- New analysis shows Great Britain’s progress in decarbonising electricity has slowed

- New solar and wind projects fall to lowest level in seven years

- Collapse of new nuclear projects and the suspension of the Capacity Market raises concerns over UK’s long term energy strategy.

Efforts to decarbonise energy generation have slowed raising concerns that the UK’s world beating progress on tackling climate change could stall.

While output from renewables reached new highs in 2018 there was a dramatic decline in the amount of new wind and solar projects coming online, according to the latest Electric Insights report.

The carbon intensity of electricity averaged 217 g/kWh last year. That was 8% lower than in 2017 but amounts to the slowest rate of decarbonisation since 2013. The fastest rate of power system decarbonisation happened in 2016 when carbon intensity dropped 85 g/kWh compared to 2018’s decrease of 20 g/kWh.

Great Britain’s carbon intensity must continue to fall by 6% a year over the coming decade to meet the Committee on Climate Change’s target of 100 g/kWh by 2030.

But it’s already projected to fall by slightly less than that – 5% – in the coming years due to the slump in new renewables and nuclear. Progress could be further dented if coal makes a comeback ahead of it coming off the system in 2025.

Commenting on the analysis Dr Iain Staffell of Imperial College London said:

“The UK has led the world in decarbonising electricity and that continued in 2018 as output from renewables hit new highs. The sharp fall in new solar and wind projects coming online is worrying, and the likelihood that this trend will continue raises serious questions over future progress towards meeting our climate targets.”

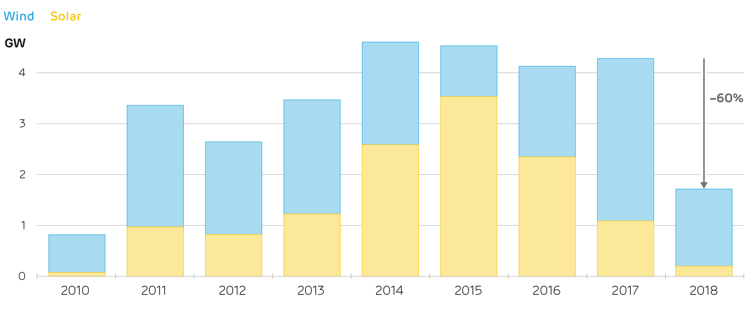

In the last 12 months, fewer wind and solar projects were built than at any time since 2010. The Government’s own forecasts expect this slump to continue into the next decade.

New solar PV and wind capacity installed in each calendar year

The suspension of the Capacity Market late last year created further uncertainty around the future of Britain’s power system.

That was compounded in January by Hitachi’s decision to suspend work on the planned 2.9GW Wylfa nuclear power plant and a similar project at Oldbury in Gloucestershire. Together with the Moorside nuclear project, which was cancelled last year, it has left a 9GW hole in the UK’s future low carbon generation plan. All but one of the current fleet of nuclear power plants are due to close by 2030.

Will Gardiner, Chief Executive of Drax Group said:

“It’s vital that the UK meets its climate goals. That’s why at Drax we have been taking coal off the system and trialling breakthrough bioenergy carbon capture and storage technology. But this analysis and the problems besetting new nuclear shows that as a country we need to look again at our future energy strategy. We must ensure that the UK power system has the flexibility and stability needed to enable much more renewable energy in the future.”

Dr Nina Skorupska CBE, Chief Executive of the Renewable Energy Association commented:

“Changes to energy policy in recent years hit the solar PV, onshore wind and bioenergy sectors hard.

“Renewables represent some of the lowest cost forms of new power generation today, a fact recognised by the Government in both recent statements from the Secretary of State and the Clean Growth Strategy. However, there remains a significant policy gap and an absence of a fair route to market for new renewable and clean technology projects.

“Today’s data highlights a collapse in the number of projects under development, despite the that fact that polling tells us the public want to see more renewable power on the system.”

Electric Insights reveals that 2018 was a record breaking year for Britain’s power system with several new renewables and low carbon records set. But Britain needed flexible gas generation too – on a cold night in January with low wind and much of the nuclear fleet out of action gas fired stations reached a new record high producing 27GW and meeting 66% of power demand. Data on the realtime Electric Insights website shows that this record was broken again last month and now stands at 27.1GW.

ENDS

Media contacts

Rachel Adeyinka

[email protected]

07940 177 999

Emilie O’ Herne

[email protected]

07774 627 257

Editor’s Notes

- 2018 was a record-breaking year for Britain’s power system. See all the current records compiled for the first time in this edition of Electric Insight A raft of renewable and low carbon records were set in 2018 with wind solar and Biomass power stations producing more electricity than every before.

- The ranking in Britain’s electricity mix has also changed significantly – last year coal fell from 4thto 6thlargest source of power, overtaken by both imports and biomass. The team at Imperial College London predicts that 2019 or 2020 could see more power produced by solar than coal.

- The report finds power generation from fossil fuels was down 15% in Q4 2018 compared to the final quarter of 2017.

- Electric Insightsalso reports day ahead power prices are at a 10-year high.

- The amount of electricity generated in Great Britain fell to its lowest in a quarter of a century, as demand fell and nine times more power was imported than interconnectors exported.

About Electric Insights

- Electric Insights Quarterly was commissioned by Drax and is delivered independently by a team of academics from Imperial College London, facilitated by the College’s consultancy company – Imperial Consultants. The report analyses raw data made publicly available by National Grid and Elexon, which run the electricity and balancing market respectively, and Sheffield Solar. Released four times a year since November 2016, Electric Insights Quarterly focuses on supply and demand, prices, emissions, the performance of the various generation technologies and the network that connects them.

- Along with Dr Iain Staffell, the team from Imperial included Professors Richard Green and Tim Green, experts in energy economics and electrical engineering, and Dr Rob Gross who contributed expertise in energy policy.

- The quarterly reports are backed by an interactive website electricinsights.co.uk which provides live data from 2009 until the present.

About Drax

Drax Group’s ambition is to enable a zero carbon, lower cost energy future. Its 2,600-strong staff operate across three principal areas of activity – electricity generation, electricity sales to business customers and compressed wood pellet production.

Power generation:

Drax owns and operates a portfolio of flexible, low carbon and renewable electricity generation assets across Britain. The assets include the UK’s largest power station, based at Selby, North Yorkshire, which supplies six percent of the country’s electricity needs.

Having converted two thirds of Drax Power Station to use sustainable biomass instead of coal it has become the UK’s biggest renewable power generator and the largest decarbonisation project in Europe.

Its pumped storage, hydro and energy from waste assets in Scotland include Cruachan Power Station – a flexible pumped storage facility within the hollowed-out mountain Ben Cruachan. It also owns and operates four gas power stations in England.

B2B supply:

Drax owns two B2B energy supply businesses:

- Haven Power, based in Ipswich, supplies electricity and energy services to large Industrial and Commercial sector businesses.

- Opus Energy, based in Oxford, Northampton and Cardiff, provides electricity, energy services and gas to small and medium sized (SME) businesses.

Pellet production:

Drax owns and operates three pellet mills in the US South which manufacture compressed wood pellets (biomass) produced from sustainably managed working forests. These pellet mills supply around 20% of the biomass used by Drax Power Station in North Yorkshire to generate flexible, renewable power for the UK’s homes and businesses.

For more information visit www.drax.com