In 2017 we made significant progress with the strategy we announced in December 2016.

First, we completed the acquisition of Opus Energy – a leading challenger brand in the UK Small and Medium-sized Enterprise (SME) energy market; second, we acquired a third biomass pellet plant (LaSalle Bioenergy), which significantly increases our pellet production capacity; and third, we continued to develop options for flexible gas generation at four sites around the UK.

We also began developing longer-term options for growth, with the exploration of coal-to-gas repowering at Drax Power Station, as we look to provide new sources of flexible generation backed up by long-term capacity contracts. To support our strategy, we completed a refinancing in May and announced a new dividend policy in June.

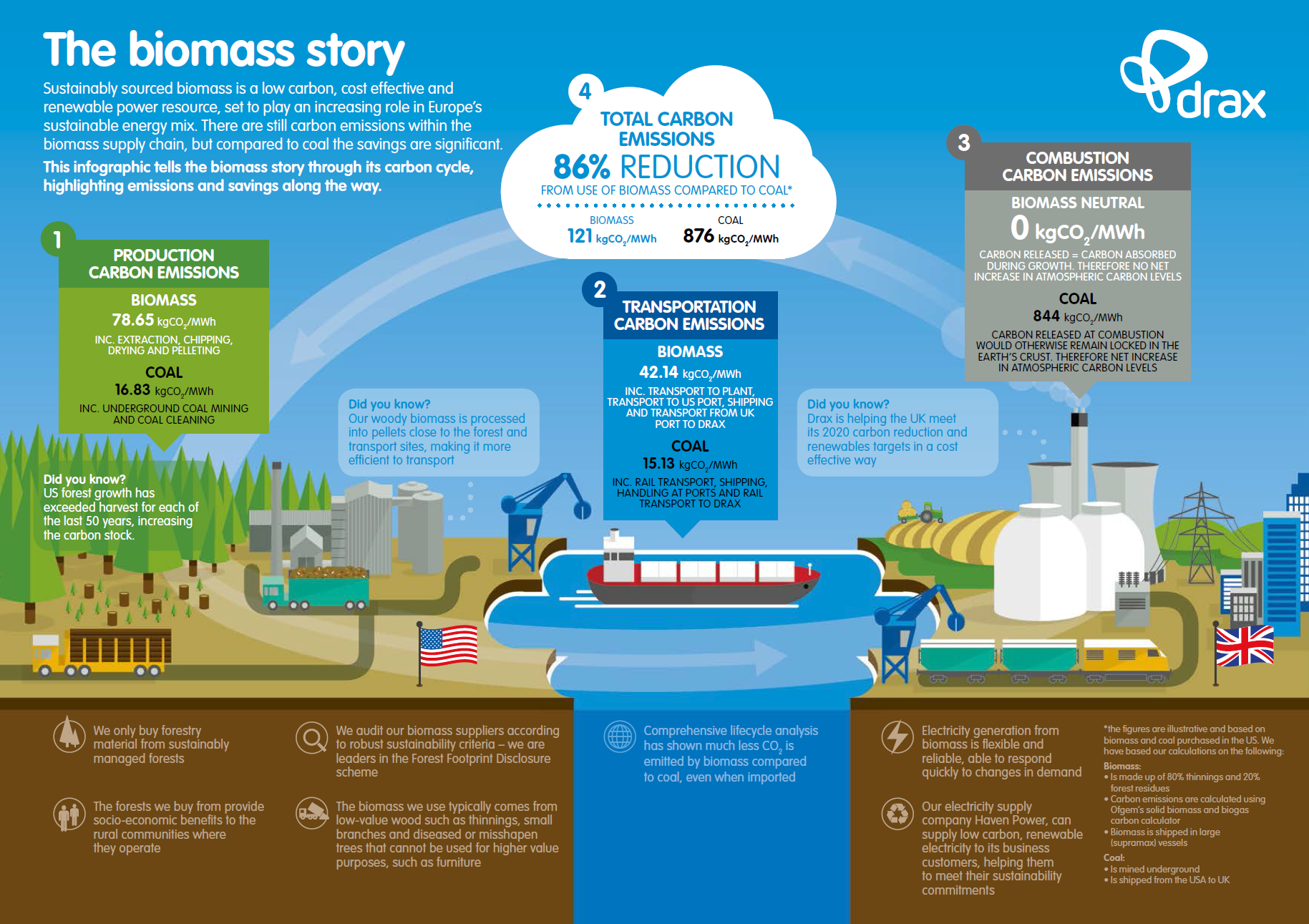

At the same time, we have continued to provide a significant amount of the UK’s renewable electricity. With confirmation of Government support for further biomass generation at Drax Power Station we plan to continue our work to develop a low-cost solution for a fourth biomass unit conversion, allowing us to provide even more renewable electricity, whilst supporting system stability at minimum cost to the consumer.

Opus Energy performed well, delivering on the plans we set out at the time of acquisition and, in North America, LaSalle Bioenergy is successfully commissioning. This performance alongside safety, sustainability and expertise in our core markets acts as a strong base from which the business can grow and deliver long-term sustainable value.

We have a major role to play in supporting the UK energy system, as it becomes increasingly ambitious in decarbonising, first the electricity sector and subsequently transport and heating. In doing so, through our flexible, low-carbon and customer- focused approach we aim to deliver higher quality earnings, with a reduction in commodity exposure alongside opportunities for growth.

Our people – employees and contractors – remain a key asset of the business. Their safety remains at the centre of our operational philosophy and we have performed well in this regard, although we continue to work to improve our performance across the Group.

Results and dividend

EBITDA in 2017 of £229 million was significantly ahead of 2016 (£140 million).

This increase was principally from producing high levels of renewable power from sustainable biomass. We also benefited from our growing B2B Energy Supply and Pellet Production businesses. Through these activities we are improving the visibility of our earnings.

In June we announced a new dividend policy. This policy is to pay a dividend which is sustainable and expected to grow as the implementation of the strategy generates an increasing proportion of stable earnings and cash flows. In determining the rate of growth in dividends the Board will take account of contracted cash flows, the less predictable cash flows from the Group’s commodity based business and future investment opportunities. If there is a build-up of capital the Board will consider the most appropriate mechanism to return this to shareholders.

At the 2017 half year results we confirmed an interim dividend of £20 million (4.9 pence per share) representing 40% of the full year expected dividend of £50 million (12.3 pence per share) (2016: £10 million, 2.5 pence per share). Accordingly, the Board proposes to pay a final dividend in respect of 2017 of £30 million, equivalent to 7.4 pence per share. In addition, the Board has decided to announce a £50 million share buy-back programme, which will take place during 2018, which is consistent with our capital allocation policy.

Corporate governance

In September, Dorothy Thompson CBE announced her intention to stand down as Group Chief Executive Officer (CEO). I would like to thank Dorothy for her enormous contribution to the Group over the last 13 years. During her tenure Dorothy led the transformation of the business and leaves the Group in a strong position with a clear strategy that lays the foundations for further success in a changing energy sector.

Dorothy is succeeded by Will Gardiner, who was previously Group Chief Financial Officer (CFO) and a key architect of the strategy. His appointment follows a thorough review of internal and external candidates and is a natural progression after two years working alongside Dorothy developing a strategy which I am confident will create significant benefits for all Drax’s stakeholders.

A process to appoint a permanent CFO is underway and Den Jones has been appointed as Interim CFO. Den is highly experienced, having previously served as CFO of both Johnson Matthey and BG Group. Drax remains committed to the highest standards of corporate governance. The Board and its committees play an active role in guiding the Company and leading its strategy. We greatly value the contribution made by our Non-Executive Directors (NEDs) and during a time of transition their role is especially important.

We indicated last year that we were seeking additional NEDs with experience in sustainability and energy supply to complement our already experienced Board. I am therefore delighted to welcome two new NEDs to the Drax Board. Firstly, David Nussbaum, whose in-depth knowledge of sustainability will support our continued focus in this area; and secondly, Nicola Hodson, whose experience in technology, business transformation and energy, will provide real value as the Group delivers its strategy.

Sustainability remains at the heart of the business, both the specific sustainability of biomass and more broadly the long-term sustainability of the business. As such I am pleased to note that alongside this year’s annual report and accounts the Group has published a comprehensive overview of our sustainability progress in 2017 on our website.

Full details of our corporate governance can be found on page 64 of the 2017 annual report.

Our people

As the Group grows I would also like to welcome colleagues from Opus Energy and our other developments. On-boarding is proceeding well and by working together in our common goal to help change the way energy is generated, supplied and used, we are creating real value for all stakeholders.

As the Group grows I would also like to welcome colleagues from Opus Energy and our other developments. On-boarding is proceeding well and by working together in our common goal to help change the way energy is generated, supplied and used, we are creating real value for all stakeholders.

I must thank all the employees and contractors who have worked so hard to help the Group succeed in the last 12 months. It is through their skill, expertise and hard work that we are able to deliver our strategy for the business.

My sincere thanks to colleagues for their commitment and hard work.

It only remains for me to say that your Board remains totally committed to the complementary aims of delivering sustainable long-term value for the Group, and of helping our country build a low-carbon economy.