RNS Number: 9930E

Drax Group plc

(“Drax” or the “Group”; Symbol:DRX)

Drax is pleased to announce that it has completed the refinancing of the Canadian dollar facilities it acquired as part of the Group’s acquisition of Pinnacle Renewable Energy Inc. (Pinnacle) in April 2021.

The new C$300 million term facility (“the Facility”) matures in 2024, with an option to extend by two years(1), and has a customary margin grid referenced over CDOR(2).

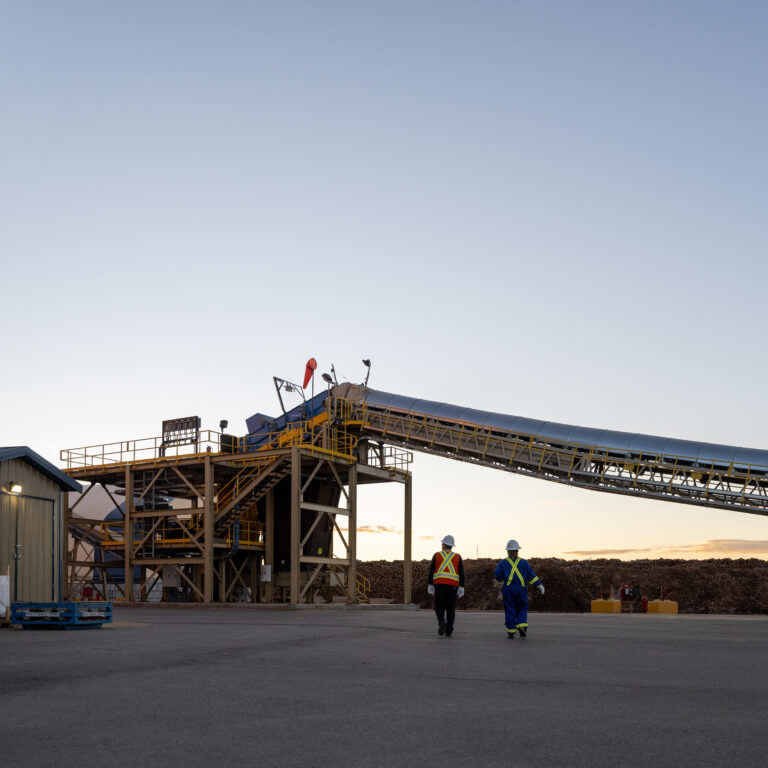

A Pinnacle wood pellet plant

The Facility reduces further the Group’s all-in cost of debt to below 3.5% and includes an embedded ESG component which adjusts the margin payable based on Drax’s carbon intensity measured against an annual benchmark.

The Facility, along with surplus cash, replaces Pinnacle’s approximately C$435 million facilities which had a cost of over 5.5%.

Enquiries

Drax Investor Relations: Mark Strafford

Media

Drax External Communications: Ali Lewis

Website: www.Drax.com

END