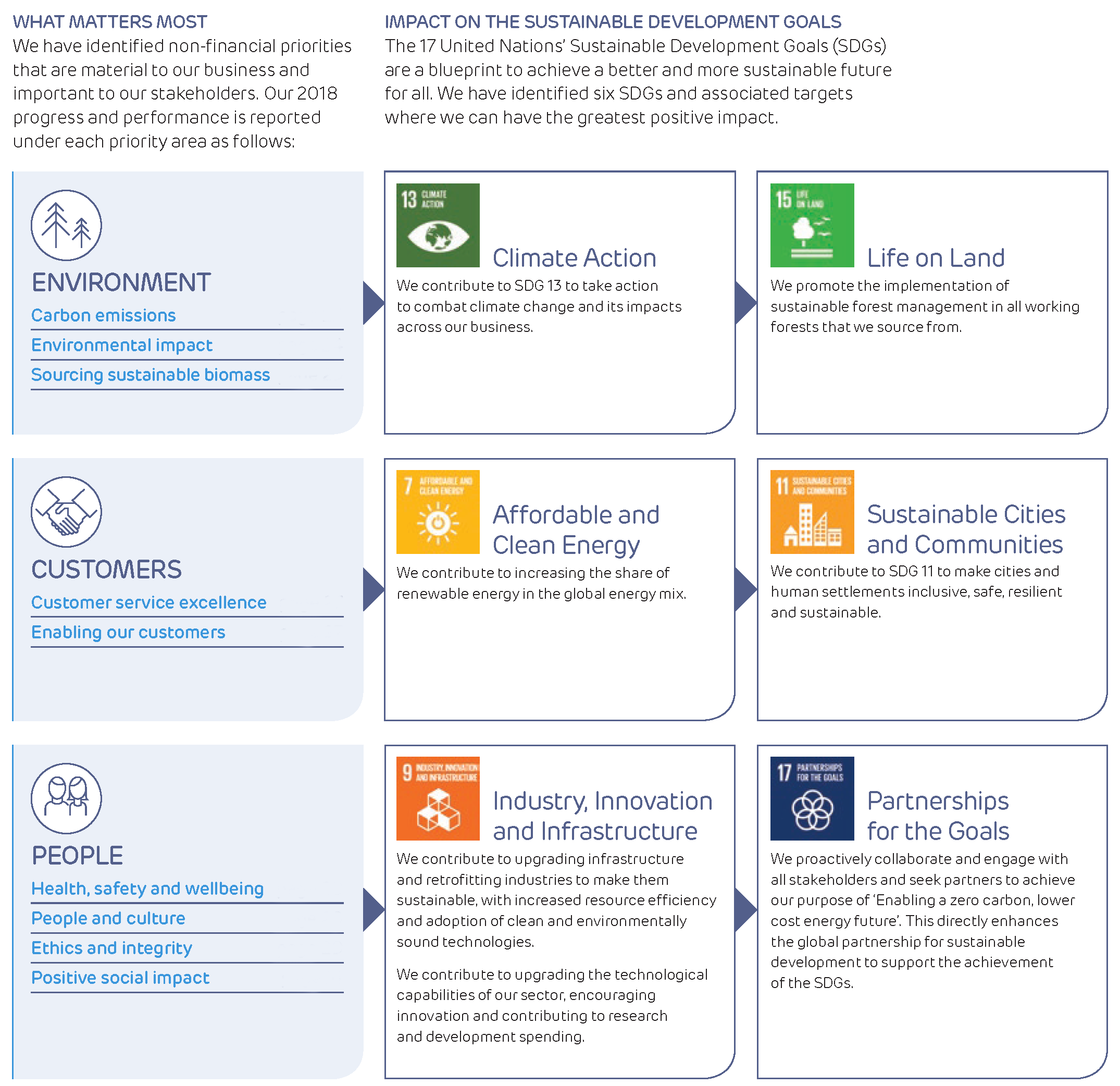

Sustainability

A key part of our approach to corporate governance is sustainability. This remains at the heart of the Group and part of its culture. It covers both biomass sustainability and, more broadly, long-term sustainability – achieving a positive economic, social and environmental impact and considering long, medium and short-term factors in our stewardship of the business.

We measure our performance as part of our Group Scorecard, which covers a range of matters that we see as crucial to the longevity of the Group. We therefore use the Scorecard as a key element of our Bonus and Long Term Incentive plans.

Our people

Opus Energy employees holding meeting in Northampton, 2019

Our people – employees and contractors – remain a key asset of the business and we are all focused on creating a diverse and inclusive working environment that is both safe and supportive. Employee safety is a long-held and central commitment of our operational philosophy. While the number of incidents we have experienced remains low, we need to remain vigilant and reduce the number of high potential incidents. We remain committed to the highest standards of safety and wellbeing across the Group.

I would also like to welcome colleagues from ScottishPower. We believe they will provide highly complementary expertise and a strong cultural fit, to create an expanded world-class engineering and operations capability.

My sincere thanks to all of my colleagues for their ongoing commitment, dedication and hard work.

In concluding, I would like to say that the Board remains totally committed to the complementary aims of delivering sustainable long-term value for the Group, supporting the communities in which we operate and enabling a zero carbon, lower cost energy future for the UK.

Philip Cox CBE

Chair

CHIEF EXECUTIVE’S REVIEW

“Progressing our strategy and supporting the UK’s transition to a low carbon economy.”

Will Gardiner, Group CEO, Drax Group

2018 HIGHLIGHTS

-

Acquisition of ScottishPower generation assets

-

Adjusted EBITDA growth

-

Group Scorecard performance ahead of target

-

Conversion of fourth biomass unit

-

Commissioning and full production at LaSalle Bioenergy

-

Completion of US bond issue

-

Share buy-back programme

-

Launch of Bioenergy Carbon Capture and Storage (BECCS) pilot

Strategy

Our purpose is ‘to enable a zero carbon, lower cost energy future’, and this is the basis of our strategy.

Over time we expect the UK’s power system to become increasingly dominated by intermittent wind and solar power. A smaller, but important, part of our power will need to be provided by other forms of low carbon generation that is available when wind and solar power are not available. Our strategy is to meet that need and support the UK power system.

Through addressing UK energy needs, and those of our customers, our strategy is designed to help us deliver long-term financial performance across the Group. In doing so we are reducing our historic exposure to commodity markets and delivering higher quality earnings with opportunities for growth.

Further growth will come from flexible operation of the Group’s expanded generation portfolio and the provision of system support services as well as growth in our Pellet Production and B2B Energy Supply businesses. As we integrate the ScottishPower assets in 2019 we will be reassessing our longer term financial targets.

The Group’s commitment to safety remains strong and, while the number of overall incidents was low, we did have a serious injury in one of our pellet plants in the US. During 2019 we will be strengthening our focus to reduce the number of high potential incidents.

Summary of 2018

We have made good progress with the delivery of our strategy during 2018 and delivered a Group Scorecard performance ahead of target.

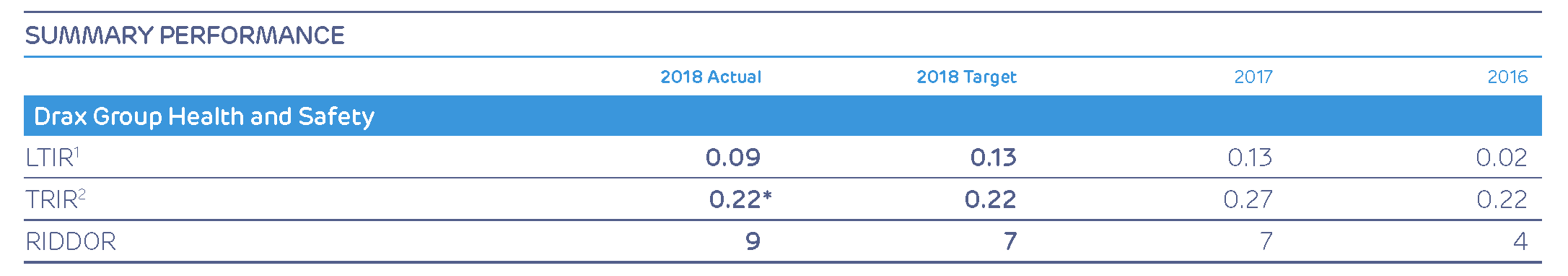

Total Recordable Injury Rate (TRIR), our primary safety measure, was 0.22. This reflects a strong performance in Power Generation but with a significant failing in Pellet Production. As always there is more we can do in our pursuit of zero incidents, and in 2019 we will be redoubling our efforts to improve our safety performance.

Adjusted EBITDA, a financial KPI, was £250 million, in line with our expectation and significantly ahead of 2017. In Power Generation the impact of unplanned biomass outages in early 2018 restricted renewable power output. However, a strong team effort, the flexible and responsive operation of our coal generating units and the conversion of a fourth unit to biomass helped to mitigate the impact. Pellet Production increased output and reduced cost per pellet, although challenges remain on pellet quality. B2B Energy Supply grew its market share and margin per meter, but faced a challenging market for customers and competitors.

In December 2018 we completed the acquisition of a portfolio of assets from ScottishPower for an initial net consideration of £687 million (based on total consideration of £702 million, less customary working capital adjustments). We expect the portfolio to provide high quality earnings and financial returns significantly ahead of the Group’s cost of capital. Integration of these assets will take place during 2019.

During the year we replaced floating debt with fixed rate bonds, reducing our overall cost of debt and extending the maturity profile to further strengthen our already strong balance sheet. Net debt to Adjusted EBITDA was 1.3x at the end of December 2018, ahead of the forecast contained in the Shareholder Circular, dated 5 December 2018, of around 1.5x for the full year. The acquisition consideration was paid on 2 January 2019.

Operational review

Our TRIR in Pellet Production was 0.63, a reduction on the previous year (2017: 0.83). We had five recordable safety incidents, three at our LaSalle plant and two at Amite. Morehouse completed the year with no incidents.

Our Pellet Production operations saw growth in Adjusted EBITDA and record levels of pellets produced, with output of 1,351kt, up 64% year-on-year. This reflects the successful commissioning of our third pellet plant, LaSalle, which has now achieved full production – ahead of plan – as well as consistent production at our Amite and Morehouse plants.

The focus of our activity is the US Gulf region – an area with strong commercial forestry, and good infrastructure and sustainability credentials. Recognising the importance of the region, we relocated our US administration from Atlanta, Georgia to Monroe, Louisiana, providing operational savings and supporting our focus on delivering good quality sustainable pellets at the lowest cost.

Pellet costs and pellet quality, which we measure based on the amount of fines (smaller particles of wood pellet material) in each cargo, are KPIs for the Group. High levels of fines lead to higher levels of dust, which can create health and safety risks through the supply chain. Year-on-year we have seen a significant improvement in pellet quality, although we did not achieve our target for 2018 and are focused on addressing this issue in 2019.

Increased volumes, operational improvements and a continuing focus on cost contributed to a year-on-year reduction in cost per tonne of 10%. This represents good progress, but there are more opportunities for cost reduction in order to achieve our goal of making biomass power generation viable without subsidy. We will do this by using a greater proportion of the very cheapest wood residues and expanding the use of sustainably sourced low-cost materials.

Early progress in this regard was the signing of a co-location agreement with Hunt Forest Products, a sawmill operator, which will see them build and operate a sawmill next to LaSalle. The agreement will enable a greater proportion of lower cost sawmill residues to be used, reducing transportation and the number of steps in the production process, thereby reducing the cost.

We have also built a new rail spur linking LaSalle to the regional rail network and our port facility at Baton Rouge. This will increase transportation efficiency, provide economies of scale and reduce both cost and carbon footprint.

We continue to evaluate opportunities for the acquisition of pellet capacity as well as the expansion of our existing sites.

In Power Generation, the unplanned biomass unit outages in early 2018 resulted in reduced generation. Biomass availability is a KPI for the Group. Since returning to service the units have performed well, with high availability during the remainder of the year. In 2018 the availability of our biomass units was 91%, ahead of target.

Notwithstanding outages our biomass units produced 12% of the UK’s renewable power – enough to power four million homes. This level of renewable generation, combined with the flexibility of our expanding portfolio, allows the Group to support the continued deployment of intermittent renewables and the UK’s ambitious targets for decarbonisation.

The protection of both our people and our assets is a top priority. The fire we experienced in December 2017 demonstrates the combustible nature of biomass and the need for strong controls and processes. Throughout the year we commenced installation of suppression equipment throughout our biomass handling plant. These complement our existing processes and respond to the detection of ingition events in milliseconds.

In August 2018 we completed the conversion of a fourth generating unit from coal to biomass. This allows us to produce a greater amount of renewable power at times of high demand, which are typically periods of higher carbon intensity. In this way we plan to deliver more renewable power, while providing system support at minimum cost to the consumer. The operational experience to date has been encouraging.

Energy and Clean Growth Minister Claire Perry visited the Drax Power Station BECCS pilot project in November 2018. Click to view/download.

In May 2018 we commenced a low-cost pilot project looking at the potential for Bioenergy Carbon Capture and Storage (BECCS). While at an early stage, the scheme is capturing carbon and offers the potential for biomass to deliver carbon negative generation, which will be required if the UK is to achieve its decarbonisation targets, further supporting the case for biomass generation in the long-term.

Stronger power prices in 2018, reflecting colder weather and higher underlying global commodity prices, led to an increase in the level of coal generation in the latter half of the year. However, the market for coal generation was challenging and our two remaining units increasingly focus on short-term power market opportunities, rather than baseload power generation.

In 2018 Value from Flexibility (a Scorecard measure of the value from flexible power generation, support services provided to the power network and attractively priced coal fuels) was £79 million, in line with plan. Given the structural shift in UK generation towards intermittent renewables we expect greater power price volatility, a growing need for system support services and increasing value from flexibility.

A combined cycle gas turbine

Our heritage is coal but our business is now flexible, low carbon and renewable power. We believe gas generation is consistent with supporting the transition of the energy system. To that end we are making progress with the development of options for four 299MW Open Cycle Gas Turbine (OCGT) plants and up to 3.6GW of coal-to-gas repowering at Drax Power Station. These projects would require support through the Capacity Market (once re-established) and if successful in a future auction could result in 15-year index-linked capacity agreements, providing a clear investment signal and extending visibility of our contract-based earnings through the late 2030s.

As part of the acquisition of the ScottishPower generation assets, the Group also acquired a permitted option for the development of a 1.8GW Combined Cycle Gas Turbine at Damhead Creek, Kent.

In B2B Energy Supply, we increased our market share by 1%(1). This was a creditable performance in what is a competitive market, although below target.

The quality of business (a measure of the margin from power sales) was below our target, reflecting exceptionally cold winter weather, the costs associated with competitor failure, and a challenging market for customers resulting in increased bad debt expense and provisioning. In the context of the wider market this reflects a good performance.

Integration of Opus Energy is progressing and we have now consolidated our Northampton operations into a single site, which we expect to deliver additional operational efficiencies and cost savings.

We are making progress in reducing our cost to serve against target, which will be an important source of competitive advantage in the future. We are currently progressing the implementation of a new technology platform which will provide further opportunities for efficient operations. Technology has a key role in shaping the market and our business and we remain alert to opportunities this may present.

Digital offerings are a growing feature of the market. We believe our investment in this area will provide commercial opportunities, a reduced cost to service and an enhanced customer experience. It will also provide scalable data analytics and build on the roll-out of smart meters to deliver tailored customer propositions.

The business has a strong renewable proposition, with 69% of power sales renewable in 2018, a level which we expect to increase. Opus Energy also provides a route to market for more than 2,000 small embedded renewable generation sites.

(1) Based on the year-on-year change to the number of SME customer meters on supply

Adjusted EBITDA

£250m

(2017: £229m)

Total operating profit

£60m

(2017: (£138m))

B2B Energy Supply customer meters

396k

(2017: 376k)

Total Recordable Injury Rate

0.22

(2017: 0.27)

Politics, regulation and policy

Brexit remains a key issue for the UK. To date the impact on the Group has been limited, with the principal risk being a weakening of sterling and the cost of biomass which is generally denominated in other currencies. Through our use of medium-term foreign exchange hedges the Group has protected its position out to 2022 at rates close to those that we saw before the Brexit referendum vote.

Most of our wood pellets are imported from North America and Europe. The potential for delays at ports is a challenge, but with access to facilities at four UK ports and associated freight links, in addition to storage throughout our supply chain, we have a good degree of resilience should delays occur.

In the event of a ‘hard’ Brexit, the UK has indicated that it will leave the European Energy Union and EU Emissions Trading Scheme. This mechanism is an important part of the UK’s total carbon price (the combined UK Carbon Price Support (CPS) and the European Union Emissions Trading Scheme – (EU ETS). The Government has confirmed that were this to happen the UK would increase the carbon tax to £34/tonne, compensating for the loss of the EU ETS until 2021. CPS has been the single most effective instrument in reducing the level of carbon emissions in power generation and Drax continues to support an effective carbon price signal for investment in low carbon technology.

Capacity market

In November 2018 the Court of Justice of the European Union declared that the process used by the European Commission to approve the UK Capacity Mechanism was not valid. Following this decision the UK Government suspended capacity payments whilst the European Commission conducted a formal investigation. The European Commission is also challenging the Court’s ruling.

The suspension of the Capacity Market impacted Group Adjusted EBITDA during 2018. In Generation we continued to meet our obligation and provide capacity but did not receive or accrue the revenue expected from this activity during the final three months of the year. In B2B Energy Supply we provided for all costs associated with the Capacity Market in 2018. Our approach was based on continuing to include charges in customer bills, with cash collected from those customers during the period. The cash will be paid to Elexon, as the collection agent, and held in escrow pending the re-establishment of the capacity market for generators, at a date yet to be determined during 2019. The net impact across the Group in 2018 was a £7 million loss to Adjusted EBITDA.

The Group assumes £68 million of capacity payment revenues in 2019. Of this, up to £47 million is derived from the ScottishPower assets. As part of the acquisition of these assets we agreed a compensation mechanism with Iberdrola. In the event that capacity payments are not received in respect of these assets in 2019, the mechanism provides, subject to gross margin thresholds, up to £26 million of payments to Drax. The agreement also allows for payments of up to £26 million to Iberdrola by Drax, subject to significantly higher than expected gross margin. These payments, if made, would not form part of Adjusted EBITDA for 2019.

We believe that the Capacity Market is an important cornerstone energy policy, a cost-effective safeguard for security of supply and necessary to underpin the development of new generation projects, including our own gas projects. Our view that the Capacity Market will be re-established on the same or similar terms is consistent with the position expressed by the UK Government. We expect the issue to be resolved during 2019 and we reflect this in our expectations for the year.

Safety, sustainability and governance

The health, safety and wellbeing of our employees and contractors is vital to the success of the Group and remains our priority. We believe that a safe and sustainable business model is critical to the delivery of our strategy and crucial for long-term performance.

We have continued to maintain our rigorous and robust approach to biomass sustainability, ensuring the wood pellets we use are fully compliant with the UK’s mandatory sustainability standards. The biomass we use to generate renewable power provides an 86% carbon emissions saving against coal, inclusive of supply chain emissions. Our biomass life cycle carbon emissions are 131kgCO2-eq/MWh of electricity, less than half the UK Government’s 285 kgCO2-eq/MWh limit.

The sustainability credentials of biomass have been further reinforced by the EU’s Renewable Energy Directive which was agreed by both the European Parliament and Council in June. This includes biomass sustainability criteria which should reinforce the credentials of sustainable biomass. During the year we also became participants of the CDP, a global disclosure system to measure and manage environmental impacts. We reported our performance for the climate and forest programmes.

During 2018, we published our second statement on the prevention of slavery and human trafficking in compliance with the UK Modern Slavery Act (2015) and have joined the UN Global Compact (UNGC). We are committed to promoting the UNGC principles on respect for human rights, labour rights, the environment and anti-corruption.

People and communities

Our people are critical to the success of the business. Through 2018 we have continued the implementation of our people strategy focused on driving performance and developing and retaining talent to deliver the Group’s objectives. We have established Group-wide practices, including a behaviour framework focused on performance and personal development, and a Group-wide approach to recognising and retaining talent.

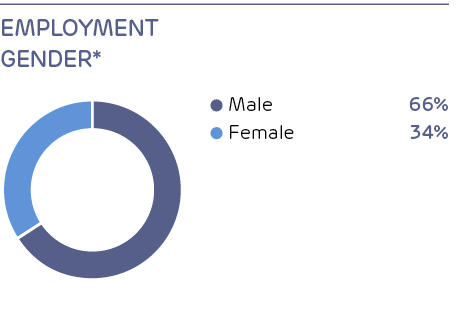

We are committed to having a diverse and inclusive workforce, where every employee has the opportunity to realise their potential. As part of this we aim to have, by the end of 2020, 40% of senior leadership roles held by women.

In March 2018 we published our first gender pay gap data. While the data showed that our businesses were in line with the energy sector overall, it highlighted that we still have work to do.

We continue to make an important contribution to the UK economy and to the local communities in which we operate. According to a study published by Oxford Economics in 2018, Drax’s total economic impact – including our supply chain and the wages our employees and suppliers’ employees spend in the wider consumer economy – was £1.6 billion, supporting 17,500 jobs across the UK in 2017.

Outlook

Our focus remains on the delivery of our strategy and long-term earnings growth, underpinned by safety, sustainability, operational excellence and expertise in our markets.

In Pellet Production we remain focused on the production of good quality pellets at the lowest cost, cross-supply chain optimisation and identifying low-cost options to increase self-supply.

In Power Generation, 2019 will see the integration of the ScottishPower assets into our generation business and opportunities to operate as a coordinated portfolio of flexible, low-carbon and renewable generation.

We believe that biomass has an important role to play in the UK power market. We also believe that existing and new gas generation has an important role to play in supporting the transition to a zero carbon, lower cost, energy future and we continue to develop our projects in that area.

In B2B Energy Supply, we are investing in digital infrastructure which we believe will enable us to continue to grow, offer market leading propositions and develop our presence in the market for flexible demand management and other value-added services.

We have made good progress with the delivery of our strategy and will continue to build on this as we progress our targets, while playing an important role in our markets and enabling a zero carbon, lower cost energy future for the UK.

Will Gardiner

Group CEO

Chapter 3:

Business model & market context

BUSINESS MODEL

Flexible, low carbon and renewable power, enabling a zero carbon, lower cost energy future.

(1) Adjusted EBITDA is defined as earnings before interest, tax, depreciation, amortisation, excluding the impact of exceptional items and certain remeasurements.

(2) Net debt is defined as borrowings less cash and cash equivalents. Net debt does not include the £687 million which was paid on 2nd January 2019 for the acquisition of the generation business from ScottishPower.

(3) Group Scorecard shows growth in market share of 0.8%.

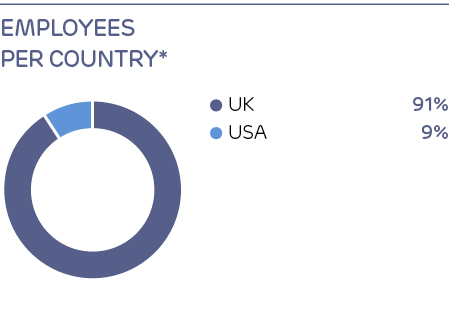

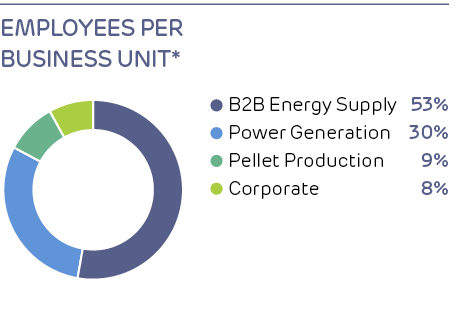

* For further details please see page 92 of the full PDF report.

MARKET CONTEXT

Delivering tomorrow’s sustainable energy

Drax operates in a dynamic, rapidly changing market.

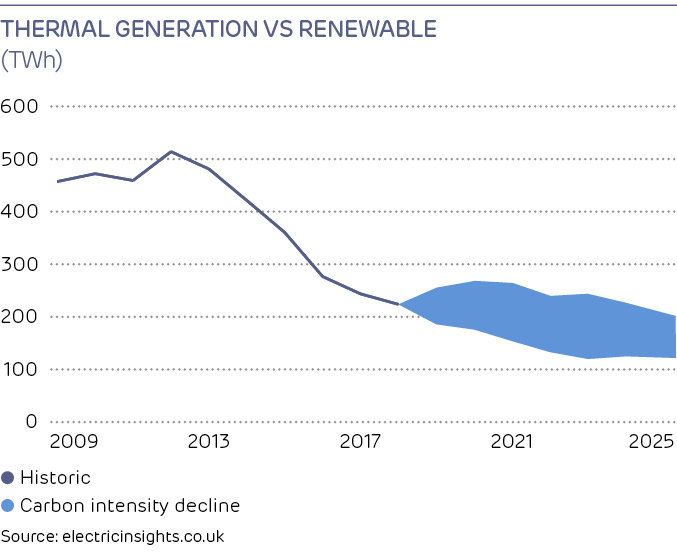

2018 saw the 10th Anniversary of the Climate Change Act (the ‘Act’) which has transformed the UK energy market and has demonstrated that market instruments can drive a cost-effective transition of the energy sector in line with climate goals. Since the Act became law the UK has seen its grid carbon content fall by more than 250g CO2/kWh and coal generation has fallen by over 75%.

Despite this progress there is more to do. Decarbonisation of power generation, transport and heat remains a key driver of change across the energy sector. The UK’s ambitious targets to reduce carbon emissions by 80% of 1990 levels means our power sector will almost certainly have to be net zero carbon by 2060.

Decarbonisation at this scale, across all sectors, is likely to require an absolute increase in the amount of electricity produced and consumed due to the electrification of heating and transport. A report from the Energy Transitions Commission (November 2018) estimates that electricity’s contribution to global energy supply must rise from 20% to 60% by 2060. The European Commission’s long-term strategy is only slightly less bullish when it concludes electricity will need to meet 50% of primary energy demand.

The International Panel on Climate Change concluded that as much as 85% of this energy could come from renewable energy – mainly wind and solar. Due to their intermittent nature this scale will only be achieved if the remaining 15% comes from sources which complement wind and solar, balancing the system and providing the increasingly valuable support services that a well-functioning energy system requires.

The challenges and opportunities presented by climate change are significant but they are not the only trends affecting the energy sector. Others include a need for more power generation, as the transport and heat sectors embrace new technologies, a need to manage more volatile sources of power, widely distributed sources of generation and customers who increasingly want more control over the way they use or generate their own energy. We explore Drax’s response to these trends in more detail below.

1 Drive to reduce carbon emissions

The UK Government aims to end unabated coal generation by 2025. Coal produced 5% of UK power in 2018 compared to 39% in 2012.

> OUR RESPONSE

We have reduced our coal generation facilities over the last five years, converting four of Drax Power Station’s six generation units to use sustainable biomass. In 2018 we generated 13.8 TWh of renewable power, which represents 12% of the UK’s total renewable power supply and means Drax is the largest renewable generator in the UK. We also launched a Bioenergy Carbon Capture and Storage (BECCS) pilot project.

2 Evolving mix of generation

The use of intermittent renewables, such as wind and solar, is increasing and flexible, thermal generation, such as coal, is declining. This places additional pressure to balance the energy system.

> OUR RESPONSE

Drax’s portfolio of flexible generation (biomass, hydro and gas) provide these increasingly important services and bring more development opportunities.

As much as

85%

of the energy of the future could come from renewable sources

3 Need to safeguard the UK’s security of supply

More distributed generation and the increase in intermittent renewables are driving increased levels of volatility in short-term prices and a need for assets to provide system support services. There is an increasing need for flexible sources of power which can provide services such as response, reserve, reactive power, black start and inertia.

At peak times UK power supply has been getting close to the total available generation capacity. Increasing intermittent renewable generation has resulted in higher levels of volatility in short-term prices and a need for flexible generation.

> OUR RESPONSE

Drax is becoming a truly national power generator with generation assets distributed across Scotland, Northern England and the South East, and options to develop generation assets in Wales and the East of England. The Group’s total generation capacity now stands at 6.5 GW and we have options to develop a further 6.6GW. As well as adding capacity this increases our ability to provide the system services the grid relies upon.

4 Increasing market convergence and changing customer behaviour

As the energy market evolves, our business- to-business customers increasingly seek to create value from their portfolios through the installation of their own generation capabilities, the provision of demand side response and energy trading.

> OUR RESPONSE

Smart meter technology presents an opportunity to offer behind-the-meter services and the aggregation of information and capacity to customers large and small. This means Drax can open up power and flexibility markets to more customers. With flexible, renewable, low-carbon generation and trading expertise, Drax is strongly placed in this market to create shared value for customers and the Group.

5 A need for affordable, sustainable power

The business-to-business energy market is highly competitive and customers are demanding access to both low cost and renewable power.

> OUR RESPONSE

Drax now supplies more of its business-to-business customers with 100% renewable power, at no premium, than any of our competitors. Our investment in digital technologies is providing new opportunities, a reduced cost to serve and an enhanced customer experience.

Chapter 4:

Acquisition of ScottishPower Generation assets

Acquisition of 2.6GW of flexible, low-carbon and renewable UK power generation

In December Drax completed the acquisition of ScottishPower’s portfolio of pumped storage, hydro and gas-fired generation assets for an initial net consideration of £687m – flexible, renewable and low carbon generation closely aligned to Drax’s generation model.

Expected Adjusted EBITDA of

£90m–£110m

in 2019

252

operational roles transferred

to Drax as part of the acquisition,

complementing and reinforcing

Drax’s existing engineering

and operational capabilities.

Highlights

- A unique portfolio of pumped storage, hydro and gas-fired generation assets

- Compelling strategic rationale

- Growing system support opportunity for the UK energy system

- Significant expansion of Drax’s generation model

- Diversified generation capacity – multi‑site, multi-technology

- Opportunities in trading and operations

Strong financial investment case

- High quality earnings

- Expected returns from the acquisition significantly ahead of the stand-alone Drax Group’s Weighted Average Cost of Capital

- Expected Adjusted EBITDA of £90 million–£110 million in 2019, subject to reinstatement of the Capacity Market*

- Group net debt/Adjusted EBITDA expected to be around 2x by the end of 2019, subject to the Capacity Market

- Supportive of credit rating and reduced risk profile for Drax

- Strengthens ability to pay a growing and sustainable dividend

* Expected 2019 Adjusted EBITDA is stated before any allocation of Group overheads (as these will be an allocation of the existing Drax Group cost base which is not expected to increase as a result of the acquisition).

Chapter 5:

Performance reviews

PERFORMANCE REVIEW:

PERFORMANCE REVIEW:

PELLET PRODUCTION

Increased production

and Adjusted EBITDA growth

Our pellets provide a sustainable, low-carbon fuel source – one that can be safely and efficiently delivered through our global supply chain and used by Drax’s Power Generation business to make flexible renewable electricity for the UK. Our manufacturing operations also promote forest health by incentivising local landowners to actively manage and reinvest in their forests.

Increasing supply chain transparency and fostering stakeholder engagement

We launched ForestScope.info, an interactive digital tool that tracks Drax’s global supply chains in order to showcase the location and types of fibre we source, as well as key growth and inventory trends in the areas from which we source.

Its depth of information, and accessibility for non-experts, makes it an important tool for informing and engaging the range of stakeholders with an interest in Drax’s biomass sustainability and sourcing practices.

ForestScope was launched at two stakeholder engagement briefings in June and July 2018. The London and Brussels events led to important discussions with organisations such as WWF, Client Earth and the Natural Resources Defence Council (NRDC).

We invite feedback from stakeholders to improve ForestScope and the sustainability of our operations.

Find out more: ForestScope.info

Sales of pellets in the year ending 31 December 2018 totalled £214 million, an increase of

57%

over 2017

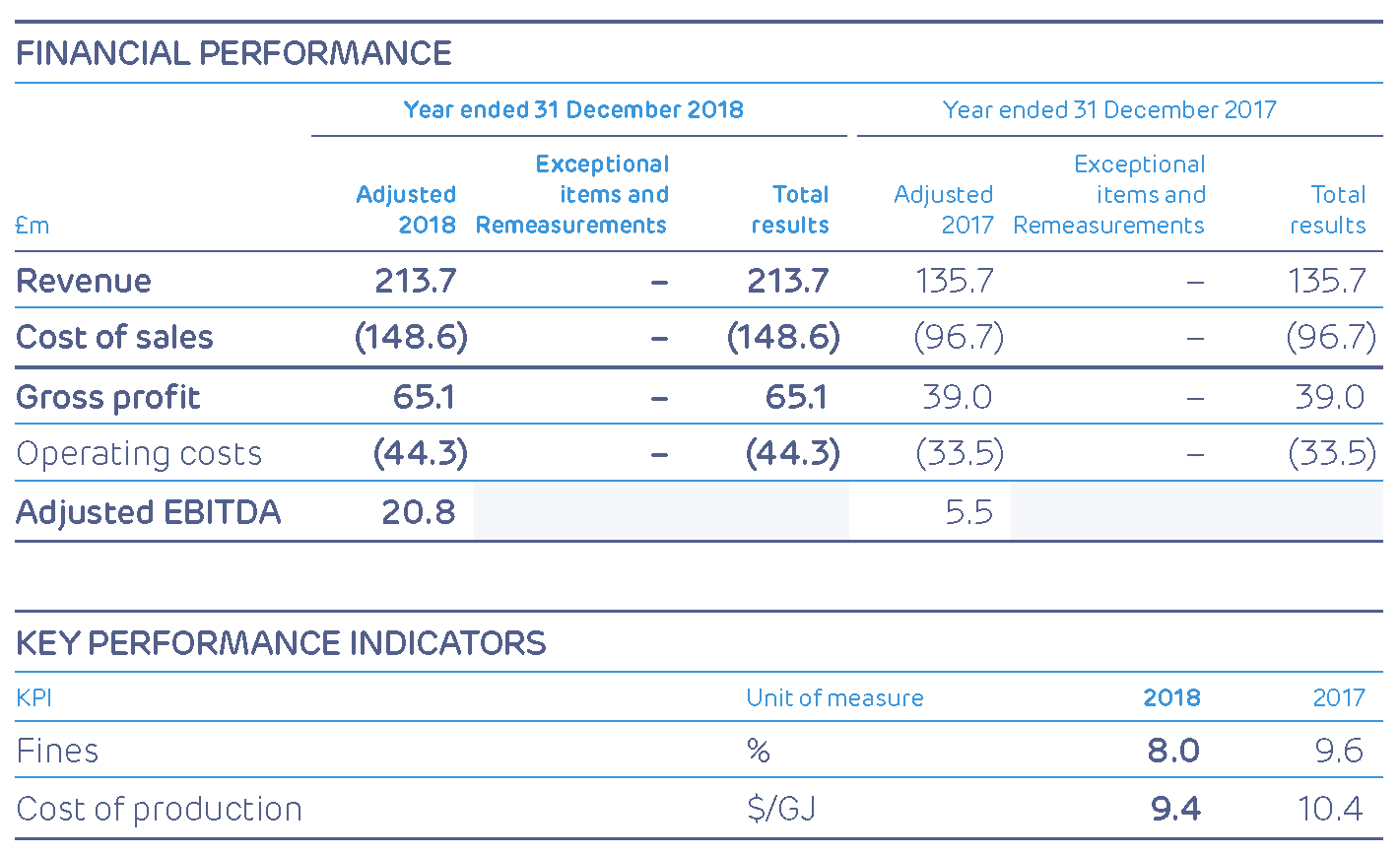

Financial performance and KPIs

Adjusted EBITDA of £21 million grew significantly compared to 2017 (£6 million), driven by increasing volumes of pellets produced and sold to the Power Generation business (on an arms-length basis) and lower production costs per tonne. This reflects operational efficiencies and greater utilisation of lower value forestry materials such as sawmill residues. Revenue in the year ended 31 December 2018 totalled £214 million, an increase of over 50% versus 2017.

Raw fibre procurement, transportation and processing comprised the majority of cost of sales and as such this remains an important area of focus

and an opportunity for the business. Through incremental investment in plant enhancements we expect to see further benefits from efficiencies and greater utilisation of lower cost residues.

Operating costs vary with throughput and increased in 2018, reflecting increased pellet production levels and throughput at the Port of Baton Rouge.

KPIs reflect a good performance on reducing the cost of production, which was ahead of target offset by the level of fines being significantly below target. Good quality pellets at the lowest cost is a key focus for the business and we will continue to work to improve quality and reduce cost during 2019.

CASE STUDY

Hunt Forest Products

The wood products industry produces large quantities of residual materials. Drax is making use of this and forming part of a virtuous cycle that benefits the forestry sector, rural communities and the environment.

With the world growing increasingly digital, the markets for residuals for pulp have been in decline. But with the growth of markets for biomass, in the form of sustainable wood pellets – which can utilize the same residuals for production of pellets and other parts of the process – there remains a sustained demand and market for this material.

As this alternative market continues to grow, so will demand. Finding ways in which this market can be made more efficient now could lead to benefits in the long term.

A collaboration between Drax and Louisiana-based Hunt Forest Products is helping to do precisely this through investment in a co-location site in Urania, LA, which will see a sawmill and pellet facility sitting side by side.

This innovative co-operation will help cut costs at our LaSalle plant, save time, reduce transportation emissions, and deliver further efficiencies.

Find out more: www.drax.com/uk/sawmill

PERFORMANCE REVIEW:

PERFORMANCE REVIEW:

POWER GENERATION

Flexible, low carbon and renewable generation

Long-term earnings stability and opportunities to optimise returns from the transition to a low carbon economy.

Drax Power Station remains the largest power station in the UK. Between Q4 2017 and Q3 2018 the station met 5% of the UK’s electricity needs, whilst providing 12% of its renewable electricity, alongside important system support services.

With an increase in intermittent renewables and a reduction in the thermal generation provided by coal, the energy system of the future will require solutions which are flexible and able to respond quickly to changes in system demand. These long-term needs inform our generation model and options for future growth.

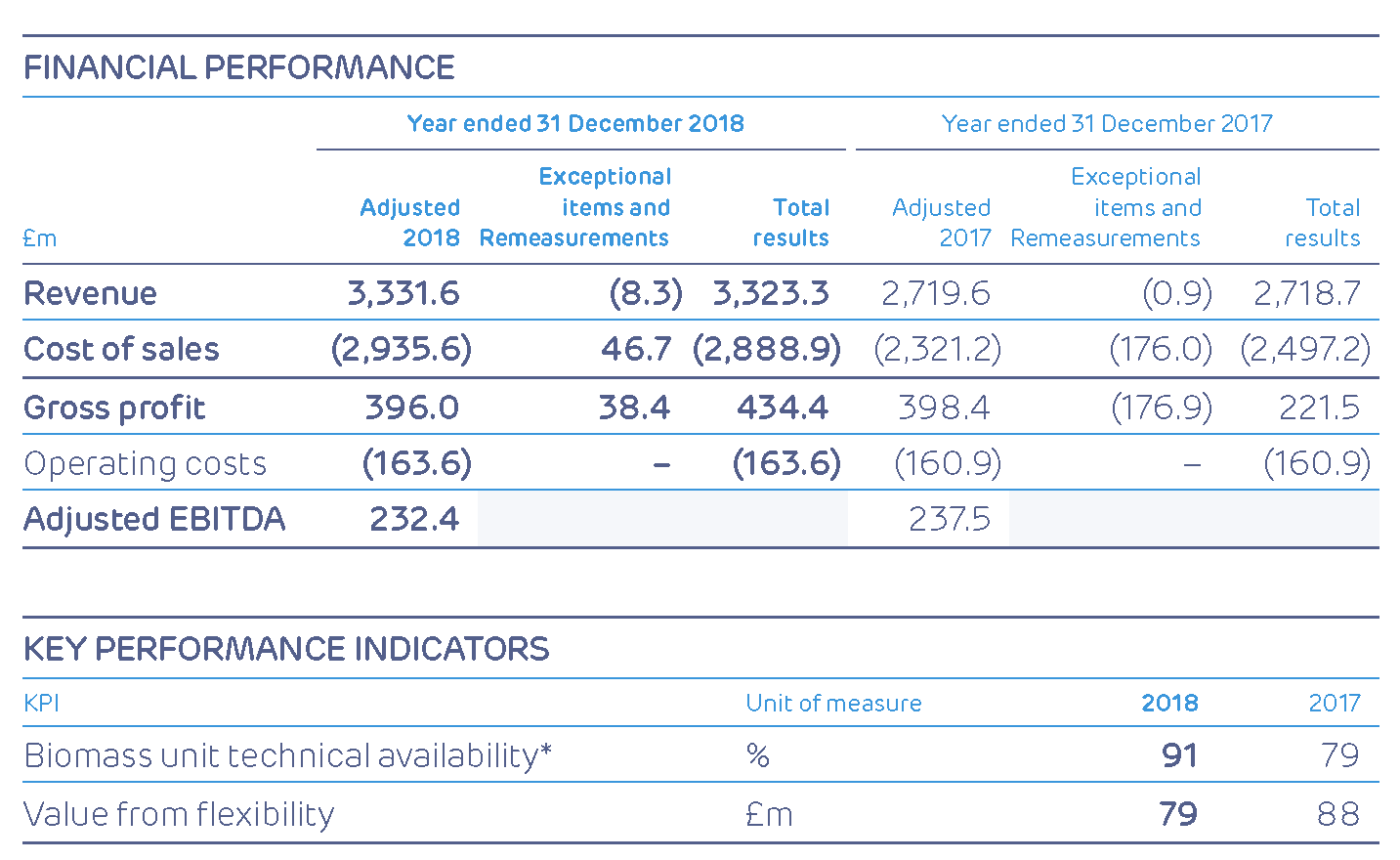

Financial performance and KPIs

Adjusted EBITDA of £232 million was a reduction of £5 million compared to 2017, principally reflecting the impact of forced outages in January and February 2018.

Contracts for Difference (CfD) generation contributed to a £73 million increase in revenue from 2017, following a full year of output. This was offset by lower margins from coal generation and lost capacity payments.

Biomass remains the single largest cost for the Group. We remain focused on opportunities for long-term cost reduction through efficiencies in operations, optimisation of our supply chain and expansion of the fuel envelope to include lower cost sustainably sourced material.

Operating costs included works associated with unplanned outages. These were offset by a deferral of a major planned outage on Unit 4 until summer 2019, and by the implementation of lean management programmes to improve business performance.

Remeasurements reflect gains and losses on derivative contracts.

KPIs were ahead of Scorecard targets, reflecting good biomass availability beyond the forced outages at the beginning of 2018, and value from flexibility – a measure of flexible generation, system support services and attractively priced coal fuels.

Value from flexibility reduced £9 million year-on-year, reflecting a specific ancillary services contract in 2016-2017 which did not extend into 2018.

* Excludes Unit 4

Not all MWs are equal, the energy market requires more than just low-carbon electricity

Historically non-generation system support services have been provided by baseload thermal generation – coal and gas. As these assets withdraw from the market, and at the same time the level of intermittent generation increases, Drax is well positioned to meet these system needs and provide increasingly important and valuable services to the UK energy system.

Biomass, pumped storage, hydro and gas are all strategically aligned with these needs and enable Drax to offer a full suite of services to the grid:

- Renewable and low carbon electricity

- Flexible dispatchable generation

- Reserve

- Headroom and footroom

- Inertia

- Voltage control

- Reactive Power

- Black start

- Frequency Response

Find out more: www.drax.com/uk/systemservices

PERFORMANCE REVIEW:

PERFORMANCE REVIEW:

B2B ENERGY SUPPLY

Increased market share but a challenging market for customers

Our B2B Energy Supply business – comprised of Opus Energy and Haven Power – is the fifth largest B2B power supplier in the UK and the largest provider of renewable energy to businesses. We provide a route to market for our flexible, renewable and low-carbon energy proposition. As the energy market transforms, we are working closely with our customers, offering them services to help them adapt to a world of flexible low-carbon and decentralised energy.

The largest supplier of renewable electricity to business in the UK

Opus Energy and Haven Power, Drax Group’s B2B Energy Supply businesses, provided over 350,000 UK business sites with renewable electricity, making them the largest supplier of renewable electricity to UK business for the Ofgem compliance period ending in 2018.

Power suppliers have a responsibility to encourage and support businesses to be more sustainable and enable the UK to achieve the clean growth needed to meet our climate targets.

59% of businesses think renewable energy is key to a cleaner future, but 80% expect suppliers to take the lead in educating them about their renewable energy options.

Find out more: www.drax.com/uk/renewable100

CASE STUDY

Value of Flexibility and Demand Management

Flexibility in the form of demand management has an important role to play in an increasingly decentralised and low-carbon energy market. We are working with large customers to create value from their portfolios through the provision of demand-side response services and access to energy trading markets.

In time, enabled by the deployment of smart meter technology, we also see an opportunity to offer behind-the-meter services and the aggregation of information and capacity to smaller customers, opening the market for flexibility to more customers.

With flexible, low carbon and renewable generation and trading expertise, Drax is strongly placed in this market to create shared value for customers and the Group.

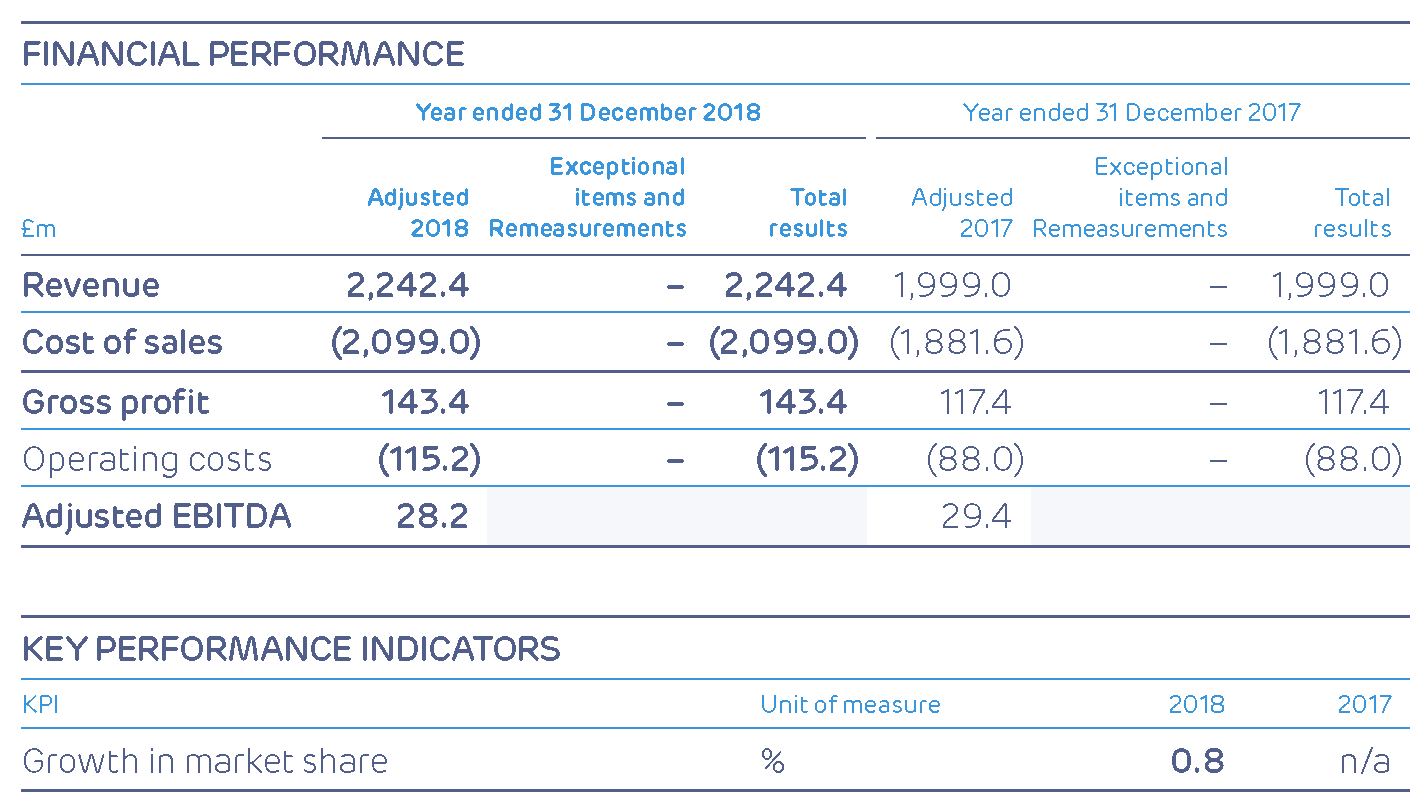

Financial performance and KPIs

Adjusted EBITDA of £28 million was a decline of £1 million from 2017 (£29 million).

Revenue increased 12% during the year, reflecting the inclusion of Opus Energy (acquired in February 2017) for a full-year, and a 0.8% increase in market share.

During the final three months of the year, when the Capacity Market was suspended, we continued to include Capacity Market charges in customer bills, and to accrue the associated payments which will be transferred to Elexon during 2019.

Cost of Sales, which includes power purchases and grid charges, also increased 12%. The increased cost of meeting our Renewable Obligation (RO) during the year reflects the impact of RO mutualisation, caused by the failure of several market participants which resulted in a larger proportion of the industry’s RO costs being shared by the remaining suppliers. In addition, gas costs were higher than expected following the “beast from the east” weather front during the first quarter. Gross profit of £143 million grew 22% compared to 2017.

Within operating costs, bad debt expense grew by £13 million in the year, to £31 million, reflective of challenging market conditions. Our investment in next generation systems and strong focus on continual process improvement are key elements in managing bad debt exposure and enabling operating efficiencies in future years.

In the context of the wider market this reflects a good performance.

Chapter 6:

Sustainable business & stakeholder

BUILDING A SUSTAINABLE BUSINESS

At Drax, being a sustainable business means achieving a positive economic, social and environmental impact as part of the Group’s strategy.

Governance

The Board has ultimate responsibility for the Group’s economic, social and environmental performance. Additional information on our approach to sustainability is available at www.drax.com/uk/sustainability.

ENVIRONMENT

Carbon Emissions

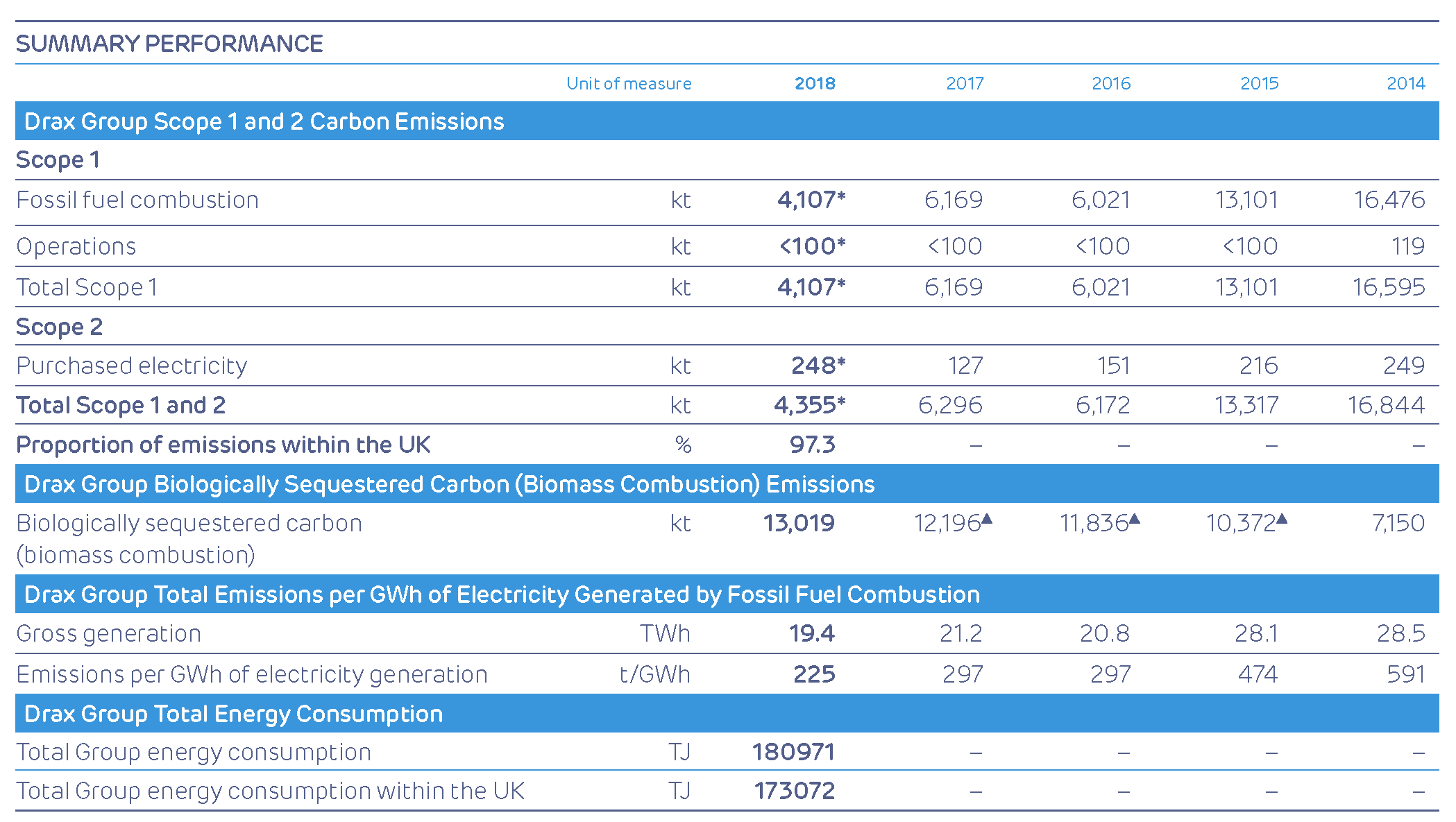

Drax Group’s total Scope 1 carbon emissions decreased by 33.4% between 2017 and 2018. This reflects a reduced use of coal and the conversion of a fourth generation unit at Drax Power Station to use sustainable biomass as fuel.

Our Scope 2 carbon emissions increased, due to Pellet Production moving into our reporting scope. Pellet Production saw a record output as our third pellet plant, LaSalle in Louisiana, achieved full production in 2018.

We have reported our global and UK Total Energy Consumption for 2018, in advance of the Streamlined Energy and Carbon Reporting (SECR) requirements effective from April 2019.

* Limited external assurance using the assurance standard ISAE 3000 for 2018 data as indicated. For assurance statement and basis of reporting see www.drax.com/uk/sustainability

▲ 2017, 2016 and 2015 data has been restated to reflect an update to the emissions factor applied to combustion data for Drax Biomass sites

Notes

We calculate and report our carbon emissions in accordance with the Companies Act 2006 and the European Union Emissions Trading System (EU ETS). We are required to disclose emissions from biologically sequestered carbon, which includes emissions released through the combustion of biomass to generate electricity. The biogenic CO2 emissions resulting from power generation are counted as zero in official reporting to both UK authorities and under the EU ETS as the use of sustainable biomass is considered to be CO2 neutral at the point of combustion. This methodology originates from the United Nations Framework Convention on Climate Change. The majority of our emissions result from the process of using solid fuel. This can make it difficult to identify other smaller trends that are still significant. To counteract this dominance and to ensure we retain a balance between highlighting significant developments and providing meaningful data, we have adopted a materiality threshold of 100,000 tonnes of CO2e.

Innovating to decarbonise our business

Drax is playing its part to enable a zero carbon future. We completed the conversion of our fourth biomass generating unit, which became operational in August 2018. We continue our work to replace our two remaining coal generating units with Combined Cycle Gas Turbines (CCGTs).

In May 2018 we started Europe’s first Bioenergy Carbon Capture and Storage (BECCS) pilot project at Drax Power Station. The pilot will capture up to a tonne of CO2 a day from the gases produced when renewable power is generated using biomass.

Advocating for carbon pricing

In 2018 we continued our engagement with Government and stakeholders to advocate for a robust carbon price. We signed a joint European carbon pricing declaration with global companies calling for more action to support a strong and predictable carbon price.

Zero carbon energy supply

Our B2B Energy Supply businesses are committed to sourcing the renewable power that our customers want. We provided over 350,000 UK business premises with 100% renewable electricity, making our B2B Energy Supply business the largest renewable electricity supplier to UK business for the Ofgem compliance period ending in 2018.

Additional information on our B2B Energy Supply fuel mix disclosures is available at

“At Drax we want to enable a zero carbon, lower cost energy future – to do that we have to test the technologies that could allow us, as well as the UK and the world, to deliver negative emissions and start to reduce the amount of carbon dioxide in the atmosphere.”

Will Gardiner, Group CEO, Drax Group

Environmental Impact

We are committed to managing, monitoring and reducing the environmental impact of our operations and the Group environment policy outlines our approach.

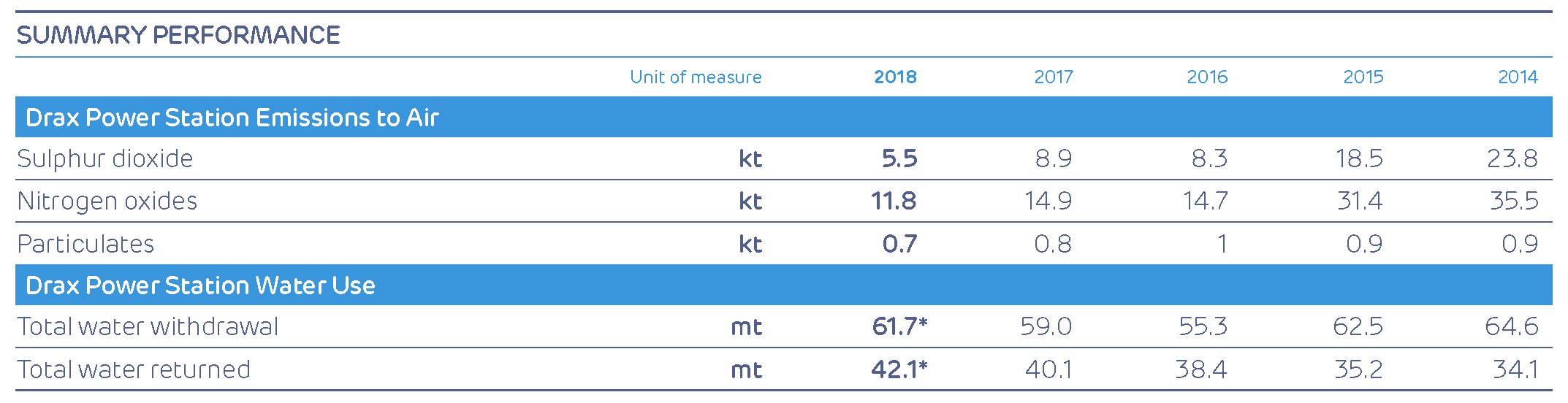

Our Environmental Management System (EMS) covering Drax Power Station is certified to ISO 14001. There were no major or minor breaches to our environmental permits at Drax Power Station in 2018. Emissions of sulphur dioxide and nitrogen oxides have reduced significantly over the last ten years, with the reductions continuing in 2018. This can be partly attributed to our reduced coal generation, as we completed the conversion of a fourth generating unit to burn biomass. Our particulate emissions also fell in 2018, with our emissions continuing to be well within our environmental permit limits.

Independent testing conducted on our behalf found emissions to air at Morehouse pellet plant exceeded permitted levels. We referred ourselves to the relevant authorities and we are working to ensure compliance.

Additional information on management of our environmental impact is available at www.drax.com/uk/sustainability

* Limited external assurance using the assurance standard ISAE 3000 for 2018 data as indicated. For assurance statement and basis of reporting see www.drax.com/uk/sustainability

Notes. Total water withdrawal is the sum of all water drawn into the boundaries of the organisation from all sources for any use over the course of the reporting period. This includes the River Ouse, borehole and mains water.

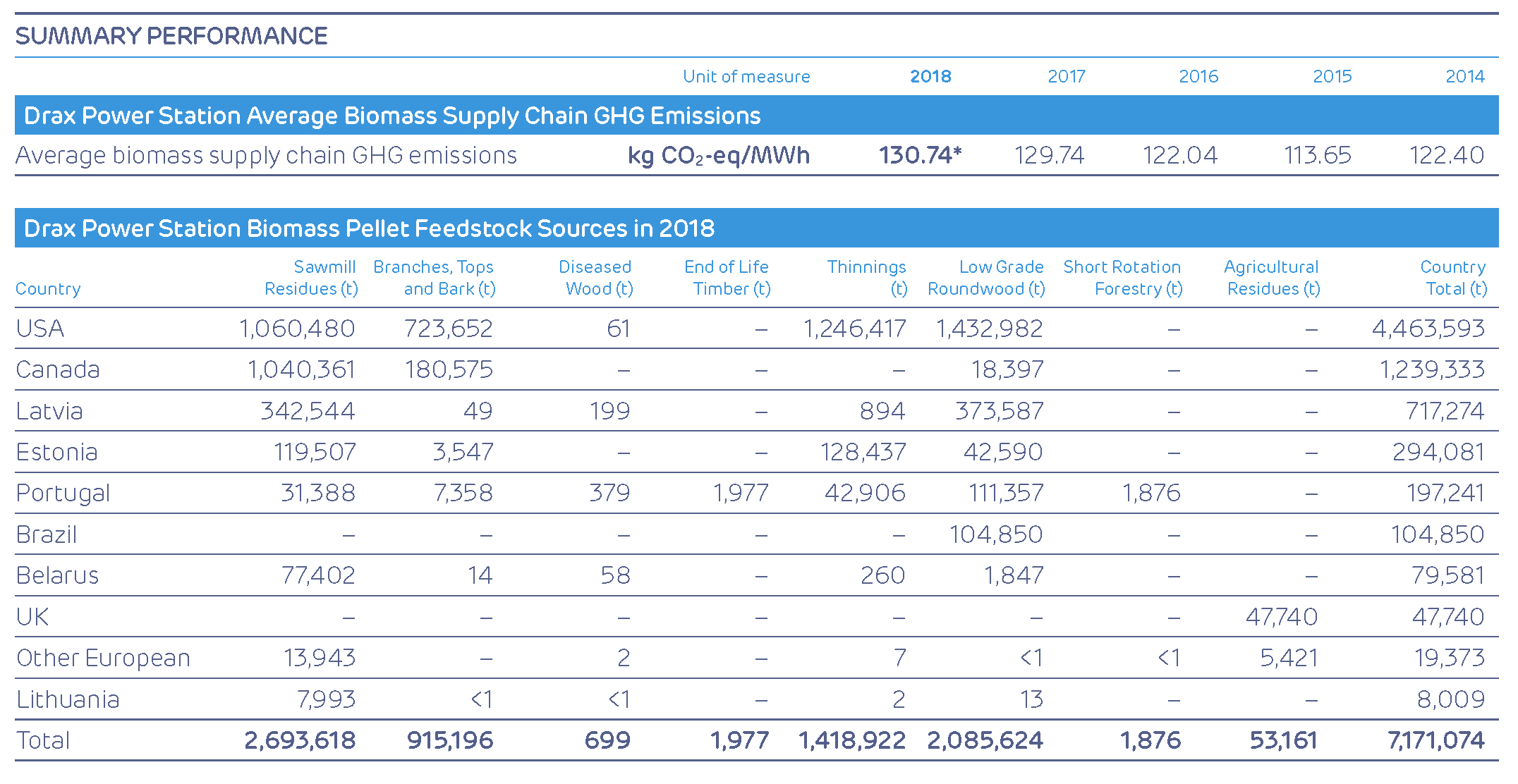

Sourcing Sustainable Biomass

* Limited external assurance using the assurance standard ISAE 3000 for 2018 data as indicated. For assurance statement and basis of reporting see www.drax.com/uk/sustainability

Ensuring sustainable biomass

We ensure our biomass is sustainable and compliant with appropriate legislation through a combination of proactive supplier engagement, third party certification schemes and our own audits and checks. The Group sustainability policy outlines our requirements and details of our due diligence process are available at www.drax.com/uk/sustainability.

We are reviewing our woody biomass sourcing policy in line with the recommendations made by Forest Research in its 2018 report(1). This is to provide further assurance that the biomass we source makes a net positive contribution to climate change, protects and enhances biodiversity and has a positive social impact on local communities.

In 2018 our biomass was sourced from established, responsibly managed working forests in the USA, Canada, Europe and Brazil. To enhance our biomass supply chain transparency, we provide detailed supply chain information at Drax ForestScope https://forestscope.info.

(1) Robert Matthews, Geoff Hogan and Ewan Mackie (2018), Carbon impacts of biomass consumed in the EU: Supplementary analysis and interpretation for the European Climate Foundation.

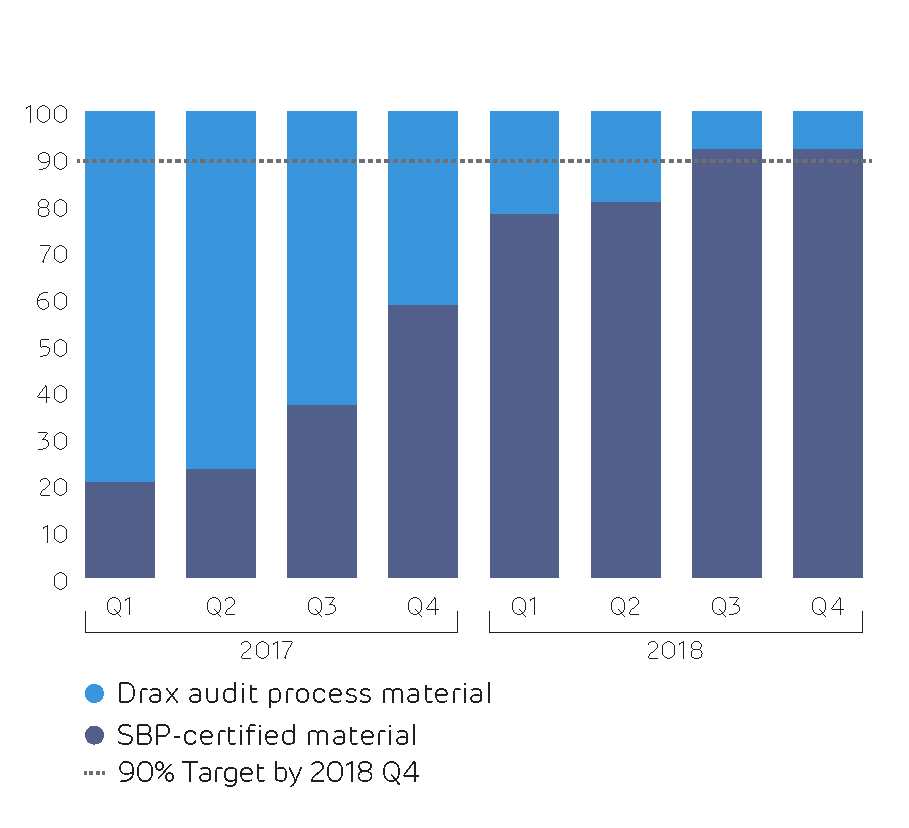

100% of our biomass is legally and sustainably sourced

At Drax, all our biomass suppliers must demonstrate that all necessary sustainability and legal requirements are being met. Supplier compliance is evidenced either by our own checks and an independent audit or by Sustainable Biomass Program (SBP) certification. SBP is a certification system for woody biomass, of which Drax is a founding member. We encourage our suppliers to move from our own audits and checks towards SBP certification. In Q4 2018 92% of our woody biomass sourced was SBP certified. This resulted in us achieving our target of sourcing 90% SBP-certified biomass fuel by the end of 2018.

No concerns regarding biomass supplier sustainability compliance were raised or escalated to the Ethics and Business Conduct Committee or the Executive Committee in 2018.

We monitor each step in the supply chain to ensure that our requirements are being met and that greenhouse gas (GHG) emissions associated with producing our biomass are calculated according to the regulatory requirements.

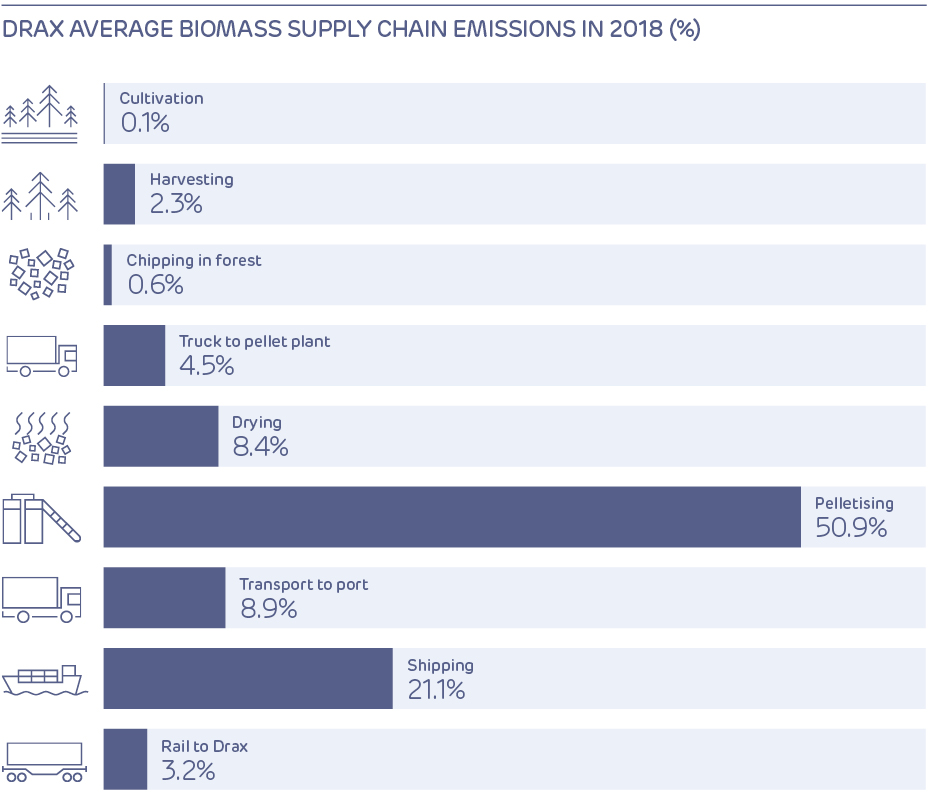

The UK Government has set a limit on the maximum supply chain GHG emissions permitted for sustainable biomass to be eligible for support under the Renewables Obligation. The current limit is 285 kgCO2-eq/MWh of electricity, reducing to 200 kgCO2-eq/MWh of electricity in 2020. In 2018, our average biomass supply chain GHG emissions amounted to 131 kgCO2-eq/MWh* of electricity. This is consistent with our 2017 average biomass supply chain GHG emissions.

* Limited external assurance using the assurance standard ISAE 3000 for 2018 data as indicated. For assurance statement and basis of reporting see www.drax.com/uk/sustainability

Additional information on our biomass sourcing, as well as coal sourcing, is available at www.drax.com/uk/sustainability

CASE STUDY

Maintaining forest carbon stocks

We source only sustainable biomass from working forests that are fully established and properly managed. Biomass can play an important role in providing markets for thinnings and low grade roundwood where few alternative uses exist. It also offers a market for material that has been damaged by natural disturbances, such as wind, fire, pests and diseases, and by-products of forest stands managed for the production of solid wood products, such as construction saw-timber and furniture.

We are committed to sourcing biomass that contributes to the long-term maintenance of growing stock and productivity and that helps to improve the health and quality of forests at a local and regional level. We monitor forest inventory data and local industry trends, in addition to certification and our auditing process, to determine whether biomass demand is having a positive impact on regional forest industries. This allows us to make informed sourcing decisions.

Customers

Customer Service Excellence

Our aim is to provide customers with the best possible service. Both Haven Power and Opus Energy have strict standards for treating customers fairly, protecting customer data and privacy and have a clear complaints procedure if things go wrong.

Haven Power was shortlisted for “Supplier of the Year” at the Energy Awards 2018.

Enabling our Customers

Smart and digital enablement

Smart meters are key to supporting customers with greater insight and opportunities to optimise their energy use. We are leading the way in rolling out smart meters to UK businesses and are investing in our digital platform to provide commercial opportunities, reduced cost to service and an enhanced customer experience.

In 2018 we upgraded the Haven Power and Opus Energy websites onto a single content management system, making it faster and easier for our teams to react to the market and deliver a smoother customer experience. We also created new functionality, making it simpler for UK businesses to get an accurate quote and switch to us online.

Facilitating prosumers’ route to market

Opus Energy buys energy from generators and developers of solar, anaerobic digestion, hydro and wind power across the UK. In 2018 this amounted to 1,103 GWh of renewable energy generated from 2,176 generators.

During the year, Opus Energy worked in partnership with Home Farm near Daventry in Northamptonshire to trial an innovative solar power and battery storage system. The farm’s 50 kW solar panels generate more power than the farm consumes. The surplus electricity is exported to the National Grid and Home Farm is paid for it by Opus Energy through a power purchase agreement.

CASE STUDY

Kinetic Café by Opus Energy

Our B2B Energy Supply businesses provide value-adding sessions to our customers. Opus Energy opened a pop-up juice bar, the Kinetic Café in London, for two days in August.

Small business owners were served free energetic juice and welcomed to network and share their business challenges, advice and personal experiences in Q&A sessions.

We served over 1,000 juices to customers and visitors who stopped by the café over the course of two days.

PEOPLE

Health, Safety and Wellbeing

1 LTIR is the total fatalities and lost time injuries per 100,000 hours worked

2 TRIR is the total fatalities, lost time injuries and medical treatment injuries per 100,000 hours worked

* Limited external assurance using the assurance standard ISAE 3000 for 2018 data as indicated. For assurance statement and basis of reporting see www.drax.com/uk/sustainability

We have Safety Management Systems (SMS) in place to ensure safe workplaces for all our people. At Drax Power Station, the SMS is certified to OHSAS 18001 and subject to regular compliance reviews, the last of which took place in 2016. In Pellet Production, the SMS meets the requirements of OHSAS 18001 and the US certification ANSI Z10. The Group health and safety policy outlines our approach.

Safety performance is reported and reviewed regularly by local management teams, the Executive Committee and the Board. Each incident is comprehensively analysed and reviewed, lessons learned are shared with employees and actions are taken to mitigate the risk of future occurrences. At Drax Power Station, a weekly safety update is uploaded to our intranet and at Pellet Production, information is made available to employees through a health and safety online portal.

The Board receives monthly reports which include Total Recordable Injury Rates (TRIR), Lost Time Injury Rates (LTIR) and numbers of Reporting of Injuries, Diseases and Dangerous Occurrences Regulations (RIDDORs) (or US equivalent) for the Group.

Our Group TRIR for 2018 was 0.22 per 100,000 hours worked. Following the fire at our Drax Power Station biomass pellet unloading facility in 2017, we carried out a full Safety and Engineering review. In 2018, initiatives were implemented to reduce the risk of future incidents and improve operator and plant safety. These initiatives continue into 2019.

2018 also saw the launch of the One Safe Drax toolkit for safety leaders, managers and supervisors at Drax Power Station. These tools provide a standard approach for safety management and support us in creating Safe People, Safe Systems and Process, and Safety Assurance to ensure we all go home safe and well every day.

Unfortunately, in December 2018 we had a major safety incident at our Drax Biomass LaSalle site which resulted in a colleague being injured. Operations at LaSalle were suspended until all employees were retrained on safety protocols and procedures.

A full safety audit was carried out by an independent third party at all three pellet plants. The audits identified a major difference in safety culture between LaSalle and our other facilities. We currently have 42 action items we are working on that consist of the recruitment of new management staff, development of new safety programmes and procedures, safety audits, safety committees and structured training.

CASE STUDY

Supporting our employees’ mental health

All employees across the Group have access to an Employee Assistance Programme. It’s a free and confidential 24-hour service which offers support on anything from financial stress and family and relationship issues to addiction, housing concerns or legal information.

There is a phone line and an app and users can be referred for six sessions of counselling per issue, per year.

Opus Energy ran 15 voluntary workshops to help our leaders understand the benefits of this service and they were attended by 113 managers.

* Limited external assurance using the assurance standard ISAE 3000 for 2018 data as indicated. For assurance statement and basis of reporting see www.drax.com/uk/sustainability

People and Culture

The Group works to maintain consistently high standards in its employment practices and all our employees benefit from a range of policies to support them in the workplace. These include policies designed to enable different work and lifestyle preferences, processes for employees to raise grievances or concerns about safety, along with supporting a diverse and inclusive workplace. Our Group-wide people strategy focuses on valuing our people, driving business performance and developing talent to deliver our strategic and operational objectives.

During the year we introduced our One Drax Awards, which recognise high-potential employees and reward those employees who act in ways that support and underpin our culture and values.

Diversity and inclusion

Drax Group is fully committed to the elimination of unlawful and unfair discrimination and we value the differences that a diverse workforce brings to the organisation. Our goal is to create and maintain a working environment that is both safe and supportive of all our people and where every employee has the opportunity to realise their potential. We believe that a commitment to diversity is critical to achieving our strategic goals. We are determined to be a place where employees, customers and suppliers alike feel respected, comfortable and supported in their diversity.

Further information on gender diversity is available in the Corporate Governance Report on page 50 of the full PDF report.

Employee representation and engagement

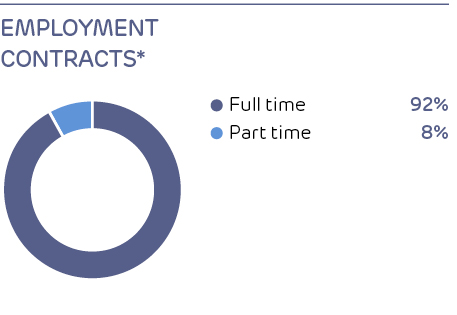

Across the Group, 19% of the workforce is covered by collective bargaining. We have representative employee consultation and information arrangements in place for those employees who have individual employment contracts.

We communicate with employees through channels including our internal intranet, quarterly newsletter and Open Forum meetings. Employees can ask our Group CEO questions through a weekly online question and answer portal.

We track employee engagement through our annual survey and in 2018 this was completed by 79% of employees. Key themes included creating greater clarity for our colleagues about our key priorities and ensuring we continue to make improvements to the learning and development opportunities we have available. In 2019, we will develop Group and business action plans to address each theme, which the Executive Committee will review regularly.

Ethics and Integrity

At Drax Group we are committed to conducting business ethically, with honesty and integrity, and in compliance with all relevant laws and regulations. We do not tolerate any form of bribery, corruption or other unethical business conduct.

Our compliance framework consists of principles, policies and procedures. The principles underpin the wider framework and are set out in our Group ethics handbook, Doing the right thing. The handbook identifies the behaviours expected from our employees and contractors on topics including human rights, ethical business conduct and integrity. Our policies and procedures provide further guidance and instruction, in line with best industry practice. These include our Group Corporate Crime policy and Gifts and Hospitality, Conflicts of Interest and Due Diligence procedures.

The ethical principles contained in the handbook form part of our terms of employment. In 2018 the handbook was converted into a series of short videos. These are used as part of our new starter induction programme and for annual ethics refresher training. Teams that are exposed to increased risk receive tailored e-learning or classroom-based training.

Responsibility for ethics

Governance of our framework is overseen by the Group Ethics and Business Conduct Committee (EBCC). The Committee meets quarterly and is chaired by the Group CFO. Managers and senior managers across the Group are responsible for demonstrating leadership on ethical matters and supporting teams to apply our ethical principles.

Our Group Corporate Compliance team carries out an annual review of the Group’s gift and hospitality records and our Internal Audit team provides assurance on the robustness of our policies and processes. Results of the annual review, details of investigations conducted and audit outcomes are reported annually to both the EBCC and the Audit Committee.

The Group Corporate Compliance team also conducts annual risk assessments of each of its compliance programmes, which relate to areas including anti-bribery and corruption and modern slavery in supply chains. This is to ensure procedures remain fit for purpose and to recommend any further mitigation measures. The results are presented to the EBCC.

Working with others

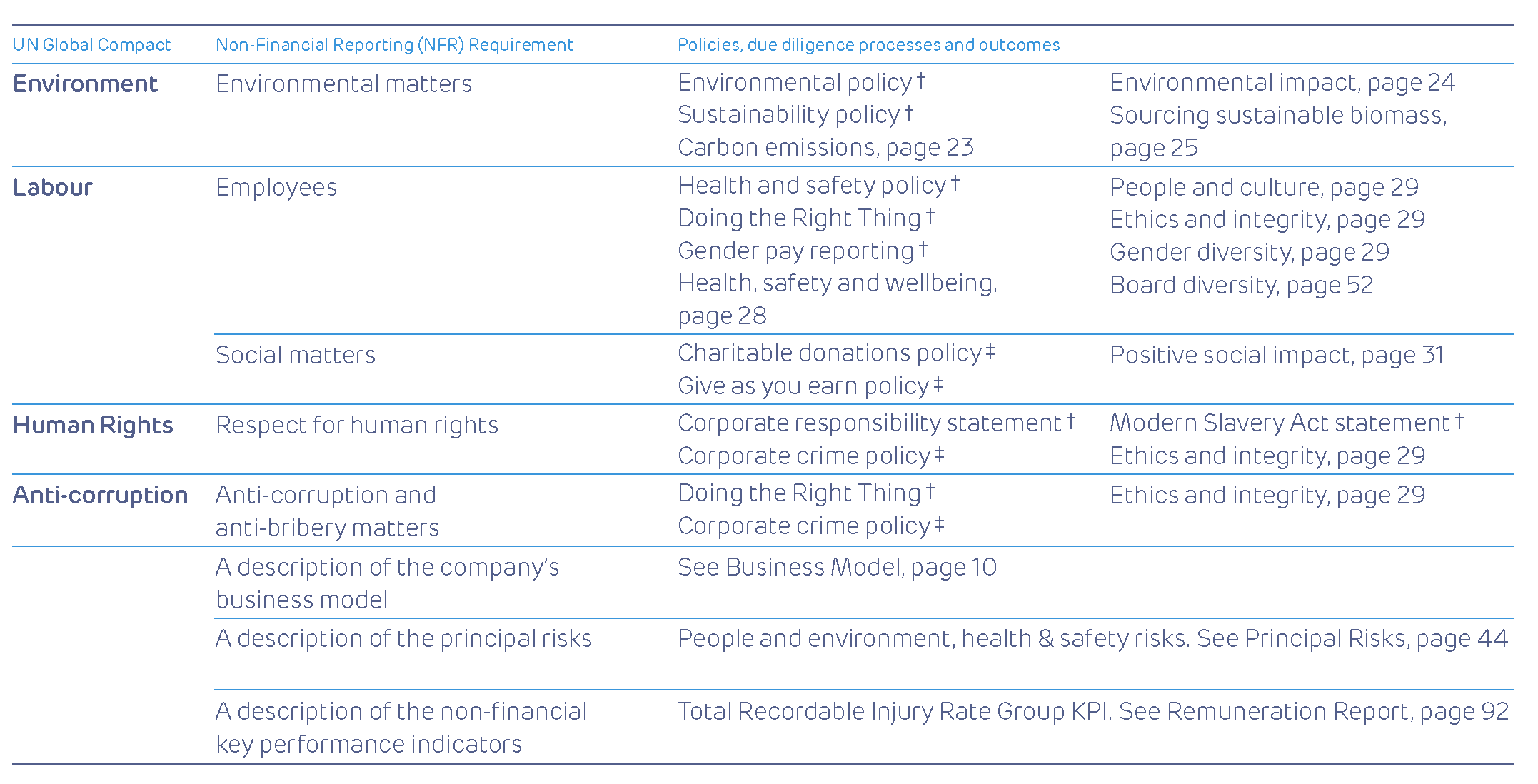

We joined the UN Global Compact (UNGC) in January 2018 and have established representation on both their UK Advisory Group and Modern Slavery Working Group. This will enable us to play an active role in the UK UNGC network, to benchmark our compliance programmes, to share and exchange experience and promote peer collaboration.

We seek to work with suppliers, partners, agents, intermediaries, contractors, consultants and counterparties whose standards are consistent with our own. Third parties are subject to our pre-contract due diligence checks and continual monitoring through the lifecycle of the contract, via our third party due diligence system. In cases where a red flag is raised, we follow an EBCC-approved escalation protocol. Depending on the nature of the flagged issue, we may decide not to engage with a third party, to engage on a conditional basis, to collaborate on remedial action or to end an existing business relationship.

Anti-bribery and anti-corruption

Our internal processes ensure consistency with our zero tolerance approach to bribery and corruption.

Geographic risk is factored into our country due diligence and third party due diligence systems. Conducting business in higher risk countries must receive prior approval from the Group Operational Risk Management Committee.

Following country approval, third parties are then put forward for our due diligence process. Suppliers in higher risk countries receive a higher level of initial due diligence and ongoing monitoring. We also screen the affiliates (directors, shareholders) of these suppliers and refresh their information on a more frequent basis, compared to our lower risk suppliers. Third parties with operations in, or linked to, higher risk countries are escalated to the EBCC for review prior to engagement. Ongoing monitoring is performed with new information provided to the relevant committee, as appropriate. In May 2018, we implemented a new due diligence system across the Group to facilitate this process.

Drax Group was not involved in any legal cases related to corruption and bribery in 2018.

Labour and human rights

Our commitment to the protection of human rights includes not tolerating the use of underage workers or forced labour. This is captured in our Corporate Crime policy and our Corporate Responsibility (CR) statement.

Our CR statement outlines the standard of ethical business conduct we expect from suppliers. Businesses in our supply chain should offer a safe workplace for their employees that is free from harm, intimidation, harassment and fear. We have incorporated further provisions into our statement template to manage these risks within our procurement contracts and will further advance this effort in 2019 with the development of a Code of Conduct.

Within the Code of Conduct, we will emphasise our requirement for our suppliers and contractors working on our behalf to challenge unethical behaviour and promote a “speak up” culture.

Modern Slavery

In 2018, we published our second modern slavery statement in accordance with the UK Modern Slavery Act. This describes the steps we are taking to reduce the risk of modern slavery in our supply chain.

Data privacy and security

We take the privacy and security of the personal data we control seriously. We are committed to maintaining effective privacy and security programmes to ensure our people, customers and the third parties with which we engage have confidence in our data handling practices.

As part of our continual improvement programme, our Privacy, IT and Security teams were re-organised and expanded in 2018. Following an internal audit, which identified weaknesses in operational IT controls that support our cyber security at Drax Power Station, we initiated a comprehensive remediation programme to address the findings and introduce more robust control measures. We also continue to update our Privacy Compliance Programme to take account of the requirements of the General Data Protection Regulation (GDPR), the new UK Data Protection Act 2018 and other associated legislation.

To support our privacy compliance processes and policies, we maintain industry-leading control measures to protect our employee and customer data, by detecting and preventing threats and security breaches. In addition to traditional security measures, we undertake advanced threat monitoring and analytics measurement as a layered toolset designed to detect, identify, respond to and resolve cyber threats and attacks before they can happen. We are conscious that such threats continue to change. Accordingly, we run a continual security programme to improve and evolve our controls and response to cyber threats.

Whistleblowing

As set out in our Whistleblowing policy, at Drax we encourage employees to speak out and report concerns either internally or through our whistleblowing hotline.

Employees can raise issues internally through managers, a member of the Group Corporate Compliance team, directly with the EBCC or though our anonymous hotline, which is independently operated by a third party.

The Corporate Human Resources team records all hotline reports received and will raise any ethical-related matters with the Group Corporate Compliance team, which maintains an investigations log. Where required, the EBCC and Group General Counsel are consulted, and a course of action agreed. Should genuine concerns be raised, we have a strict non-retaliation policy.

During 2018, no reports were made through our third party whistleblowing hotline.

Additional information on ethics and integrity is available at www.drax.com/uk/sustainability

Positive Social Impact

We provide jobs, support economic growth, pay tax responsibly and deliver charitable and volunteering initiatives in the communities where we operate. Oxford Economics estimate that the Group contributed £1.6 billion towards UK GDP and supported 17,500 jobs across the country in 2017.

Volunteering and charitable giving

In 2018, we provided £129,016 in charitable donations through employee match funding, payroll giving, our community fund and national fundraising days. We also established strategic national partnerships and consistent Group charity and community principles. We will roll-out our Group-wide social impact strategy in 2019.