Drax Group plc

(“Drax” or the “Group”; Symbol:DRX)

RNS Number : 2747E

Following a comprehensive review of operations and discussions with National Grid, Ofgem and the UK Government, the Board of Drax has determined to end commercial coal generation at Drax Power Station in 2021 – ahead of the UK’s 2025 deadline.

Commercial coal generation is expected to end in March 2021, with formal closure of the coal units in September 2022 at the end of existing Capacity Market obligations.

Will Gardiner, Drax Group CEO, said:

“Ending the use of coal at Drax is a landmark in our continued efforts to transform the business and become a world-leading carbon negative company by 2030. Drax’s move away from coal began some years ago and I’m proud to say we’re going to finish the job well ahead of the Government’s 2025 deadline.

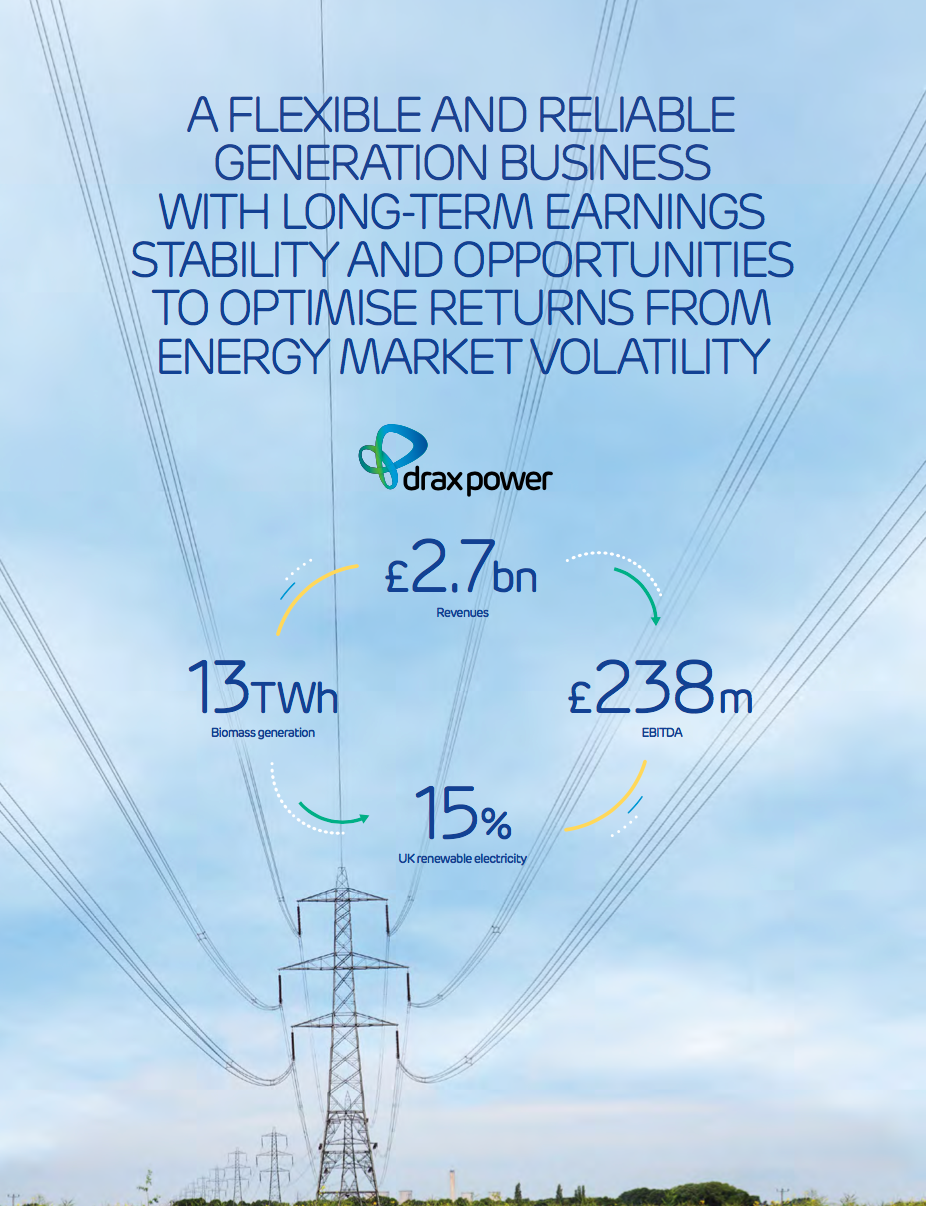

“By using sustainable biomass we have not only continued generating the secure power millions of homes and businesses rely on, we have also played a significant role in enabling the UK’s power system to decarbonise faster than any other in the world.

“Having pioneered ground-breaking biomass technology, we’re now planning to go further by using bioenergy with carbon capture and storage (BECCS) to achieve our ambition of being carbon negative by 2030, making an even greater contribution to global efforts to tackle the climate crisis.

“Stopping using coal is the right decision for our business, our communities and the environment, but it will have an impact on some of our employees, which will be difficult for them and their families.

“In making the decision to stop using coal and to decarbonise the economy, it’s vital that the impact on people across the North is recognised and steps are taken to ensure that people have the skills needed for the new jobs of the future.”

Drax will shortly commence a consultation process with employees and trade unions with a view to ending coal operations. Under these proposals, commercial generation from coal will end in March 2021 but the two coal units will remain available to meet Capacity Market obligations until September 2022.

The closure of the two coal units is expected to involve one-off closure costs in the region of £25-35 million in the period to closure and to result in a reduction in operating costs at Drax Power Station of £25-35 million per year once complete. Drax also expects a reduction in jobs of between 200 and 230 from April 2021.

The carrying value of the fixed assets affected by closure was £240 million, in addition to £103 million of inventory at 31 December 2019, which Drax intends to use in the period up to 31 March 2021. The Group expects to treat all closure costs and any asset obsolescence charges as exceptional items in the Group’s financial statements. A further update on these items will be provided in the Group’s interim financial statements for the first half of 2020.

As part of the proposed coal closure programme the Group is implementing a broader review of operations at Drax Power Station. This review aims to support a safe, efficient and lower cost operating model which, alongside a reduction in biomass cost, positions Drax for long-term biomass generation following the end of the current renewable support mechanisms in March 2027.

While previously being an integral part of the Drax Power Station site and offering flexibility to the Group’s trading and operational performance, the long-term economics of coal generation remain challenging and in 2019 represented only three percent of the Group’s electricity production. In January 2020, Drax did not take a Capacity Market agreement for the period beyond September 2022 given the low clearing price.

Enquiries

Drax Investor Relations:

Mark Strafford

+44 (0) 7730 763 949

Media

Drax External Communications:

Ali Lewis

+44 (0) 7712 670 888

Website: www.drax.com/uk

END