https://www.havenpower.com/news/our-contingency-plans-for-coronavirus/

https://www.havenpower.com/news/our-contingency-plans-for-coronavirus/

We all want our homes and our workplaces to be warm and cosy, but not at the cost of catastrophic climate change. That’s why decarbonising our heating is a challenge that simply cannot be ignored.

Making decisions about how this is done requires careful consideration and a detailed, deliverable national strategy.

Here we discuss the key issues in decarbonising heat.

The Climate Change Act commits the UK to reducing its carbon emissions by at least 80 per cent of their 1990 levels by 2050.

As heating our homes and workplaces is responsible for almost one fifth of our country’s total carbon emissions, we are clearly going to need to make huge changes to the way we keep our homes and workplaces warm in order to meet those commitments.

‘Over 80% of energy used in homes is for heating – suggesting large potential for continued decarbonisation.’

— Energising Britain: Progress, impacts and outlook for transforming Britain’s energy system, by I. Staffell, M. Jansen, A. Chase, C. Lewis and E. Cotton, 2018.

Improved insulation, greater energy efficiency and electrification will all reduce the need for fossil fuel-based heating. However, domestic energy efficiency in the UK is lagging well behind targets, although the situation varies from region to region – and such targets do not even exist yet for the non-domestic sector.

Roof insulation material

Even in a low or zero-carbon future, we’re still going to need to keep our homes and workplaces warm – and affordably.

Against this backdrop, in March 2018, the UK Government issued a call for evidence for a Future Framework for Heat in Buildings.

Chancellor Phillip Hammond introduced a new ‘future homes standard’ in his 2019 Spring Budget Statement, “mandating the end of fossil fuel heating systems.” Gas boilers will be banned from all new homes from 2025.

A major change is coming. But what else will we need to change in order to transform our heating systems?

The most noticeable change in the way we heat our homes and workspaces in the future may well come from the need to switch from systems that fuelled by natural gas to ones that are driven by electricity.

Some technologies that can offer a solution to the challenge of decarbonising heating depend on a significant amount of electricity to keep the warmth flowing.

For instance, the hybrid heat pump scenario which is currently supported by the Committee on Climate Change would see up to 85% of a consumer’s need for heat being met by low-carbon electricity.

To give some context to that figure, according to the Committee, 85 per cent of the UK’s homes now rely on fossil-fuel derived natural gas for heating and hot water, and on average these: “currently emit around 2tCO2 per household per year… which represents around one tenth of the average UK household’s carbon footprint.”

Changing from a situation where our heating depends on 85% fossil fuel gas to one that depends on 85% low or zero carbon electricity is little short of a complete transformation. Given that the new future homes standard is due to be introduced in less than six years, this transformation will need to happen quickly.

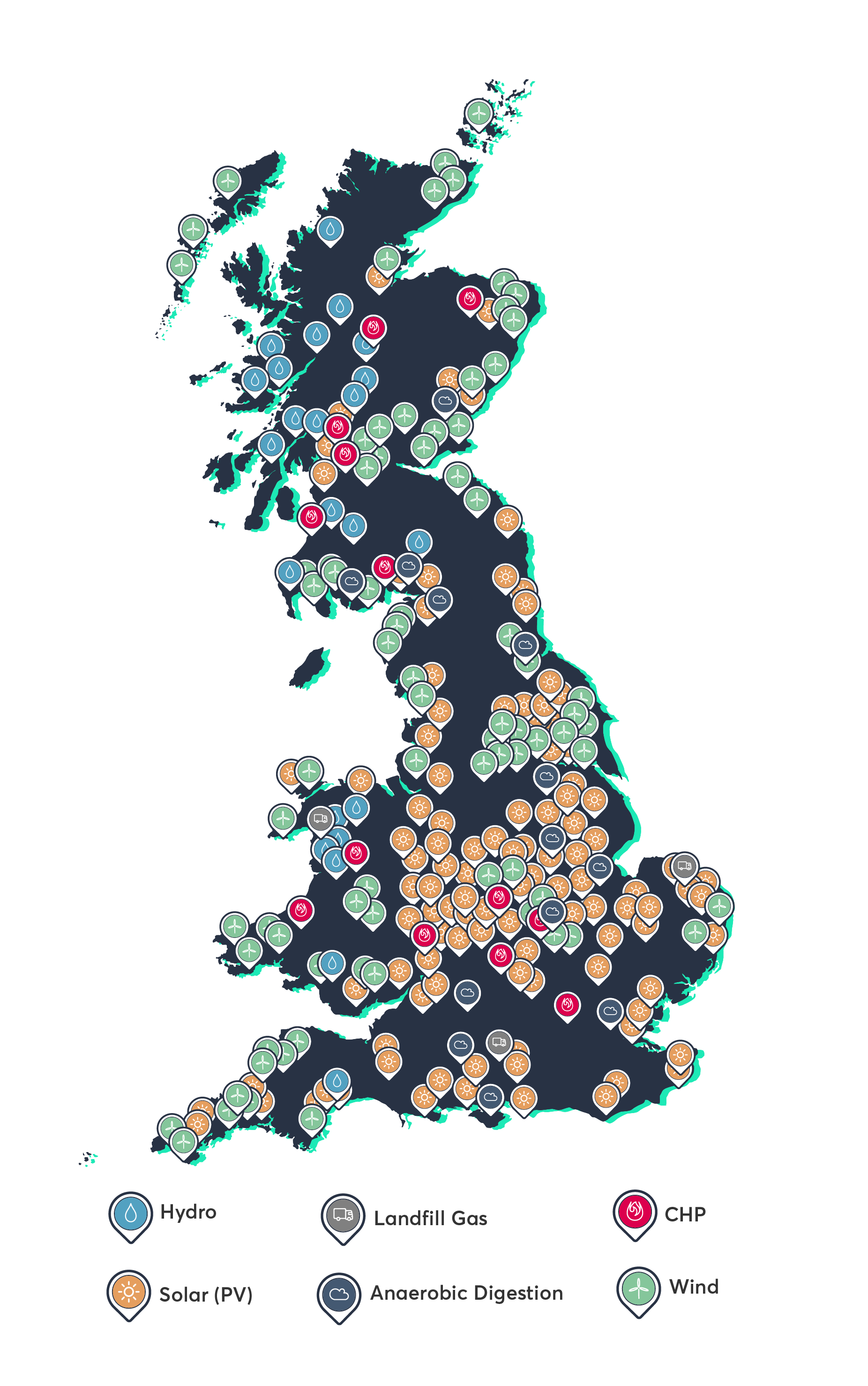

Of course, a great deal of the extra electricity needed will come from intermittent renewables such as wind turbines and solar panels – especially as the cost of renewable electricity is falling.

Much of that power looks likely to be supplied by distributed sources rather than those integrated into the national grid. Indeed, since 2011, power generation capacity connected directly to the distribution network grew from 12 gigawatts (GW) to more than 40 GW by the end of 2017, according to estimates from energy experts Cornwall Insight in a report for our B2B energy supply business, Haven Power.

With so much of our electricity reliant on the weather, there will still be a need for dispatchable and flexible thermal sources and energy storage, such as Drax and Cruachan power stations. Their centralised power generation can be turned up and fed directly into the national transmission system at short notice, to keep our heating running and our homes warm.

Dam and reservoir, Cruachan Power Station, Scotland

Such a transformation will obviously require careful strategic planning as well as an enormous amount of investment.

There may well be no single solution to the challenge of heat decarbonisation, rather a number of different solutions that depend on where people live and work, their individual circumstances, the energy efficiency of their homes and the resources they have close at hand.

But while it has previously been reported that the overall or system costs of electrifying heating could be as much as three times the cost of using gas, another study suggests that the costs could be much closer.

Heat pumps that absorb environmental warmth and use it to provide low carbon heating have always been considered a possible option for the four million homes and countless workplaces that are not currently connected to the UK’s mains gas network.

Recently expert opinion has been changing with hybrid heat pumps seen as a workable solution even for homes and workplaces that are connected to gas supplies. Indeed, in 2018 the Committee on Climate Change stated that hybrid heat pumps: “can be the lowest cost option where homes are sufficiently insulated, or can be insulated affordably.” This means that they may be one of the simplest and most affordable options to provide the heating of the future.

Hybrid heat pumps draw heat from the air or ground around them and use a boiler to provide extra heat when the weather is exceptionally cold. In a low carbon future, that boiler could be fuelled by biogas. In a zero carbon situation, it could be powered by hydrogen.

Heat pumps can be air-source (ASHP) – absorbing warmth from the atmosphere like the heat exchanger in your fridge in reverse – or ground source (GSHP). GSHPs absorb heat through on a network of pipes (a ground loop) buried or a vertical borehole drilled in the earth outside your home or workplace.

Both ASHPs and GSHPs can be used to support underfloor heating or a radiator system, though neither will provide water heated to the high temperature a natural gas boiler will reach to keep radiators hot.

And even though the warmth they absorb is free, heat pumps depend on a supply of electricity to condense it and to bring it back to the heating system inside the house.

This electricity could be generated by distributed power from local solar PV, wind turbines, drawn from batteries or even from the low carbon grid of the future.

It is worth noting that the size of heat pumps and the amount of land they require – especially GSHP – makes them a less attractive solution for people who live or work in built up areas such as cities. While for those who live in blocks of flats, it is difficult to see how individual heat pumps could be a practical solution.

The idea of switching the mains gas grid to store and transport hydrogen has long appealed as a potential solution to the challenge of decarbonising heating. Renewable hydrogen could then be burnt in domestic boilers similar to those we currently use for natural gas.

The benefits are many. Hydrogen produces no carbon emissions when burnt, and can be stored and transported in much the same way as natural gas (provided old metal pipes have been replaced with modern alternatives).

And given the sunk costs involved in the existing gas grid and in the network of pipes and radiators already installed in tens of millions of homes, hydrogen has always been expected to be the lowest cost option too.

However, according to the Committee on Climate Change’s latest findings, hydrogen should not be seen as a ‘silver bullet’ solution, capable of transforming our entire heating landscape in a single change.

The main reasons they give for this judgment are the relatively high cost of the electricity required to produce sufficient hydrogen to power tens of millions of boilers, the undesirability of relying on substantial imports of hydrogen, and the lack of a carbon-free method to supply the gas cost-effectively at scale.

Hydrogen could, however, be produced by gas reformation of the emissions retained by bioenergy carbon capture and storage (BECCS) such as that being pioneered at Drax Power Station. Carbon capture use and storage (CCUS), of which BECCS is the renewable variant, is supported by the UK government through its Clean Growth Strategy as it has potential to accelerate decarbonisation in power and industrial sectors.

Extremely rapid progress to provide hydrogen in sufficient quantities from BECCS is unlikely – but the first schemes could begin operating in the late 2020s.

Hydrogen production also has the potential to radically transform the economics of CCUS, making it a much more attractive investment.

It was originally assumed that the power required to drive the energy-intensive process of hydrogen created via electrolysis would come from surplus electricity generated by intermittent renewables at times of low demand. However, that surplus is not now generally regarded as likely to be sufficiently large to be relied upon.

It is these limitations, together with a comprehensive model of the likely costs involved in different approaches to decarbonisation, that led the Committee on Climate Change to suggest that hybrid heat pumps could provide the bulk of domestic heating in the future.

At present, it seems likely that converting to hydrogen-fuelled boilers will mainly be an attractive option for those who live and work near areas where the renewable fuel can be most easily created and stored. The north of England is a prime example – close to the energy and carbon intensive areas of the Humber and Tees valleys where CCUS and hydrogen clusters could be located with good access to North Sea carbon stores such as aquifers and former gas fields.

Many homes in the UK – especially in the south – could be heated electrically without carbon emissions at the point of use.

Solar thermal (for water heating) or solar PVs (for electric and water heating) common sights on domestic property rooftops. The intermittency of solar power need not be an issue as the electricity generated could then be stored in batteries ‘behind the meter’ until it is needed.

However, the lack of sufficient daylight for much of the year in many parts of the UK could, together with the still relatively high cost of battery storage, still mean that this would not necessarily be a solution that can be applied at scale to millions of homes and workplaces all year round.

As the cost of battery storage continues to fall, it may well be that solar becomes a more practical and cost-effective solution.

More geothermal

Sustainably sourced compressed wood pellets and biomass boilers have long been proposed as a potential solution to decarbonising heating for the many people who live and work off the mains gas grid. Bioenergy as a whole – including biogas as well as wood pellets – now provides around four percent of UK heat, up from 1.4% in 2008.

The main barriers to this are the current relatively high cost of biomass boilers. This is currently offset by the Renewable Heating Incentive (RHI) which the UK government has committed to continuing until 2021.

As this solution is adopted by more consumers, it is anticipated that the real costs of such new technology will fall as economies of scale start to take effect in much the same way that solar PV and battery technology has recently become more affordable.

Ruins of a tin mine, Wheal Coates Mine, St. Agnes, Cornwall, England

Geothermal energy uses the heat stored beneath the surface of our planet itself to provide the energy we need.

While in some countries such as Iceland, geothermal energy is used to drive turbines to generate electricity that is then used to provide power for heating, it is envisaged that in the UK it could be converted into warmth through massive heat pumps that provide heating to entire communities – especially those in former mining areas. There is already one geothermal district heating scheme in operation in the UK, in Southampton.

It is envisaged that such geothermal schemes would work most effectively at a district level, providing zero carbon heat to many homes and workplaces. According to a recent report, geothermal energy has the potential to “produce up to 20 per cent of UK electricity and heat for millions.”

At present, drilling is being carried out to see if geothermal heating could be viable in Cornwall. However, there is no reason why it could not be used in disused coalmines too where ground source heat pumps (GSHPs) would absorb and condense the required heat. This means that geothermal could have strong potential as a solution to the challenge of decarbonisation for former mining communities.

Cory Riverside Energy’s Resource Recovery Facility in Belvedere, London, could be operated as a CHP plant in the future

By using the heat created in thermal renewable electricity generation – such as biomass – in combined heat and power schemes, businesses and individuals can reduce their energy costs and their carbon emissions. Such schemes can work well for new developments on a district basis, and are already popular in mainland Europe, especially Sweden, Denmark and Switzerland.

There are already a number of viable solutions to decarbonising heating in the UK. They rely on smart policy, smarter technology and customers taking control of their energy.

Rather than any one of these technologies providing a single solution that can help every consumer and business in the country to meet the challenge in the same way, it is more likely that it will be met by a number of different solutions, depending on geography, cost and individual circumstances. These will sometimes also work in concert rather than alone.

The UK has made solid progress on reducing carbon emissions – especially in power generation. When it comes to heating buildings, rapid decarbonisation is now needed. And that decarbonisation must avoid fuel poverty and help to rebalance the economy.

Find out more about energy in buildings in Energising Britain: Progress, impacts and outlook for transforming Britain’s energy system.

Where does our electricity come from? One answer might be the power stations, wind turbines and solar panels that generate it. You might even go as far as to say the wind, sun, water, biomass and gas powering those stations. Or even the network companies transporting that power around the country. But there’s also a very important middle-man in this process: electricity suppliers.

Most of Great Britain gets its power from one of the ‘Big Six’ energy suppliers, which buy electricity from the wholesale market and then sells it to consumers. However, with more businesses and consumers looking for less carbon-intense electricity sources, there are now a whole host of smaller companies taking on the incumbents and offering all-renewable electricity.

From Ovo to Bulb to Drax’s own Haven Power and Opus Energy, consumers and businesses have more and greener options than ever about where to buy their electricity, with many even offering 100% renewable electricity.

But how do these companies ensure the megawatts powering homes, offices and street lights come from renewable sources?

The electricity we use doesn’t just flow through a single cable from a power station to our houses. It travels through what’s called the transmissions system, which is run by National Grid ESO and local distribution network operators.

Apart from off-grid installations like solar panels on buildings, some of which are unable to export their unused power, all the electricity generated by different sources around the country goes into this same system. It means megawatts generated by a wind turbine get mixed up with those generated by a nuclear reactor or a coal power station.

Think of it as a river. Although it is its own entity, it is fed by multiple streams of water coming from different sources. In the case of electricity, megawatts from various generators are fed into a central system, which then enter homes, offices and devices around the country.

So, what makes green power generated from renewable sources, green power used in homes?

Suppliers can’t control exactly what megawatts you use, but they can influence the makeup of the overall ‘river’ your electricity is pulled from by what electricity they agree to buy and offer to their customers.

Renewable suppliers match the amount of electricity their customers use with the amount they buy from renewable sources. So, if a home uses 4 megawatt-hours (MWh) a year, a supplier will need to ensure it buys an equal amount of power from National Grid, which National Grid sources from generators. If that supplier offers 100% renewable power, it will need to ensure it has the right kinds of deals in place with renewable generators to deliver that amount of power.

It means that while the river of electricity is still a mix from different streams, more of the water will come from renewable streams. Therefore, if more homes and businesses switch to renewable suppliers, more of the overall river will be renewable, which will in turn help to decarbonise the electricity system, enabling a lower-carbon economy.

But how does this fit into the existing electricity business and infrastructure?

But how do suppliers actually buy renewable power from generators?

To understand how suppliers ensure they are buying renewable power you first need to understand how the business works. Or at least, how it used to. The most obvious place to start is with the generators.

Be they gas power stations or an offshore wind farm, the generator is where electricity is produced and are often owned by a supplier.

Suppliers can buy electricity from their own generators, often months or years ahead of delivery. But if there is a shortfall, the supplier can also buy electricity on the wholesale market, where other generators can sell their electricity.

Because suppliers are on a competitive market, their aim is to buy the electricity for the lowest possible price and sell it for more – but at a better rate than rivals. Measures like carbon prices or green incentives help lower the cost of renewable and low-carbon generation, and position it as a more economically viable purchase than more expensive fossil fuels like coal.

Renewable-only suppliers also want to buy electricity as cheap as possible and sell it as affordably as possible. But unlike standard suppliers they only buy electricity from renewable sources.

This can be done by purchasing electricity from independent renewable generators on the wholesale market, or arranged through what are known as Power Purchase Agreements (PPAs) – longer-term contracts between generators and suppliers agreeing on a specific amount of power.

The advantage of these for the renewable generator is it secures revenue for the future, while for the supplier it means a dependable source of electricity. For large installations, these deals are often signed before construction even begins to ensure investors there will be a return.

Transitioning to a low-carbon electricity system, however, is not just about suppliers buying more electricity from renewable sources.

As more businesses, individuals and communities are becoming prosumers and generating their own electricity, the wider role of the supplier in the system is changing.

The government’s feed-in-tariffs financially reward customers for generating their own electricity, even if they don’t export it to the grid. But even small generators can sign deals with suppliers to sell electricity through schemes such as Good Energy’s SmartGen policy, which is open to generators with between 10 and 100 kilowatts (kW) of installed capacity. Similarly Opus Energy helps over 2,100 businesses sell more than 1,100 gigawatt-hours (GWh) of excess wind, solar, anaerobic digestion and hydro power.

For larger prosumer businesses, the relationship with suppliers and the grid is different. Rather than the traditional buying and selling of electricity, it requires a cooperative approach to understand how the prosumer can best utilise their assets.

Beyond increasing the amount of low-carbon electricity, decarbonising the electricity system also means making more efficient use of energy and managing the data that can help improve efficiency. Haven Power’s partnership with Thames Water sees it analyse an average of 68 million half-hour smart meter readings every year, using the data to help the company improve its billing and forecasting. As the wider system becomes more intelligent, suppliers will be able to better forecast how much electricity its customers use and help them reduce their consumption.

The role required of suppliers in a changing system will create opportunities for more renewable and efficient use of electricity. And empower more consumers to get their electricity from low-carbon sources that can help to make the whole country’s electricity greener.

Want a different perspective on the same story? Watch TV’s Jonny Ball explain.

Opus Energy opened a pop-up juice bar, the Kinetic Café in London, for two days in August. Small business owners were served free energetic juice and welcomed to network and share their business challenges, advice and personal experiences in Q&A sessions.

We served over 1,000 juices to customers and visitors who stopped by the café over the course of two days.

| Adjusted(1) | Total | |||

| Twelve months ended 31 December | 2018 | 2017 Restated(2) | 2018 | 2017 Restated(2) |

| Key financial performance measures | ||||

| EBITDA (£ million)(3) | 250 | 229 | ||

| Profit / (loss) before tax (£ million) | 37 | 5 | 14 | (204) |

| Basic earnings / (loss) per share (pence) | 10.4 | 0.7 | 5.0 | (41.3) |

Dam and reservoir, Cruachan Power Station

“Drax is now one of the leading generators of flexible, low carbon and renewable electricity in the UK. As the grid decarbonises, our ability to support intermittent renewables will become increasingly important as we strive to deliver our purpose of enabling a zero carbon, lower cost energy future.

“Drax performed well in 2018. Our commitment to operating safely and sustainably remains at our core. We commissioned our third pellet production plant, which contributed to our good results. After a difficult first quarter for our Power Generation business, we delivered strong availability and financial results. Whilst the year was challenging for our B2B Energy Supply business, we continued to grow our customer base and are investing in the significant opportunity created by smart meters.

“We are confident in our ability to continue growing our earnings and advancing our strategy through the year. We have attractive investment opportunities throughout our business, and while short-term uncertainty over the Capacity Market remains, we look forward to developing those opportunities in a disciplined fashion.”

View complete full year report

View analyst presentation

Register and watch 9am webcast of presentation

Think of the phrase ‘3D’ and may people instantly think of video games, television or cinema, along with the special glasses you needed to watch it.

But another form of 3D is, I believe, going to be at the heart of the energy revolution which is rapidly gathering place.

The three Ds in this case are Data, Diversification and Decarbonisation. Together, they will transform the way businesses buy, use and sell their energy, help companies take control of their energy use and save money and also play a key part in our journey towards a zero carbon, lower cost energy future.

We’re already seeing some real innovations in the energy sector. Our trial of a storage battery with a customer of Opus Energy is an example, offering a farming business in Northampton the chance to sell stored energy generated by solar panels back to the grid at times of peak demand – a potential new revenue stream.

But other innovations and advances will maintain the pace of change and data will be at the core of this now the new generation of smart meters are being installed in businesses, revolutionising customer relationships with their energy suppliers.

The data from the new meters will finally give customers insight into where and when they use energy. Suppliers will have to work much more closely with customers to help them access new opportunities for cost savings, access to new markets and even new revenue streams.

An example would be a restaurant. With the data smart meters will provide, the restaurant’s supplier will be able to tell the owners how their energy use compares to the local competition and where improvements can be made.

The detail could go as far as identifying whether the restaurant’s equipment is older and less efficient, whether rivals have installed newer kit or whether other businesses are switching off their equipment earlier or using it at different, cheaper times.

Using energy during the peak weekday morning and early evening hours is often the most expensive time to do so. Data will give businesses the insight into how they can use energy more efficiently and when they use it, offering them the chance to avoid buying at peak times whenever possible and driving efficiencies.

This is why Haven Power’s trading team is now working closely with GridBeyond. The partnership allows our customers to trade the power they produce as well as optimise their operations to help balance the grid at times of peak demand. The really smart thing is that in doing so, customers are reducing their energy costs and making their operations more sustainable.

Trading desks at Haven Power’s Ipswich HQ

The way demand changes and is managed by businesses and consumers on a diversified power system will also be key. The business energy sector is already diversifying as many customers are able to generate and store their own power but the next step is for more customers to be paid to reduce their usage at peak times.

Think of a busy time for the National Grid – half time in the FA Cup Final or after the results in Strictly Come Dancing. Previously, the grid would have to pay a power station to ramp up generation to meet demand but these days, customers are paid to reduce demand for 30 minutes or so – in effect becoming a huge virtual power station.

This has happened for some time of course with larger, industrial customers but now, smaller companies can benefit from this too, thanks to the data and insight they will have from their smart meters. This empowers customers and puts them, not the energy companies, in control of the key decisions about their energy.

A close, advisory relationship between energy suppliers and their customers will become ever more important to make sure business can choose to avoid the high demand periods, and maximises use during the lower, cheaper times. In fact, I can see a time when customers will end up paying more for insight and advice than they do for the power they buy – and they’ll save money overall in doing so.

And if we get all this right, it will help drive one of the most important of the three Ds – decarbonisation.

Sustainability is increasingly becoming a primary focus for businesses and demand for renewable energy is growing because it is now cost-effective. That will help us in our drive towards a zero carbon future as more and more renewable energy comes onstream, though the UK will continue to need power generated from more flexible assets as well.

So there are huge opportunities out there to transform our energy landscape but they have to be viewed positively. The smart metering programme can be viewed as a regulatory burden or it can be seen as an opportunity. We take the positive view.

Likewise, batteries were once the preserve of massive companies only but now, as technology develops, they are becoming available for smaller firms too. The more we can innovative on a larger scale, the more the technology will work its way into smaller markets too, adding momentum to the energy revolution.

The opportunities are huge. If we get it right, so too will be the benefits to one of the biggest priorities of all – the work to decarbonise the UK and create the lower carbon future we all want.