Energising Britain

Chapter 1:

Foreword, preface, exec summary & intro

Will Gardiner, CEO, Drax Group. Click to view/download in high res.

Foreword

Our world is changing fast.

New technologies are transforming the way we live and work. They are changing businesses and communities and creating huge opportunities to improve our quality of life, and Britain’s ability to compete in a global economy.

This shift is being enabled by a revolution taking place across our energy system – ultimately to a zero carbon, low cost system where technology and data will enable businesses and homeowners to create energy as well as use it, and give them more control over the energy they use.

These changes are creating significant benefits. But as in every transition there is a risk that those most able to take advantage of new technologies will enjoy their benefits first while others get left behind.

A failure to ensure the transition is enjoyed across Britain will also undermine much needed progress to decarbonise our economy and tackle climate change.

Drax, is at the heart of the energy transition. We see these changes taking place every day – across our businesses, and among the customers and communities we serve. What’s less clear is how Britain is faring through this change.

Now, for the first time, this report gives us some answers. Researchers at Imperial College London and E4tech have looked right across our economy. Using 20 different metrics they have assessed progress in critical sectors including power, transport and industry. Crucially they’ve also broken down their findings to a regional level.

The results make stark reading. While real progress has been made in some sectors to decarbonise, others lag behind.

While most nations and regions have taken steps to create the future energy system we need, the picture is not uniform. Most worrying is clear evidence that once again a divide is opening between those parts of the country where people are better placed to take advantage of new technologies – and those who are not.

The conclusion is clear: Failure to address these energy divides will leave some communities falling behind. It will restrict our businesses’ ability to compete in a fierce global economy. And our efforts to tackle climate change will be hindered.

To respond energy companies, businesses, communities and governments must work together. Drax is committed to play our part.

I’m proud of the contribution we have already made. We have transformed the UK’s largest coal-fired power station to become the biggest decarbonisation project in Europe and the country’s biggest renewable power generator. Today, we maintain significant generation capacity and aim to bolster our ability to provide flexible, low-carbon generation further − supporting the increase in solar and wind power across Britain’s energy system. We’re trialling innovative Bioenergy Carbon Capture Use and Storage technology, which is the first of its kind in Europe and has the potential to deliver negative emissions. And through our retail businesses we are helping thousands of business switch to use 100% renewable energy, and use it more efficiently.

But, this report shows us there is much more to do.

We will continue to invest in and develop the new technologies which will finish the job of taking Drax off coal, ensure we become zero carbon and play a bigger part in decarbonising the wider economy.

And, we will continue to help our customers reduce their own carbon emissions, save money and create new revenues from energy production which will boost their ability to compete in their own markets.

Our role is clear. Drax is enabling a zero carbon, lower cost future for all.

This report reinforces the challenges ahead, but also the opportunities to meet them. I commit Drax to playing our part to do so.

Authors:

Dr Iain Staffell, Dr Malte Jansen: Imperial College London

Adam Chase, Chester Lewis, Eloise Cotton: E4tech

Please refer to this report as:

I. Staffell, M. Jansen, A. Chase, C. Lewis and E. Cotton, 2018.

Energising Britain: Progress, impacts and outlook for transforming Britain’s energy system.

Drax Group: Selby.

Please see the PDF version for footnotes, references and appendices not contained within this web version.

Preface

This report was commissioned by Drax Group and delivered independently by academics from Imperial College London (facilitated by the College’s consultancy company, Imperial Consultants), and consultants from E4tech.

Drax Group commissioned the authors to conduct new research into how transformations in Britain’s energy system are likely to impact the country’s economic, societal and environmental outcomes.

The aim of this research is to provide insight into the changes that are occurring and those that are needed to ensure that energy system transformation unlocks opportunities for businesses, government and households in a just and equitable way.

This report is the independent opinion of the authors. It focuses on Great Britain rather than the United Kingdom as lack of data prevented Northern Ireland from being included.

Drax Group

Drax Group plc plays a vital role in helping change the way energy is generated, supplied and used for a better future. Its 2,300-strong staff operate across three principal areas of activity – electricity generation, electricity sales to business customers and compressed wood pellet production.

Imperial Consultants

Imperial Consultants provide access to over 4,000 research-active expert academics and Imperial College London’s state of the art facilities to deliver innovative solutions to meet the business needs of industry, government and the third sector.

E4tech

E4tech is an international strategic consultancy focused on sustainable energy. E4tech helps clarify and simplify complex and uncertain situations, to achieve solutions that are technologically, economically and environmentally sound

Executive Summary

Why this report matters

Major pressures are shifting the UK’s patterns of employment, leisure, travel and industry, with consequences for our energy needs. At the same time, the UK has made strong commitments to reduce greenhouse gas emissions related to energy. Many towns and cities struggle with chronic air pollution from cars, vans and lorries. Businesses and households face rising energy bills, putting a squeeze on both economic competitiveness and quality of life.

Electrification is essential, touching all elements of Britain’s changing economy and energy system. Renewable electricity has radically transformed the power sector, and electric vehicles are poised to revolutionise transport. Electricity could lower the cost and pollution from home heating and the daily commute, as well as the way in which large buildings and factories operate. Alongside electricity, other ingredients of the future energy system will include a growing role for data, minimising energy use when power is in short supply and maximising use when and where it is plentiful, flexibly managing demand and supply, making intelligent use of low carbon fuels and heat, and potentially capturing greenhouse gases. Together these changes are known as the ‘energy revolution’. There is strong global evidence of the imperative for this significant and – increasingly – urgent change.

Work towards the energy revolution is underway in UK, but so far much of the action has been behind the scenes. The sweeping changes to how we generate electricity have not changed what happens when you turn on the lights at home, but the next steps will impact on everyday life for many. The emergence of electric vehicles, intelligent home energy management and zero-carbon buildings are all necessary to stay competitive and honour our climate change and related policy targets. These will have profound implications on the cost of energy and how people receive energy services, so it is imperative to outline these changes for stakeholders of all types.

The UK’s energy transition is well described by national and international expert bodies, but mainly looking at individual components of the system in terms of technologies, costs and benefits. These studies treat countries and continents as a whole, potentially missing the important socio-economic and environmental differences that exist within countries.

This assessment is the first to examine Britain’s energy transition at the regional level, showing where each aspect of the energy system currently stands and where it must go to avoid being left behind.

This assessment is the first to examine Britain’s energy transition at the regional level, showing where each aspect of the energy system currently stands and where it must go to avoid being left behind. It looks more broadly than raw emissions reductions to consider the many infrastructural enablers for revolutionising the energy system.

Crucially, it explores what these changes will mean for individual households, businesses and society as a whole, and exposes the important regional differences that are developing within Britain. Without awareness of these regional disparities and their potential impacts, Britain risks creating a two-tier energy system, where some get ahead with the fuels and technologies of the future, while others are left behind with the higher costs, environmental and health problems that come from burning legacy fossil fuels – leaving millions of families and businesses less equipped to enjoy cheaper bills and better outcomes.

Britain risks creating a two-tier energy system, where some get ahead with the fuels and technologies of the future, while others are left behind with the higher costs, environmental and health problems that come from burning legacy fossil fuels – leaving millions of families and businesses less equipped to enjoy cheaper bills and better outcomes.

Britain’s energy transition progress

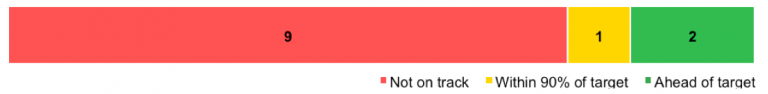

This report analyses Britain’s complex and highly interdependent energy system by considering power generation and then energy use in transport, buildings and industry.

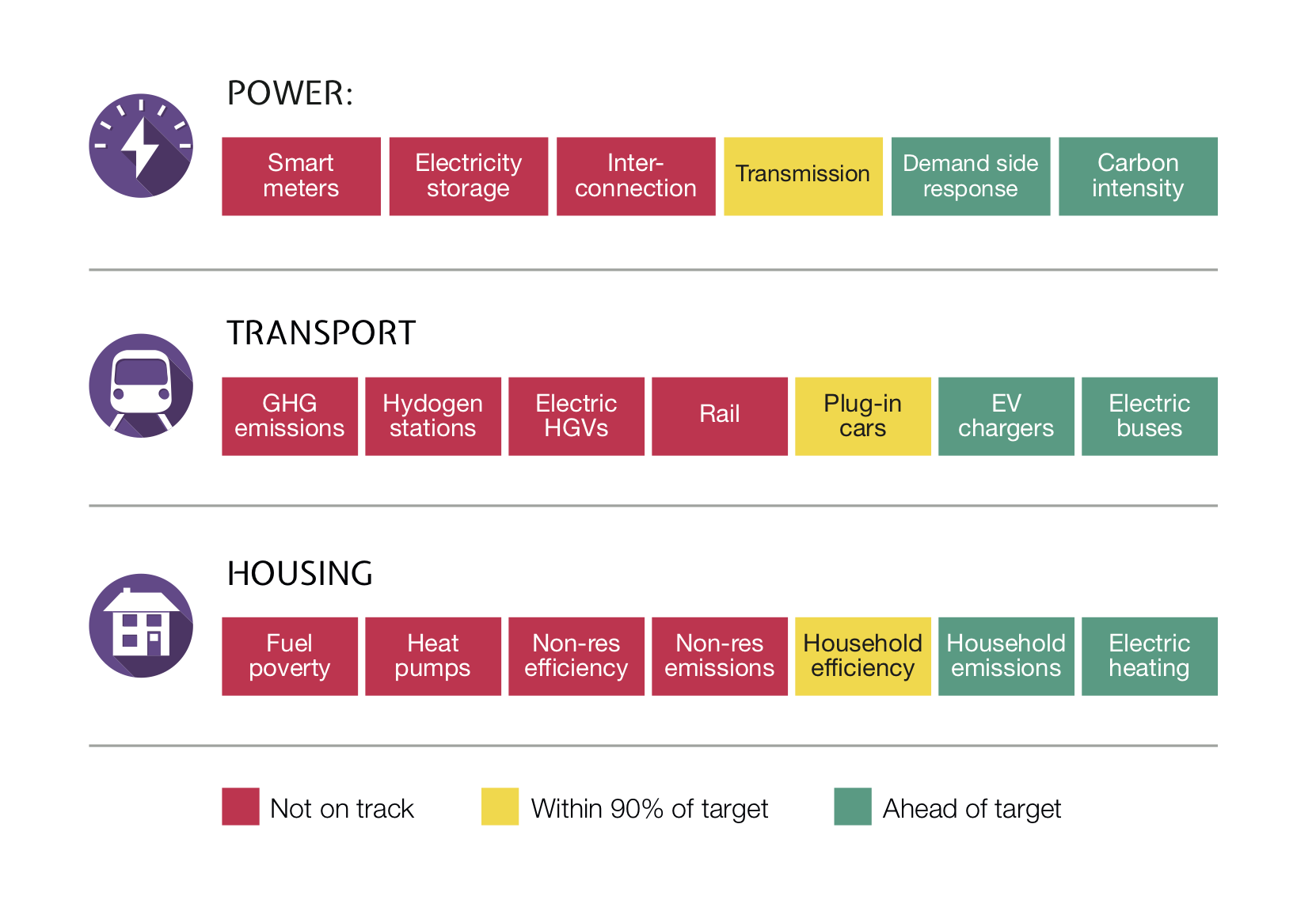

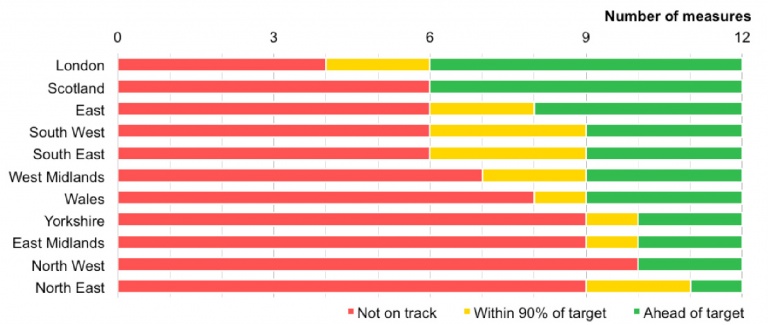

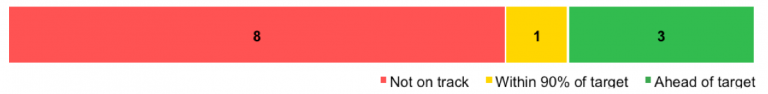

Within these four sectors, 20 measures have been devised to represent Britain’s progress towards having an energy system that’s fit for the future, and can serve households and businesses with clean, secure and low-cost energy. Aggregate progress is summarised with a ‘barometer’ below for three of the four sectors.

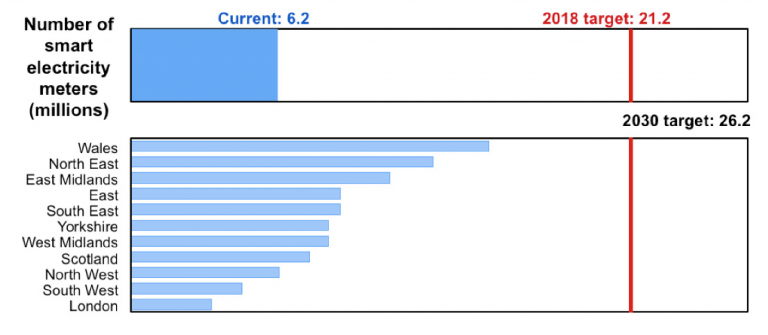

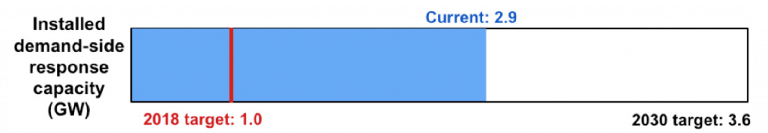

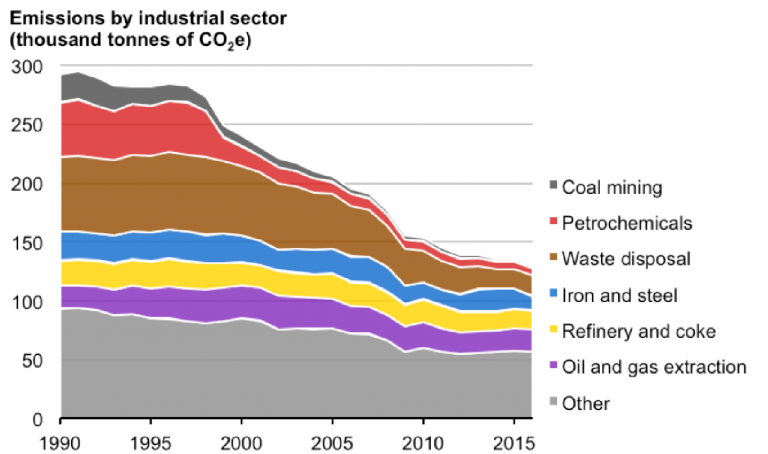

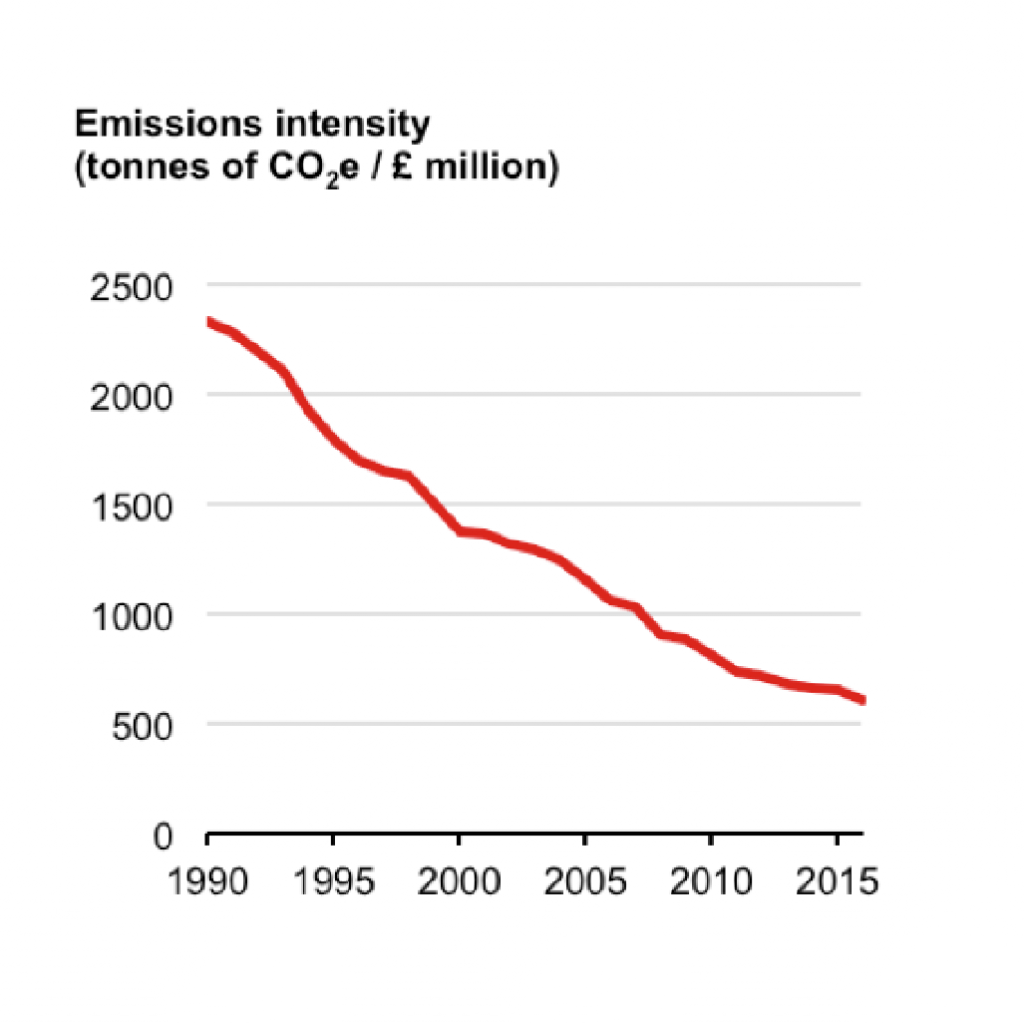

Britain’s greenhouse gas (GHG) emissions have fallen since 1990, but the decline is not evenly distributed across energy sectors. The outstanding success has been in the power sector, chiefly through closing coal-fired generation and the rise of renewables, also benefiting air quality. Further progress is expected, raising the importance of a smart and flexible power system that features demand side response, storage, interconnections and smart meters. Most of these areas are behind target, requiring immediate efforts to bring them in step with growing renewables.

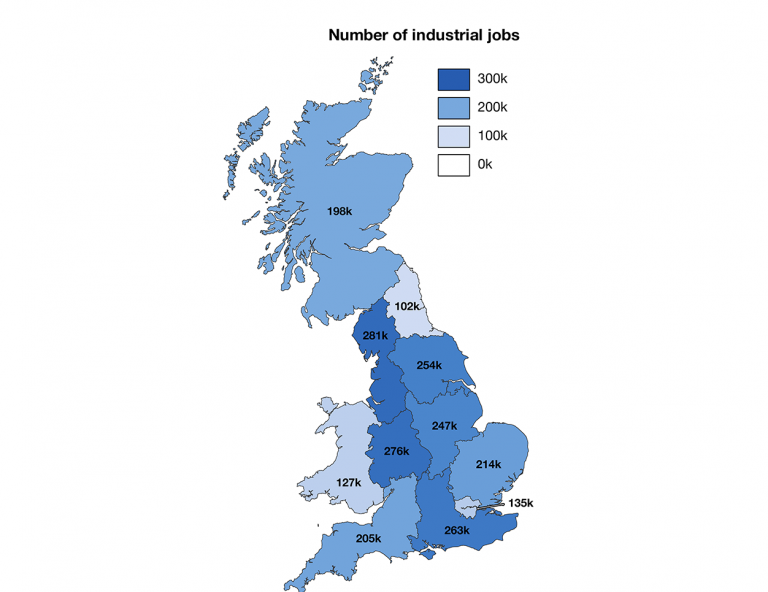

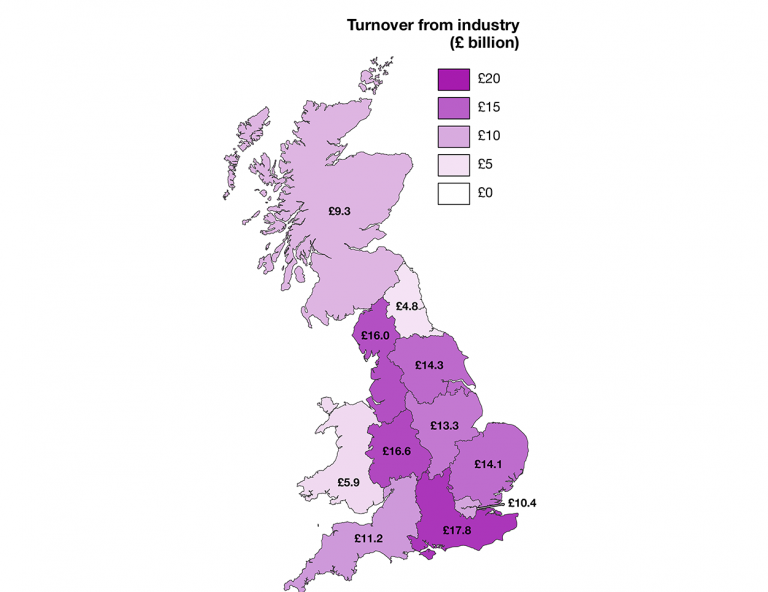

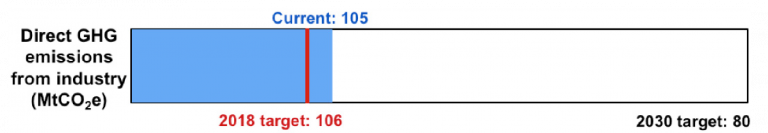

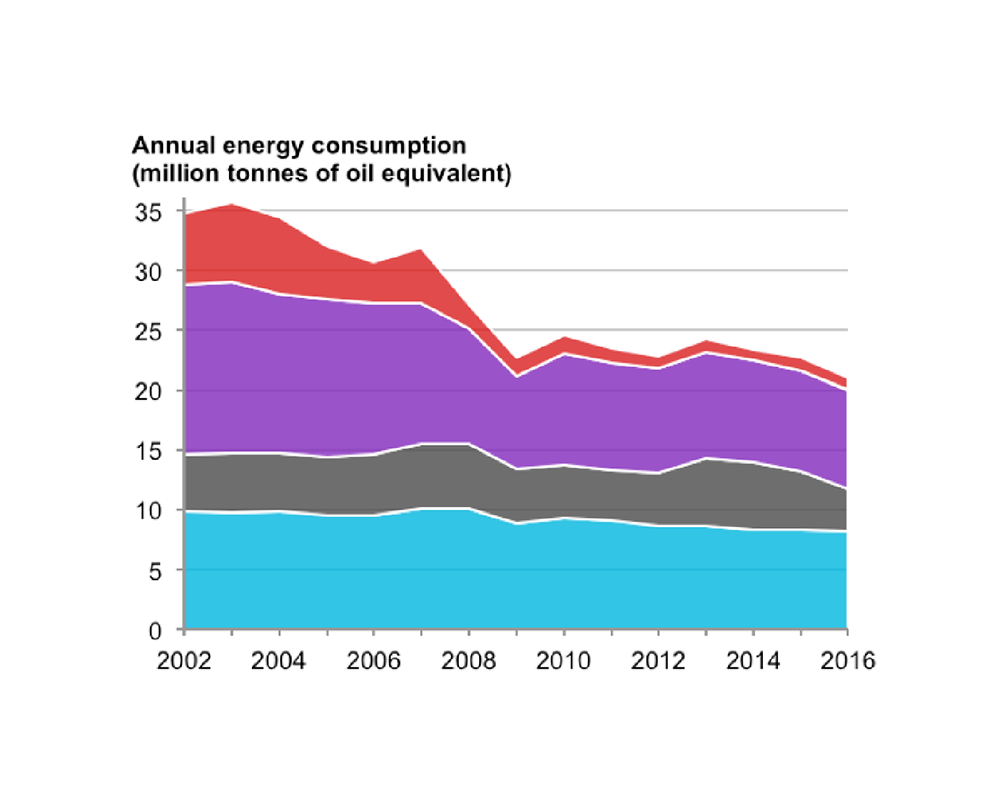

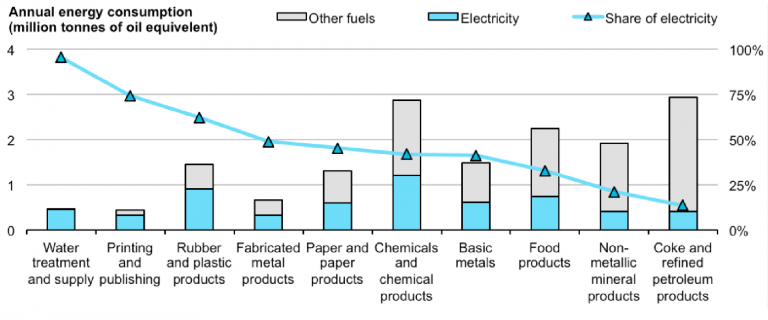

The rapid clean-up of the power sector has fed through into electricity-consuming areas such as industry, where economic growth has decoupled from GHG emissions. Britain’s industry is currently on track to reach climate targets. Absolute electricity use in industry has stayed constant while fossil fuel combustion has declined, as processes have been electrified and efficiency increases have been made. Further electrification will be harder, so GHG reductions may need to come through technologies such as hydrogen and carbon capture use and storage (CCUS).

All of this is made harder still by the need for most industries to remain internationally competitive whilst avoiding the ‘offshoring’ of emissions and jobs to other countries.

In contrast with the power sector, the limited pace of transformation in transport and domestic heating means that there is much more to do. Of particular concern is air quality in Britain’s cities and the slow progress being made on diesel pollution, but CO2 emissions from transport are also on the rise, especially from goods vehicles. The stage is set for a radical shift in transportation thanks to recharging infrastructure growth and EV sales picking up; over a quarter of new vehicle sales are expected to be ‘plug-ins’ by 2030 and forecasts are frequently being revised upwards. Electric buses are finding a place in cities where pollution is a pressing problem, but electric goods vehicles are some way behind. Hydrogen vehicles and infrastructure remain in their infancy in UK, though these provide a zero emission option for goods vehicles, where batteries appear less suitable. Furthermore, hydrogen may offer a means to electrify railway lines where the cost of overhead power lines is prohibitive.

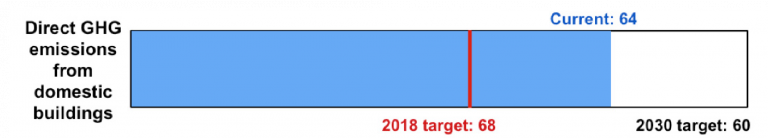

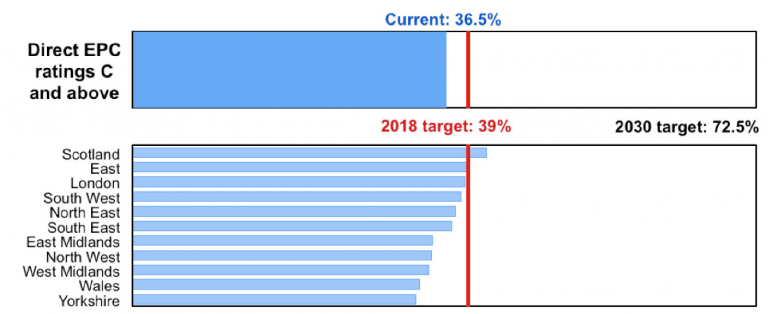

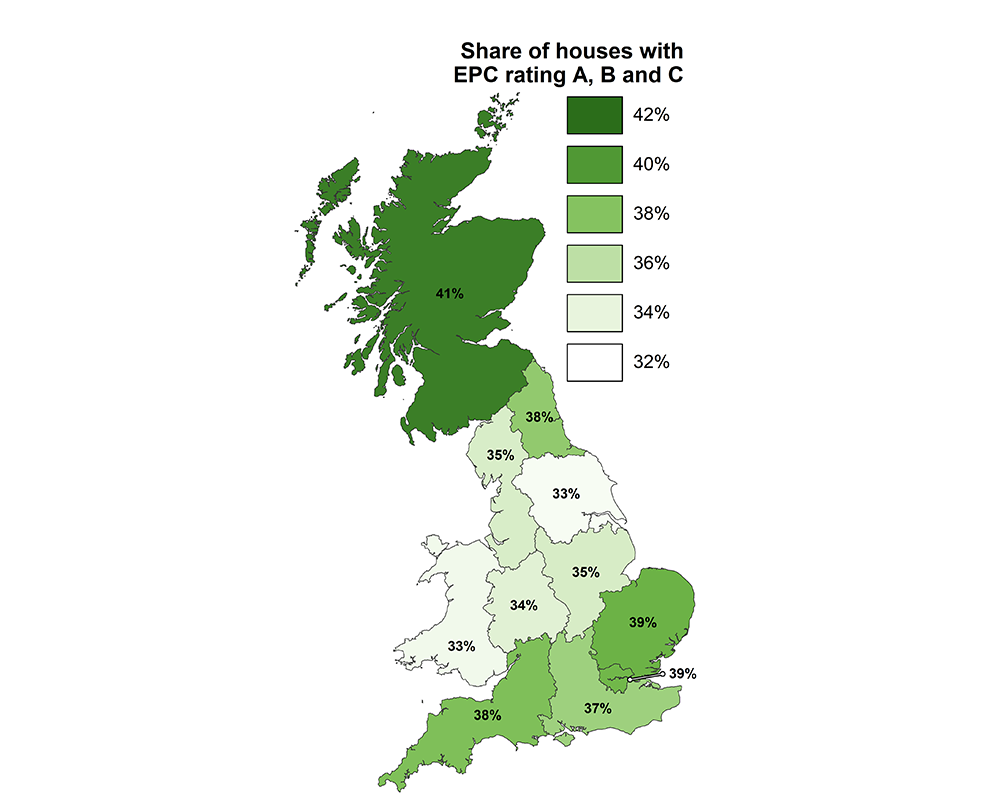

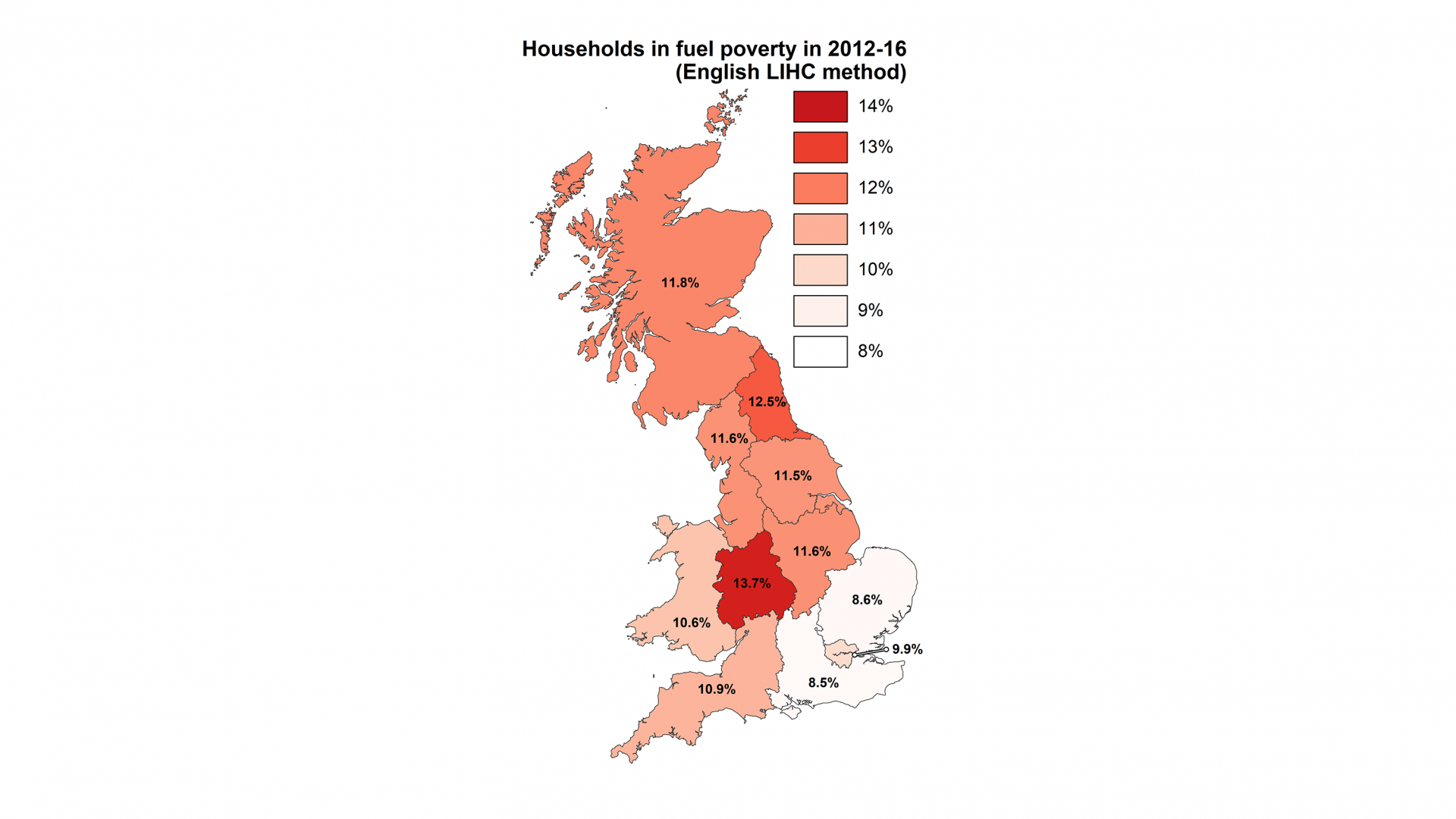

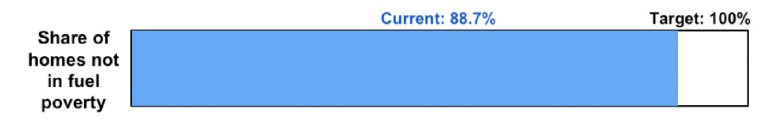

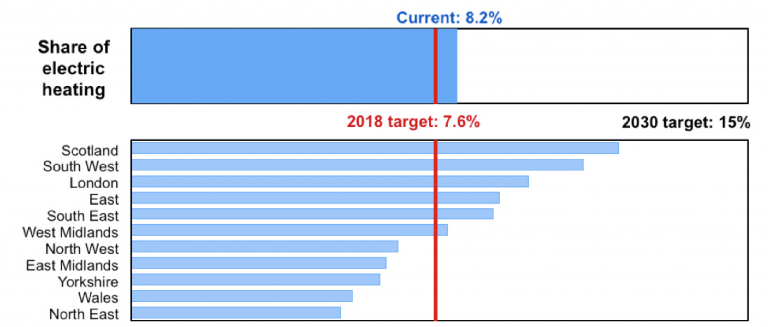

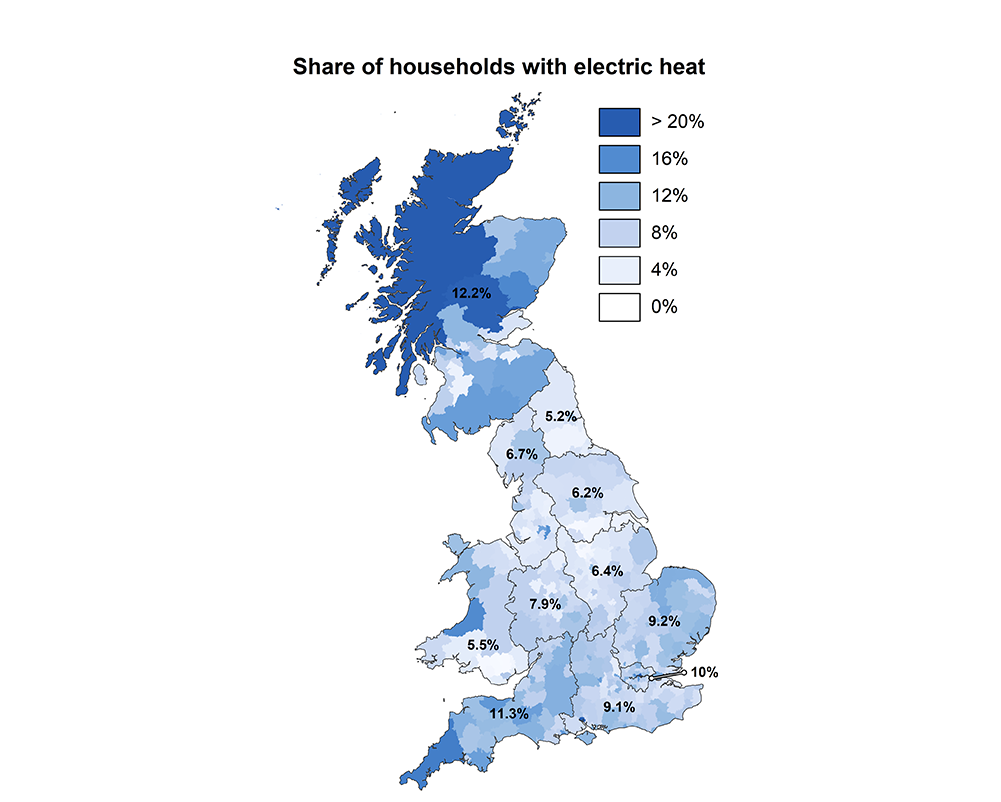

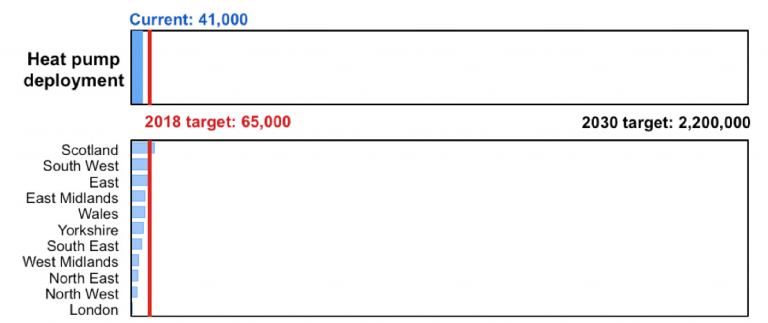

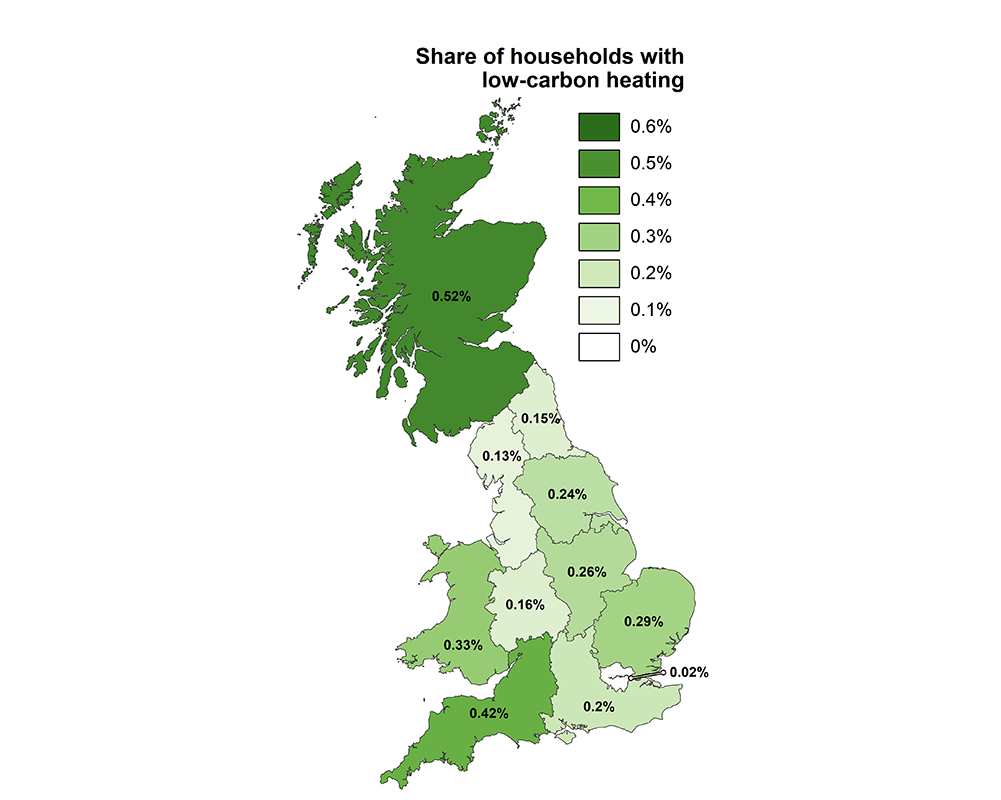

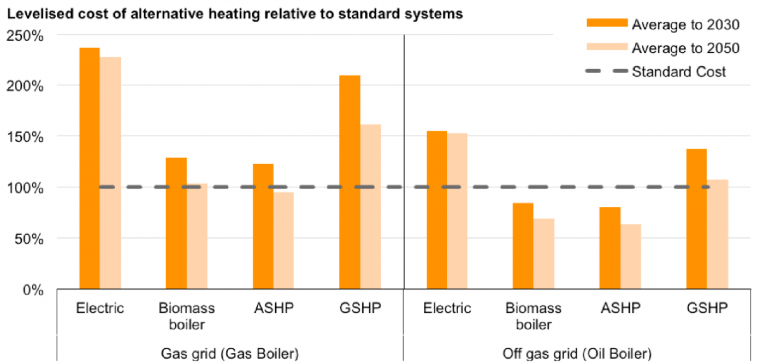

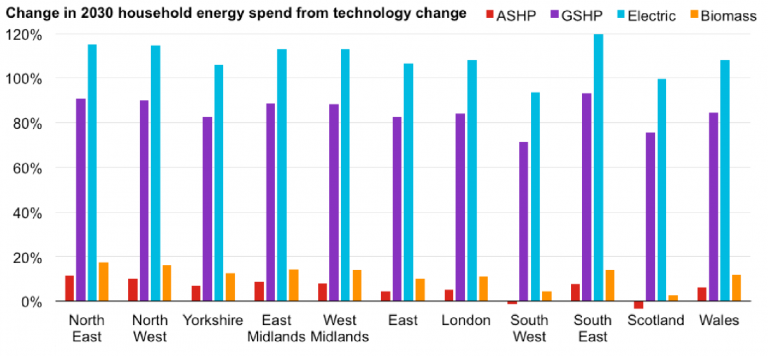

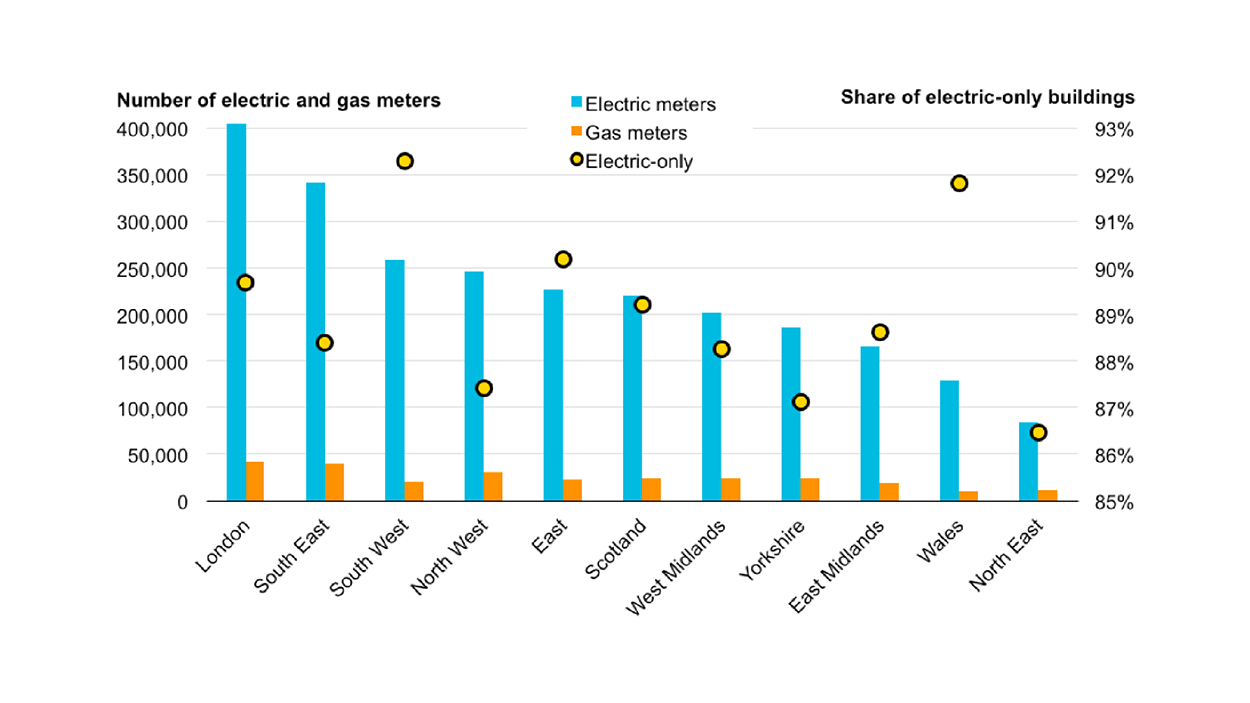

The efficiency of Britain’s building stock is a critical issue, with 13% of homes suffering from fuel poverty, and non-domestic buildings generally worse than households. UK buildings remain largely heated by fossil fuels, so only a few parts of the UK are well-placed to benefit from the decarbonisation of power through electric heating. The outlook for heating is unclear, with heat pumps, electric heating and hydrogen each having their proponents, but no overall direction. Regardless of the pathway choice (which is needed urgently) building efficiency will be a core feature. Thankfully, appliances and lighting in buildings have seen improved efficiency and thus reducing pressure on energy bills and indirect GHG emissions from the power sector.

Regional disparities

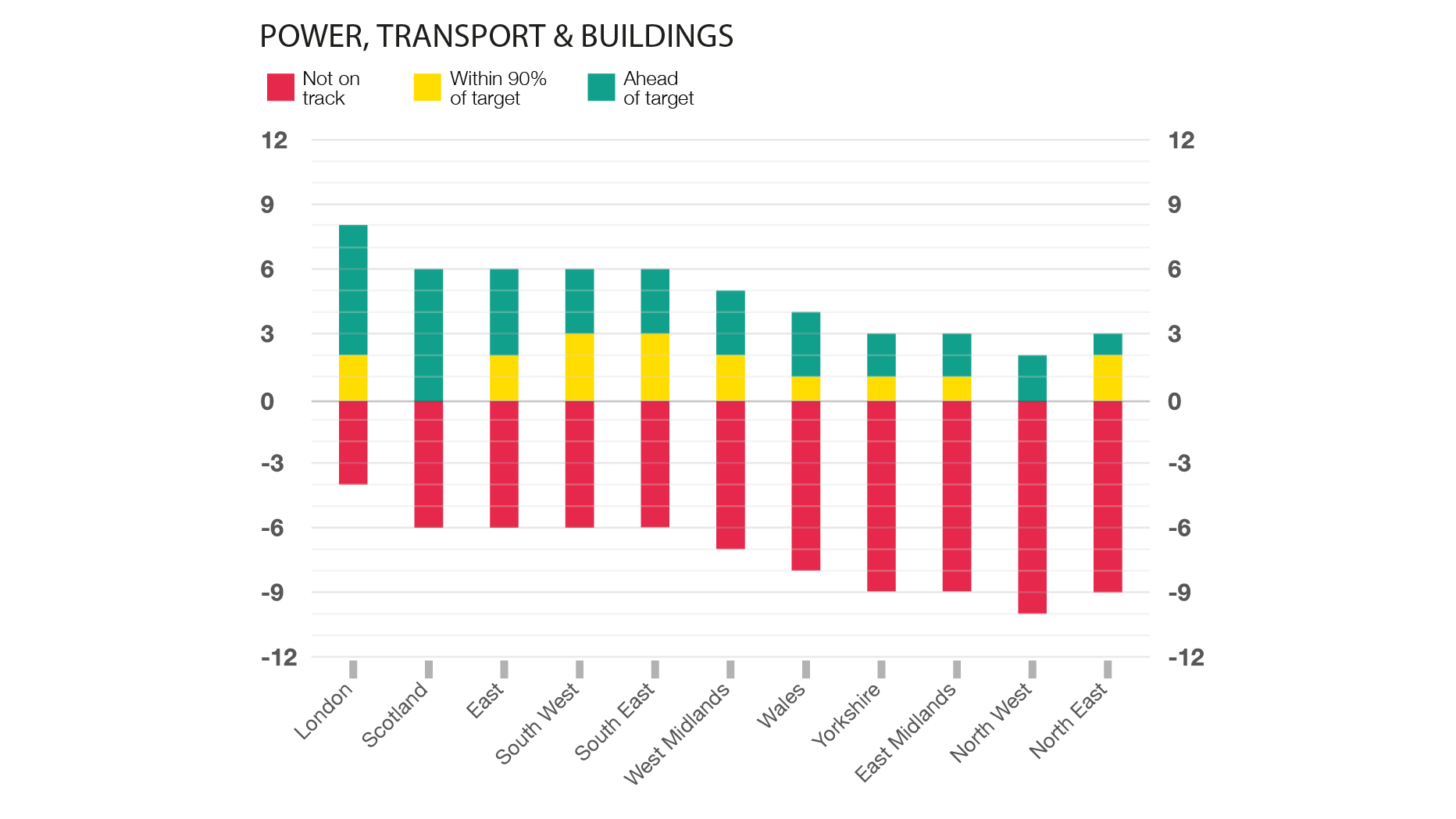

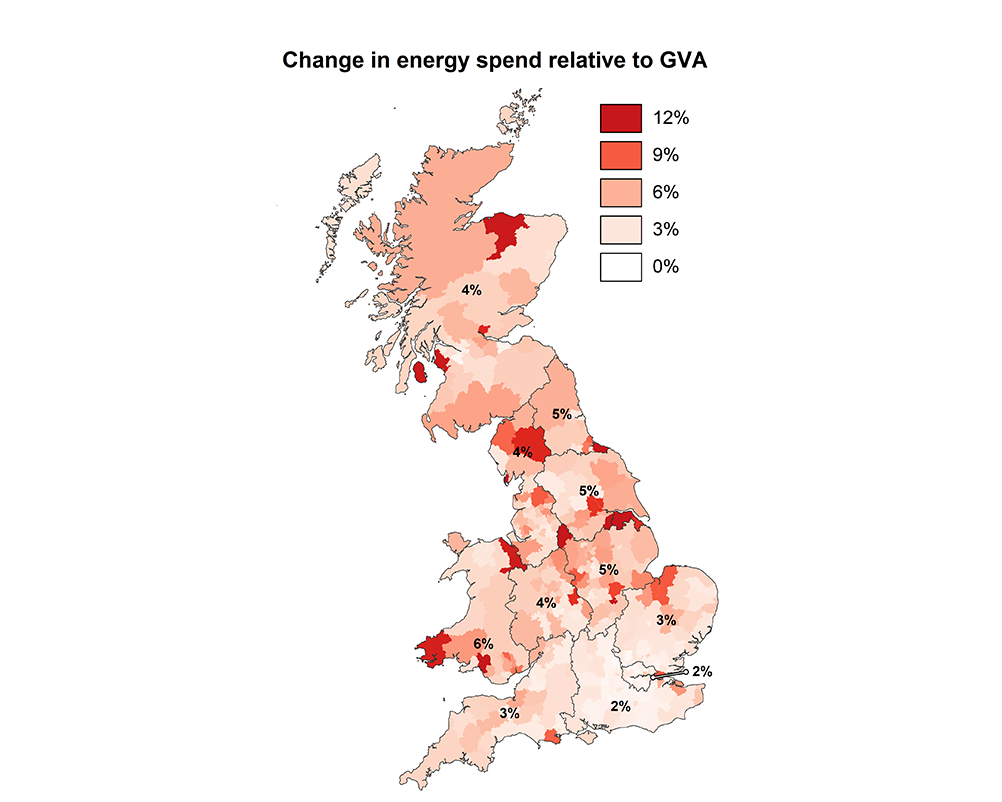

Progress in transforming Britain’s energy system is uneven and this report reveals marked differences between the regions.

Generally, more affluent regions have made significantly greater progress. The north of England is falling well short, with only

London and Scotland coming close to being on track to meet their overall targets. This first step towards exposing the differences between the regions paints an instructive picture of Britain’s unequal progress, and it should be remembered that differences within individual regions will be similarly important.

Renewable power generation is distributed according to natural resources, so England has much less low-carbon power per person than Scotland and Wales. However,

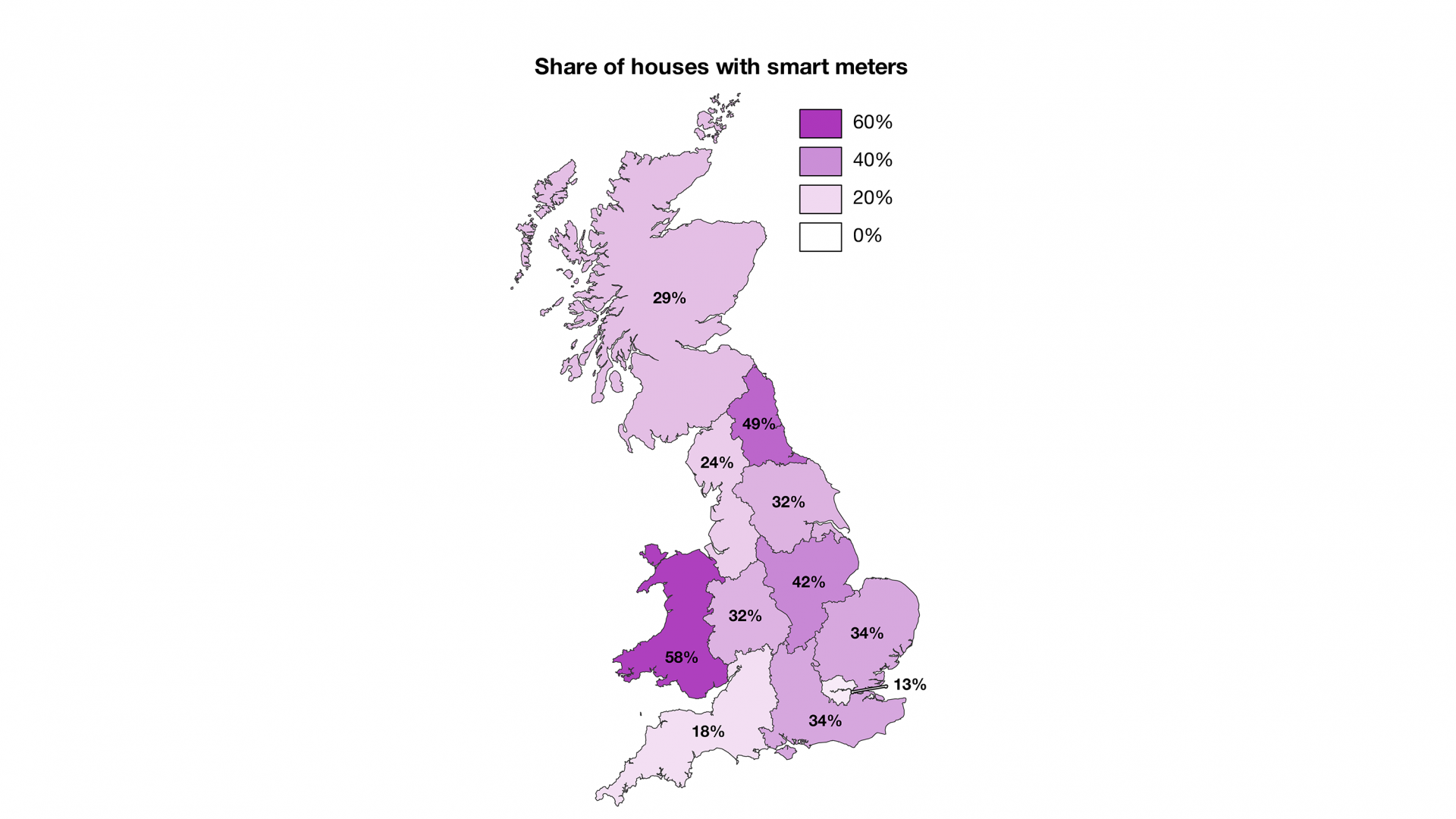

Scotland and Wales also have some of the lowest transmission capacities to neighbouring regions, holding back further development of renewables. In contrast with the general picture for most metrics, Wales and the North East have the highest penetration of smart meters in Britain, London the lowest.

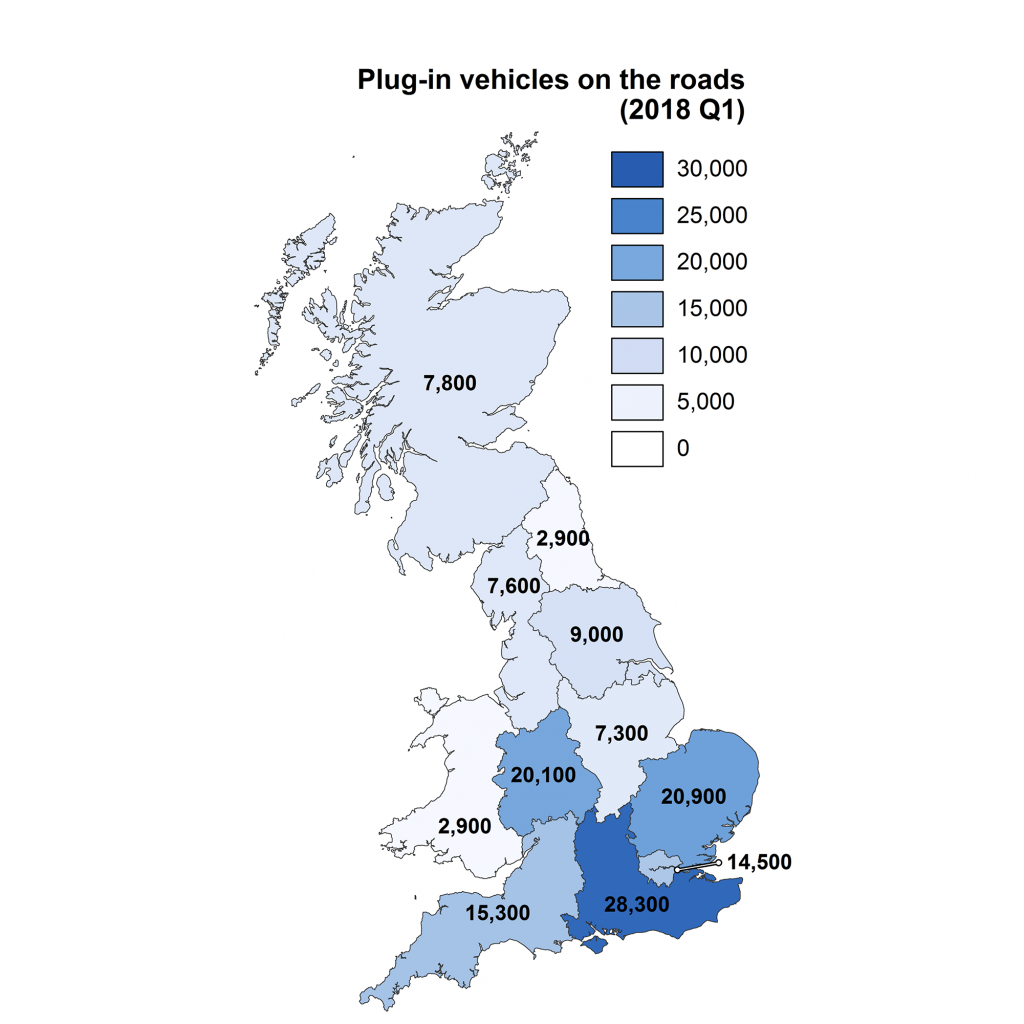

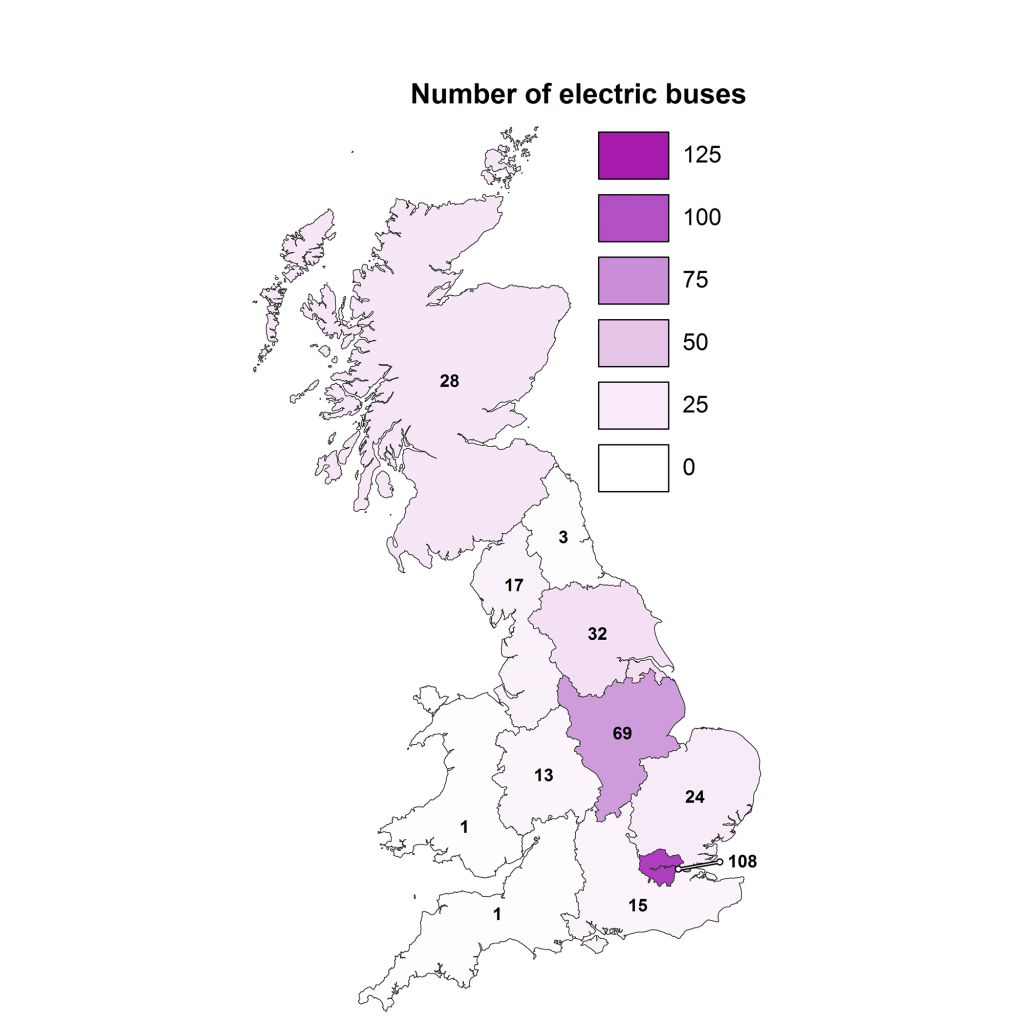

In a fast-changing transport picture, the West Midlands and the East currently have the highest uptake of passenger electric vehicles, London has the most electric buses, while the South East, northern regions of England and Scotland have the highest share of ultra-low emission HGVs. On an absolute basis, however, the south of England is leading in the deployment of plug-in electric vehicles, which is correlated to higher household incomes in these regions.

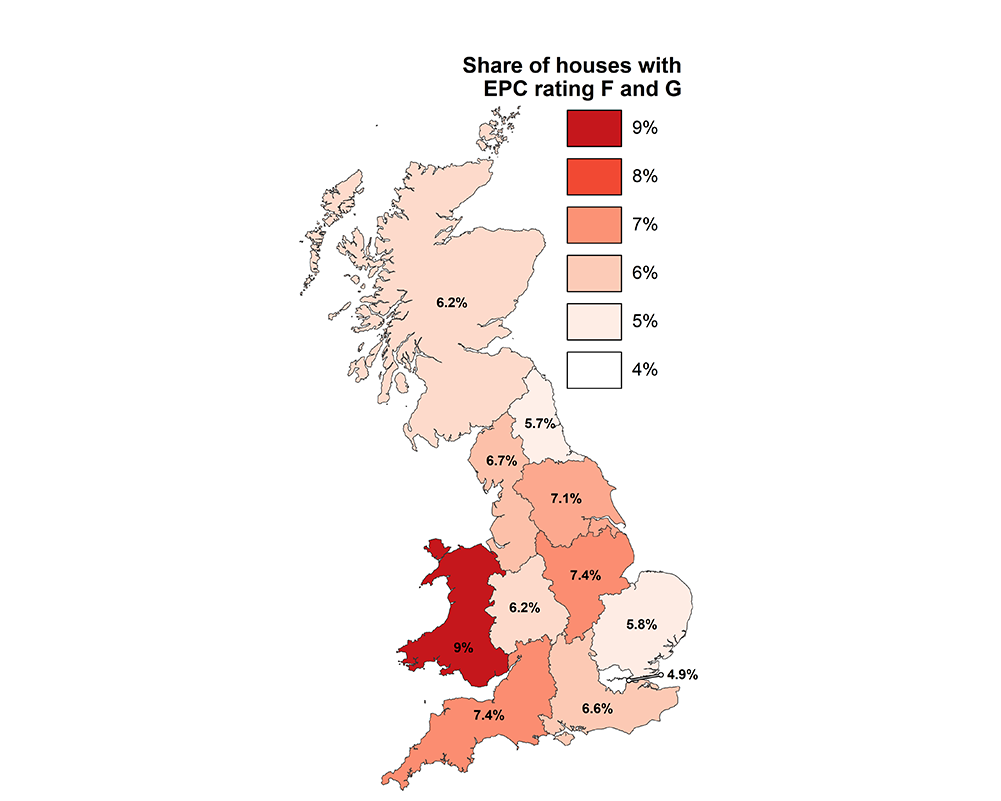

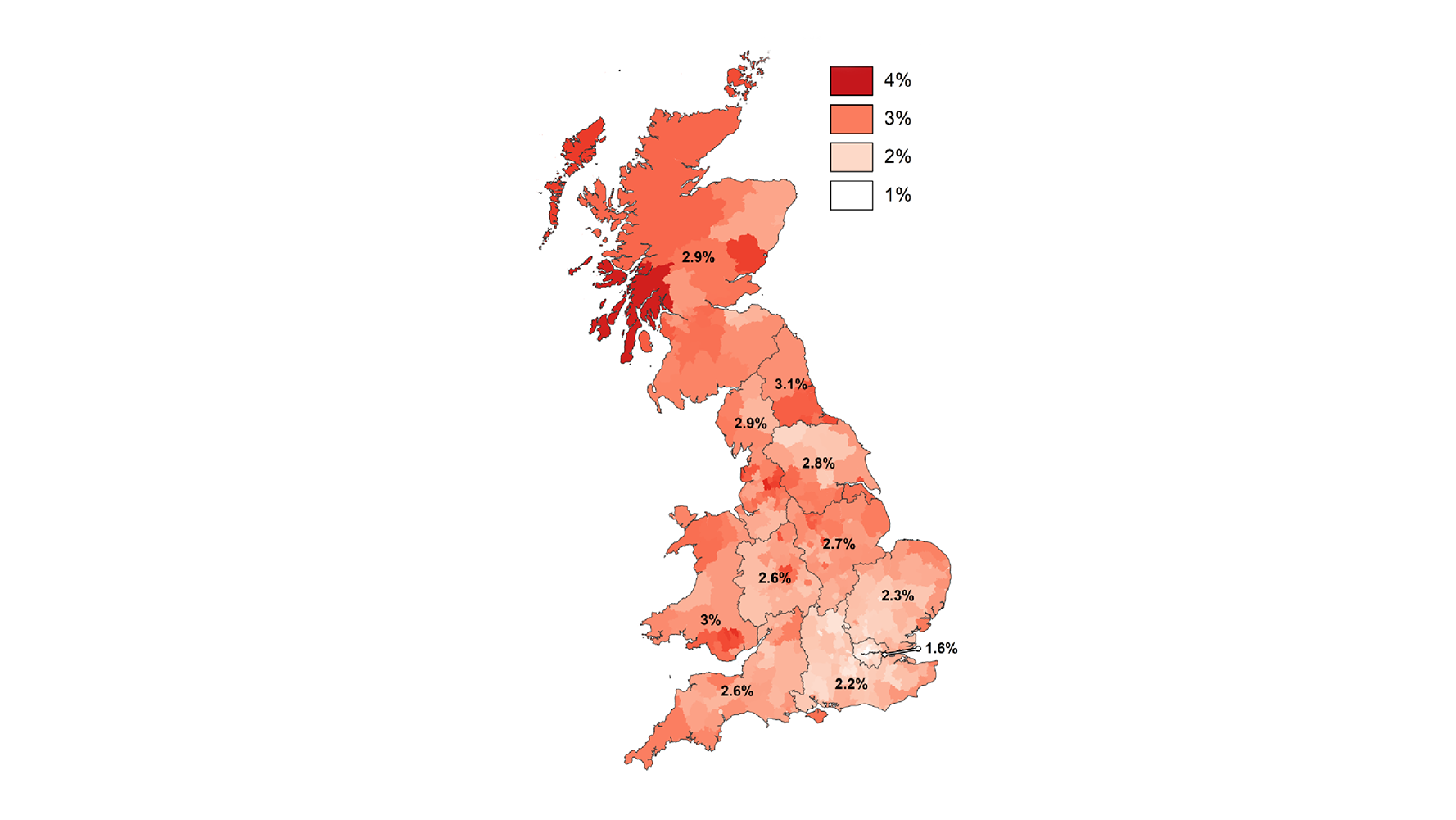

Energy efficiency in buildings is neglected across Britain, and much lower than is justifiable. However, it is generally better in the south of England and Scotland and worse in the Midlands, northern England and Wales. The North East has done the most to fix low-efficiency houses, but still has high fuel poverty rates due to income levels and remaining poor quality buildings.

Implications for individuals, businesses and society

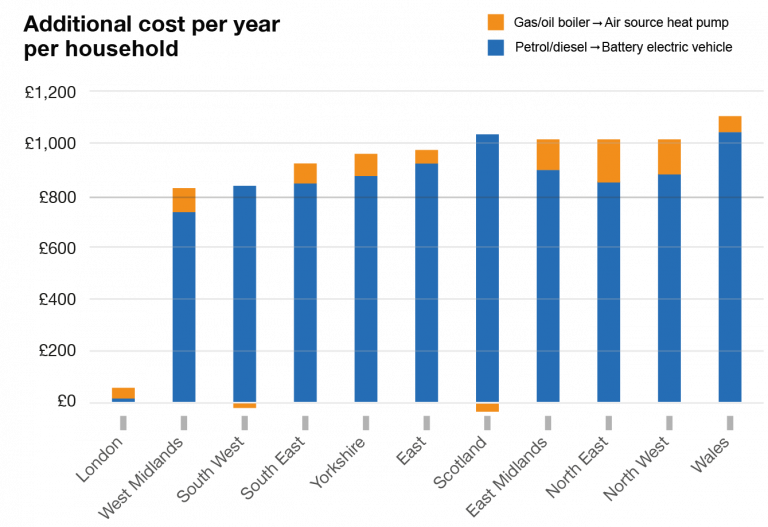

Cost reductions in key technologies such as renewable generators and batteries show that the costs of transforming the energy system could be modest. Ultimately, moving to modern clean energy could result in the lowest bills, although any increased capital costs to consumers and businesses should be considered in the context of affordability.

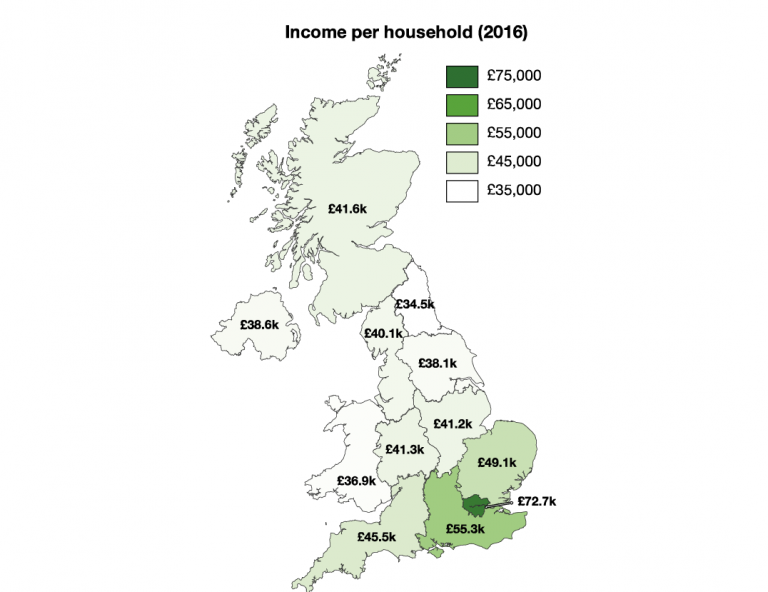

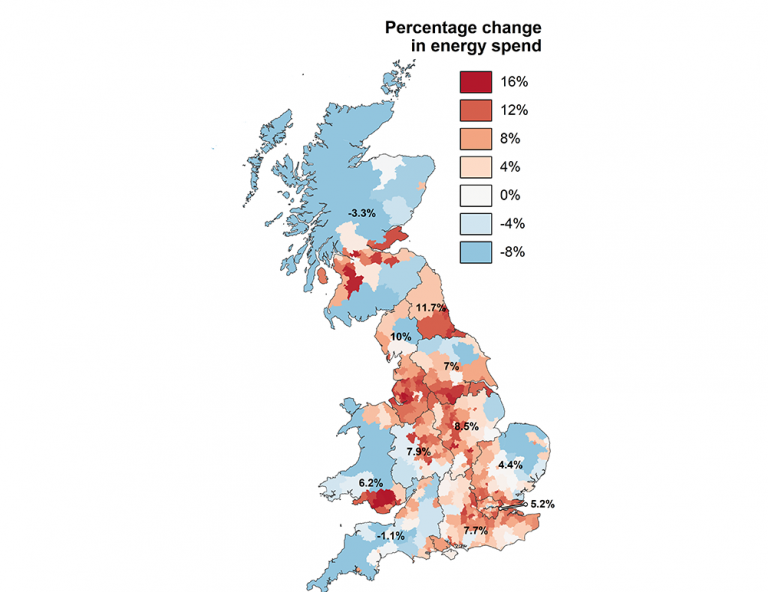

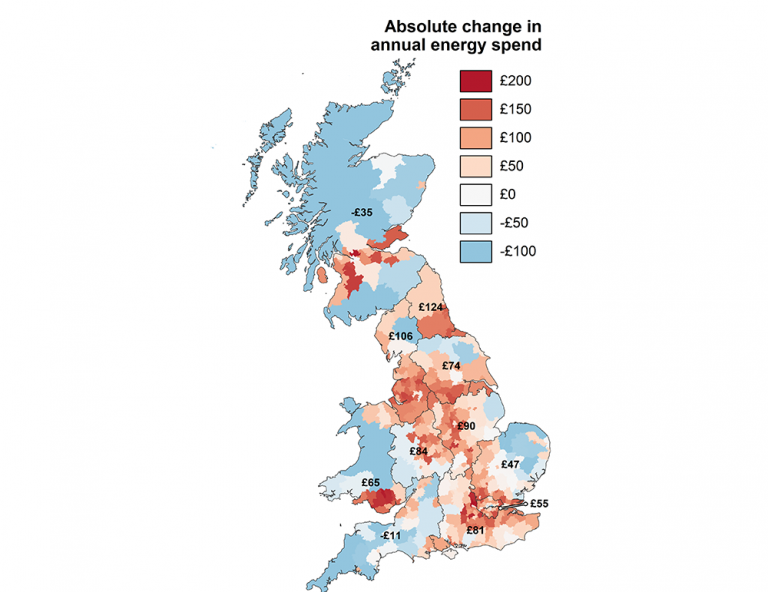

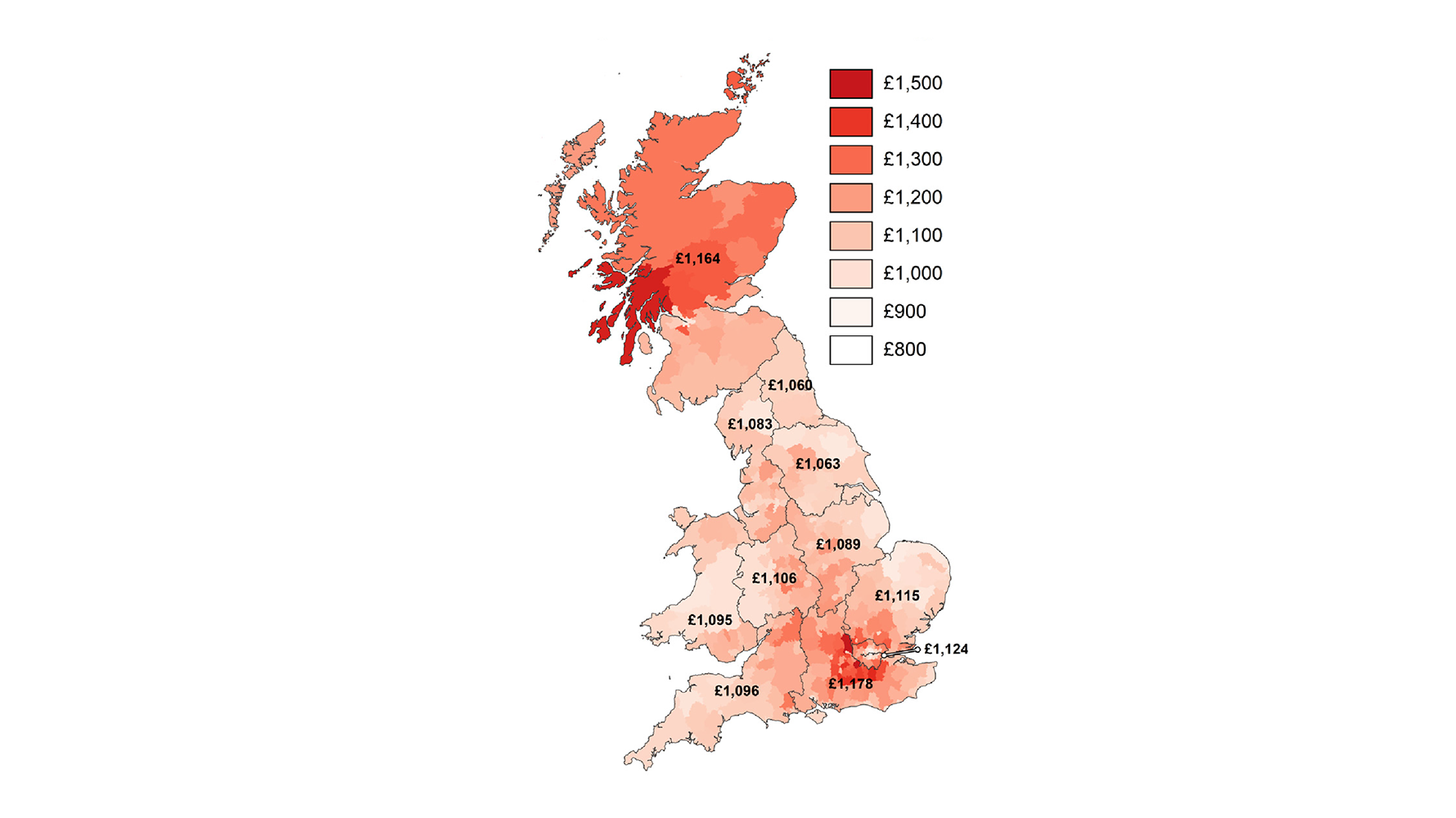

Homes and companies in London and the South East spend less on energy relative to income. Those in Wales and the North East spend the most, so any changes to energy costs will make the greatest difference to the welfare and profits of homes and businesses in these areas. In transport, the total cost of owning electric vehicles is on track to reach parity with conventional vehicles. However, the higher upfront purchase price of EVs poses a greater affordability barrier in less affluent regions. Scotland and

Wales have lowest EV affordability, the West Midlands and London the highest. If marked differences in uptake arise from this, Britain’s cities could see rising inequality due to the health effects of air pollution.

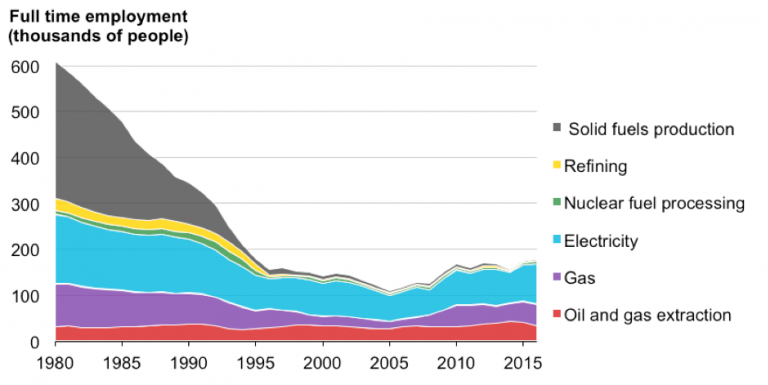

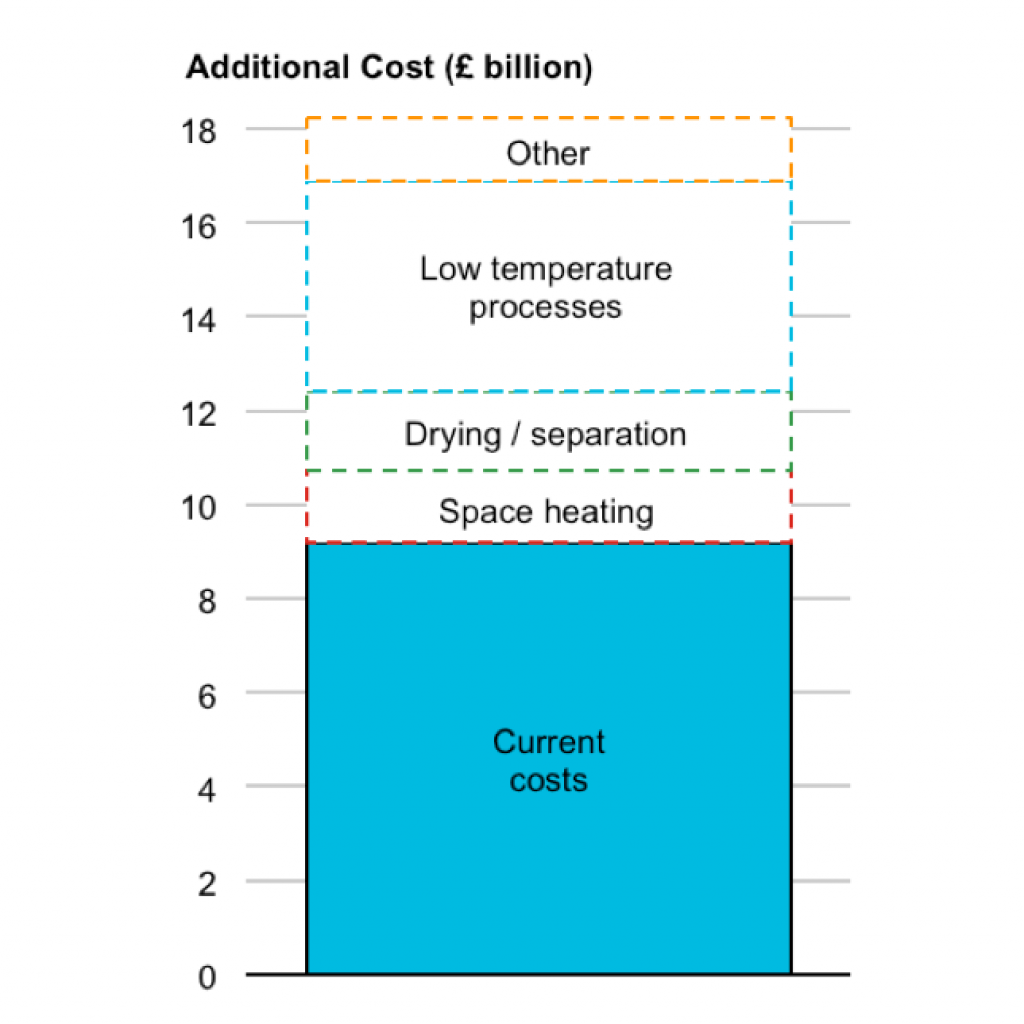

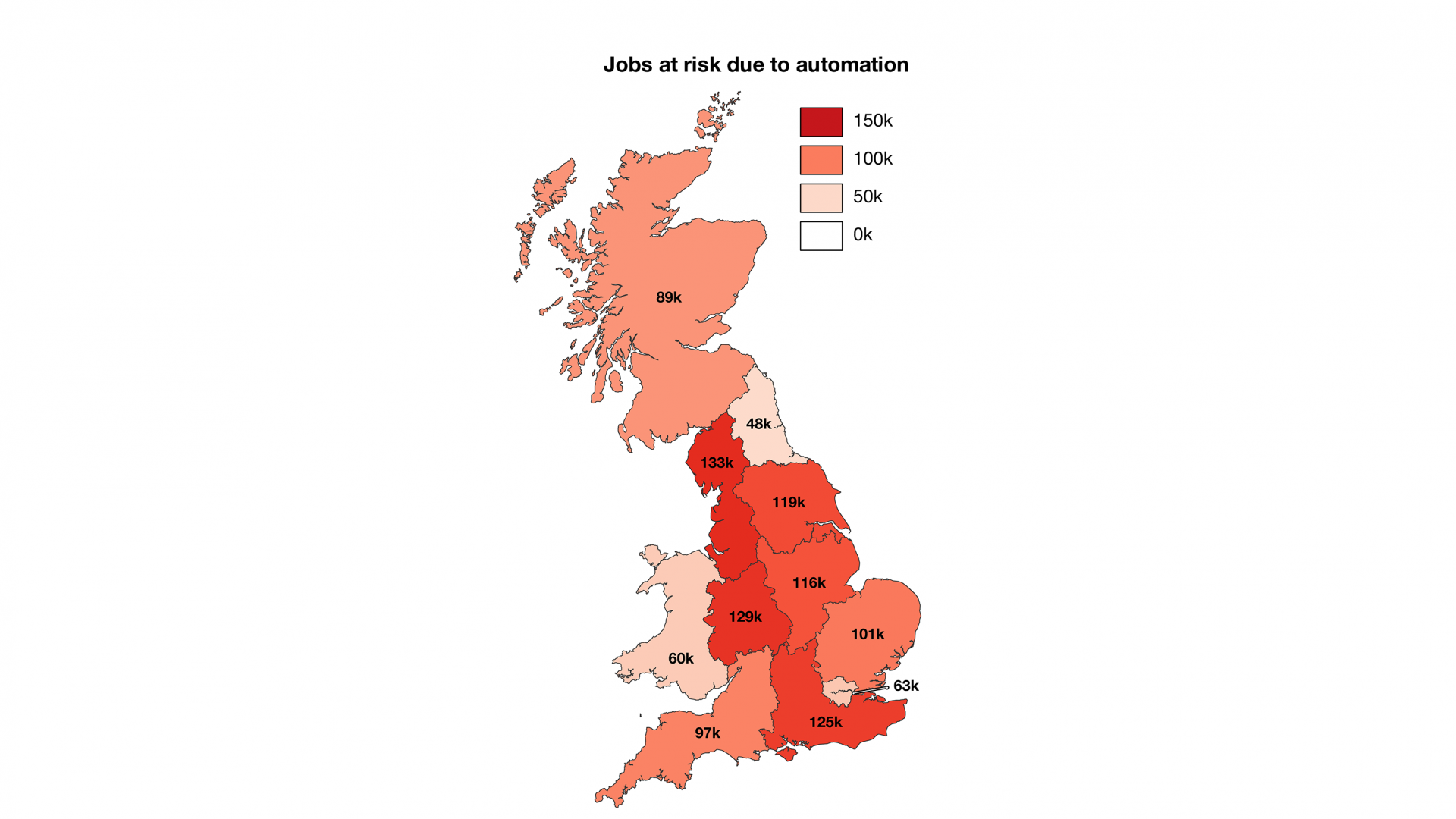

In industry, further electrification may be difficult without impacting on energy costs, unless measures are taken to level the playing field. The changing power mix is shifting employment patterns, with job losses in fossil fuels offset by gains in new industries, often in poorer remote areas. Electrification and automation often go hand in hand, and the South East, Midlands and north of England face the highest risk of job losses from automation.

Overall conclusions

In this first assessment of Britain’s energy transition, there is much to be positive about, but the observation that “the future is already here – it’s just not very evenly distributed” applies.

The rapid decarbonisation of electricity is a feather in the UK’s cap, providing a means to transform electricity-intensive sectors. Buildings and to some extent industry are already benefiting, whilst transport is potentially well-positioned.

There are tough challenges ahead though, since areas such as heavy industry, freight transport and some parts of heating do not immediately lend themselves to electrification, so other options need to be considered.

The uneven distribution of change also applies regionally and socially. A looming concern is the effect of disparities in the energy transition, with some at risk of being left behind economically due to unaffordable changes.

As in other walks of life London stands apart, whilst less affluent regions in the north and elsewhere are falling behind on many measures.

As in other walks of life London stands apart, whilst less affluent regions in the north and elsewhere are falling behind on many measures. If the sole aim of the transition were to decarbonise energy, it might be rational to focus on wealthier metropolitan areas like London ahead of the rest of the country. However, if this begins to affect our way of life through the cost of energy, quality of services and air pollution then such a strategy risks creating a twotrack energy system that worsens regional inequality. To be effective, the UK’s energy transformation needs be a force for good across society and across the UK, not just where it is most convenient.

To be effective, the UK’s energy transformation needs be a force for good across society and across the UK, not just where it is most convenient.

Introduction

1.1 Context and motivation

The energy transition is being driven top down by climate and environmental policy and bottom-up by evolving consumer preferences and technological innovation. Britain has made excellent progress in transforming its power sector, at a world-leading pace, which has allowed decarbonisation that is largely invisible to consumers – no change in lifestyle, added daily considerations and little impact on bills.

There is a growing recognition that change must now sweep through other sectors; we must transform the way energy is provided in homes, businesses, transport and industry. There is a huge opportunity for newly-cleaned electricity to transform these sectors.

The key gaps are:

- Understanding how the country is progressing more broadly towards a transformed energy system. Carbon emissions are well understood, but are the wider changes to electrification and its enabling infrastructure also making headway

- Understanding the differences within Britain – national studies mask regional differences – are we at risk of creating winners and losers in the energy transition?

This change could have profound social and economic implications for the country.

If some sectors or regions forge ahead and others are left behind, this could create a two-speed economy and lead to substantial differences in the cost of energy.

Some may be forced to use legacy infrastructure and support it together with a dwindling consumer base, whereas others may take advantage of affordable lowcarbon solutions independent from these costs.

1.2 Scope and methods

1.2.1 About this study

This study sets out to explore the current status of the power system and how it needs to change to deal with electrification demands and the need for low-carbon power. The current status, targets and regional disparities in the energy transition in end-use sectors are mapped. Finally, the implications that can be drawn from these results for technologies and socio-economic factors are evaluated, focussing on affordability, competitiveness and jobs.

This work was commissioned by Drax to assess the state of energy system transformation across all sectors. It is delivered independently by academics at Imperial College London and sustainable energy consultants E4tech. This report is the start of an ongoing discussion titled Energising Britain, where future outlook reports will address aspects of the energy transition.

1.2.2 Technological and geographical scope

The Energising Britain work examines Britain’s energy system in the context of the 2008 Climate Change Act and the COP21 Paris Climate Agreement. To achieve this, not only power but also the transport, buildings and industrial energy sectors need to be decarbonised.

Given the ongoing decarbonisation of the electricity system and the continuously falling costs of renewables, this work investigates how all energy sectors can be decarbonised through electrification. This entails the use of lowcarbon generation technologies, hydrogen and carbon capture use and storage (CCUS) where suitable.

To understand the regional differences in how Britain’s energy system is being transformed, this report considers the 11 unitary regions of Great Britain (Scotland, Wales, and 9 in England). Northern Ireland could not be included due to the availability of data, and because of the different electricity markets operating on the islands of Ireland and Great Britain. Northern Ireland accounts for approximately 3% of the population and energy consumption of the UK.

1.2.3 Underlying methodology

The main principle for our assessment is to derive metrics that identify the state of transition of the energy system.

These metrics are presented as a ‘barometer’ which sets out three points:

- the end-point of the transformation for the target year in the scenario (e.g. total number of EV charging points in 2030),

- the current state of transformation (e.g. number of charging points operational), and

- an indication of where we would

have to be to meet the target

(e.g. number of charging points).

Justifiable targets for each metric are derived which show the state of transformation and where we should be if we are to fulfil our legal obligations. The end-point targets allow us to locate our position in the energy transition in line with carbon budgets and climate targets.

National and regional level data have been gathered for each metric in order to explore regional disparities and their implications for people. This translates energy systems findings into social and economic implications. The analysis is based on public data, primarily government sources, providing transparency, accuracy and independence. Especially in the case of target definitions for individual metrics, the study relies on energy system scenarios, published by National Grid, HM government including BEIS and the Committee on Climate Change (CCC).

1.3 Background

1.3.1 The regions of Britain

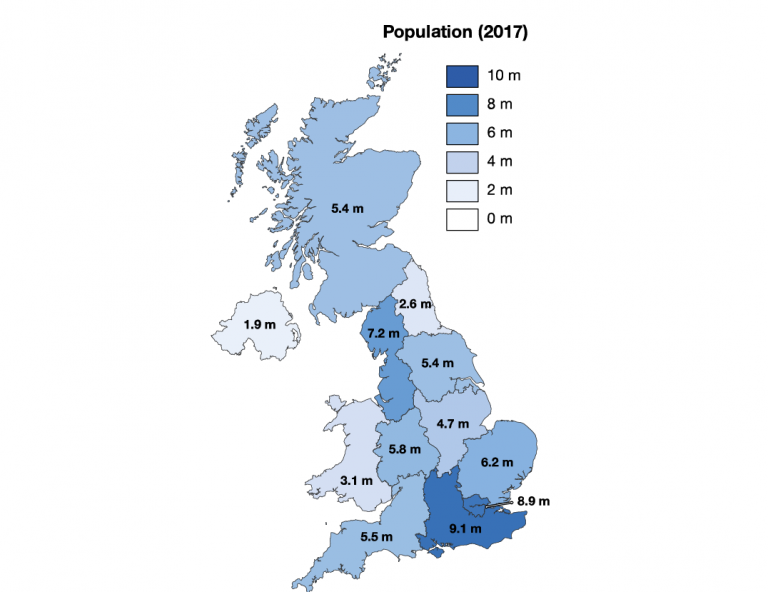

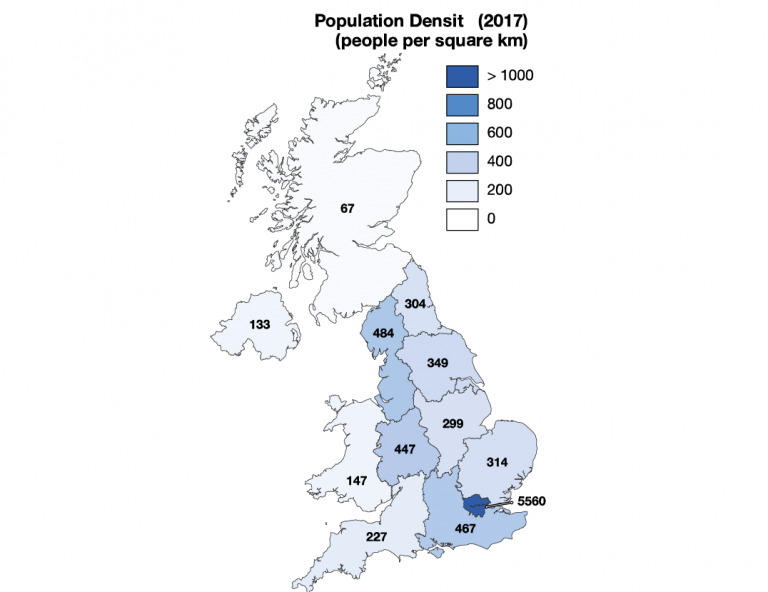

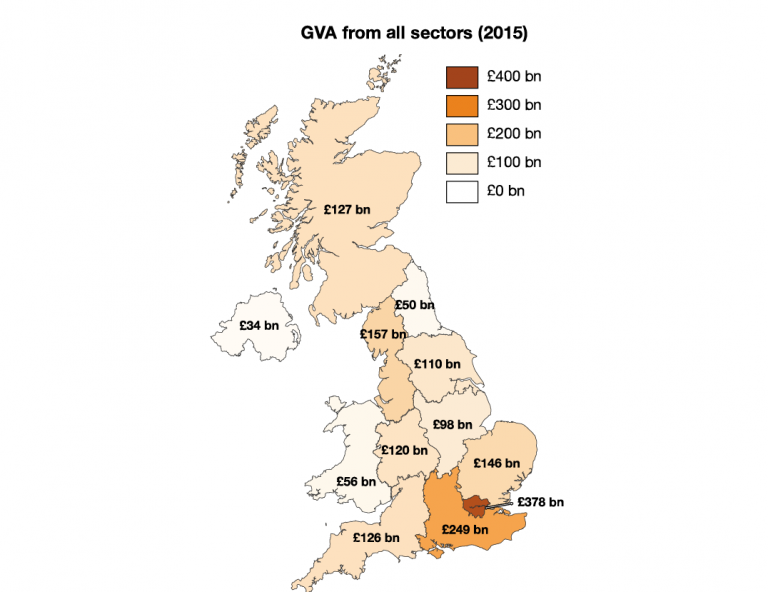

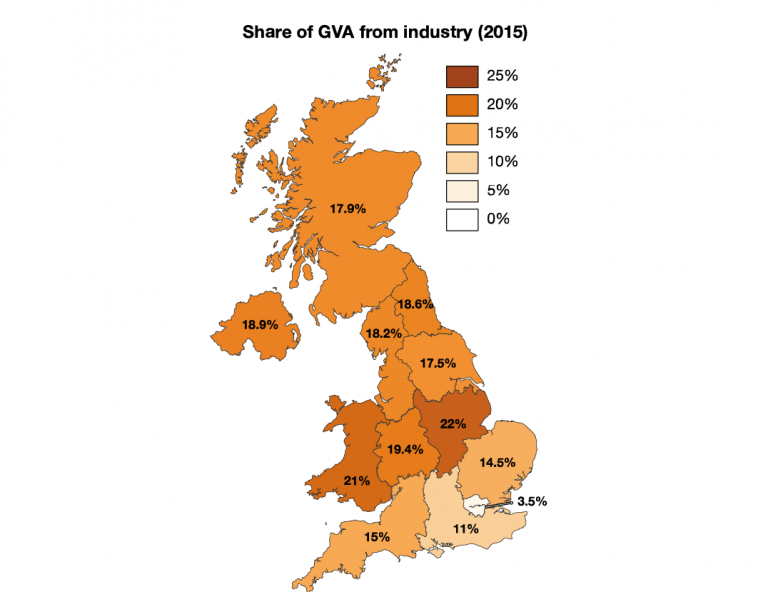

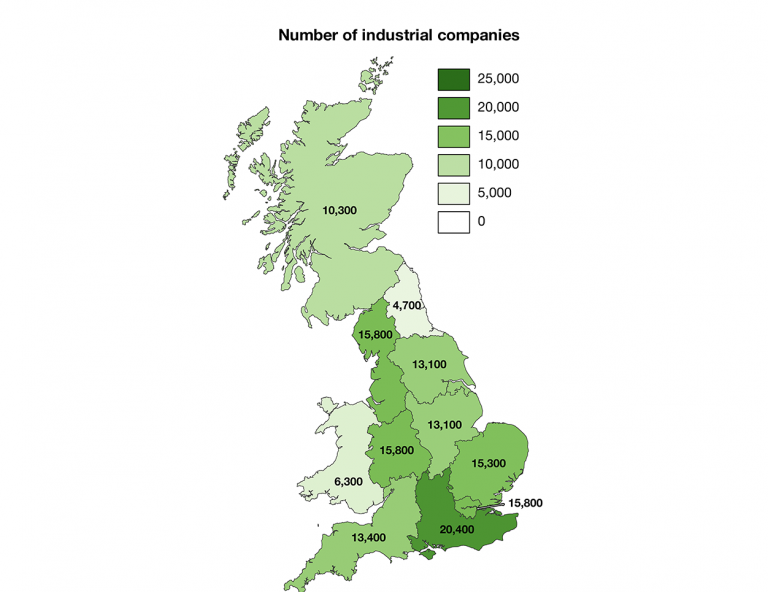

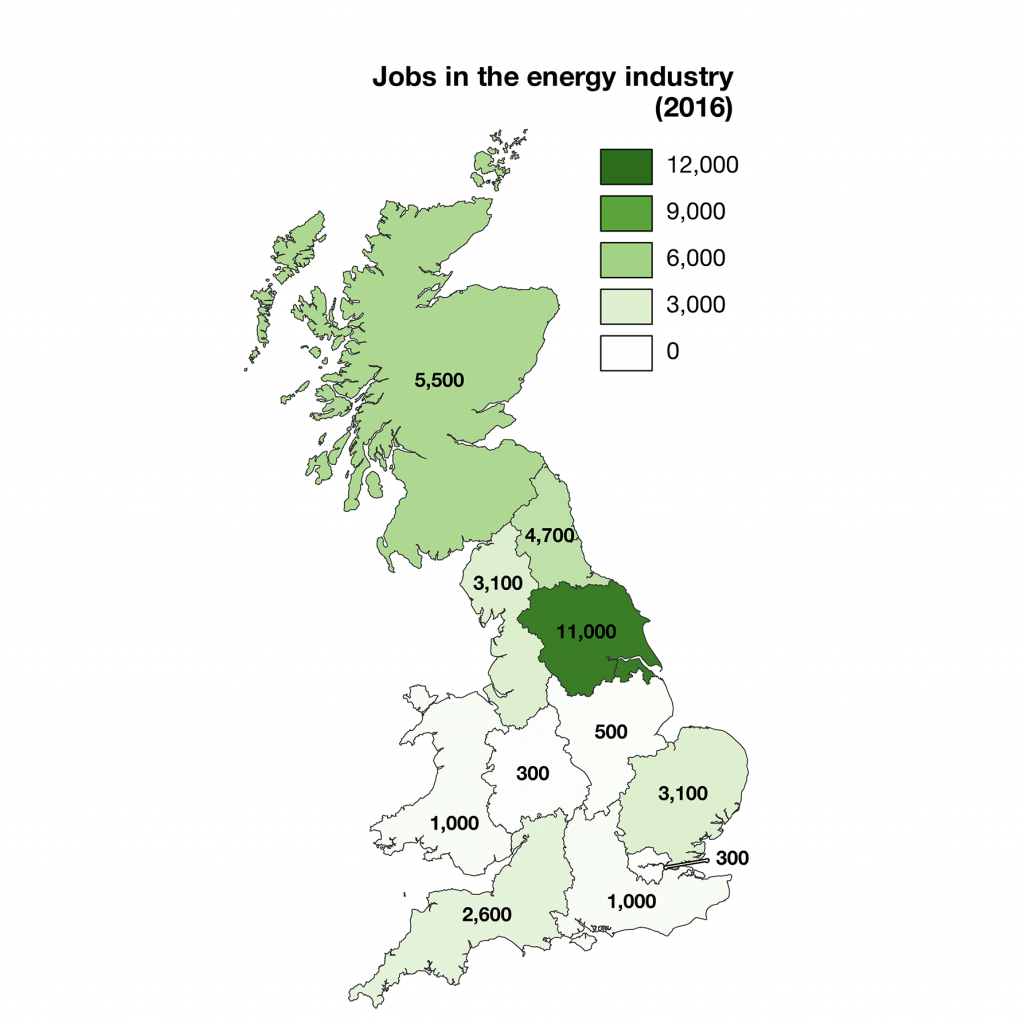

Figure 1.1 presents some underlying indicators for the 11 unitary regions of Britain (and Northern Ireland) for context.

There are already many differences in the regions’ starting points: London stands out as a purely urban region with high incomes and population density; the Midlands and Wales are the most industrialised; wealth is divided between north and south.

As this study investigates the socio-economic impact of the energy system transition, it must be noted that the unitary regions have different starting points.

Some regions may have an advantage, for example in terms of income or commercial and industrial economic activity and are therefore better positioned to make certain changes. The overarching question is whether the energy transition changes this picture for better or for worse.

1.3.2 What is electrification?

The general discussion on electrification of the energy sector is often focussed on the electrification of road and rail transport. This ignores the fact that many other areas of the economy and society in Britain are being electrified. Therefore, this study provides a more holistic approach at the decarbonisation of all energy sector (power, building, transport and industry) and answers the question on what the electrification of Britain’s economy will look like and the technologies involved.

On the supply side, i.e. the power system, low-carbon technologies to mitigate greenhouse gas (GHG) emissions are in focus as well as technologies that allow for the integration of these low carbon sources (e.g. energy storage). The study identifies a list of technologies which are considered relevant when electrifying the energy system. As these technologies mature, the picture will change and this list will have to be adjusted. The technologies that are currently relevant in the power sector are wind and solar, nuclear, batteries and storage, gas-fired generators with carbon capture use and storage (CCUS), grid expansion and construction of interconnectors, smart meters and demand side response (DSR).

On the building side, besides increasing energy efficiency, we are looking at electrifying heating with heat pumps and electric heaters. The transport sector of the energy system includes the state and target for key transport technologies, such as electric vehicles (cars, buses and HGVs), charging points, hydrogen refuelling station and electrification of rail.

Lastly, the current status of industry and implications from trends in the industrial sector are discussed. It is noteworthy that this sector has the least data coverage. As the energy system transition continues, measuring the progress in industry will be required to track the overall progress towards climate targets and avoid unintended socio-economic implications of a transitioning energy system. The heterogeneity of industrial processes requires an approach which presents key metrics, such as energy intensity as a function of Gross Value Added (GVA), GHG emissions or energy use. The social-economic implications of the energy system transition to further electrification and/or automation are presented.

1.3.3 The sectors in context

This study investigates the power, transport, buildings and industrial sectors and the extent of their transformation. All sectors need to decarbonise to ensure the overall national target is met, meaning that many sectors will need to undergo further transformations.

Sectors, such as agriculture, remain outside the scope of this study, but do, however, contribute to net GHG emissions. Electricity supply is being treated as its own sector, meaning the related GHG emissions from electricity production are attributed to the sector. GHG emissions only include direct emissions for the end-use sectors, unless otherwise specified, therefore excluding the indirect emissions associated with electricity use.

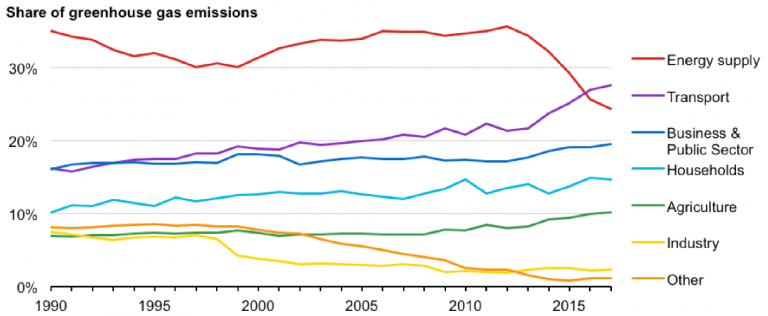

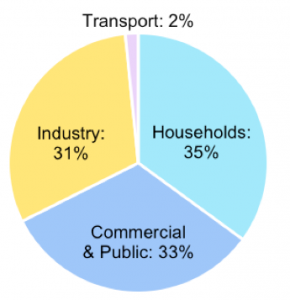

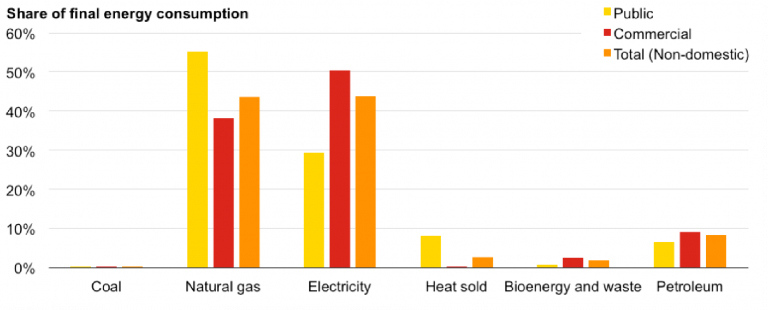

The power sector has seen large reductions in GHG emissions (Section 2.1), causing the energy supply sector to heavily decrease its share of total GHG emissions over the last 5 years (Figure 1.2). In 2017 over two thirds of electricity supply was consumed by buildings, just under a third in industry and the remaining small percentage in transport (Figure 1.3).

Figure 1.2: Greenhouse Gas Emissions by sector, 1990–2017 – direct emissions accounted from source

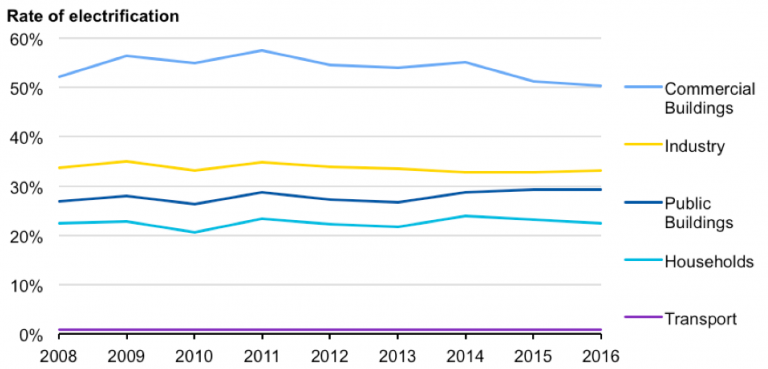

The transport sector’s relative share of total GHG emissions has been increasing since 1990 (Section 3.1) and for the first time in 2016 the share of transport emissions surpassed the share of emissions originating from the energy supply sector. In absolute terms, however, total GB transport emissions have decreased compared to 1990 and 2008. This is likely linked to the global recession, increased fuel efficiency, and increased use of renewable energy in transport. Only 2% of the energy used in transport comes from electricity, and this has remained fairly constant since at least 2008 (Figure 1.4). The sector is still heavily reliant on fossil fuels, though there have been recent increases in the use of biofuels and electricity, especially in road transport.

Figure 1.3: The share of electricity in total energy consumption by end-use sectors in 2017.

Emissions from buildings are a combination of the Household and Business & Public Sectors in Figure 1.2. In 2017, GHG emissions from buildings accounted for 19% of total GHG emissions (Section 4.1). The share of direct emissions from all subsectors of buildings have remained relatively constant since 1990, with the residential sub-sector showing a small increase. In absolute terms, all of these subsectors, thus the buildings sector as a whole, have significantly reduced their direct emissions during this period. Electricity use in buildings has remained relatively constant since 2008, suggesting that direct emission decreases are linked to other factors rather than increased electrification rates (e.g. energy efficiency).

Emissions from the industrial sector are composed of emissions related to industrial processes, as well as some business and power sector emissions. In 2017, the industrial sector made up 23% of total GHG emissions. The emissions from industry are discussed in more detail in Section 5.2. Further, electricity use in industry has consistently remained around a third of total energy usage (Figure 1.4).

Figure 1.4: The use of electricity in the sector as a percentage of total energy consumption

As mentioned above, electricity usage in the sectors investigated for this report has remained fairly constant since 2008. Increasing electricity use can reduce the direct emissions of an end-use sector, especially if the electricity is replacing a fossil fuel.

However, depending on the carbon intensity of the power sector, total (direct and indirect) greenhouse gas emissions could increase.

Chapter 2:

The power system

The UK’s carbon budgets require major decarbonisation of energy supply. By 2050, virtually all electricity must come from clean sources. Large scale use of intermittent renewables will require extensive flexibility options for balancing.

Many options exist: interconnection, storage, demand side response and flexible generation; so consumers should not see any difference in terms of supply quality.

The current pathway relies heavily on wind and solar power, driven by the large cost reductions they have experienced. If these intermittent renewables continue to dominate future electricity supply, the location of power generation will change and the economic activity that comes with it – favouring rural and coastal areas.

The roll-out of smart meters is taking place at very different speeds across Britain. Wales is leading whereas London is lagging. The structure of the housing sector is a strong influence: lower home ownership places some regions at a disadvantage.

Demand response from commercial and industrial sites is already active, but the large domestic resource (e.g. smart appliances such as fridges and washing machines) cannot be tapped without rollout of smart meters.

Energy bills may be higher than today regardless of power sector transformation, due to rising fossil fuel system service costs. However, large cost reductions in key technologies such as renewables, batteries and hydrogen suggest that regions which can take advantage of these (through electric vehicles and heat pumps) could see the cheapest energy.

Renewables have led to job creation, especially in poorer regions. Scottish renewables have created a strong new industrial sector.

Job losses in the legacy fossil-fuel sectors are offset by growth in renewable industries. The dispersed nature of renewables means that the jobs created in construction, operation and maintenance are in more remote areas, giving a welcome employment boost.

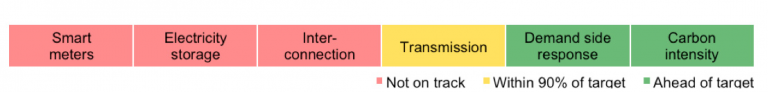

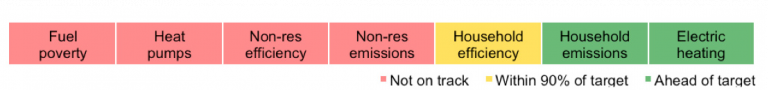

Figure 2.1: Progress towards transforming Britain’s power system, highlighting the areas that are under- and overperforming relative to near-term targets for decarbonisation. Each area is reviewed later in this section

2.1 Current status and future targets for the power sector

The following section will give a detailed analysis on the current status of the power sector, and how it is progressing against its targets. Overall the sector is on track to achieve three out of the six targets examined for this research (with three being well on track) (Figure 2.1). Further, it is falling behind on three other targets. The effects of progress towards each target are not directly comparable, in that achieving some targets will have greater effects on the energy transformation than others. Therefore, this barometer (Figure 2.1) gives an indicative understanding on how the sector is progressing.

The island location of GB creates a unique challenge for the power system when compared to its continental European counterparts. This shows in the increased balancing needs to maintain system stability. The need for flexibility is disproportionally larger when compared to highly interconnected systems.

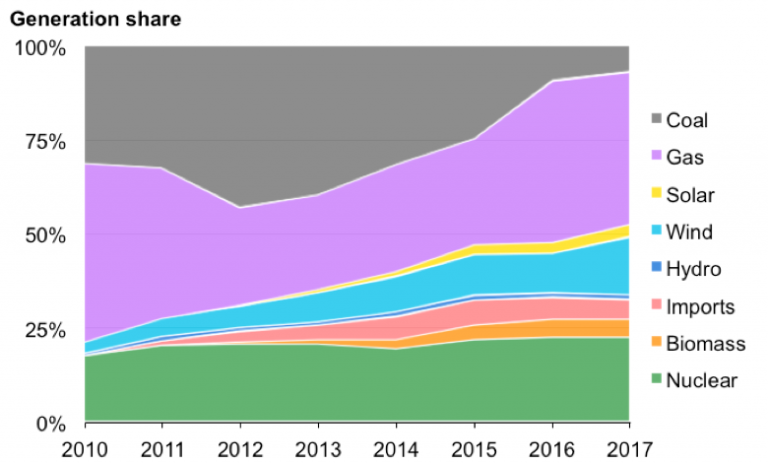

The GB power system has proven that electricity generation can change rapidly in a short time span.

The GB power system has demonstrated that carbon reduction by overhauling the generation mix is possible in a very short time. The introduction of a carbon floor price and clean air legislation has reduced the use of coal power plants by five-sixths in the last 5 years. At the same time, significant amounts of wind, solar and bioenergy have entered the power system and gas generation has seen a renaissance. Nuclear power has maintained its share of the mix in the past decade. However, based on current projections, it is likely that replacements will not outweigh closures in the coming decade. Figure 2.2 shows the generation share and total generation of all (major) generation types for the last 9 years. The analysis is conducted at GB-level as Northern Ireland is part of the power system of Ireland.

Figure 2.2: Development of the generation mix and total power generation between 2009 and 2017.

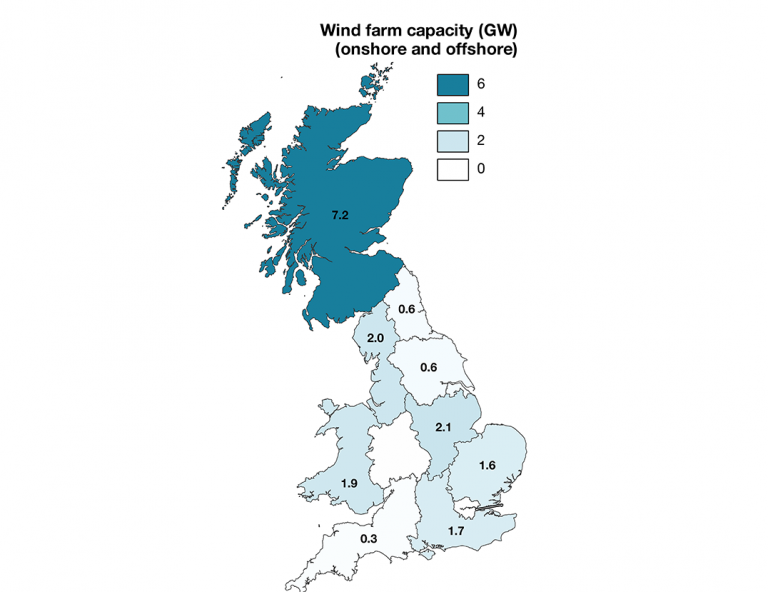

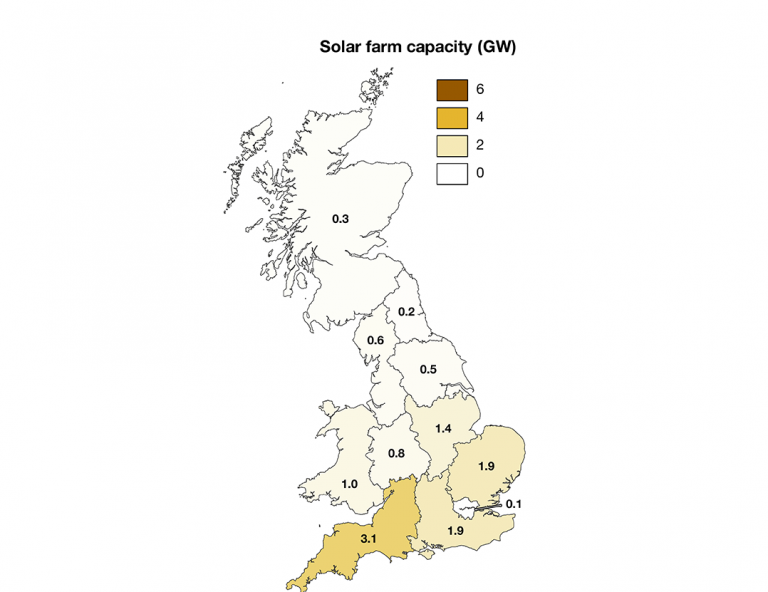

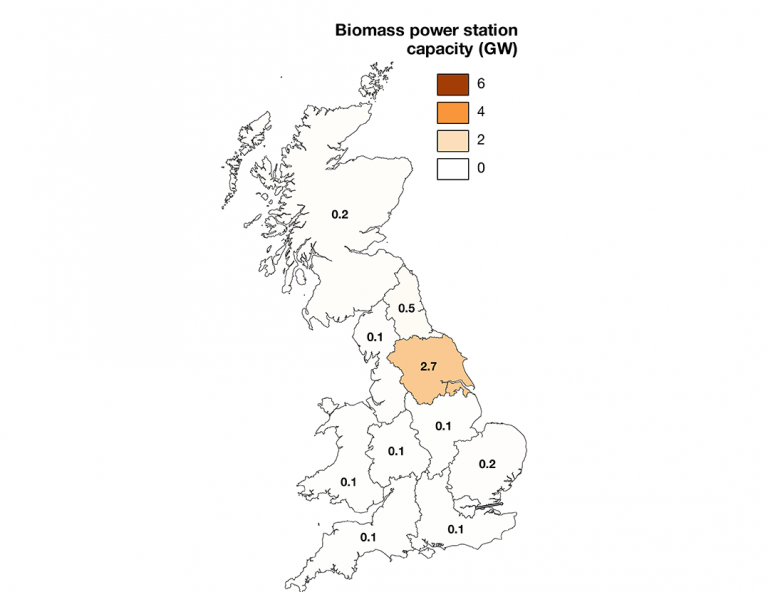

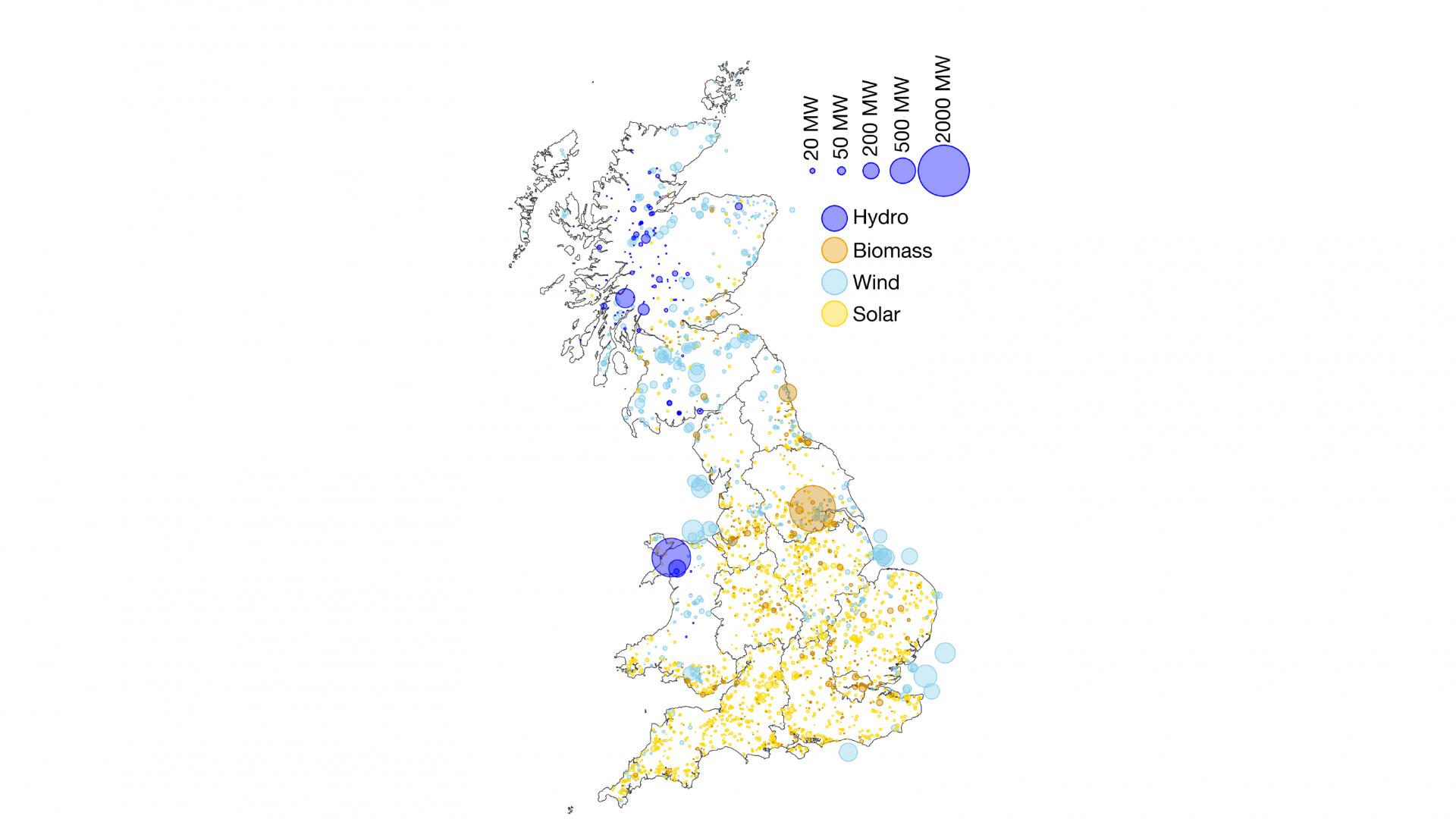

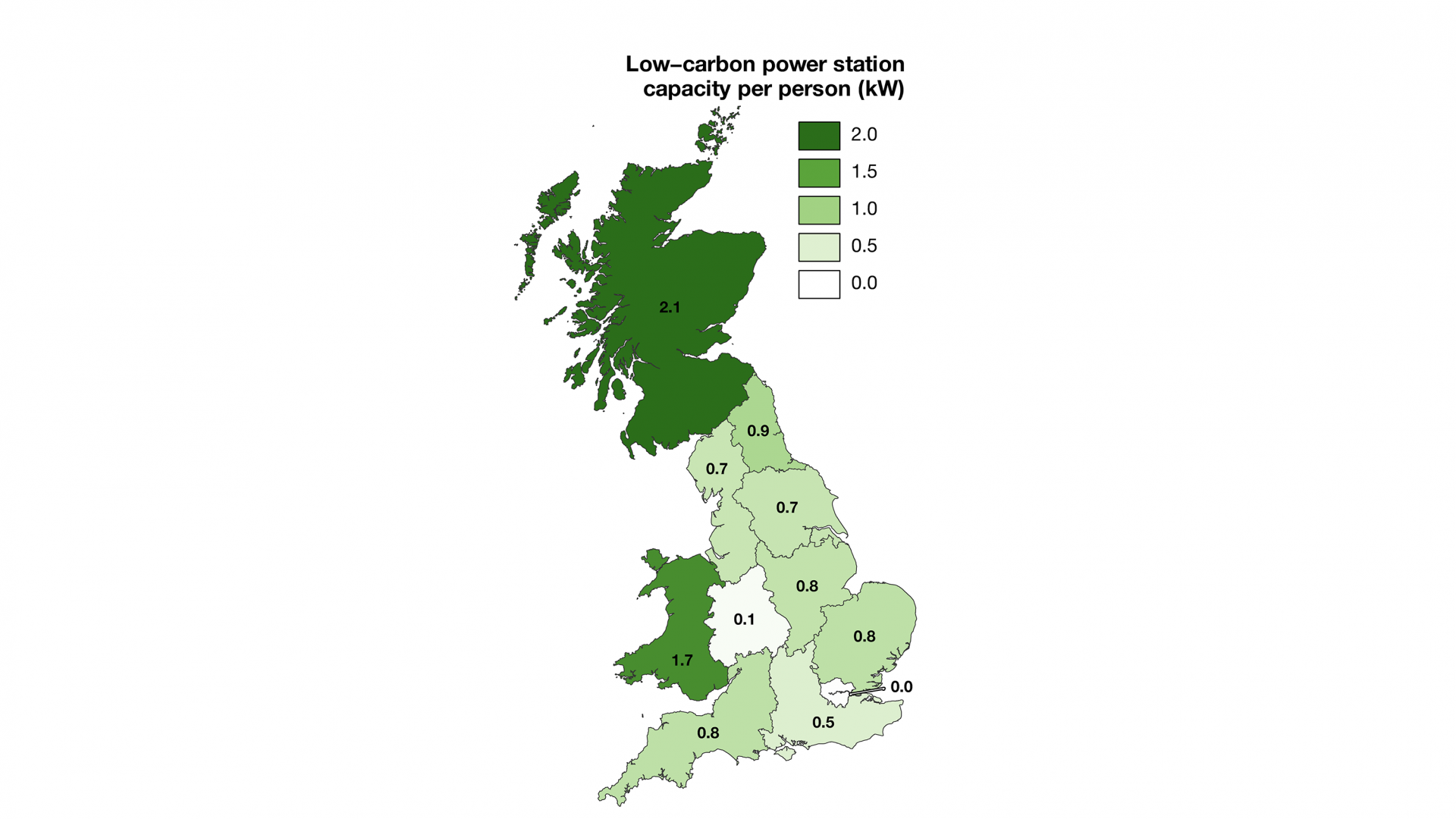

These changes have led to a redistribution of generators around Britain. The closure of coal power plants nearer to the load centres in England and Scotland on the one side has been offset by the construction of renewables in Scotland, the South West of England and Wales. The total installed capacity of renewables is highest is Scotland and Wales, with a relatively homogenous distribution of renewable capacity through England.

The West Midlands, the North East and London stand out as having little generation capacity, due to population density and resource availability. A similar picture is visible when looking at the installed capacity of renewables per capita where Scotland and Wales are leading and equal in value. Both have about twice the capacity installed as the rest of Britain, which raises a challenge for the grid to cope with the redirected flow of electricity and may require investments.

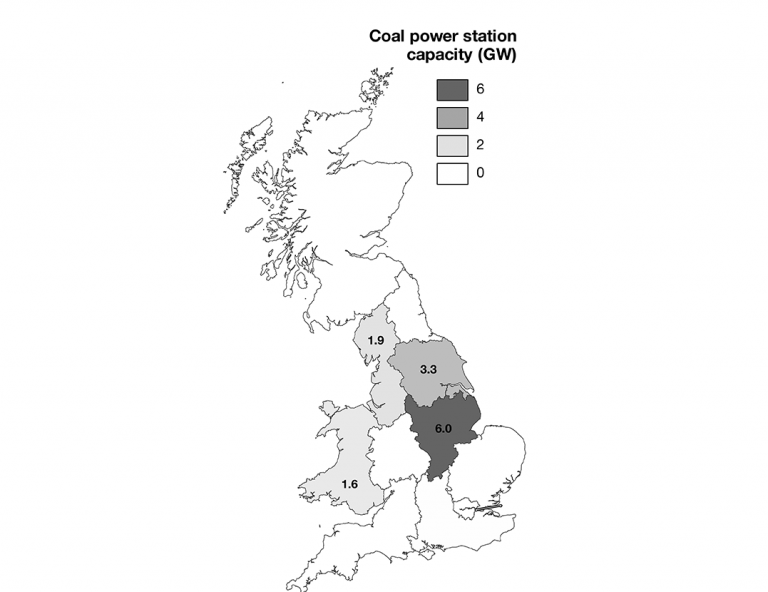

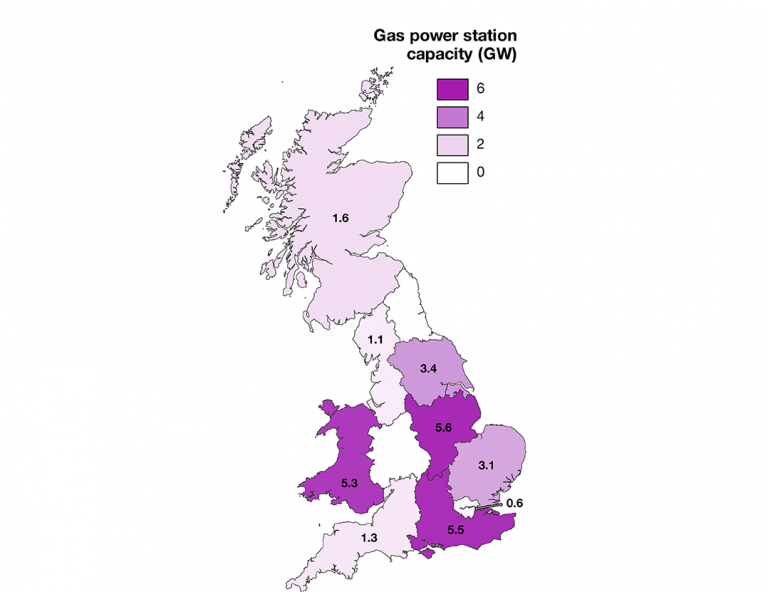

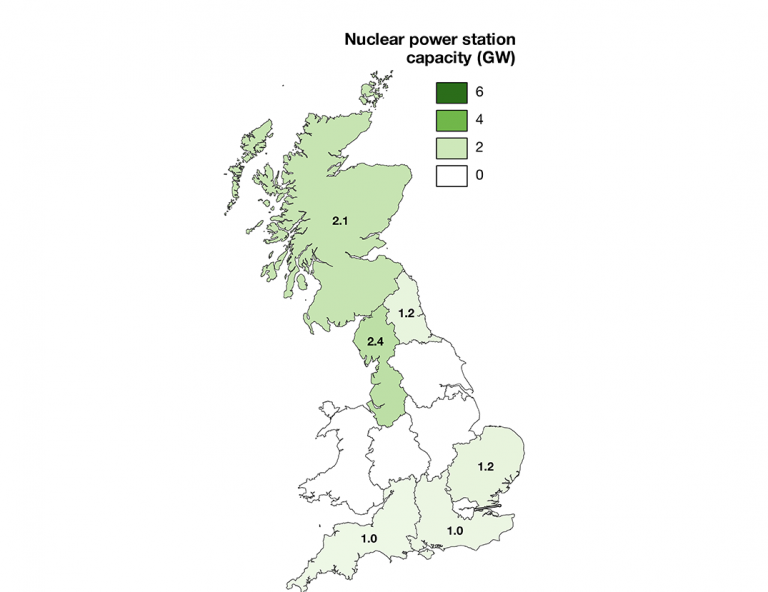

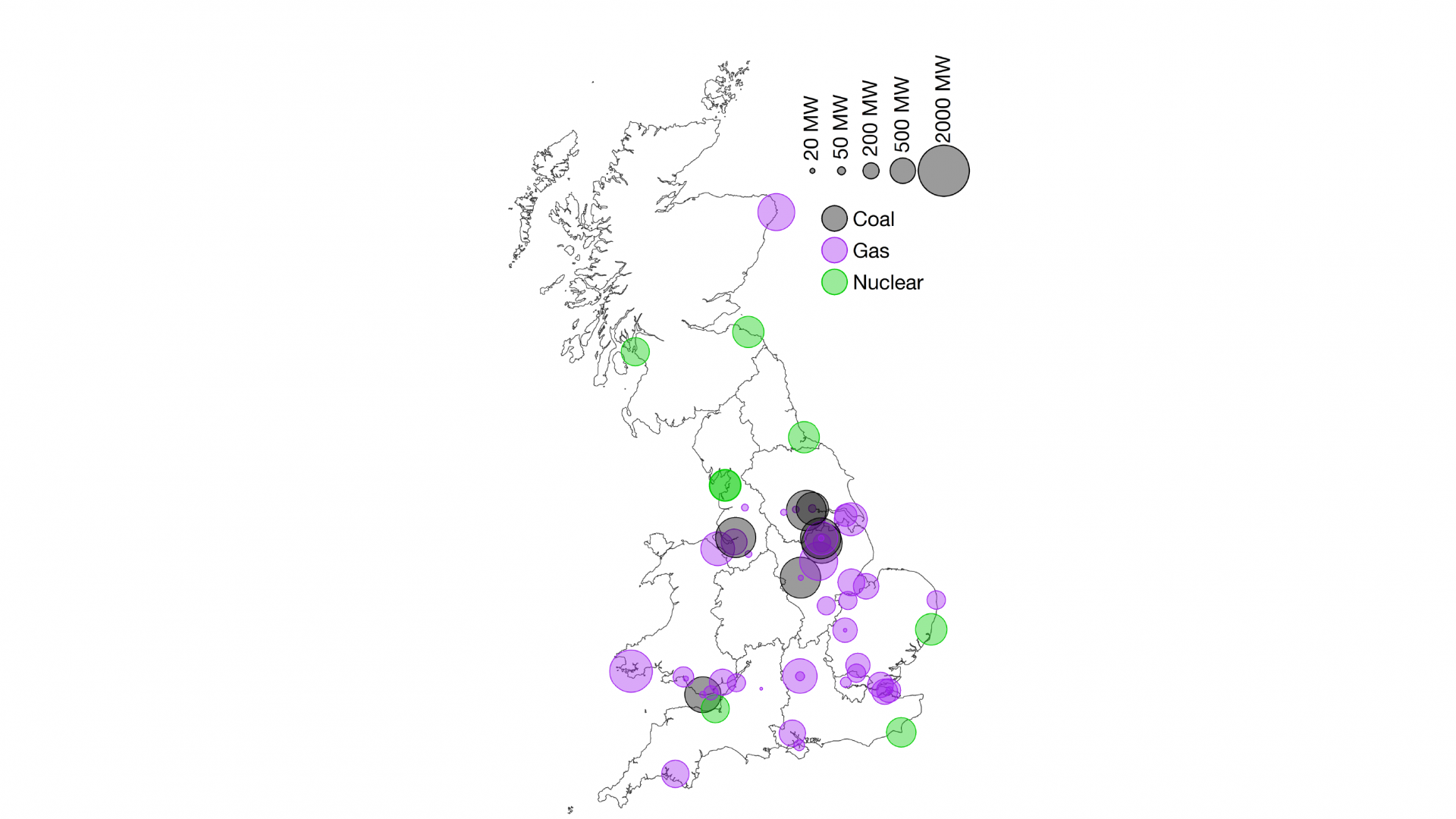

Figure 2.3 shows distribution of power stations by generator type. The last remaining coal stations are located in Yorkshire, the Midlands, the North West and Wales. These stations are due to be closed no later than 2025, apart from Drax power station in Yorkshire, where four of its six units have been converted to use biomass instead of coal. The energy system transition will alter the location of power stations and a redistribution of economic activity and employment in the country. This raises the question how to best facilitate the energy system transition, not only in terms of energy system issues but also economic development and employment. Retaining large parts of the workforce through conversion or the investment in renewables may help to ease the transition.

Additional discussion on the topic can be found in 2.2.

Transforming the energy system affects the locations of generators and so redistributes economic and employment across the regions.

Previous closures of coal stations in the West Midlands have left the region almost entirely reliant on electricity imports from other regions, due to the lack of local renewable generation capacity. Conversely, Scotland invested heavily in onshore wind before its thermal fleet were retired. This makes Scotland a substantial exporter of electricity. Wales hosts large hydro power stations (legacy renewables), masking the relatively slow progress of its energy transition.

The installed base of renewable energy sources (RES) shows a concentration of biomass generation in Yorkshire and the North East. Solar power is predominant in the South West, South East and East Anglia. Onshore wind is mostly deployed in Scotland whereas offshore wind on the other hand is more evenly allocated around the coast of Britain and closer to the load centres, mainly connected to England. Generally speaking, wind and solar follow the resource availability within a tight framework of planning permission. Due to the topography, hydropower and pumped-hydro storage can only be found in Wales and Scotland and not in the rest of the country.

Britain's conventional power stations

Britain's conventional power stations

Britain's renewable power stations

Britain's renewable power stations

Figure 2.3: Location of power generation in Great Britain. Energy to waste plants are grouped with biomass.

Non-renewable thermal generation (coal, gas and nuclear) is more concentrated than renewable generation. Gas stations are more widely distributed throughout the country and located closer to the load centres. Coal is now restricted to central

England and Wales. Nuclear power stations are all located on the coasts due to the volume of cooling water intake and security considerations.

Interestingly, the West Midlands and Greater London no longer have any large scale thermal generation. The transition from coal to gas fired power stations sees a shift away from typically slow-ramping base load power plants to more flexible (combined cycle) gas turbines, fewer operating hours for the residual generators and variable output over time.

Figure 2.4: Regional distribution of power stations in Great Britain, showing renewable (three maps on the left) and conventional (three, right). Hydro plants are not shown, these are all concentrated in Wales and Scotland

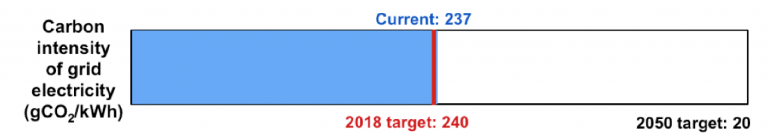

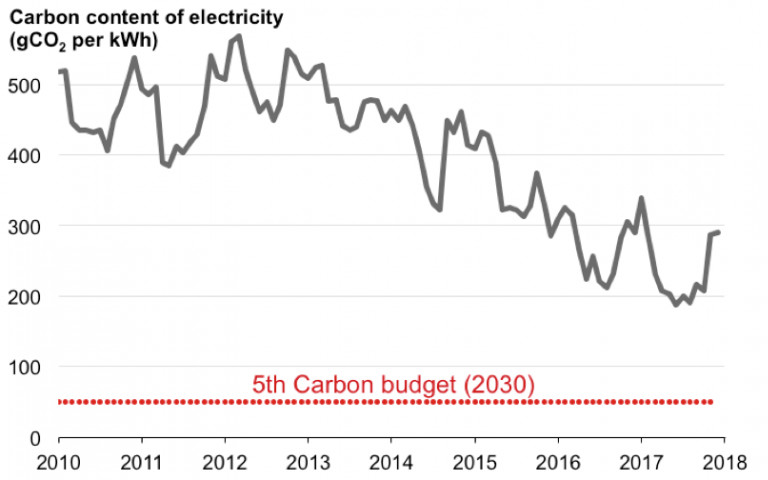

2.1.1 Carbon intensity

The reduction of coal has led to a strongly decreasing carbon intensity of the produced electricity between 2009 and 2018. This is due to the lower carbon content of natural gas when compared to hard coal.

The carbon intensity of grid electricity has more than halved within five years after the introduction of the carbon floor price and emissions Directives. Further decarbonisation however will prove more challenging.

The carbon intensity of grid electricity peaked in 2012 at 508 g/kWh and has since more than halved to 237 g/kWh. This change came at a remarkable speed after the introduction of a carbon-floor price of 18 £/tCO2 transformed the economics of coal power stations and enabled their rapid phase-out.

Further increases in the CO2 price are likely to be necessary to build momentum on further decarbonisation of power generation.5 Despite this, the shift towards low carbon technologies is likely to be more challenging and not as rapid as the phaseout of coal. Further decarbonisation will require building new generators rather than simply redeploying existing ones.6 A recent uptake of the European carbon price (EU-ETS) to over €20 (£18) per tCO2 should provide a stable environment outside the country-specific carbon floor price policy instruments.

Figure 2.5: Barometer for grid electricity carbon intensity

Additional policy support is required to keep the rate of decarbonisation at the same pace. For example, the application of carbon capture, utilisation and storage (CCUS) technology to capture CO2 emissions from gas-fired and biomass power plantsb is still in its infancy. The need for decarbonisation using CCUS has seen a renewed support commitment in the Clean Growth Strategy7 by the Government as well as from private entities, albeit timings are tight to deliver at scale in 2030s for large CO2 reductions.

Despite the rapid success of decarbonisation, additional effort is necessary as further decarbonisation will be more challenging4,c. The rapid progress in the last five years makes up for the previous decade of zero progress on decarbonising electricity. Britain is therefore just about on track – but emissions must continue to fall at 7.5% per year.

There are many technologies for achieving this, wind, solar, biomass, new nuclear build, and power stations equipped with carbon capture use and storage (CCUS). To keep further decarbonisation affordable it is necessary to assess the suitability of all low carbon generators, based on their levelised cost of energy as well as the system integration cost, including those technologies that do not receive policy support at the moment.

Figure 2.6: Development of carbon intensity of the electricity grid in Great Britain.

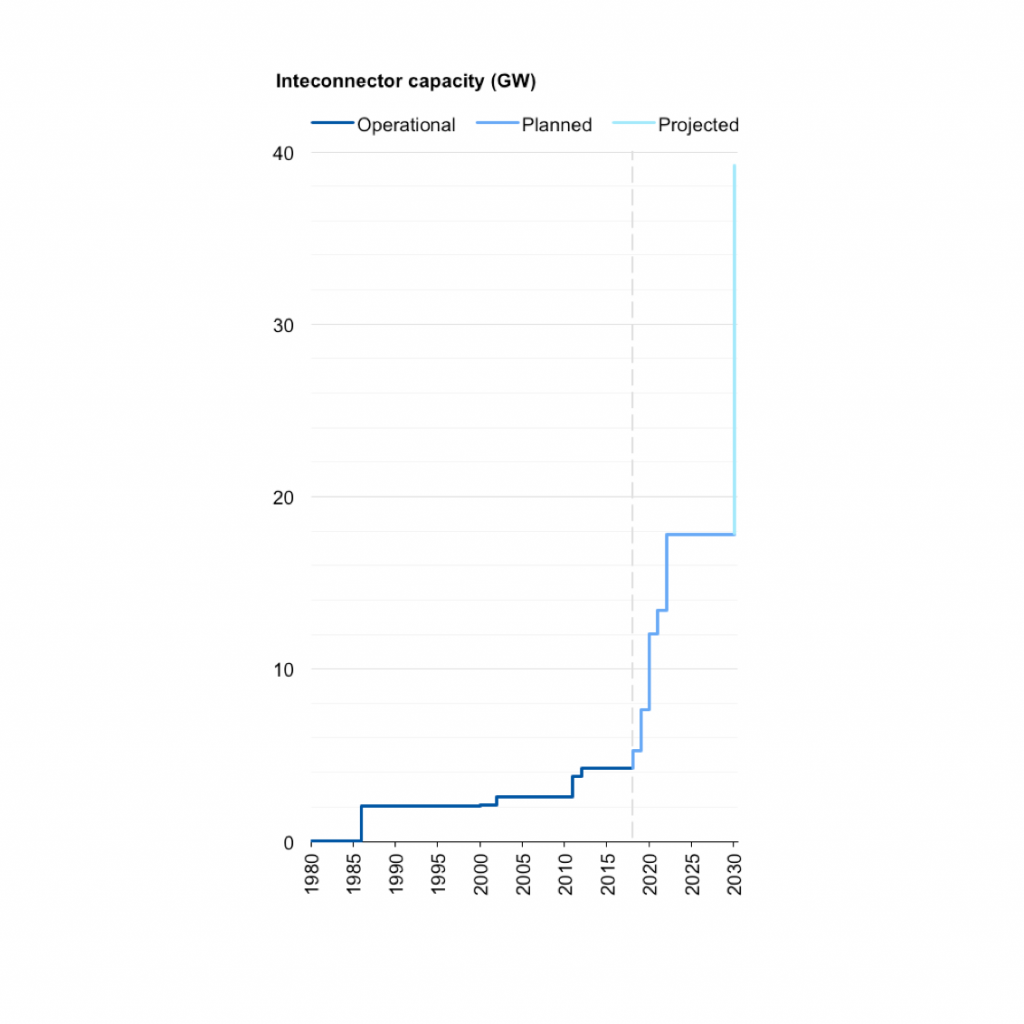

Past, present and future development of interconnectors.

2.1.2 Interconnection

Britain is an island system with limited connections to neighbouring countries, and so traditionally struggles with security of supply issues relative to continental Europe.

Virtually all of Britain’s balancing capabilities must be sourced from within the system. This has negative impacts on balancing costs, as large capital-intensive plants have to remain in standby mode.

The availability of interconnectors allows sharing of some of the balancing tasks with neighbouring energy systems. Technically speaking this means that power plants outside the British system can provide energy to the GB system and vice versa to account for outages or the intermittency of renewables. Conversely they can increase strain on the system during stress events which affect the two connected markets.

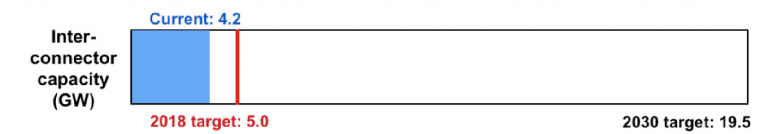

Figure 2.7: Barometer for interconnector capacity

The relatively low interconnection capacity to Britain is due to the high cost of building under-sea cables and the fact interconnectors cannot be viewed as firm capacity or provide the same system services as synchronous power stations.

The drive for better asset utilisation and renewables integration has led to the construction of interconnectors. Further expansion is under construction or in final planning stages, all of which are due to be operational by 2022. The increase from currently 4.2 GW (2018) to 17.8 GW (2022)

is more than quadrupling the capacity in a short time period. One note of caution is necessary for the projects in planning, as the UK may leave the European Single Energy Market which could change the economics of interconnector projects, potentially leading to the cancellation of the projects.

Interconnector capacity is set to more than quadruple in the near future.

If realised, these interconnectors provide a large but unreliable increase in system flexibility and allow RES balancing with continental Europe and Scandinavia. Further expansion beyond 2030 is envisaged, however these are competing interconnector projects and are not all likely be realised.

Having a wide-ranging portfolio of interconnectors to different countries may benefit the energy system, as they can be used to balance renewable energy sources across large distances and may reduce costs for consumers through the benefits of trade. An unbalanced portfolio exposes both energy systems to each other’s specific risks and does not allow for economic optimisation.

The barometer indicates that interconnection capacity is falling behind the target for 2030. However, considering the planned upgrades in the next 5 years, the development of interconnectors is within the target corridor despite the barometer’s indication. A regional barometer is not presented

as interconnection is a country-to-country issue.

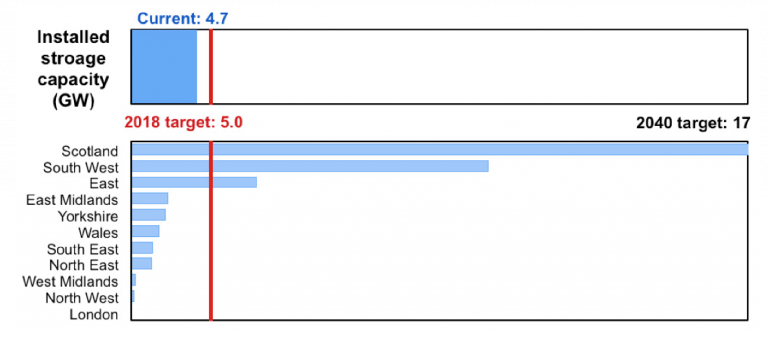

2.1.3 Storage

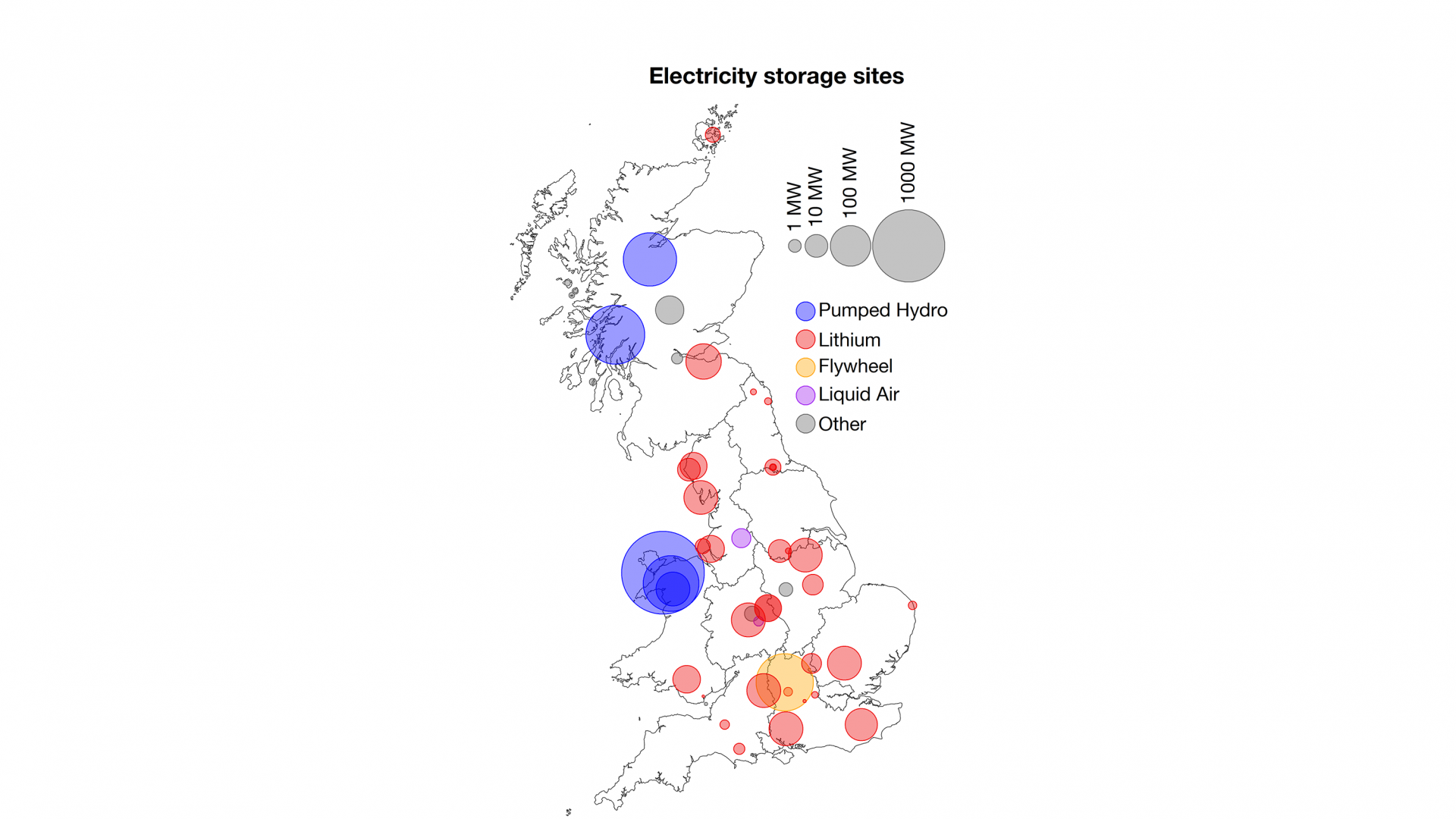

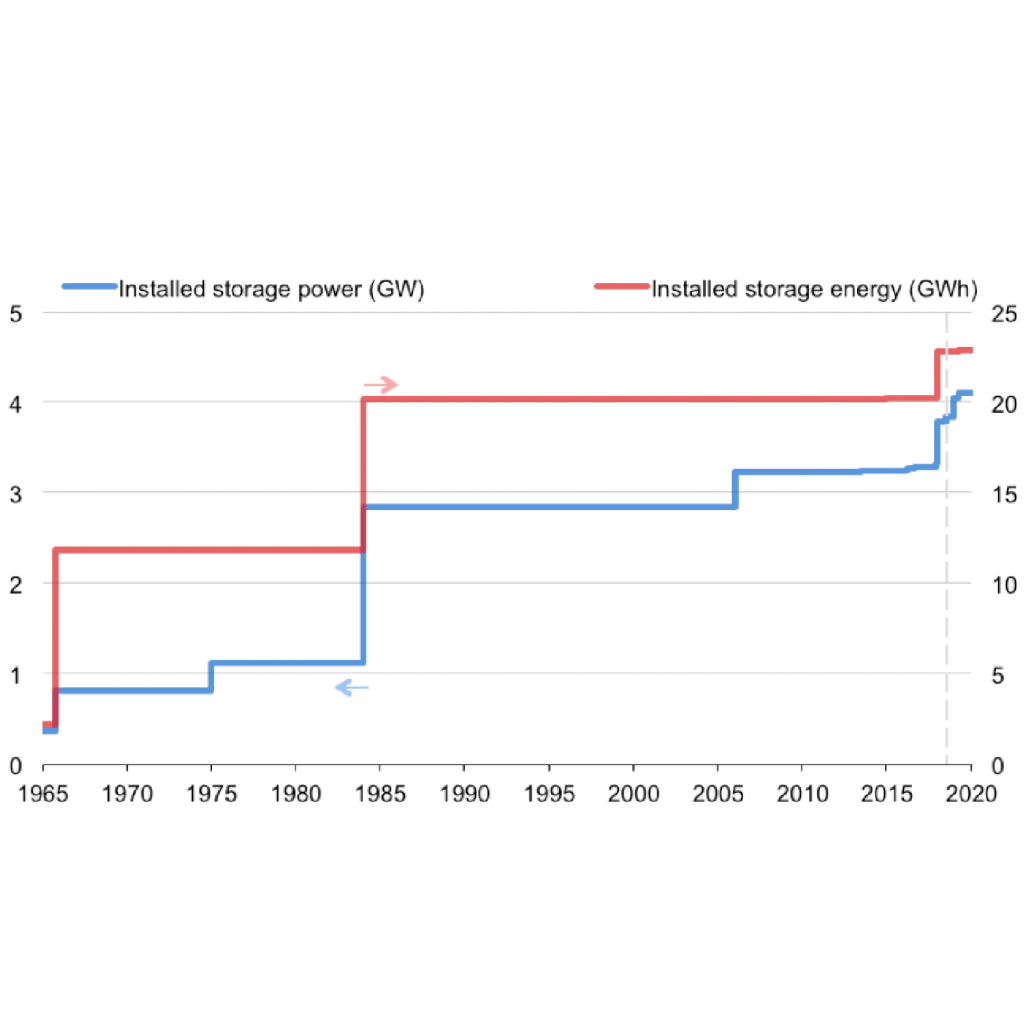

In total 3.7 GW of storage is active in the GB power system, of which 2.9 GW is pumped hydro, 0.8 GW is batteries (primarily lithium-ion), 0.4 GW is mechanical (flywheels) and the rest is thermal storage (liquid air and hot water storage).

The stock of storage is dominated by pumped-hydro storage and new batteries added in the last year.

Batteries and other modern storage technologies are still dependent on specific market rules for economic viability. With the recent increase in RES penetration and the goal to reduce thermal ‘must-run’ capacity for the delivery of ancillary services, National Grid has encouraged demand-side response (DSR) and storage to participate in the ancillary services markets but still finds itself overwhelmingly dependent on thermal generation.

Figure 2.8: Barometer for storage deployment.

The GB power system has less storage than most neighbouring countries due to geographical constraints. Until the mid-2010s the only economical storage technology was pumped hydro which requires mountains, and thus is concentrated in Wales and Scotland. These still make up the largest share of storage capacity. The recent and rapid cost reduction in other storage technologies means that new systems are becoming more widely deployed, with small scale, rapid dispatch lithium-ion batteries contributing the largest share of the new market entrants.

Figure 2.9: Installed storage capacity in the GB power system.

Storage has so far been applied in ancillary services markets, which are high value, but low volume markets. In particular, battery storage can be used, making it economically viable in these markets but only when generous derating factors are applied. This helps to accelerate the cost decline of grid-scale storage until eventually it can serve high-volume but lower-yield markets economically. The GB capacity market, has in some cases helped to foster the uptake of storage. However, the dependency on specific market rules creates uncertainties for long-time investments.

The barometer indicates that storage deployment is close to being on track. However, one needs to consider the reliance of storage on markets with specific rules. If these were to change, the deployment of storage might take a downturn. Additionally, a supportive environment must be maintained into the future as batteries are short-lived relative to pumped hydro (e.g. 10-20 rather than 60 plus year lifetimes) and so must be repowered at end of life.

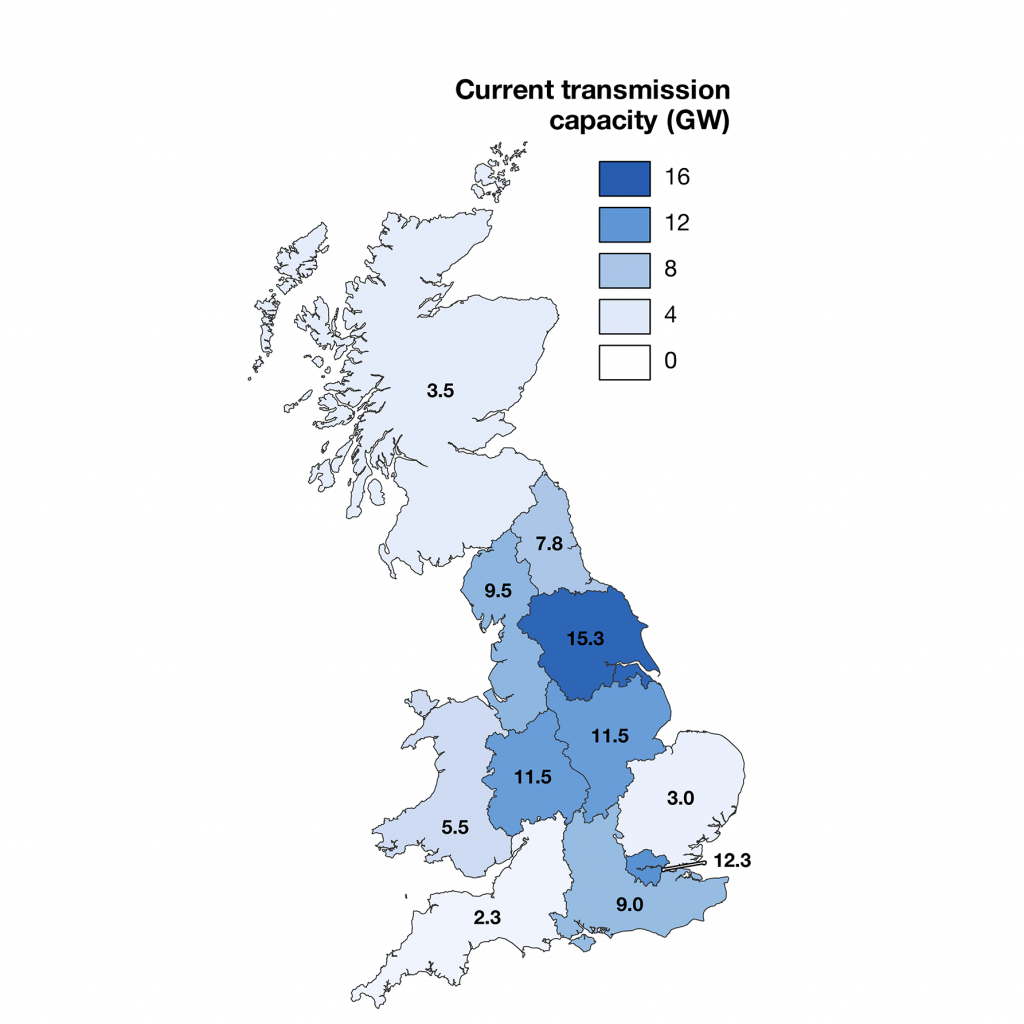

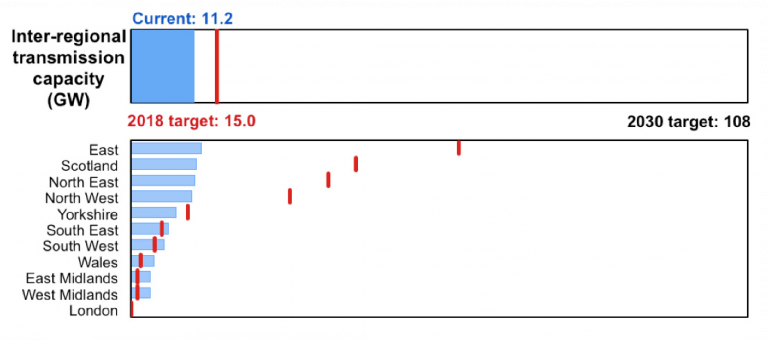

2.1.4 Network and transmission capacity expansion

Grid expansion is necessary to transport electricity between the locations of generation and consumption. Generator locations are changing due to the shift from fossil to low-carbon generators, but this also changes the generation pattern away from a more constant use of transmission lines towards more intermittent utilisation.

Relocation of generators and the shift towards renewables requires a doubling of grid transmission capacity.

There are significant risks to the expansion of the electrical network. It may face the risk of opposition from local residents and tackling such challenges is a major societal task if we are to proceed with a low-carbon transition in the power sector.

Assessing the transport capacity at the borders of the unitary regions allows potential shortfalls in transmission capacity to be localised. Scotland is currently facing the greatest shortfall and portraying it as one unitary region might not accurately cover the full grid expansion needs. Assuming that grid congestion does not occur within the region is essentially oversimplifying the issues in some cases, as Scotland does not have limitless internal transmission capacity. Grid congestion already occurs in Scotland, especially as wind power plants are typically located in the more rural areas, some of which were already troubled by weak grid connections.

The barometer shows good progress if we assume the already well-developed grid as the current state. If this is used as a starting point the actual progress of expansion is very little. Transmission capacity at the borders of the unitary regions will have to double up until 2050. The transmission capacity within the regions is not assessed by the data sources.

Regionally the grid connection reinforcement needs differ largely. The East of England faces a five-fold increase in grid capacity which is needed for the transport of electricity from offshore wind farms to the load centres in the region. The grid in the North East will need to triple its grid transmission capacity by 2040 to cope with the increasing amount of Scottish wind power as well as the possible connection of offshore wind farms in the near future. Yorkshire will have to double its capacity for the same reasons.

Figure 2.10: Barometer for transmission capacity.

The East Midlands has the second highest transmission capacity and therefore does not require the rapid growth of other regions further north. Large parts of today’s grid congestion in Great Britain happens in Scotland, with grid reinforcement requirements. Additionally, potential future nuclear power plants could increase the grid congestion already happening in Scotland. The siting of wind turbines at the best wind resource locations does not coincide with pre-existing location of the grid which lead to frequent grid congestion due to under-sizing of the grid.

There are significant risks to the expansion of the electrical network. For example, it may face the risk of opposition from local residents and tackling such challenges is a major societal task if we are to proceed with a low-carbon transition in the power sector.

2.1.5 Smart meter roll-out

The availability of smart metering is seen as one of the key enablers of a smarter and more balanced grid through the uptake of small-scale demand side response (DSR). A country-wide roll-out of smart meters is envisaged by 2020. This target is conditional, in that every property needs to be offered a smart meter by 2020 but the owners are under no legal requirements to accept.

The smart-meter rollout faces several challenges and significant regional variation.

Varying success can be observed in the rollout, with Wales leading and London lagging.

Possible reasons for this may be socioeconomic effects (e.g. tenancy structure) and technical challenges (e.g. access to meter).

The target for a complete roll-out by 2020 will not be met without rapid acceleration. Only a third of households currently have a smart meter. The current pace would not see roll-out finishing until towards 2040. This would prevent the uptake of time of usage tariffs with higher temporal resolution (e.g 30 minute settlement periods) and domestic DSR services in the near future. This could have knock-on effects such as increased costs for the consumers.

Various challenges are faced by the roll-out. Some are related to use of different types of smart meters, with some of them “smarter” than others, boasting additional functionality between the three types of smart meter – AMR, SMETS1 and SMETS2. The Automated Meter Reading (AMR) is a legacy infrastructure for larger electricity customers. SMETS1 is the first generation smart meter with reduced functionality (e.g. not working after supplier change without intervention) SMETS2 is the latest generation, with connection to the smart meter gateway. Currently, there are only a few use-cases for smart meters and a lack of offerings from the electricity suppliers. The initial vision that smart meters will enable DSR services to the grid has yet to fully materialise at the domestic consumer level.

Figure 2.11: Barometer for smart meter roll-out.

Non-domestic smart meters account for about 1% of the total numbers. However, the installed capacity behind those meters is much higher and likely to be more readily available to provide DSR services.

2.1.6 Demand side response

Demand side response (DSR) could enable buildings to intelligently reduce their demand at peak times, mitigating the need for additional power generation capacity. DSR services at the domestic level are mostly limited to legacy Economy 7 (and 10). The electric loads of a typical household in Britain with gas supply for heating usually do not warrant the aggregation in DSR schemes; the loads are just too small to be economically viable.

The smart meter roll-out has yet to produce demand side response capacity from households. Industrial and corporate consumers are actively providing these services already though.

Some energy suppliers now offer ‘smart tariffs’ for households with electric vehicles and heat pumps. These first market entrants, however, do not make full use of the smart meter infrastructure. DSR activity that couples these together may at first be limited to smart charging, rather than responding in real time.

Further cost reductions in ICT infrastructure and integration of car-based and personal device communication plus aggregation means that we are likely to see domestic DSR developing. The ongoing digitalisation could see the use of artificial intelligence (AI) to predict users’ behaviour and adjust the energy consumption without a noticeable interruption for the consumer. The use of smart meters may reduce the costs for the consumers when DSR services are provided. However, this will be further down the transition pathway as currently economic benefits are negligible.

FIGURE 2.12: BAROMETER FOR DEMAND SIDE RESPONSE

On the industry and commercial side, DSR aggregators are active in the market.

The high cost of communication infrastructure still makes them reliant on the high value and low volume opportunities, such as frequency response markets. Currently about 2300 MW of DSR is reported to be participating in various markets. This constitutes an over-achievement with regards to the targets laid out by National Grid. However, there is uncertainty whether the reported capacity is correct; the same physical units can be accredited in different ancillary services markets and may be double-counted. If this is the case, it would prove that actors are optimising their participation in the market and reacting to price signal as intended.

Ultimately, the DSR potential with industrial and corporate consumers is high, but it takes a compelling business case to exploit it. As DSR must compete with other flexibility options, saturation may be reached at lower single-digit GW levels due to diminishing returns in the market and increasing effort of connecting consumers at decreasing unit sizes. For price-sensitive industrial and commercial DSR providers, this saturation will happen where the cost of connection and potential gains offset the risk of e.g. lost production in the factory. Increasing awareness of the benefits of DSR, decreasing connection costs and higher intermittency will change this equilibrium and add additional capacity to the system.

2.2 Implications of a transitioning power sector

Overall employment in the conventional energy sector has been steady at around 175,000 since the mid-1990s, after a large decline as the phase-out of coal mining cost more than 300,000 jobs. Around 80,000 jobs are directly associated with nonrenewable electricity generation in recent years.

Figure 2.13: Employment in the non-renewables energy industry.

Figure 2.14: Employees in renewable electricity generation per region. Data split within England based on DECC data.

Investment in renewable energy sources creates more jobs per MWh produced than the thermal generation industry (including nuclear). An annual share of 75% of the electricity in Britain was generated by the non-renewable generators in 2017, maintaining around 80,000 jobs. The share of electricity from renewables (wind, solar, bioenergy, hydropower was about 25% in 2017. This economic activity supports about additional 34,000 jobs. The expansion of renewables therefore has a small net positive employment effect. The effect is substantially larger when hydropower is removed. Additionally, the employment growth is typically located in more rural areas, following the changes in location of electricity generation.

Figure 2.14 shows how the employment in the renewables sector is distributed across Great Britain. The employment numbers for all of England are split using investment announcements by companies. Wales and Scotland employment numbers are taken from the ONS survey directly. Most notably, Yorkshire is hosting a large number of jobs, which can be explained with the presence of Drax power station as well as with being a major hub for offshore wind power. For example, the Siemens-Gamesa blade manufacturing for large offshore wind turbines is located in Hull.

Chapter 3:

Energy in transport

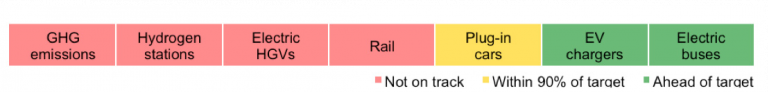

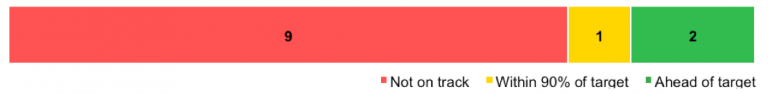

The overall barometer for transport shows a mixed view. Targets for the electrification of private car and public bus transport are on-track, along with the infrastructure required for charging these vehicles. However, it will require a large ramp up in deployment of these technologies in the near future to stay on-track.

The story for the sector’s transition looks worse for hydrogen deployment, heavy duty transport and rail emissions. Deployment numbers and GHG emission reductions in these areas are behind where they need to be. Technologies that could benefit these applications are not on-track to have the infrastructure in place.

Figure 3.1: Progress towards transforming Britain’s transport system, highlighting the areas that are under- and over-performing relative to near-term targets for decarbonisation. Each area is reviewed later in this section.

Transport is behind in reaching its GHG emissions target meaning large transformations (e.g. electrification) are required to achieve the 2030 climate targets.

Electric vehicle (EV) sales are ramping up, but the current 0.4% fleet penetration will need to become 27% by 2030.

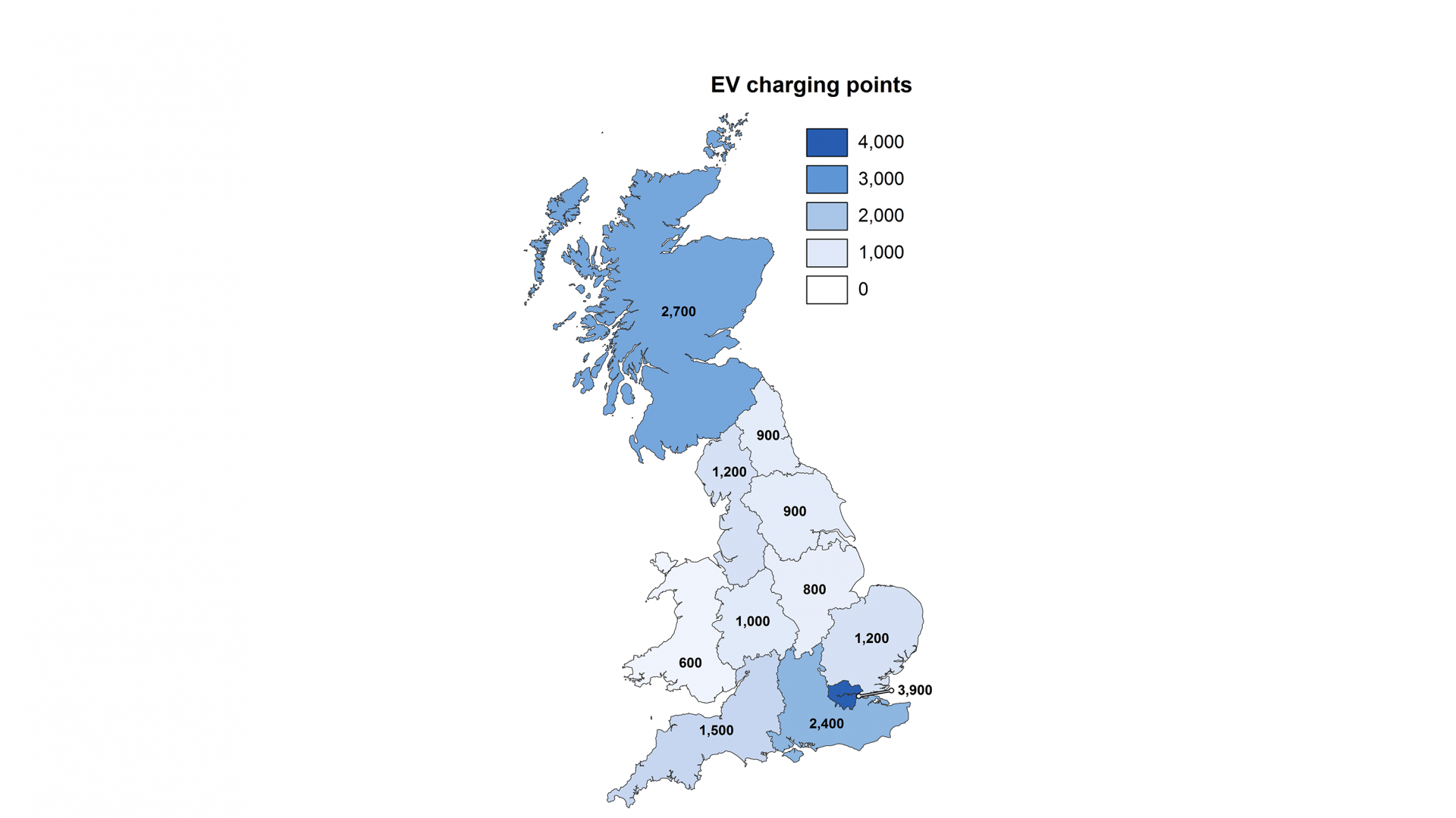

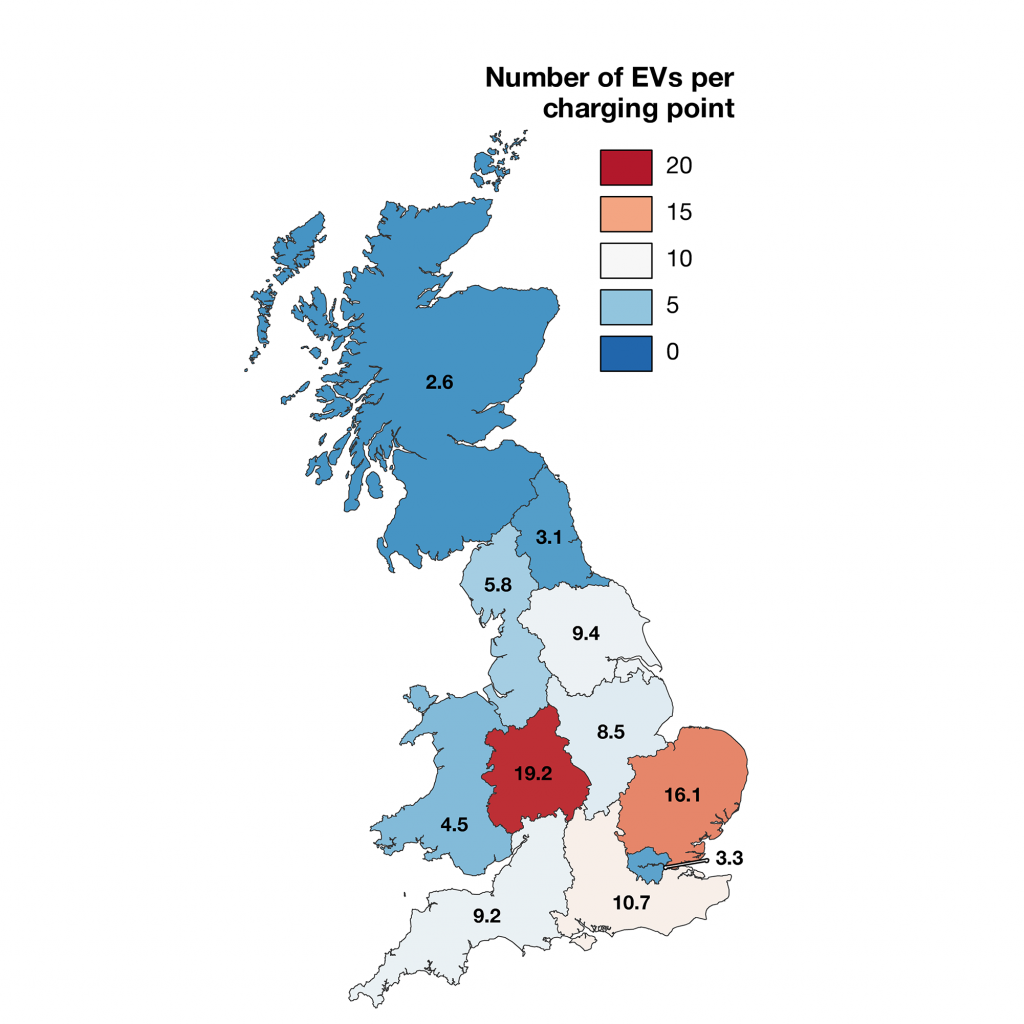

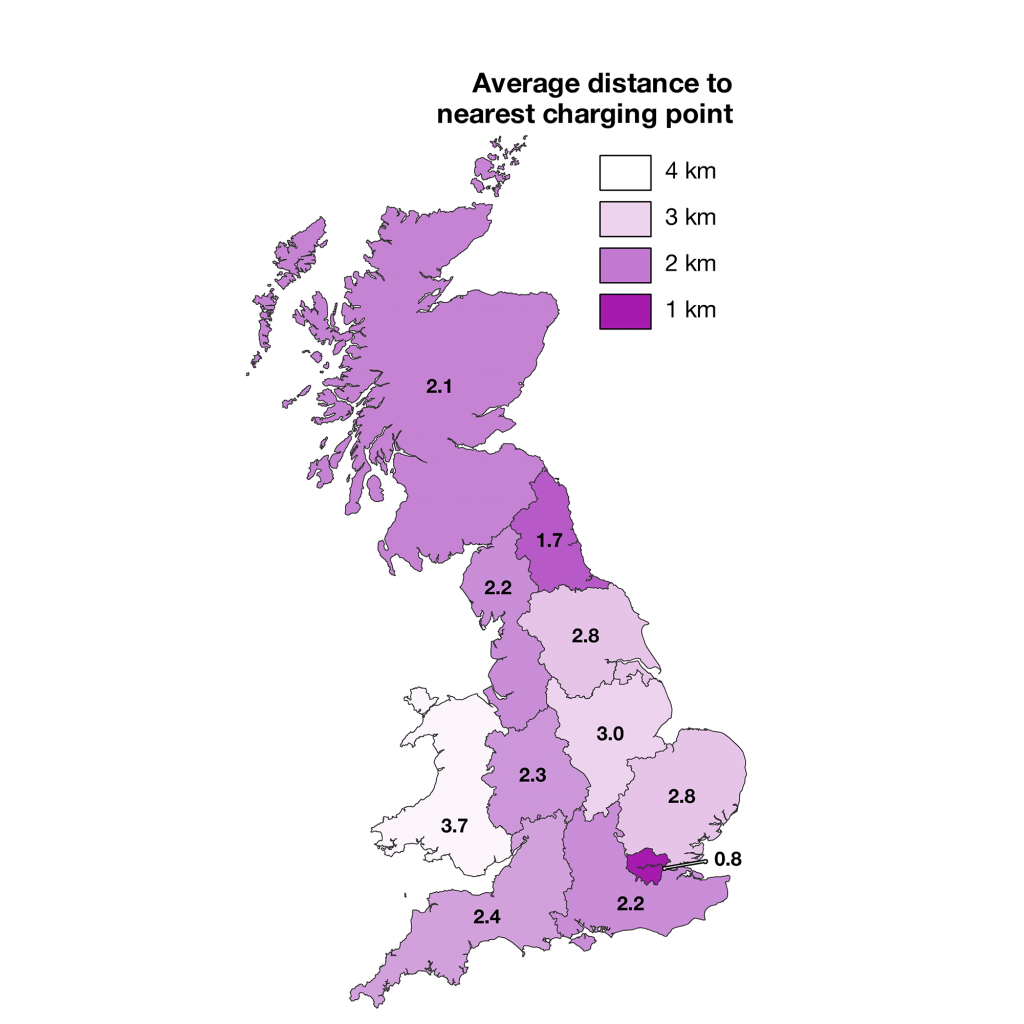

At an aggregated, national level EV charger deployment appears to be on target to deliver enough charging points for the projected EV uptake. However, there is regional and intraregional clustering of these charging points, which will result in shortages and access problems in some areas. The electricity network implications of charging infrastructure also require significant investment.

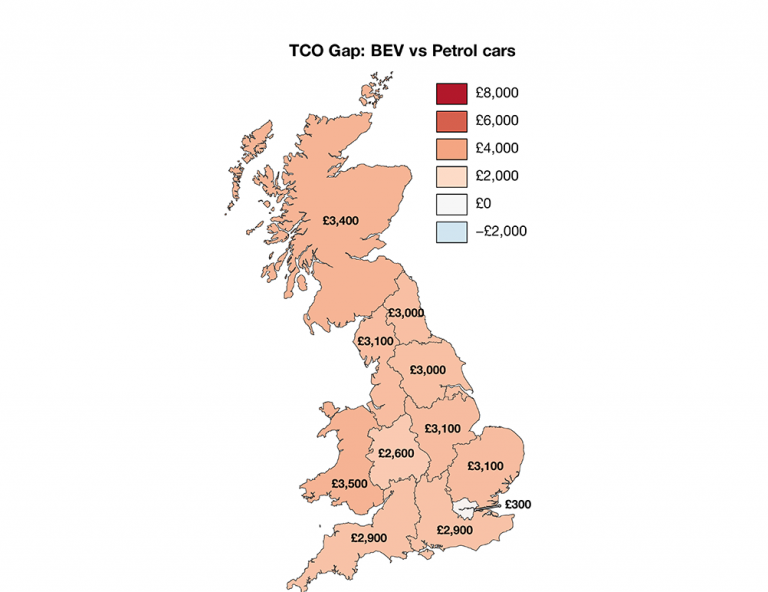

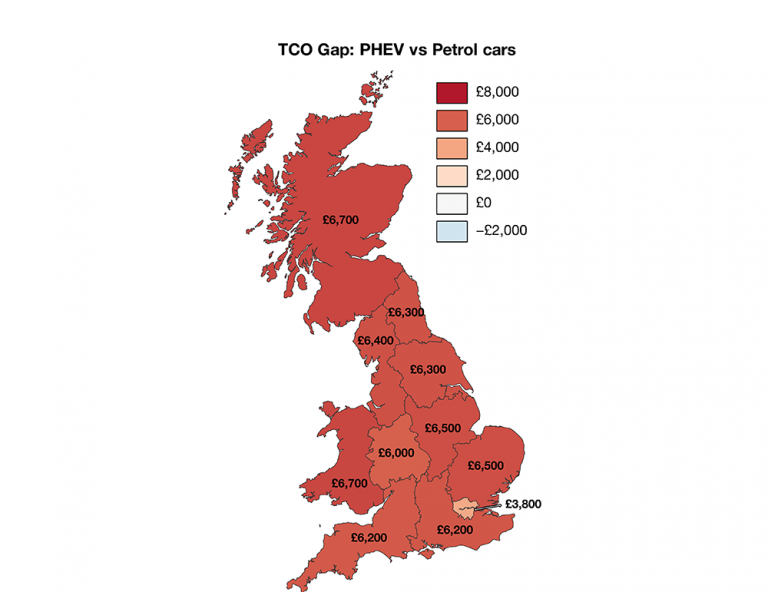

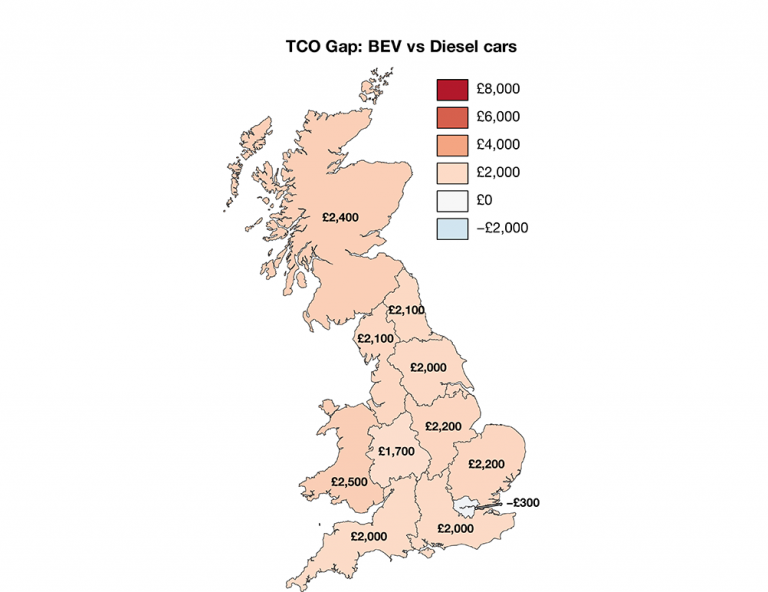

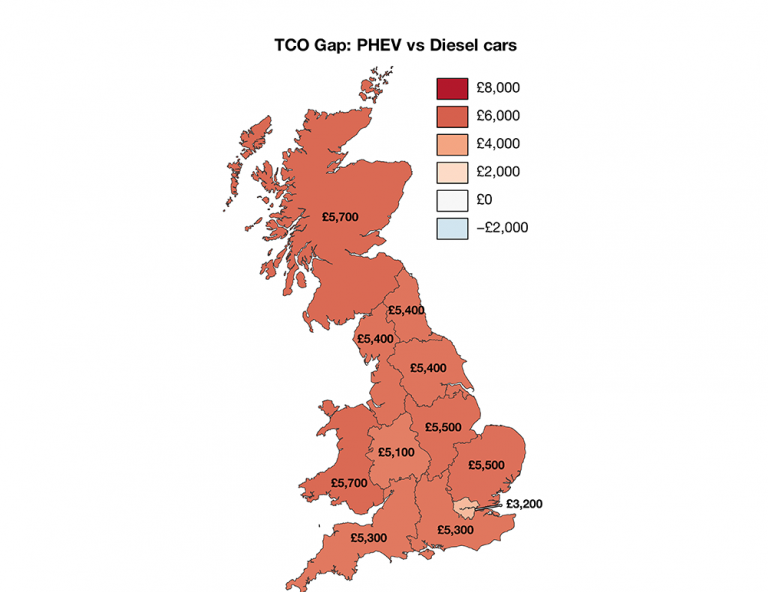

Total cost of ownership (TCO) calculations show that in London battery EVs are less expensive than diesel or petrol vehicles. The regional variation in

TCOs is linked to the average distance travelled by private vehicle per year per region and, to a lesser extent, regional variation in fuel and electricity prices.

EV owners in Wales, Scotland and the North East face the greatest additional financial burden, relative to average income, when switching to battery electric and plug-in hybrid vehicles.

Rail emissions are currently not on track to achieve decarbonisation targets, and progress will likely fall further behind as electrification projects are being abandoned.

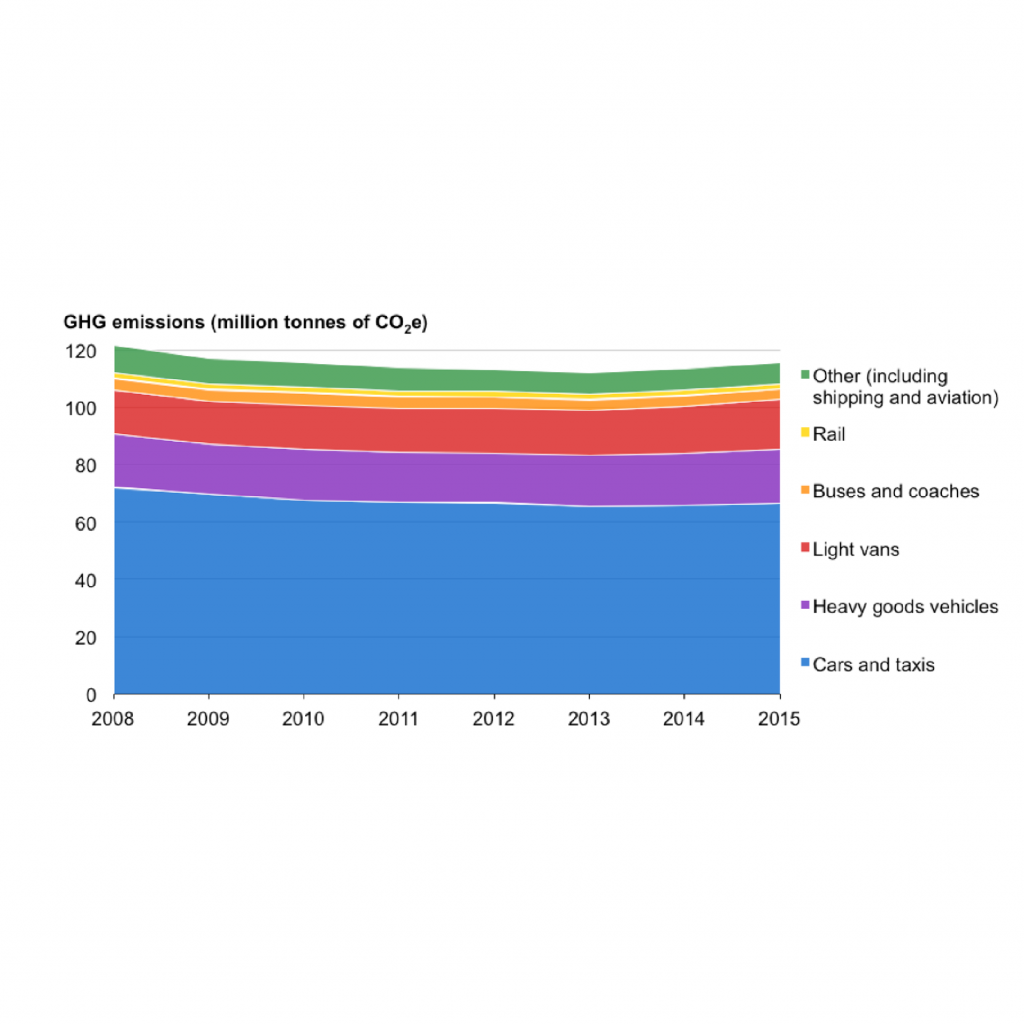

Figure 3.2: Total GHG emissions by transport mode in Britain from 2008-2015.

3.1 Current status and future targets in transport

The energy transition in the transport sector has been relatively slow and limited. In 2004, renewable energy (biofuels and electricity) made up less than 1% of all transport energy. By 2016, this figure stood at 3.5%. The transport sector generated 115 MtCO2e in 2015, accounting for 24% of total emissions (Figure 3.2). Of this, surface transport makes up 95% of these emissions. This coupled with current technological innovation suggests that surface transport has the greatest scope for an energy transformation within the transport sector. The remainder of this section will provide a detailed analysis of the current state of the surface transport sector, and how it is progressing against energy transition targets. The focus will be on road transport, as opposed to rail, as this accounts for around 90% of GHG emissions and passenger kilometres.

The future sees a transition in transport where GHG emissions are halved, EVs account for 27% of the personal vehicle fleet, electric charging and hydrogen refuelling infrastructure support the changing vehicle fleet, and rail emissions decrease by a quarter, all by 2030. Air quality concerns and national climate targets are the main drivers of this transition, resulting in a variety of low-carbon options, such as electrification and hydrogen.

Other options include biofuels and synthetic fuels, which will likely play a role in the transition, especially in the short-term, but remain outside the scope of this study. The transition up to 2030 will be mostly focussed on private-vehicles, with governments and industry already ramping up to achieve future targets. Electrification of buses, heavy good vehicles and rail will be low until 2030 but are expected to achieve large scale deployment nearer 2050.

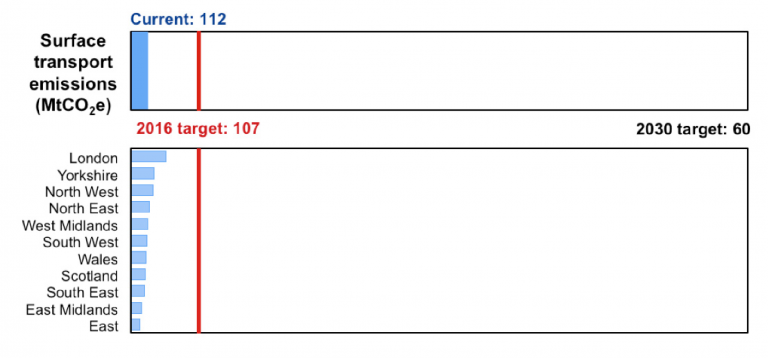

Barometer for GHG emission reductions.

By 2030, surface transport emissions should not exceed 60 MtCO2e. As emissions currently stand at 111.8 MtCO2e, there is still a considerable amount of work required by this sector.

The surface transport system is not reducing emissions fast enough to remain on track to meet its 2030 target.

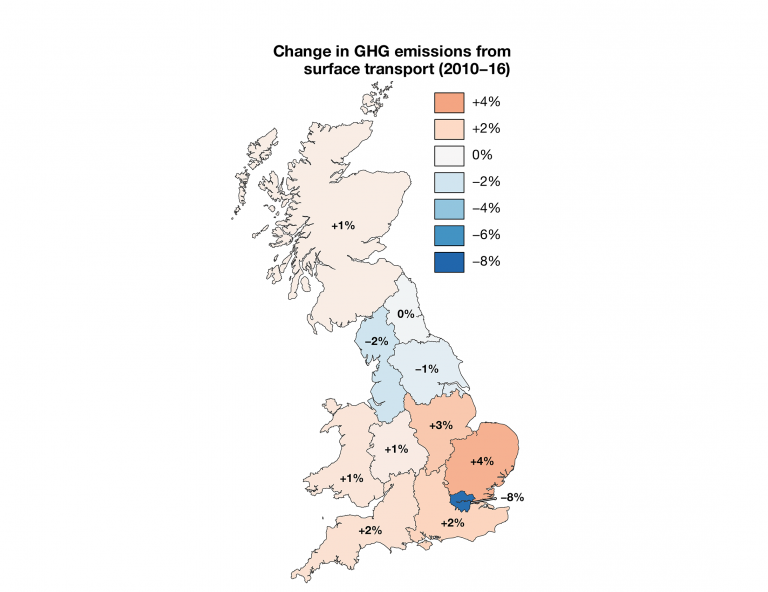

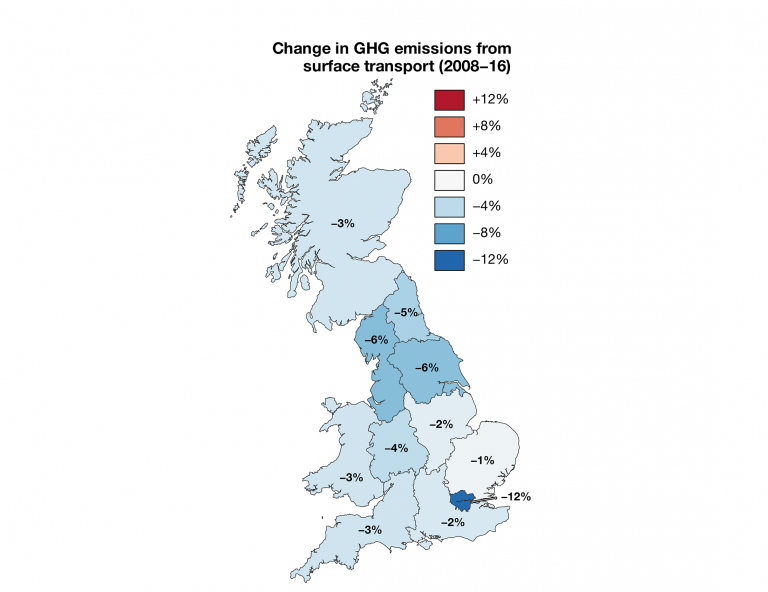

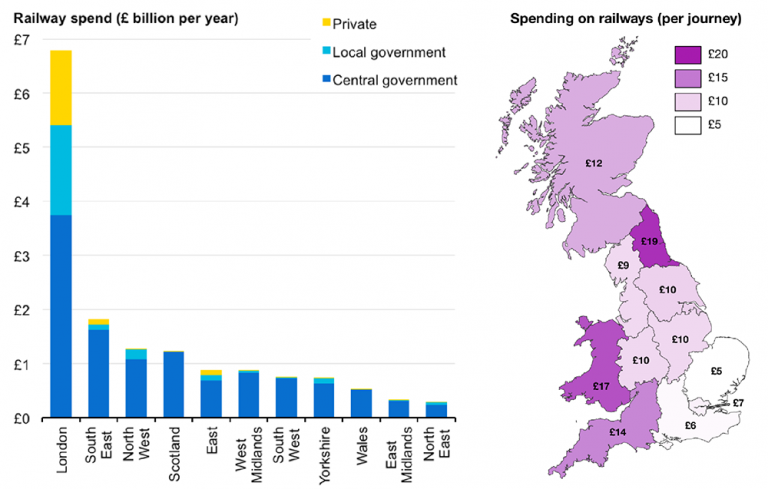

Progress against the 2030 decarbonisation targets is unequal between regions, with London and the North West decarbonising the quickest and the East and East Midlands falling the furthest behind. This indicates that the energy transition in transport is not occurring at the same rate across the country.

Compared to 2008, transport emissions have decreased by 3.7%, likely a result of the global recession and improved vehicle efficiency, as opposed to an energy transformation or fuel switching. During this same time, renewable energy in transport increased by less than 1% (2.8% in 2008 to 3.5% in 2016). Further, between 2010 and 2016, surface transport emissions increased by 1.1%. With 2016 emissions at 111.8 MtCO2e, significant decreases will be required to achieve emissions below 60 MtCO2e by 2030.

All regions in GB have decreased their surface transport emissions relative to 2008 (Figure 3.4). However, compared to 2010, the story changes, with only four regions decreasing or maintaining their emissions (Figure 3.3). This shows the relative importance the recession has played on reducing surface transport emissions in GB since 2008. London, compared to both 2008 and 2010, shows the greatest decrease in emissions likely related to efficiency gains in public transport, increases in active travel and decreases in road kilometres driven.

Using decarbonisation as a proxy, the regions of GB are undergoing energy transitions at unequal rates. London has decarbonised at the fastest rate, and along with the North West has exceeded the required emissions reductions to be on track to achieve the 2030 emissions target. In contrast, the East and the East Midlands are the furthest behind. These regional inequalities could further be amplified if regions continue progressing at these speeds, suggesting that some regions will be significantly further behind in the transport energy transition.

3.1.2 Plug-in vehicles in the car fleet

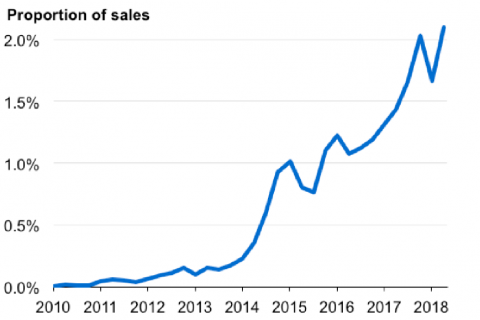

Plug-in vehicles are still in their infancy, representing only 1 in 50 new car sales, and 1 in 250 vehicles on the road. However, Britain is on-track to achieve plug-in vehicle targets, which require a 27% share of the private vehicle fleet by 2030.

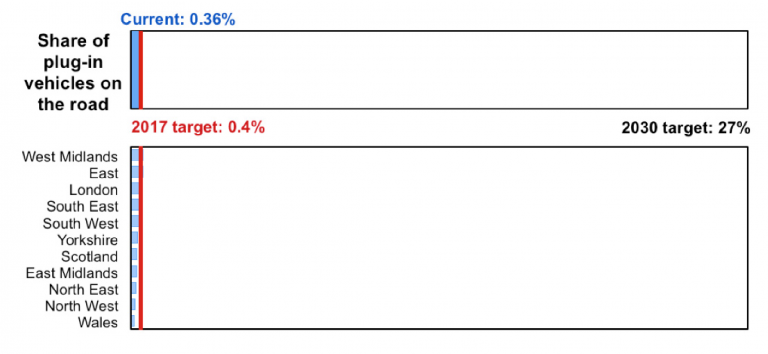

Barometer for plug-in vehicle penetration

Electric vehicle sales have dramatically increased since 2011 in all GB regions.

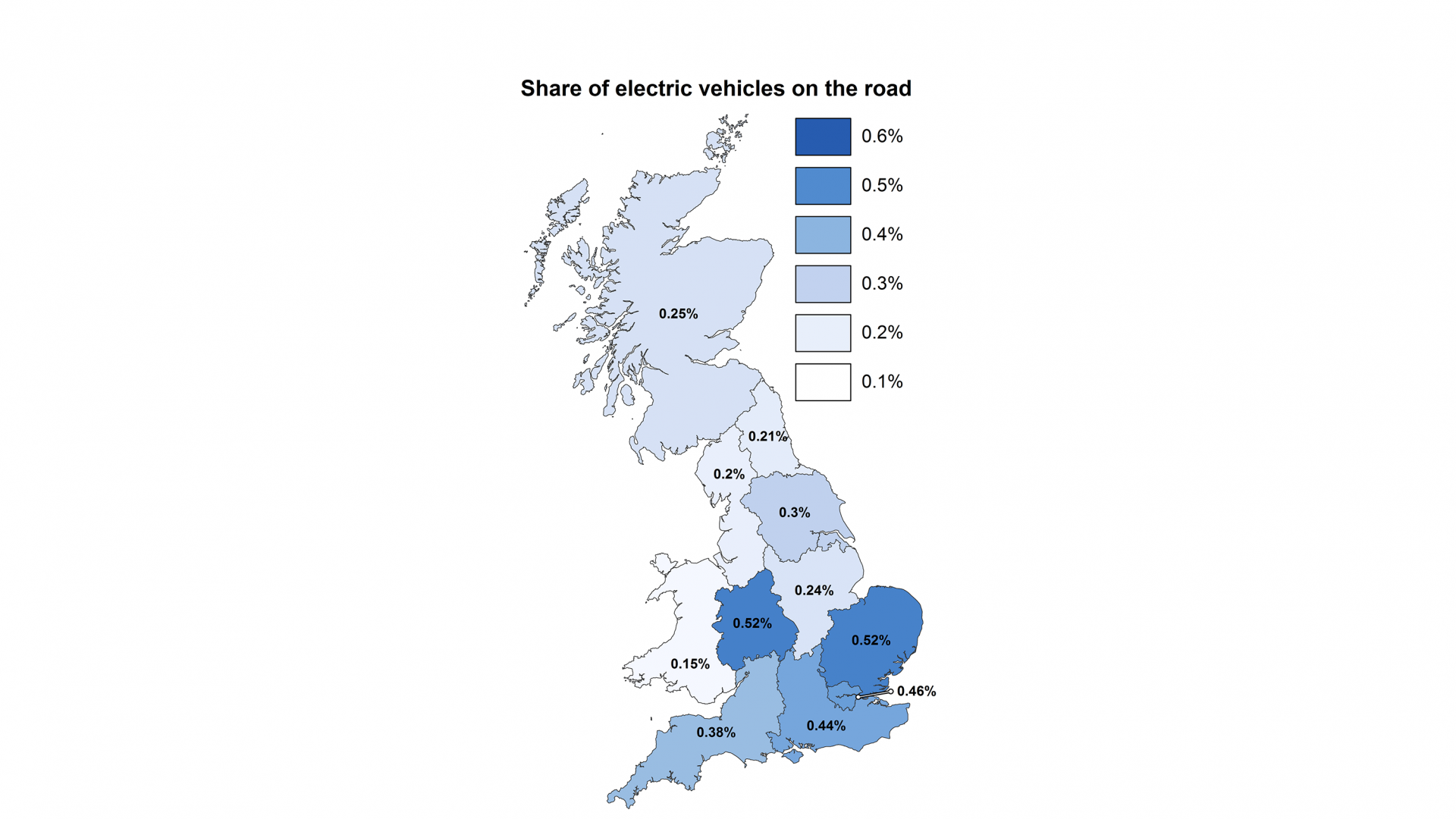

Plug-in vehicles are most abundant on the roads of the southern half of Britain. They are more than three-times more prevalent in the West Midlands as in Wales. This suggests other barriers are present in the northern regions that is impeding the growth of plug-in vehicles.

Plug-in vehicle growth has had a 60-fold increased since 20117, resulting in their increased share of newly sold vehicles, from 0% in 2008 up to 2% by 2018 (Figure 3.6). This growth is likely a direct result of EVs becoming cheaper, and a greater range of vehicles available on the market. All regions of GB have significantly increased the number of plug-in vehicles on the road since 2011 – with the Yorkshire and the Humber having 200 times more vehicles in 2018 (Figure 3.6).

Plug-in vehicles are most abundant in the southern regions of GB. This suggests regional factors – e.g. income, availability of chargers, driving patterns – are affecting the expansion of plug-in vehicles.

Despite recent growth, plug-in vehicle penetration is less than 1 in 200 vehicles currently on the road. This suggests that growth will need to continue along this seemingly exponential trend to ensure that the plug-in vehicles account for 27% of all personal vehicles by 2030.

Regionally, the West Midlands, the East, South East and London are leading, with plug-in vehicle penetration above the 2017 target of 0.4%. However, many regions, such as Wales and the North West, are at risk of being left behind in the plug-in vehicle transition, achieving less than 0.2% of plug-in vehicle penetration. This regional disparity could potentially be masked in the future, if the national target is achieved through the efforts of only a few key regions.

Figure 3.6: (chart) Proportion of new car sales that are electric; (map) Number of registered plug-in vehicles by region.

3.1.3 EV charging points

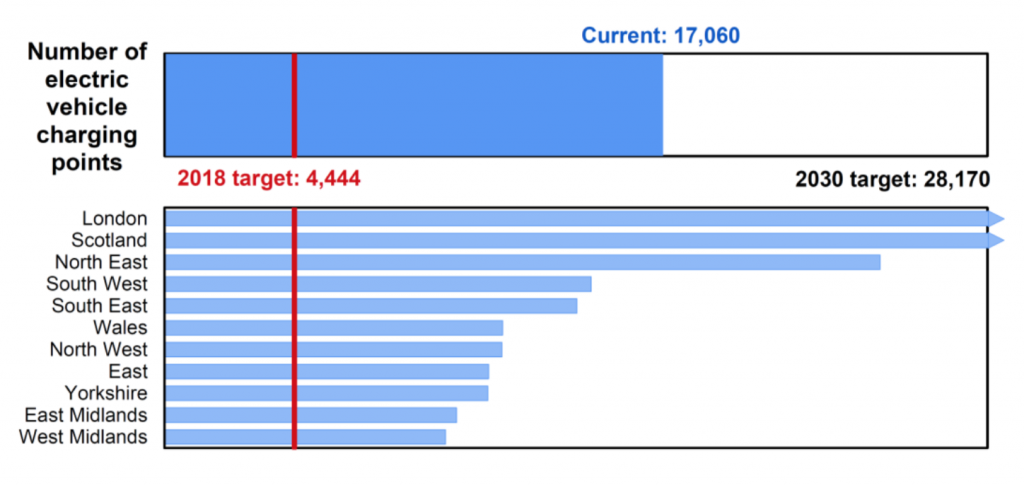

There are currently over 17,000 chargers in Great Britain, of which 3,600 are rapid. By 2030, there should be over 28,000 chargers.

EV charger deployment is well ahead of schedule to meet the 2030 target, but the deployment is highly clustered in cities.

While all regions have deployed more chargers than required to achieve the indicative 2018 target, over 50% are located in London, Scotland and the South East. Scotland and London have already deployed more chargers than required by the 2030 target.

Electric charger deployment is on track to achieve its 2030 target ahead of time, having already achieved the interim target for 2020 (6,250 chargers). There are currently more rapid chargers in the GB than the target suggests there should be by 2030 to support a growing EV industry (1,170 in 2030 versus 3,600 in August 2018). Further, in August 2018, 2/3 of the parking-based chargers required by 2030 were already installed in Britain. However, these EV chargers are not evenly distributed amongst the British regions, with over 50% located in London, Scotland and the South East.

This is not particularly surprising for London and the South East, as they currently have a large share of the electric vehicles currently on the road. Scotland, on the other hand, is one of the lower ranking regions in terms of number of EVs on the road. The high number of electric chargers could suggest a strong projected growth in battery electric vehicles in the region. This could in part be related to the environmental commitments set by the devolved power.

Figure 3.7: map of the number of electric charging locations.

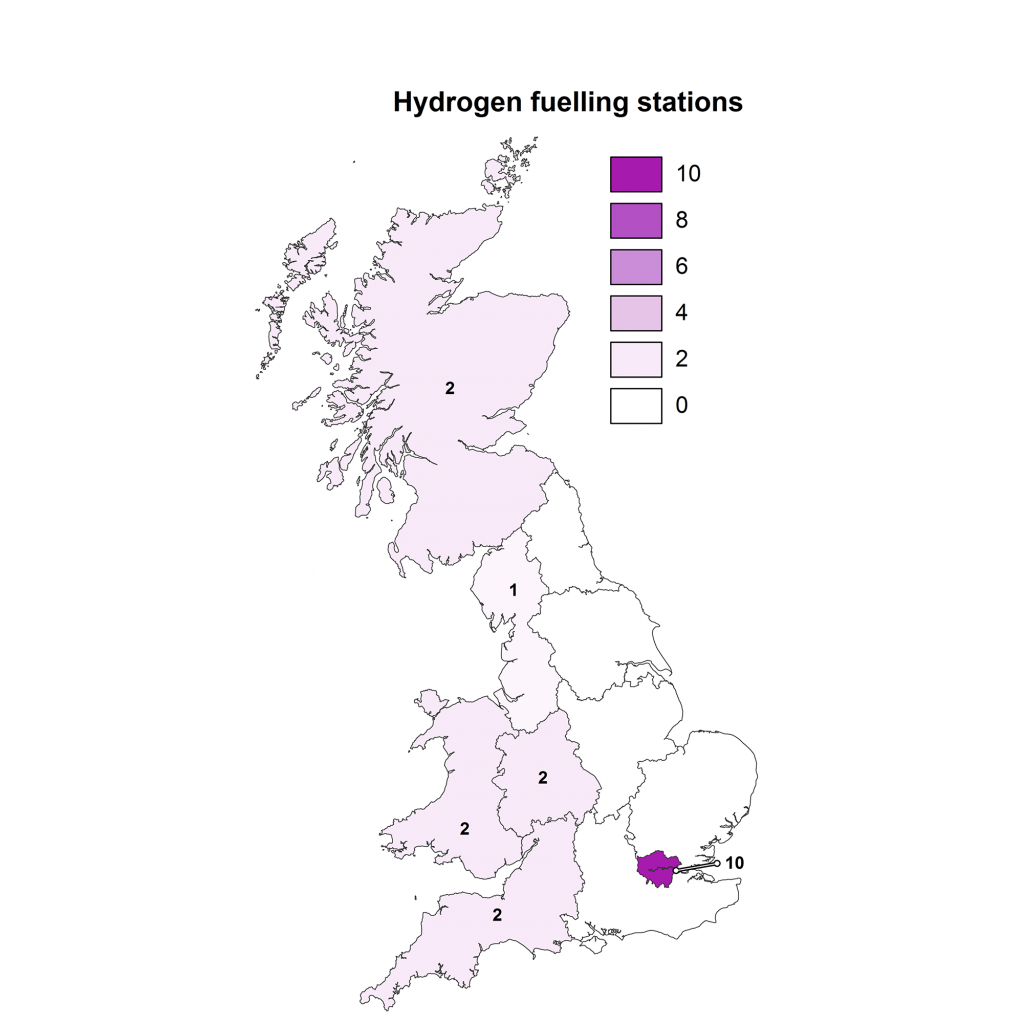

3.1.4 Hydrogen refuelling stations

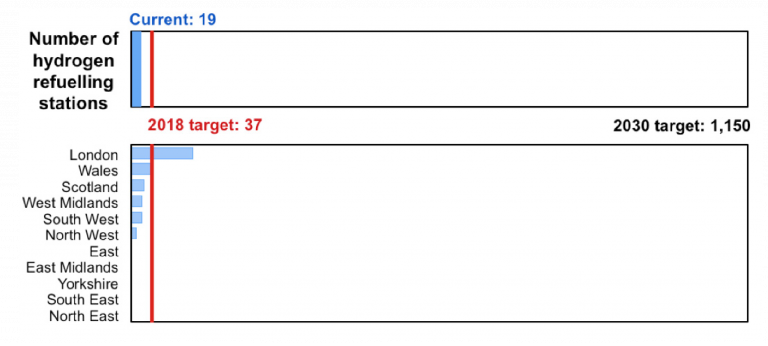

Hydrogen refuelling station deployment is not occurring quickly enough, jeopardising the achievement of the 2030 target, needed to support a hydrogen transport network.

65 hydrogen refuelling stations are required to support an initial hydrogen network in GB. There are currently 19, with over half located in London.

Figure 3.8: map of regional current status.

Apart from London, hydrogen refuelling stations are predominantly located on the western side of Britain and tend to be relatively clustered.

The government-industry UK H2 Mobility initiative set a target for the number of hydrogen refuelling stations required to support a national hydrogen vehicle fleet.

By 2030, 1,150 would be required, with intermediate targets of 65 filling stations for 2020 and 330 by 2025. Currently, there are only 19 hydrogen refuelling stations, jeopardising the feasibility of achieving the 2030 target, unless considerably more effort is put towards their deployment.

As with electric chargers, though to a more extreme degree, the distribution of hydrogen stations is strongly clustered – currently, over 50% of refuelling stations are in London. A further eight stations are located in western Great Britain, and one on the Scottish East coast. Further, the national target for stations was apportioned to each region based on the current number of registered vehicles. London and Wales are the only regions that are on track to achieve the 2030 target. Conversely, the eastern side of England (excluding London) does not have any refuelling stations, threatening their ability to achieve the 2030 target.

Barometer for hydrogen refuelling stations.

The location of these stations limits the operation of hydrogen-fuelled vehicles, and further limits the benefits (e.g. improved air quality) of this energy transition to a few clustered areas. Due to their long distance and high energy requirements, heavy goods vehicles (HGVs) would benefit most from a well-developed hydrogen network. However, the limited deployment and clustering of stations are restricting its use in HGVs.

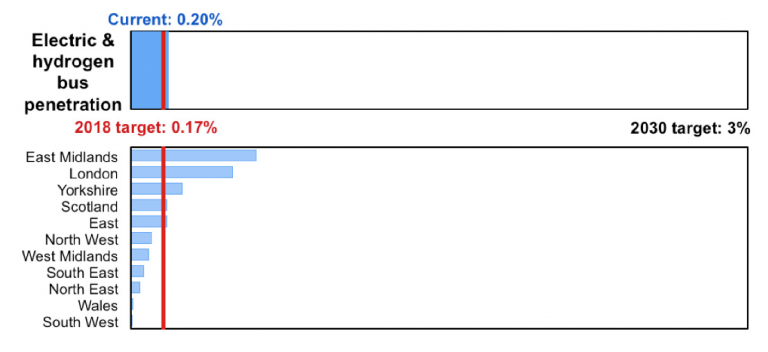

3.1.5 Electric and hydrogen bus penetration

The transition to electric and hydrogen buses in on track to achieve the 2030 target. Despite making up a low share of the bus fleet, electric buses are replacing, in part, diesel buses coming to the end of their lifetime.

Early battery and hydrogen electric bus fleet penetration is on track even with overall growth of the bus fleet.

Commitments to improving air quality by cities is resulting in an increased share of electric and hydrogen buses in the overall fleet.

Barometer for battery electric and hydrogen buses.

By 2030, battery electric and hydrogen buses should account for 3% of bus fleet, which, compared to the plug-in vehicle target, is relatively small. This is related to the longer asset lifetime of the current bus fleet compared to private vehicles, and therefore a complete change in the fleet requires more time. While electrification transition may be slow, the progress is encouraging. The absolute number of battery electric and hydrogen buses is increasing at the same rate as its penetration rate of the entire fleet (Figure 3.10). This suggests that the increased proportion is due to replacing the existing (diesel) fleet with electric/hydrogen buses, rather than from any decrease in the absolute number of buses.

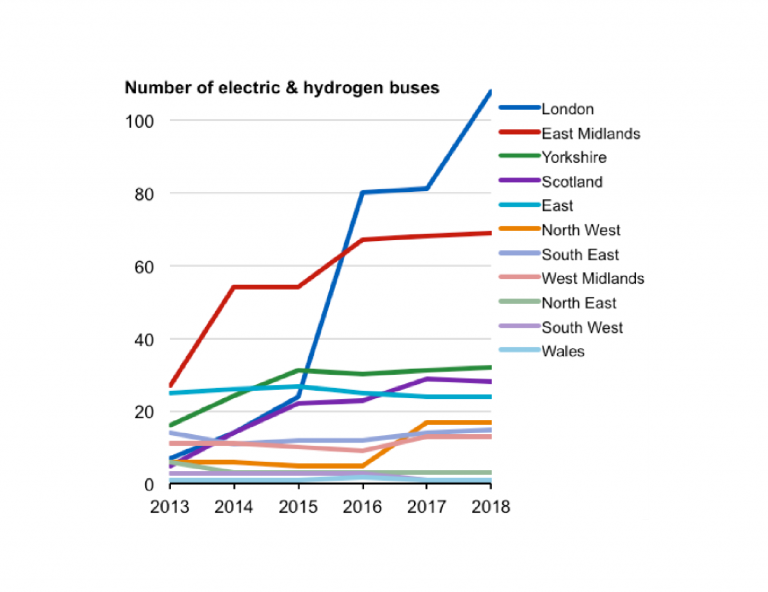

Figure 3.10: (left) Electric and hydrogen buses (blue line) and penetration of bus fleet (red line); (right) Number of ultra-low emission buses by region between 2013 and 2018 (quarter 1).

The share of battery electric and hydrogen buses in each region is affected by the commitments made by cities within each region. The East Midlands has the greatest share of electric buses compared to any other region. Nottingham, in the East Midlands, has been an early adopter having just increased their fleet to 58 electric buses. Cities tend to make their commitments to electric buses due to the air quality improvements they can provide. London has seen a 15-fold increase between 2013 and 2018 in the number of electric and hydrogen buses, which is linked to TfL’s air pollution commitments. The continued transition towards electrified public road transport will depend on cities, as currently electric buses have been limited to relatively short routes. However, with the implementation of a larger hydrogen network across the country, non-metropolitan areas could also benefit from an ultra-low emissions bus network.

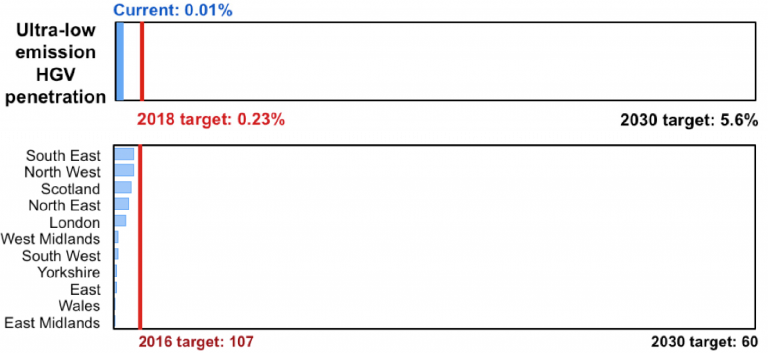

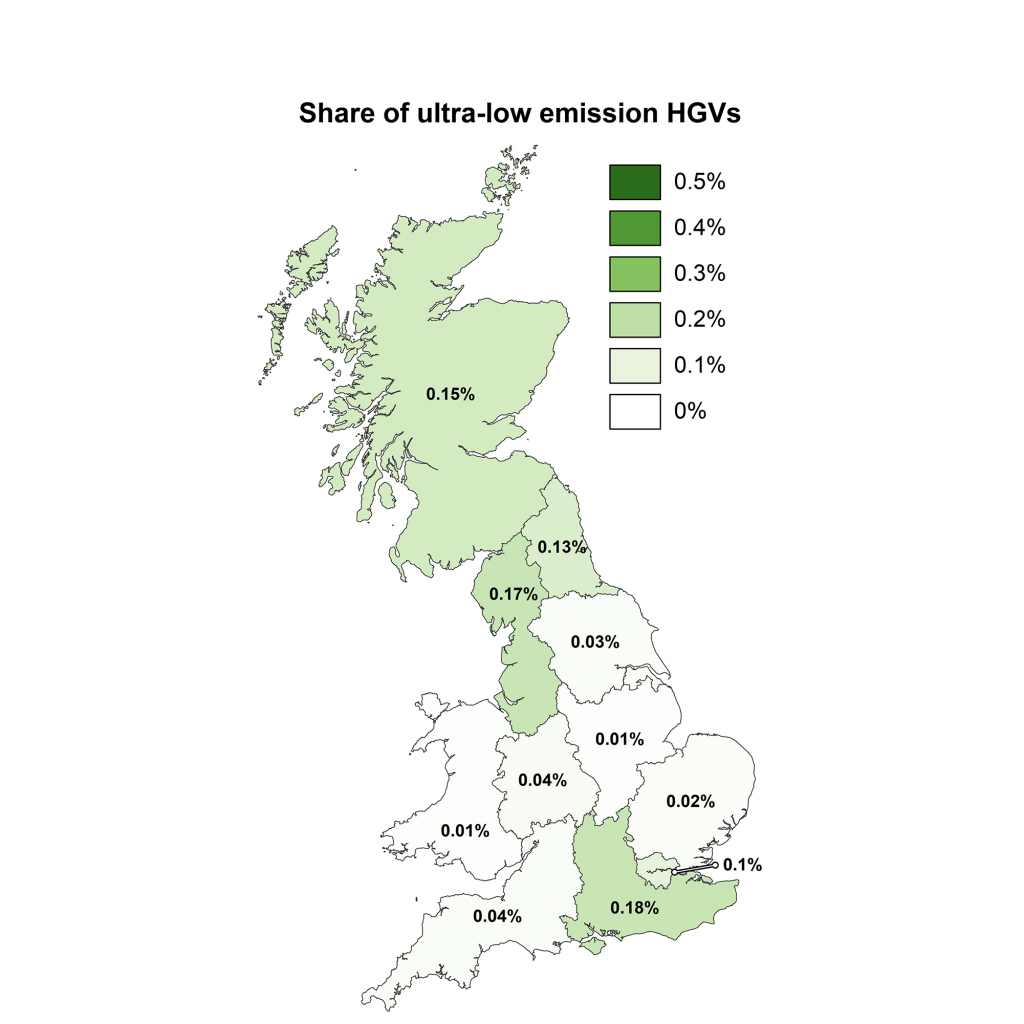

3.1.6 Ultra-low emissions heavy goods vehicles

Less than 0.1% of the heavy goods vehicle (HGV) fleet is considered ultra-low emission.

This is not surprising as the transition is likely to be based around hydrogen fuel, which is lacking a developed refuelling network.

Ultra-low emissions HGV deployment is limited in Britain, with only four regions having more than 1 in 1000 heavy goods vehicles on the road.

Progress towards the electrification of HGVs is not on track to achieve the 2030 target, where 5.5% of the HGV fleet must be electrified.

Currently, less than a tenth of a per cent of the HGV fleet is considered ultra-low emissions. This is not unsurprising, as HGV technology currently limits its transition to using hydrogen, which, as discussed previously, is lacking a developed infrastructure. However, companies such as Tesla, Daimler, Volkswagen and ThorTrucks, have unveiled plans to produce electric HGV vehicles, with Tesla aiming to start production as soon as 2019. These future technological advancements could help Great Britain achieve its target, but this will be dependent on when these vehicles are commercially rolled-out.

Barometer for ultra-low emission HGVs.

Regionally, the South East, North West and Scotland have the greatest proportion of ultra-low emission HGVs. These regions are equipped with or are near hydrogen refuelling stations. Wales, on the other hand, has over 10% of British hydrogen refuelling stations, but have one of the lowest share of ultra-low emission HGVs in its fleet. This is likely explained by the fact that these hydrogen refuelling stations are located at universities/research centre, and therefore are not likely to play a large role in ensuring an uninterrupted hydrogen network. Further, it is important to note that differences between regions are very small and all regions are at risk of not achieving the 2030 target.

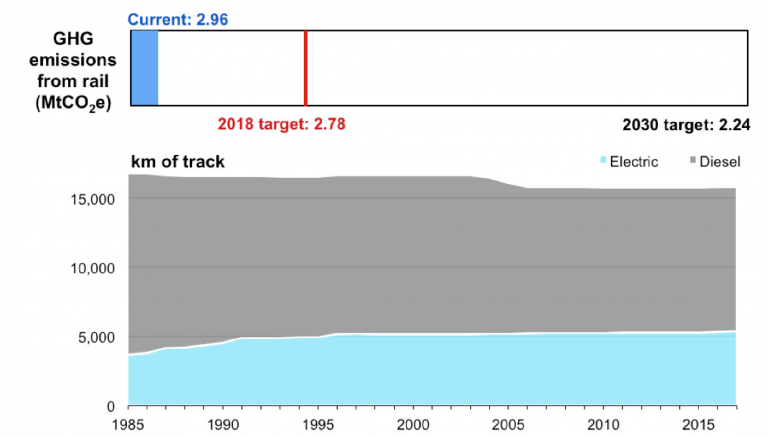

3.1.7 Rail emissions

Rail emissions have decreased by only 1% since 2010, suggesting the industry is falling well behind the progress needed to achieve the 2030 target.

Abandoned electrification plans are jeopardising the achievement of the 2030 rail emissions target.

The proportion of electrified rail has only modestly increased since 1985, allowing only a small segment of the rail network to benefit from a decarbonising power sector.

By 2030, the rail industry needs to reduce its direct and indirect emissions by 25% as compared to 2010. Emissions reductions will likely occur in an exponential fashion due to the inertia of the industry and the relatively long time-frames required to complete infrastructure improvements. It is, therefore more likely that emissions reductions will occur in large discrete steps, rather than constant yearly reductions. However, since 2010, emissions in rail have only decreased by 1% suggesting that there is still considerably more work required to achieve the 2030 target.

Barometer for rail emission reductions. Top: national progress; Above: share of electrified railways across Britain over the last three decades.

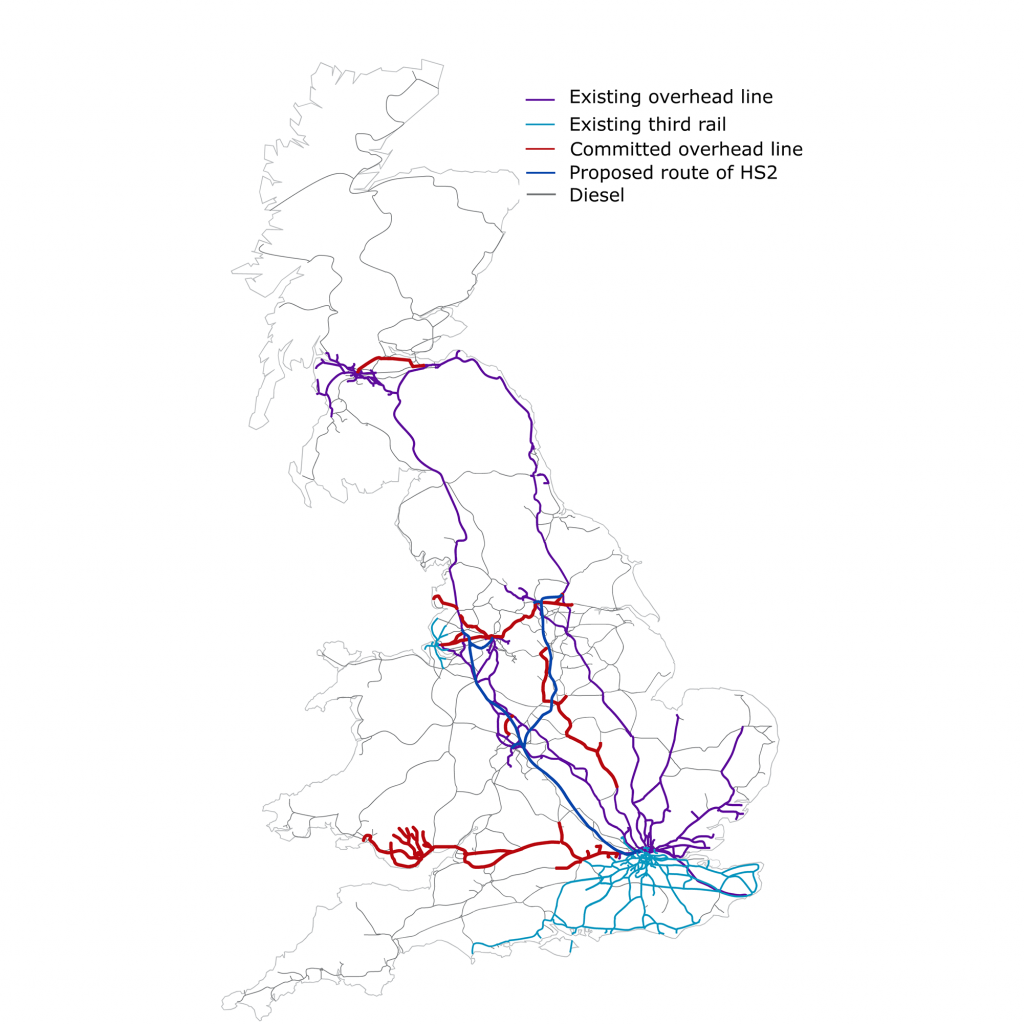

Figure 3.12: map of Britain’s railway lines, with colours to signify existing or proposed electrified lines, and grey to signify diesel.

To remain in line with the target, emissions will need to start falling due to greater overhead electrification and increased use of bi-modald, battery and hydrogen trains, as well as the use of other low carbon fuels. As the target includes both direct and indirect emissions, the sector could benefit from increasing the proportion of railways that are electrified to capture the falling carbon intensity of the power sector. However, there has been very modest progress towards railway electrification in the last 30 years (Figure 3.12). The proportion of electrified rail in a year is sensitive to the completion of electrification projects. The recently abandoned overhead electrification plans on the Great Western Main Line, Midland Main Line and Lake Line suggests that the proportion of electrified rail will not dramatically increase in the near future, jeopardising the 2030 target. But, the government does suggest that trains on these lines could be battery and hydrogen powered. While the proportion of electrified rail will increase with the completion of High Speed 2, this is not expected to be completed before the late 2020s, and therefore its contribution towards achieving the target could be limited, especially if there are any completion delays. Further, part of the remaining regions to electrify are too remote, and therefore the business case for electrification is not strong.

3.2 Implications of a transitioning transport sector

3.2.1 Total cost of car ownership passenger vehicles

A regional analysis of the total cost of ownership (TCO) of conventional (petrol and diesel), battery electric (BEV) and plug-in hybrid electric (PHEV) reveals which regions will incur a greater financial burden from electrification. This investigates the impacts of regional differences (e.g. driving habits, fuel costs) on the TCO of privately-owned vehicles. Appendix 1 provides an overview of the methodology, while Appendix 2 provides further analysis of the results.

The TCO gap is the difference in the lifetime cost of owning one vehicle over another. At a national level, the TCO gap is greatest between a petrol vehicle and a PHEV (~£6,200) and is the smallest between a diesel vehicle and a BEV (~£1,900). The regional variation in TCO is strongly related to the regional differences in kilometres driven, and, to a smaller extent, the regional variation in fuel cost prices (i.e. electricity, petrol and diesel). The annual distance travelled by each vehicle impacts its fuel requirements, depreciation rate and maintenance cost.

Further, recent changes to the Plug-In Grant Scheme –BEVs, as of the beginning of November 2018, will receive £3,500 instead of £4,500 and PHEVs will no longer receive any subsidy, previously £2,500 – has increased the TCO gap between these electric cars and fossil fuelled ones. Prior to this change, the TCO gap between a petrol vehicle and PHEV was ~£3,700 and between a diesel and BEV was ~£900.