For more than 50 years Great Britain has been electrically connected to Europe. The first under-sea interconnector between British shores and the continent was installed in 1961 and could transmit 160 megawatts (MW) of power. Today there is 4 gigawatts (GW) in interconnector capacity between Great Britain, France, Ireland and the Netherlands – and there’s more on the way.

By the mid-2020s some estimates suggest interconnector capacity will reach 18 GW thanks to new connections with Germany, Denmark and Norway. The government expects imports to account for 22% of electricity supply by 2025, up from 6% in 2017.

This increased connectivity is often held up as a means of securing electricity supply and while this is largely true, it doesn’t tell the full story.

In fact, this plan could risk creating a dependency on imported electricity at a time when flexibility and diversity of power sources are key to meeting demand in an increasingly decentralised, decarbonising system.

Great Britain needs to be connected and have a close relationship with its European neighbours, but this should not come at the expense of its power supply, power price or ongoing decarbonisation efforts. Yet these are all at risk with too great a reliance on interconnection.

To secure a long term, stable power system tomorrow, these issues need to be addressed today.

Unfair advantage

At their simplest, interconnectors are good for the power system. They connect the relatively small British Isles to a significant network of electricity generators and consumers. This is good for both helping secure supply and for broadening the market for domestic power, but the system in which interconnectors operate isn’t working.

Since 2015 interconnectors have had the right to bid against domestic generators in the government’s capacity market auctions.

The government uses these auctions to award contracts to generators that can provide electricity to the grid through existing or proposed facilities. The original intention was also to allow foreign generators to participate. As an interim step, the transmission equipment used to supply foreign generators’ power into the GB market – interconnectors – have been allowed to take part. In practice, interconnectors end up with an economic advantage over other electricity producers.

Firstly, interconnectors are not required to pay to use the national transmission system like domestic generators are. This charge is paid to National Grid to cover the cost of installation and maintenance of the substations, pylons, poles and cables that make up the transmission network. Plus the cost of system support services keeping the grid stable. Interconnectors are exempt from paying these despite the fact imported electricity must be transported and balanced within England, Scotland and Wales in the same way as domestic electricity.

Secondly, interconnectors don’t pay carbon tax in the GB energy market. The Carbon Price Floor is one of the cornerstones of Great Britain’s decarbonisation efforts and has enabled the country’s electricity system to become the seventh least carbon-intense of the world’s most power intensive systems in 2016, up from 20th in 2012.

Interconnectors themselves do not emit carbon dioxide (CO2) in Great Britain, but this does not mean they are emission-free. France’s baseload electricity comes largely from its low-carbon nuclear fleet, but the Netherlands and Ireland are still largely dependent on fossil fuels for power. Because the European grid is so interconnected even countries which don’t yet have a direct link to Great Britain, such as Germany with its high carbon lignite power stations, also contribute to the European grid’s supply. The Neuconnect link is planned to connect Germany and GB in the late 2020s.

Not being subject to the UK’s carbon tax – only to the European Union’s Emissions Trading System (EU ETS) which puts a much lower price on CO2 – imported power can be offered cheaper than domestic, lower-carbon power. This not only puts Great Britain at risk of importing higher carbon electricity in some cases, but also exporting carbon emissions to our neighbours when their power price is higher to that in the GB market..

This prevents domestic generators from winning contracts to add capacity or develop new projects that would secure a longer-term, stable future for Great Britain. In fact, introducing more interconnectivity could in some cases end up leading to supply shortages, be they natural or market induced.

Under peak pressure

The contracts awarded to interconnectors in the capacity market auctions treat purchased electricity as guaranteed. But, any power station can break down – any intermittent renewable can stop generating at short notice. Supply from neighbouring countries is just the same.

Research by Aurora found that historically, interconnectors have often delivered less power than the system operator assumed they would and on occasion exported power at times of peak demand. This happened recently during the Beast of the East, when low temperatures across the continent drove electricity demand soaring.

This European-wide cold spell meant Ireland and France (which has a largely electrified heating system) experienced huge electricity demand spikes, driving power prices up.

As a result, for much of the time between 27 and 28 February Great Britain exported electricity to France to capitalise on its high prices. This not only led to more fossil fuels being burned domestically, but it meant less power was available domestically at a time when our own demand was exceptionally high. Even when the interconnectors do flow in our direction they cannot provide crucial grid services like inertia so our large thermal power stations are often still needed.

It is difficult to say for certain how interconnectors will function during times of high demand in the future due to a lack of long-term data, but that which we do know and have seen suggests they don’t always play to the country’s best interests.

There is still an important role for interconnectors on the Great Britain grid, but to deliver genuine value the system needs to be fairer so they don’t skew the market.

Where interconnectors fit into the future

Interconnectors bring multiple benefits to our power system. They can help with security of supply by bringing in more power at times of systems stress, with the right system in place they can help reduce the need to rely on domestic fossil fuels and enable more renewable installation, and if electricity is being generated cheaper abroad, they can also create opportunities to reduce costs for consumers.

However, the correct framework must be put in place for interconnectors to bring such benefits while allowing for domestic projects that can help secure the country’s electricity supply.

As a start, interconnectors should be reclassified – known as de-rating – to compete with technologies on an equal footing.

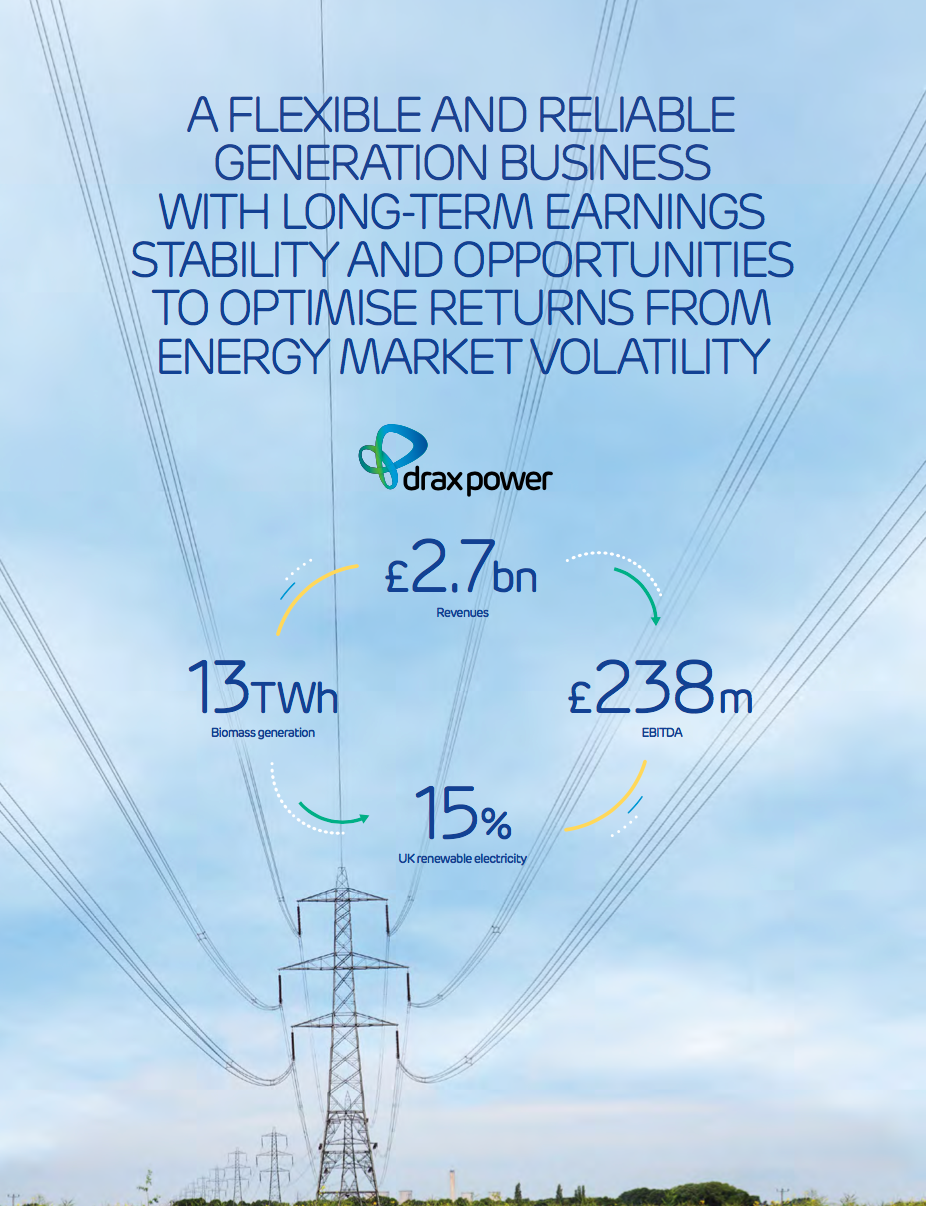

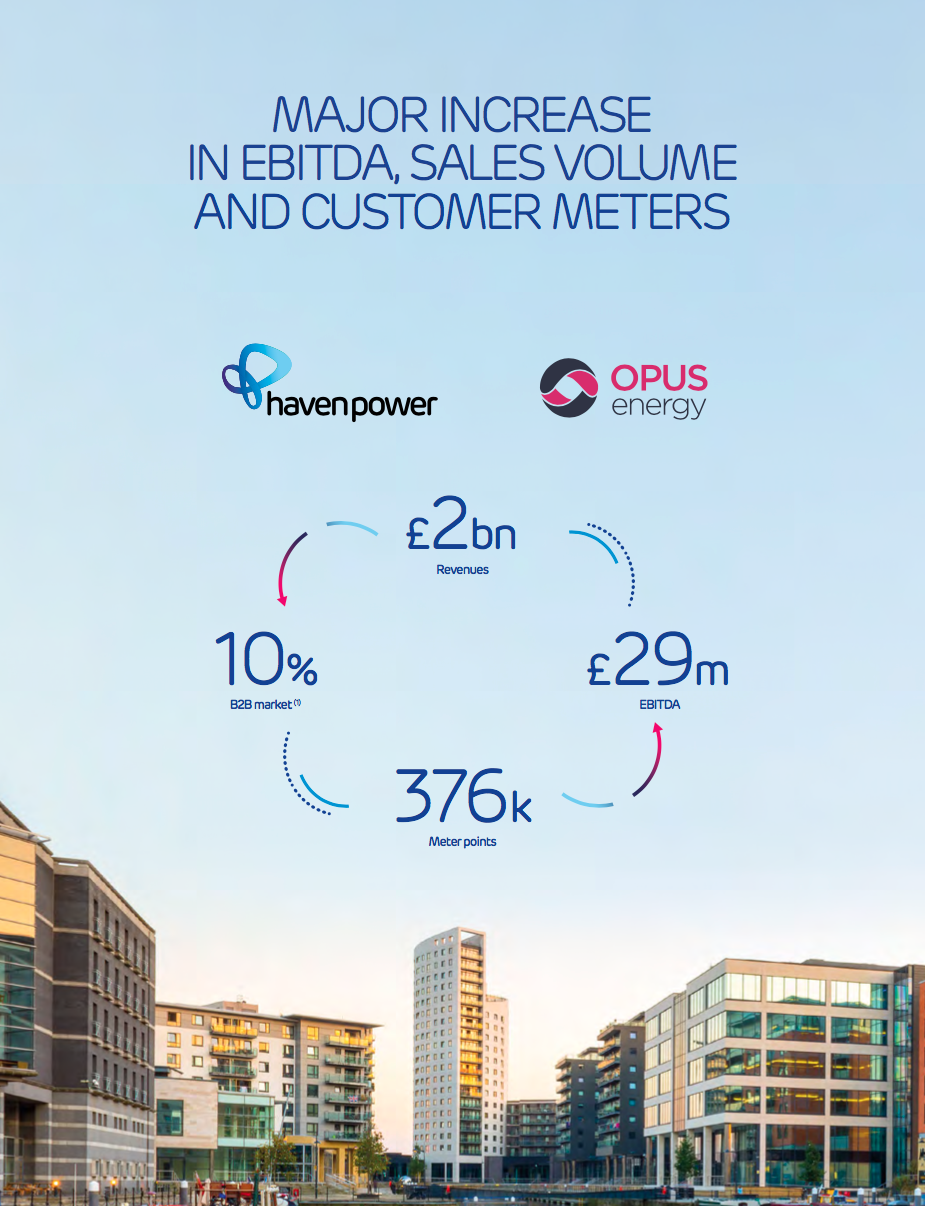

Drax’s proposed OCGT plants, which can very quickly start up and provide the grid with the power and balancing services it needs, before switching off again, could offer a more reliable route to grid stability than such overwhelming dependence on interconnectors will. In addition, the coal-to-gas and battery plans at Drax Power Station, would prove to be a highly flexible national asset.

New gas and interconnectors should be able to compete fairly with one another. Policymakers should facilitate a system that allows competing technologies to exist in a cost beneficial way. Both interconnectors and domestic thermal power generators can play their part in creating stability, transitioning towards a decarbonised economy and fitting within the UK’s industrial strategy.

In 1961, when the first interconnector was switched on it marked a new age of continental co-operation. Five decades on we should not forget this goal. In an ever more complex grid, what we need is different technologies, systems and countries working together to achieve a flexible, stable and cleaner power system for everyone.