Demand for electricity might have been 6% lower in the first three months of 2019 than in last year’s first quarter but the demand for lower carbon power is only growing and there’s more pressure than ever for global industries to decarbonise more rapidly.

Aided by a significantly milder winter than last year, Great Britain’s electricity sector continued to make further progress in reducing carbon emissions in the first quarter (Q1) of 2019.

The carbon intensity of Great Britain’s electricity was almost 20% lower in Q1 2019 than in the same period last year. This was driven by a significant decrease in coal usage, with 581 coal-free hours in total over the period – eight times more than in Q1 2018. This trend has only increased, with May seeing the country’s first coal-free week in modern times.

The findings come from Electric Insights, a report commissioned by Drax and written independently by researchers from Imperial College London, that analyses Great Britain’s electricity consumption and looks at what the future might hold.

As public, commercial and political demand for lower carbon emissions mounts, the question for the power system is: can it truly reach zero-emissions?

Keeping a zero-carbon system stable

Quarter after quarter, the carbon intensity of Great Britain’s electricity system has declined. From 545 grams of carbon dioxide (CO2) per kilowatt hour (g/kWh) in Q1 2012, to just over 200 g/kWh last quarter. For a single hour, carbon emissions have fallen as low as just 56 g/kWh. But how soon can that figure reach all the way down to net-zero carbon emissions?

Quarter after quarter, the carbon intensity of Great Britain’s electricity system has declined. From 545 grams of carbon dioxide (CO2) per kilowatt hour (g/kWh) in Q1 2012, to just over 200 g/kWh last quarter. For a single hour, carbon emissions have fallen as low as just 56 g/kWh. But how soon can that figure reach all the way down to net-zero carbon emissions?

The National Grid’s Electricity System Operator (ESO), believes it could be as soon as 2025. But some serious changes are needed to make it possible for the system to operate safely and efficiently, when you have fewer sources offering balancing services like reserve power, inertia, frequency response and voltage control.

The National Grid ESO believes an approach that establishes a marketplace for trading services holds the solution. The hope is that competition will breed new innovation and bring new technologies such as grid-scale storage and AI into the commercial energy markets, offering reserve power and more accurate forecasting for solar and wind power.

For the meantime, weather-dependent technologies are a key source of renewable electricity in Great Britain, with wind making up more than 20% of all generation in Q1 2019. However, with wind capacity only expected to increase, how should the system react when it’s not an option?

Read the full article, co-authored by Julian Leslie, Head of National Control, National Grid ESO: How low can we go?

We cannot control the weather – but we can harness its power

Today there are around 20 gigawatts (GW) of wind capacity installed around Great Britain, and this is forecast to double to 40 GW in the next seven years. However, average wind output can fluctuate between 2 GW one day and 12 GW the next – as happened twice in January. It highlights the ongoing needs for flexibility and diversity of sources in the electricity system even as it decarbonises.

There are a number of ways to make up for shortfalls in wind generation. The most obvious of which is through other existing sources. There is more solar installed around the county than any source of generation (except gas), at 12.9 GW and sun power helped meet demand during a wind drought last summer. Solar averaged 1.3 GW over the last 12 months, this is more than coal which accounted for 1.1 GW.

However, storage will also be important in delivering low or zero-carbon sources of electricity when there is neither wind nor sufficient sunlight. At present this includes pumped storage and some battery technologies, but in future will include greater use of grid-scale lithium-ion batteries, as well as vehicle-to-grid systems that can take advantage of power stored in idle electric cars.

New fuels, particularly hydrogen, also have the potential to meet demand and help create a wider lower-carbon economy for heating, as well as vehicle fuel, with water as the only emission.

Hydrogen can be produced from natural gas or using excess electricity from renewable sources, or through carbon capture from industrial emissions. It can then be stored for a long time and at scale, before being used to generate electricity rapidly when needed.

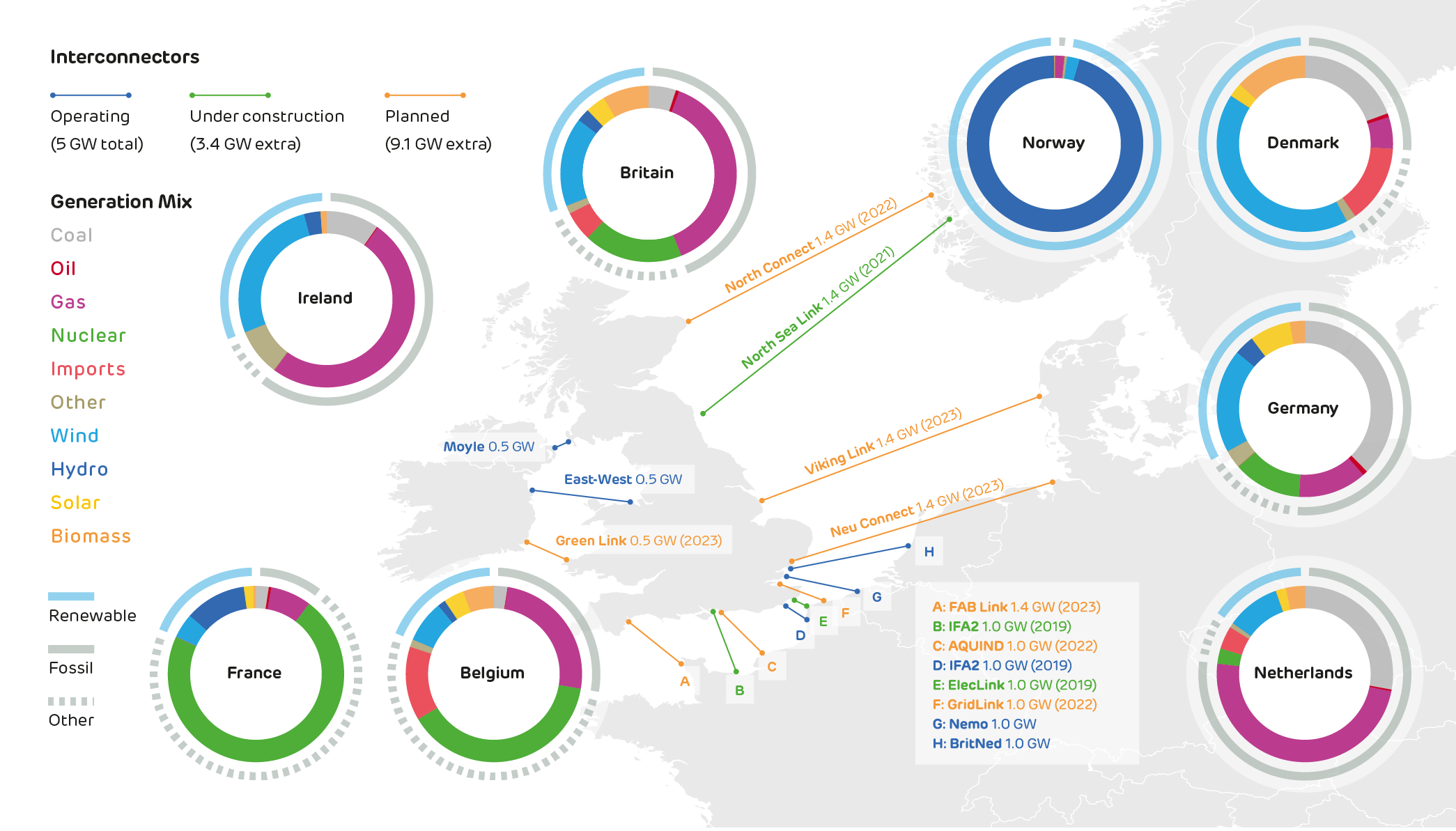

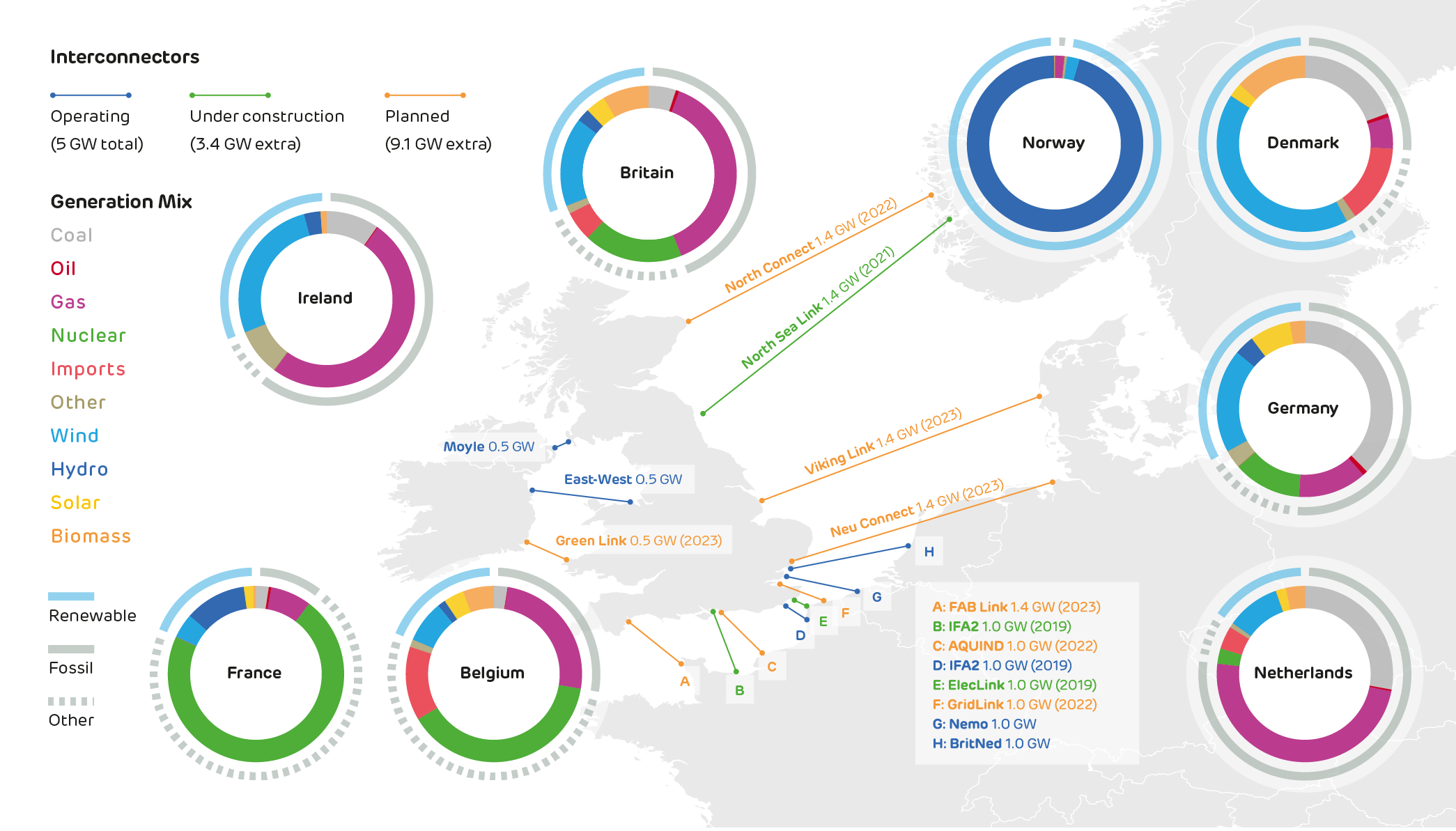

Another increasingly important source of Great Britain’s electricity is interconnectors. However, they are not yet being used in a way that can support gaps in the electricity system, with Northern European countries normally all experiencing the same weather – and wind levels – at the same time.

Read the full article: What to do when the wind doesn’t blow?

A bigger future for interconnection

Great Britain added a new power source to its electricity system in Q1 2019, in the form of Belgium. The opening of the £600 million NEMO link between Kent and Zeebrugge added another 1 GW of interconnection capacity.

Great Britain added a new power source to its electricity system in Q1 2019, in the form of Belgium. The opening of the £600 million NEMO link between Kent and Zeebrugge added another 1 GW of interconnection capacity.

It joins connections to France, the Netherlands, Northern Ireland and the Republic of Ireland to bring Great Britain’s total interconnection capacity to 5 GW. These links accounted for 7.9% of the 78 terawatt hours (TWh) of electricity consumed over the quarter.

Electricity from imports also set new records for a daily average of 4.3 GW on 24 February, accounting for 12.9% of total consumption, and a monthly average in March when it made up 10.6% of consumption. These records represent the first time Great Britain fell below 90% for electricity self-sufficiency.

With 3.4 GW of new interconnectors under construction coming online by 2022 and 9.1 GW more planned to be completed over the next five years, Great Britain’s neighbours are set to play a growing role in the country’s electricity mix.

However, while interconnectors offer an often cost-effective way for Great Britain to ensure electricity supply meets demand, the carbon intensity of neighbouring countries’ electricity should also be considered.

Read the full article: 10% of electricity now generated abroad

The need for cross-border decarbonisation

The new link to Belgium has imported, rather than exported, electricity every day since it began operations, as Belgium has the lowest natural gas prices in Europe and its power stations pay £16 per tonne less for carbon emissions than their British counterparts. This makes it cheaper to import, and less carbon intense, than electricity from the more coal-dependant Netherlands and Ireland.

Planned links to Germany and Denmark could allow Great Britain to import more renewable power. However, if there is a wind drought across Northern Europe these countries often turn to their emissions-heavy coal or even dirtier lignite sources.

France is currently Great Britain’s cleanest source of imports, mostly using nuclear and renewable generation. However, when the North Sea Link opens in 2021, it will give Great Britain access to Norway’s abundance of hydro-power to plug gaps in renewable generation.

Considering the carbon intensity of Great Britain’s imports is important because the decarbonisation needed to address the global climate change emergency can’t be solved by one country alone. For electricity emissions to go as low as they can it takes collaboration that goes across borders.

Read the full article: Where do Britain’s imports come from?

Commissioned by Drax, Electric Insights is produced, independently, by a team of academics from Imperial College London, led by Dr Iain Staffell and facilitated by the College’s consultancy company – Imperial Consultants.

Adjusted EBITDA of £8 million (H1 2018: £10 million)

Adjusted EBITDA of £8 million (H1 2018: £10 million)

Adjusted EBITDA of £9 million (H1 2018: £16 million)

Adjusted EBITDA of £9 million (H1 2018: £16 million)

Quarter after quarter, the carbon intensity of Great Britain’s electricity system has declined. From 545 grams of carbon dioxide (CO2) per kilowatt hour (g/kWh) in Q1 2012, to just over 200 g/kWh last quarter. For a single hour, carbon emissions have fallen as low as just 56 g/kWh. But how soon can that figure reach all the way down to net-zero carbon emissions?

Quarter after quarter, the carbon intensity of Great Britain’s electricity system has declined. From 545 grams of carbon dioxide (CO2) per kilowatt hour (g/kWh) in Q1 2012, to just over 200 g/kWh last quarter. For a single hour, carbon emissions have fallen as low as just 56 g/kWh. But how soon can that figure reach all the way down to net-zero carbon emissions? Great Britain added a new power source to its electricity system in Q1 2019, in the form of Belgium. The opening of the £600 million NEMO link between Kent and Zeebrugge added another 1 GW of interconnection capacity.

Great Britain added a new power source to its electricity system in Q1 2019, in the form of Belgium. The opening of the £600 million NEMO link between Kent and Zeebrugge added another 1 GW of interconnection capacity.