Key takeaways

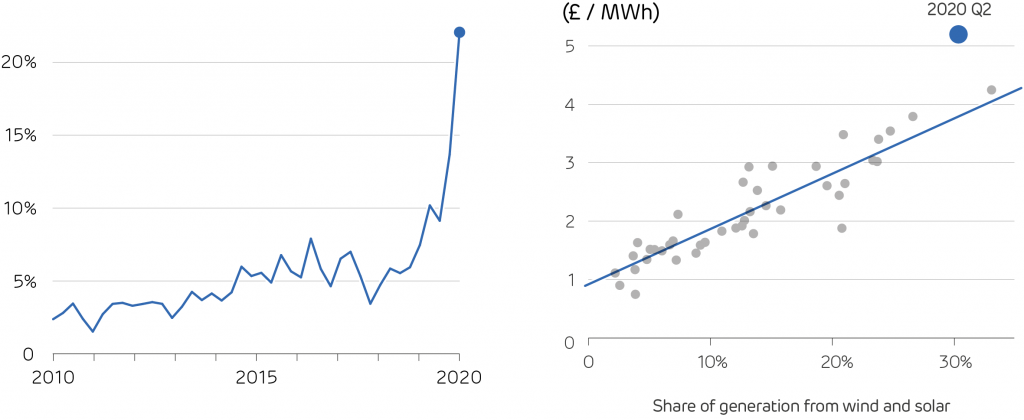

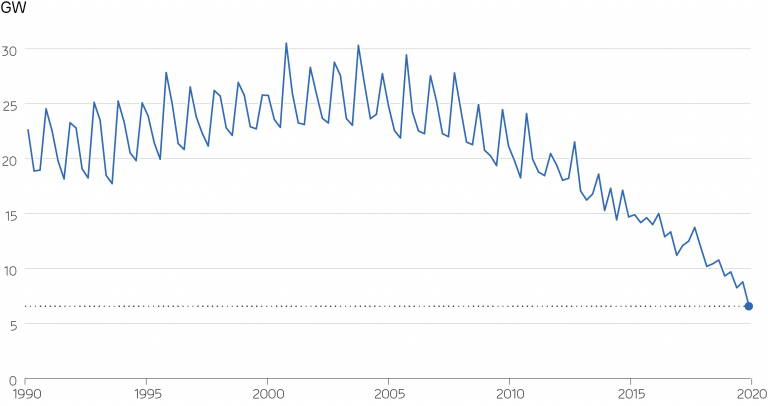

- Since 2021, there has been a sharp rise in the price of electricity, driven by a steep increase in wholesale gas prices in Europe in particular.

- A number of factors, including the impact of COVID-19 and the effects of the war in Ukraine have contributed to driving gas prices to record highs.

- The volatility of gas prices means the UK needs to find replacements for the role of gas in helping to balance the electricity grid.

- Biomass and pumped storage hydro have the capacity to provide reliable, renewable energy to UK homes and businesses, while contributing to keeping the grid stable.

Great Britain, and many other parts of the world, are in a phase of energy uncertainty. Since 2021, soaring power prices have caused energy bills to escalate as much as five-fold and led to a string of collapses of UK energy suppliers.

As of October 2022, the annual energy bill for a UK household with “typical” energy consumption has been capped at £2,500 a year – 96% higher than the winter 2021/22 price cap – the upper limits the rates suppliers can charge for their default tariffs.

The costs of energy to end consumers would be even higher were it not for this energy price guarantee introduced by the UK government on 1 October and currently due to be in place until 31 March 2023. In Germany, the government has committed €200 billion towards a ‘defensive shield’ against surging energy prices, while France has capped energy price increases at 4% for 2022 and 15% from January 2023.

The primary factor in this change is the rise in natural gas prices.

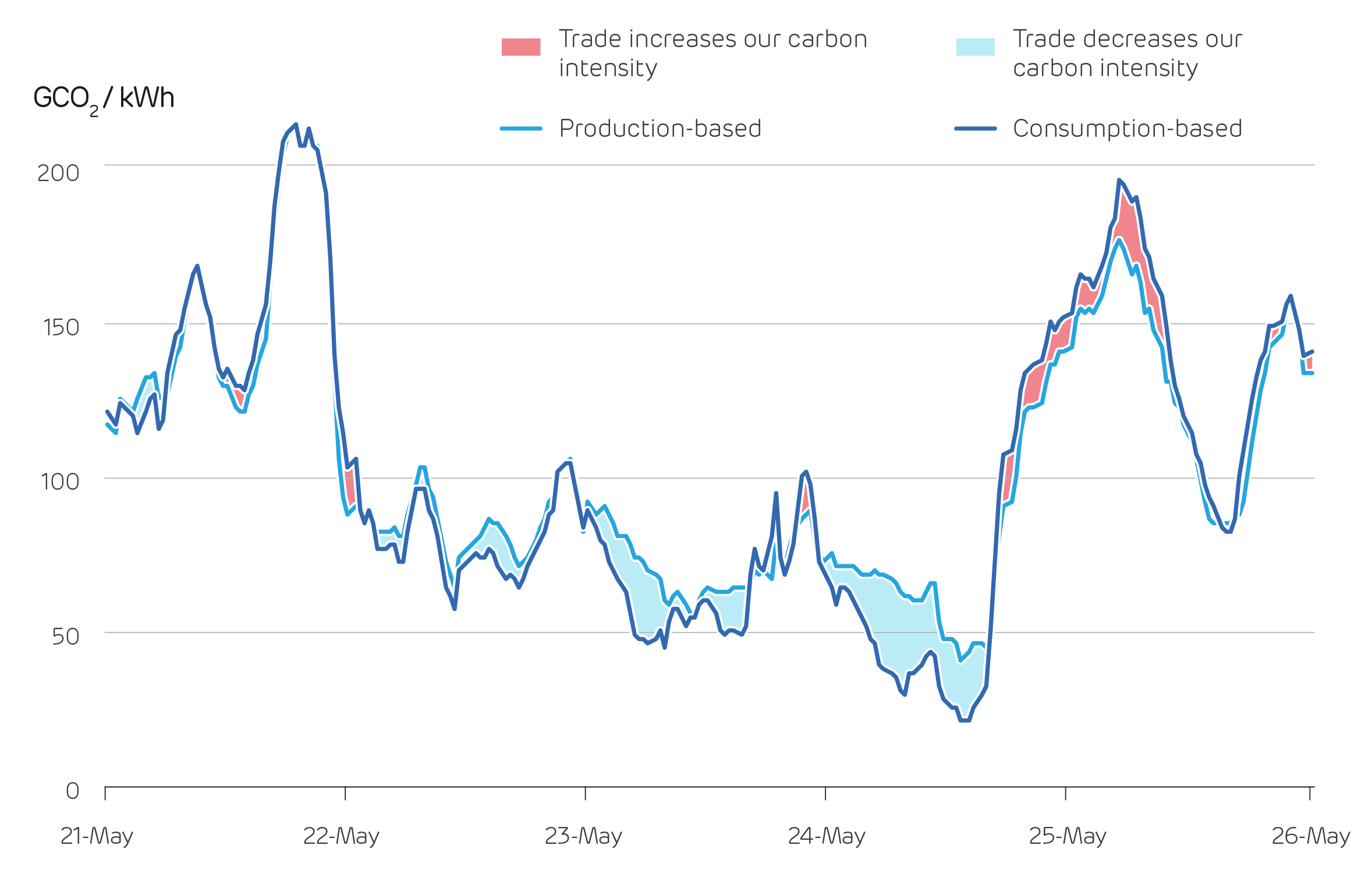

Periods of turbulence driven by commodity prices emphasises the need for a diverse, secure supply of power generation available to the UK grid. As the energy system works through the necessary transition away from fossil fuels to renewable sources, the need for a reliable, low-carbon, affordable power becomes even greater.

What’s driving up gas prices?

As the world went into lockdown in 2020 the demand for energy, including gas, dropped – and so did supply. When countries began to emerge from lockdown in 2021 and economies started to reboot, supply struggled to keep up with renewed demand, triggering a rise in the price of wholesale gas, and other fuels. The cold winter in 2020-2021 and unusually hot summers in 2021 and 2022 also dented European gas storage levels, further contributing to rising gas prices.

An already uncertain energy market was further destabilised by Russia’s invasion of Ukraine. This was particularly true in Europe, (most notably Germany) where Russian gas at the time accounted for around 40% of total gas consumption. Gas prices began increase rapidly as a result of factors including fears that Russia would restrict the supply of gas to Europe in response to sanctions against the country, or that an embargo on Russian gas would be introduced.

Constrained gas supplies also increased global demand for alternative sources like liquified natural gas (LNG) imports, which account for about 22% of the UK’s gas. This increase in demand has pushed up the price of these alternatives, forcing countries to compete to attract supplies.

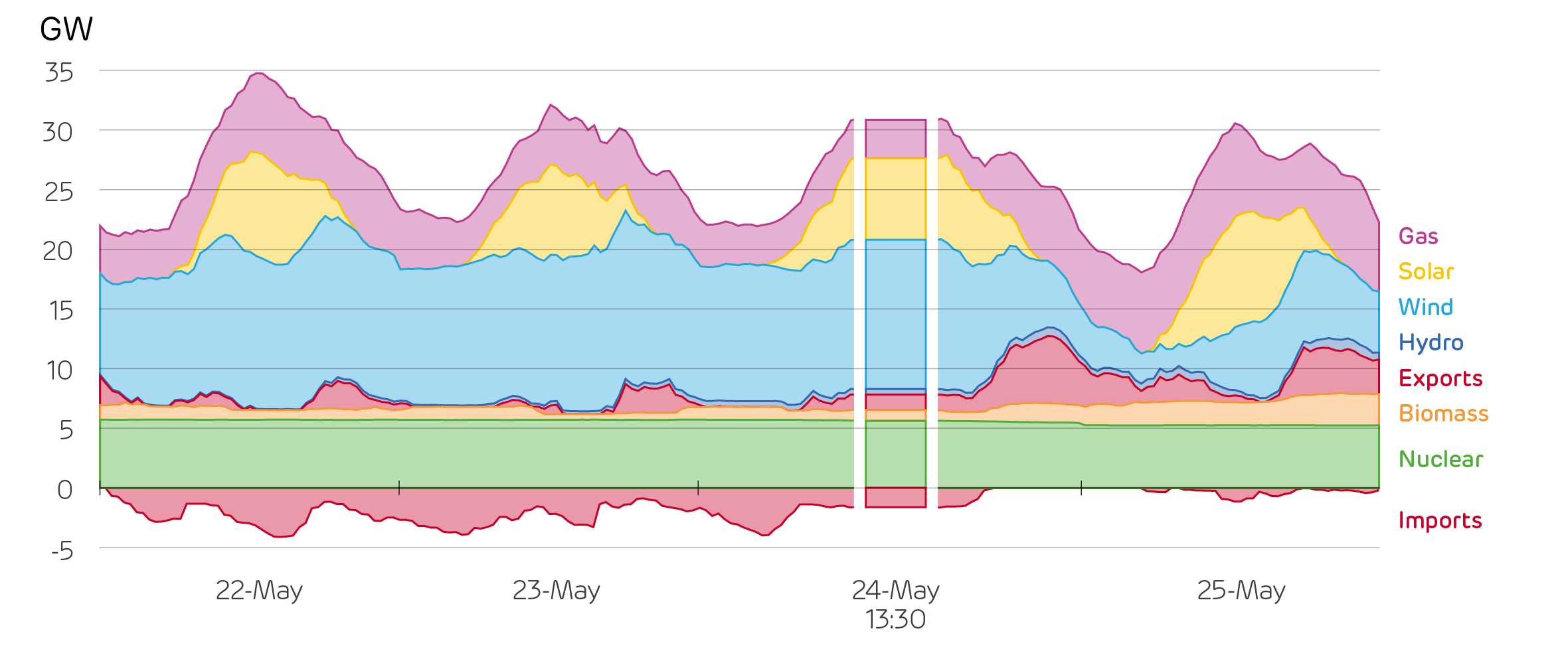

There are several reasons why higher gas prices have such a significant impact on UK energy prices. Firstly, a considerable proportion of UK electricity comes from gas. In the second quarter of 2022, gas represented 42% of the UK energy mix, making it the country’s single largest source of electricity.

The UK also relies heavily on gas to heat its homes. And with those homes being some of the oldest and least energy-efficient in Europe, it takes more gas to heat them up and keep them warm.

Click to view/download

The role of biomass and pumped storage hydro in ensuring security of supply

In addition to the pressures placed on gas and electricity supplies since 2021, the UK’s journey to net zero depends on increasing reliance on intermittent sources of power, such as wind and solar. As such, there is a renewed need to ensure a diverse range of power generation sources to secure electricity supply globally.

As gas becomes less economical, biomass offers a renewable reliable, dispatchable source of power that can balance the grid and supply baseload power regardless of weather conditions.

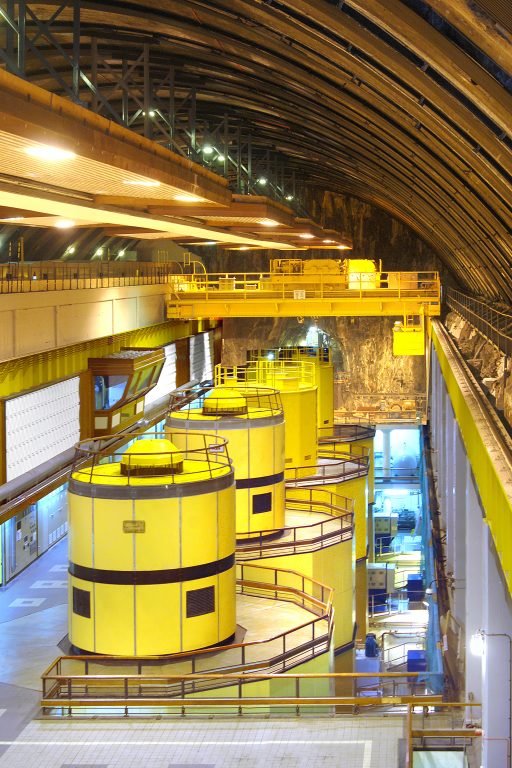

The Turbine Hall at Cruachan Power Station

Our four 645 MW biomass-fuelled generating turbines at Drax Power Station make it the largest single renewable source of power in the UK. The plant can produce enough electricity to power the equivalent of five million homes come rain or shine.

Drax’s Cruachan pumped storage hydro power station in the Scottish Highlands also offers National Grid the capacity to store 440 MW of renewable power. By absorbing excess electricity from zero carbon sources, like wind and solar, Cruachan can store and deploy power when the grid needs it most.

The ability of pumped storage hydro and biomass plants to store energy and quickly adjust output as required will become ever more important as the UK’s use of renewables grows and there are fewer spinning turbines connected to the grid. As renewable, non-intermittent sources of electricity, biomass and pumped storage hydro are central to a safe, economic, and stable electricity grid – and to the UK’s low-carbon energy future.

Pumped storage / hydro – good operational and system support performance

Pumped storage / hydro – good operational and system support performance