What are ancillary services?

Ancillary services are a set of processes that enable the transportation of electricity around the grid while keeping the power system operating in a stable, efficient and safe way.

Why do we need ancillary services?

When electricity makes its way through the country, it needs to be managed so that the power generation and electricity useage levels are equal.

The regulating of elements such as frequency and voltage has to be carefully managed, so that the massive amounts of electricity moving – or transmitted – are able to be used safely in homes, businesses, schools and hospitals around the country.

Ancillary services enable the power system to operate in a stable, efficient and safe way.

What do ancillary services offer?

Ancillary services include a wide variety of electrical efficiency and safety nets, all focussed on ensuring the power system delivers enough output to meet demand yet remains stable:

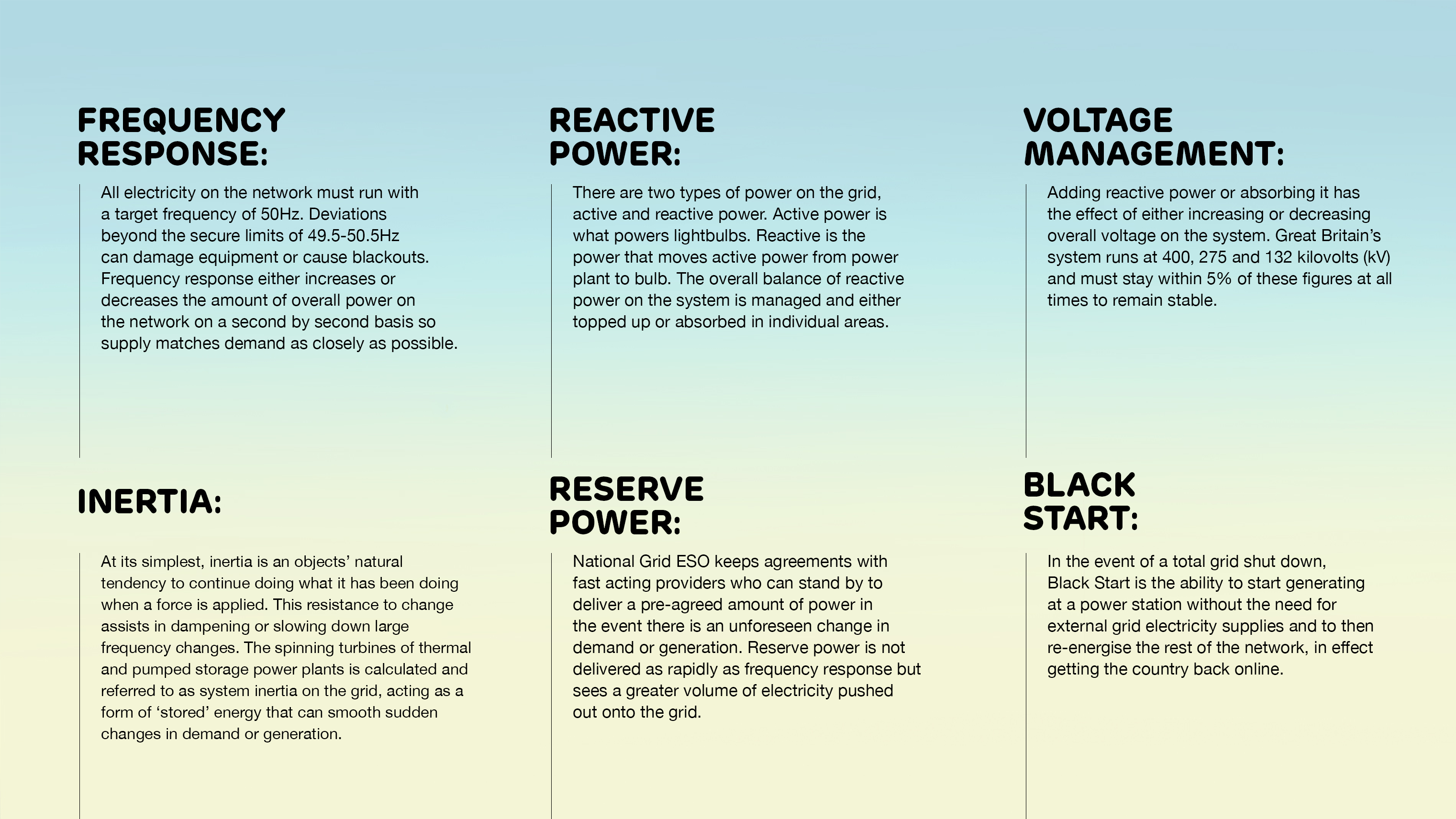

Frequency: The UK’s power system runs at a frequency of 50 hertz – to stay balanced, it has to remain at that frequency. Turbines and generators adjust the speed at which they spin automatically to increase or decrease power in line with demand and ensure that the system is kept stable.

Voltage: Different parts of the UK’s transmission system use voltages of either 400, 275 or 132 kilovolts. To ensure that voltage remains within 5% of those figures at all times, to be safe for domestic electricity use, power stations can produce or re-absorb excess energy as reactive power, keeping the overall system reliable.

Inertia: Turbine use is important in keeping the system operating in its current state, even with disruptions and sudden changes. The electricity system uses the weight of heavy spinning turbines to create stability, acting as dampeners and smoothing out unexpected changes in frequency across the network.

Reserve: An important part of ancillary servicing is making sure that there are no surprises – so holding back powerto release if something unexpected happens means that the network can function confidently, knowing that there are generators and other power providers such as pumped hydro storage waiting ready to back it up.

Who manages ancillary services?

In the UK the grid’s stability is managed by National Grid Electricity System Operator (ESO) – a separate company of National Grid Electricity Transmission (ET). The ESO works with ancillary service providers to either sign long-term contracts or make short term requests for a service.

These partners are often power stations, such as Drax Power Station, which have large spinning turbines capable of controlling voltage, frequency, providing inertia and serving as a source of reserve power.

What is the future of ancillary services, as we move to a more renewable system?

As the UK’s electricity system continues to change, so to do its requirements for different ancillary services. The switch from a few very large power stations to a greater variety of different electricity sources, some of which may be dependent on the weather, as well as changes in how the country uses electricity, means there is a greater need for ancillary services to keep the grid stable.

These services have historically been delivered by thermal power stations, but new innovations are enabling wind turbines to provide inertial response and overcome changes in frequency, and batteries to store reserve power that can then be supplied to the power system to ensure balance.

Ancillary services fast facts

- Batteries can in some cases be cheaper ancillary alternatives to conventional sources of energy. The Hornsdale Power Reserve, which runs on a Tesla battery in South Australia, lowered the price of frequency ancillary services by 90% after just four months of use.

- Ancillary services usually work from habit; knowing when to slow electricity production, or increase supply based around the general public’s standard working hours, dinner time and the early morning rush.

- But during the COVID-19 lockdown, electricity consumption on weekdays fell by 13% and so National Grid ESO had to intervene with ancillary services to keep the lights on.

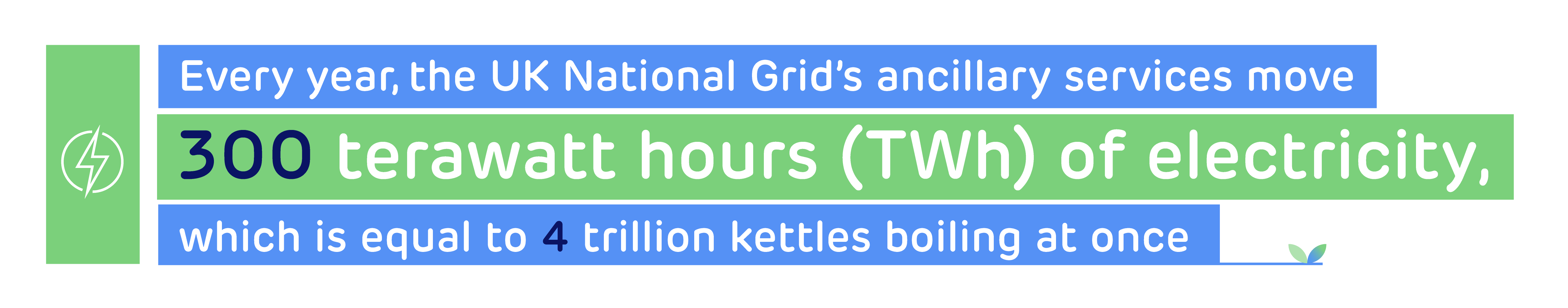

- Every year, the ESO’s ancillary services move 300 terawatt hours (TWh) of electricity, which is equal to 4 trillion kettles boiling at once.

With recent innovations around renewable energies, there are a wider variety of ways for ancillary services to generate power.

Go deeper

- Balancing for the renewable future

- Ancillary services – greening the grid

- Maintaining electricity grid stability through rapid decarbonisation

- Renewable energy sources as a new participant in ancillary service markets

- How the market decides where Great Britain gets its electricity from

- Behind the power grid: humans with high-stakes jobs