Highlights

- Targeting biomass self-supply capacity of five million tonnes by 2027

- 1.5 million tonnes of existing capacity, plus 0.35 million tonnes of low-cost capacity announced at the 2019 half year results

- Evaluating options for a further three million tonnes over the next seven years

- Supports target to reduce biomass cost by c.30 percent to c.£50/MWh

- Targeting returns significantly in excess of the Group’s cost of capital

- Trading update – in-line with expectations

- Acquired assets performing strongly

- Capacity Market restored and included in 2019 Adjusted EBITDA(1)

Will Gardiner, Drax Group CEO, said:

“Drax’s purpose is to enable a zero-carbon lower cost energy future. We believe sustainable biomass has a long-term critical role to play. That’s why we plan to supply 80 percent of our biomass from our own sources – a significant increase on the 20 percent we currently self-supply. Supplying more of our own biomass will cut costs and reduce supply chain risks, ensuring our biomass power generation remains viable in the long term. When combined with carbon capture it will also enable negative emissions, helping the UK on its path to net zero by 2050.”

Will Gardiner, CEO, Drax Group. Click to view/download in high res.

Capital Markets Day

Drax is today hosting a Capital Markets Day for investors and analysts.

Will Gardiner and his management team will update on how the Group is delivering on its purpose. The day will outline the significant opportunities Drax sees in growing its biomass supply and renewable generation businesses.

Investment in biomass to increase capacity and reduce cost

As a part of the Group’s key strategic objective of building a long-term future for sustainable biomass, Drax remains focused on opportunities to reduce its cost of biomass to a level which is economic without subsidy in 2027.

These savings will be delivered through further optimisation of existing biomass operations and greater utilisation of low-cost wood residues; an expansion of the fuel envelope to incorporate other renewable fuels and; a significant expansion of self-supply capacity.

Drax is targeting five million tonnes of self-supply capacity by 2027 (1.5 million today, plus 0.35 million tonnes in development), with greater scope for operational leverage and cost reduction. Drax will continue to work with its current suppliers to develop its portfolio.

At the 2019 half year results, Drax announced an investment in low-cost capacity at its existing three sites in the US Gulf, adding 350k tonnes of new capacity by 2021. The capital cost is in the region of £50 million, enabling targeted fuel cost savings in excess of £15/MWh on the additional capacity once commissioned.

Drax is evaluating options to deliver an additional three million tonnes of capacity. These options are expected to deliver returns significantly in excess of the Group’s cost of capital, with strong cash flow generation and a fast payback.

These activities would enable Drax to develop an unsubsidised biomass generation business by 2027, with the option to service wood pellet demand in other markets – Europe, North America and Asia.

Biomass sustainability is at the heart of the Group’s activities and Drax has implemented industry leading processes which support this expansion, encourage forest growth and make a positive contribution to climate change.

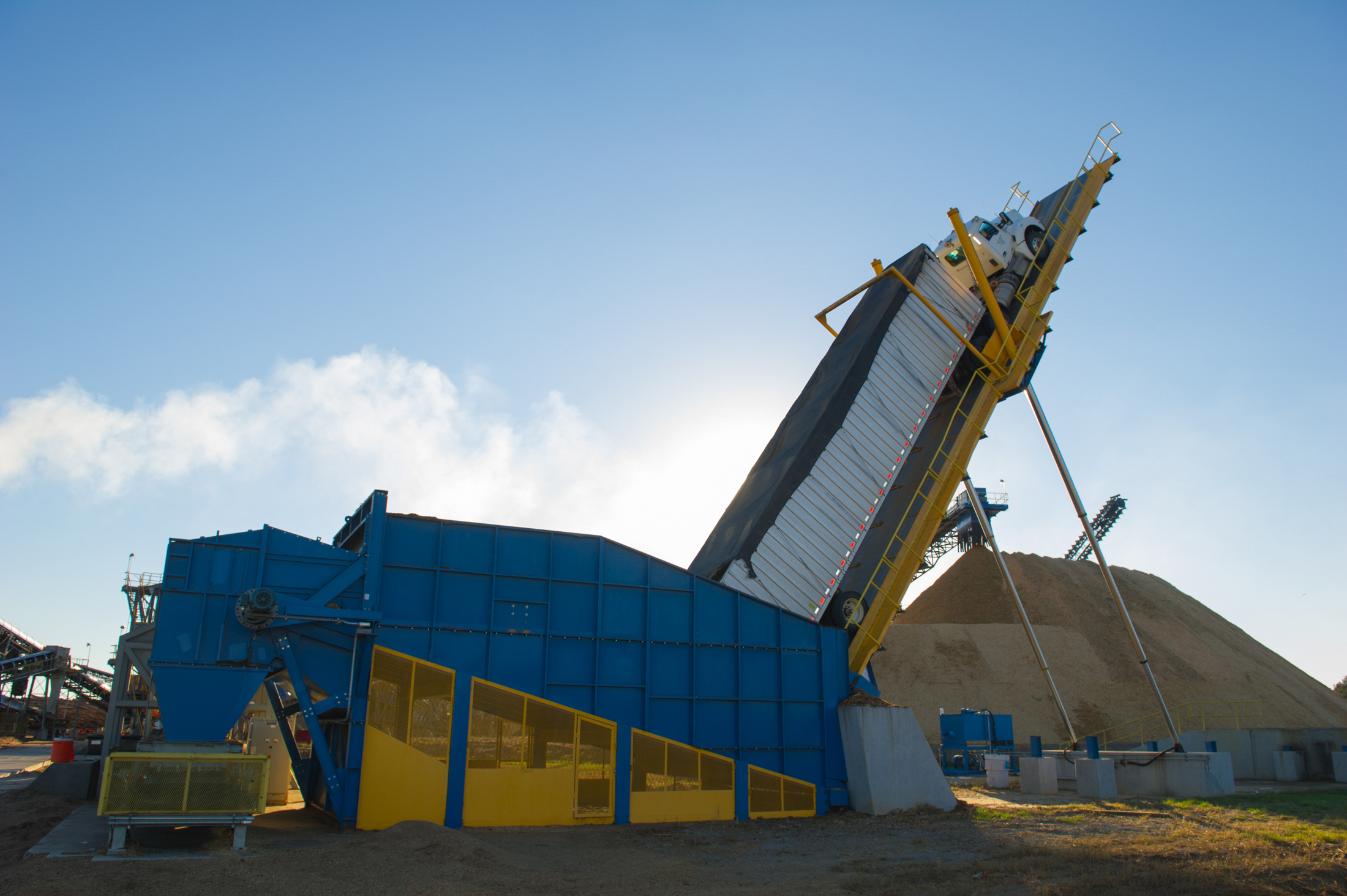

Drax LaSalle BioEnergy wood pellet plant in Louisiana is now co-located with a sawmill. A new rail spur became operational at LaSalle earlier in 2019. Click to view/download.

Options for gas generation

Drax continues to see flexible gas generation as an enabler of greater renewable and low carbon generation, in addition to supporting the development of hydrogen.

Any investment decision would reflect Drax’s objective of delivering earnings visibility and be underpinned by a 15-year capacity agreement to support a low double-digit rate of return. Drax would consider a range of funding options, including partnerships, consistent with Drax’s balance sheet objective of around 2 x net debt to Adjusted EBITDA(1) over time.

Capital allocation and dividend

Drax remains committed to the capital allocation policy established in 2017.

Trading and operational performance

The performance of the assets acquired from Iberdrola in December 2018 has been strong, particularly the pumped storage business which has performed well, driven by the system support market. Drax reiterates the Adjusted EBITDA(1) guidance provided at the time of acquisition, of £90-£110 million in the 2019 financial year.

In July, Drax completed the refinancing of the acquisition bridge facility used to acquire these assets. These facilities now extend the Group’s debt maturity profile to 2029, adding an ESG(2) facility with a mechanism that adjusts the margin based on Drax’s carbon emissions against an annual benchmark. The Group’s cost of debt is now below four percent and below three percent on the new facilities, reflecting the Group’s reduced business risk. The Group continues to identify opportunities to optimise its balance sheet and cash flow.

During the summer, Drax completed major planned outages on two biomass units. Following a delayed return to service, the plan is to run all four ROC(3) units at high utilisation levels in the fourth quarter of 2019.

The outlook for coal generation remains challenging and Drax continues to monitor the situation with regards to future operation, noting that all unabated UK coal generation must close by 2025.

Following formal confirmation from the UK Government, Drax expects the Capacity Market to be re-instated shortly, with full retrospective payments made for the capacity provided. Capacity payments due to Drax for 2019 and since the suspension of the Capacity Market in 2018 are £75 million. Drax expects these to be included in 2019 Adjusted EBITDA(1), with cash settlement in January 2020.

These factors underpin the Group’s expectations for full year Adjusted EBITDA(1), which remain unchanged and around 2 x net debt to Adjusted EBITDA(1) when adjusted to reflect cash payment of retrospective capacity payments received in January 2020.

Capital Markets Day webcast and presentation material

The event will be webcast from 9.30am and the material made available on the Group’s website at the same time. Joining instructions for the webcast and presentation are included in the links below.

https://view-w.tv/3-1479-22819/en

https://www.drax.com/uk/investors/capital-markets-day/

Notes:

(1) Earnings before interest, tax, depreciation, amortisation, excluding the impact of exceptional items and certain remeasurements.

(2) Environmental Social and Governance.

(3) Renewable Obligation Certificate.

Enquiries:

Drax Investor Relations:

Mark Strafford

+44 (0) 1757 612 491

Media:

Drax External Communications:

Matt Willey

+44 (0) 203 943 4306

Website: www.drax.com/uk

END

RNS Number: 8192T

Adjusted EBITDA of £8 million (H1 2018: £10 million)

Adjusted EBITDA of £8 million (H1 2018: £10 million)

Adjusted EBITDA of £9 million (H1 2018: £16 million)

Adjusted EBITDA of £9 million (H1 2018: £16 million)